Master the cTrader Support and Resistance Indicator for Better Entries

Dec 29, 2025

The cTrader support and resistance indicator is one of the most effective tools traders can use to improve entry timing, control risk, and trade with structure instead of emotion. Support and resistance define market behavior, reveal where price reacts, and help traders plan trades with clarity. When applied correctly on cTrader, a well‑used support and resistance indicator can significantly improve entry quality - especially for traders operating under funded or prop‑style rules.

This guide focuses on practical execution, not theory. It’s written for traders who want cleaner entries, controlled risk, and consistency, the mindset required when trading capital in a professional or funded trading environment.

What cTrader Support and Resistance Indicator Actually Represents

A cTrader support and resistance indicator highlights decision zones created by real market participants.

Support is an area where buying pressure has repeatedly absorbed selling

Resistance is an area where selling pressure has repeatedly capped price advances

These zones exist because:

Institutions and algorithms place orders around key price levels

Liquidity clusters near previous highs and lows

Price revisits areas where strong reactions occurred before

For funded and prop traders, this matters because:

Entries must be planned, not impulsive

Risk must be defined before execution

Drawdown limits must be respected

The cTrader support and resistance indicator helps visualize this structure clearly and consistently.

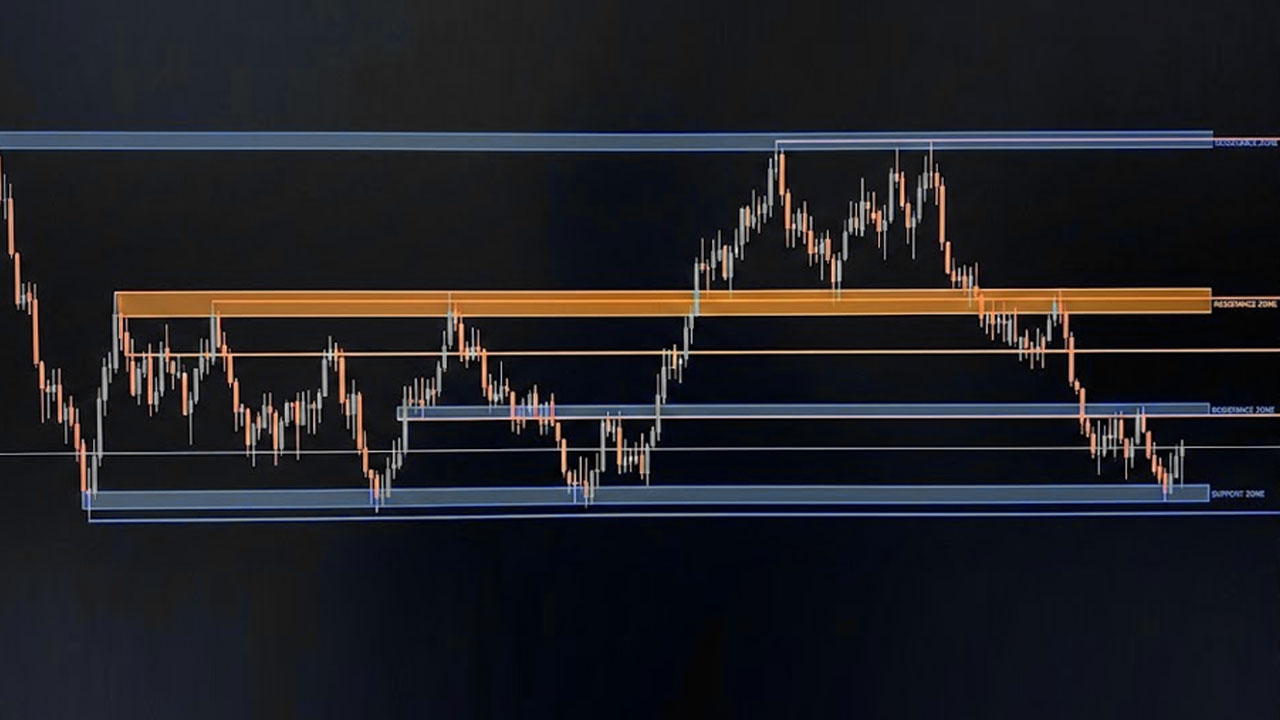

How cTrader Approaches Support and Resistance

cTrader is well suited for structure-based trading because it prioritizes clean charts and precise tools, which is one of the main reasons many prop traders prefer it over other platforms when comparing cTrader vs MT5 for prop firm trading.

The cTrader support and resistance indicator works by analyzing historical price reactions and plotting zones where price is statistically more likely to react again.

On cTrader, support and resistance can be identified using:

Manual drawing tools

Automatic cTrader support and resistance indicators

Price action combined with confirmation tools

The goal is not to predict price, but to react to it intelligently using the indicator as contextual guidance. Traders who are still getting familiar with the platform often benefit from understanding how to trade on cTrader for prop firm challenges, as platform execution and chart behavior play a direct role in level‑based trading.

Manual Support and Resistance on cTrader (Still the Foundation)

Even with a strong cTrader support and resistance indicator, manual level marking remains essential.

How to Mark High‑Quality Levels Manually

Follow these rules:

Start from H4 or H1 timeframes

Identify areas where price reacted multiple times

Extend levels forward, not backward

Treat levels as zones, not single prices

Manual mapping improves your understanding of what the cTrader support and resistance indicator is showing and prevents blind reliance on automation.

Using Trendlines as Dynamic Support and Resistance

Trendlines act as dynamic support and resistance and complement a cTrader support and resistance indicator when:

The trend is clearly defined

Swing highs or lows are respected

Lines are not forced to fit price

Dynamic levels are useful for trailing stops and managing trades once price moves away from the zone. This becomes especially important during funded evaluations, where execution delays or platform instability can affect trade management around dynamic levels, as explained in cTrader connectivity issues during prop challenges.

Using the cTrader Support and Resistance Indicator Effectively

A cTrader support and resistance indicator should be used as an assistant, not a signal generator.

What a Good cTrader Support and Resistance Indicator Should Do

A quality indicator should:

Plot clear zones, not excessive lines

Adapt to changing market structure

Work consistently across timeframes

Avoid aggressive repainting

The best cTrader support and resistance indicator settings favor clarity over quantity.

How Funded Traders Use the Indicator

Professional traders do not enter trades just because the cTrader support and resistance indicator highlights a level.

Instead:

The indicator defines the zone

Price action confirms the setup

Risk is calculated before execution

This workflow supports discipline and repeatability - both essential in funded and prop trading environments. The same principles are expanded further in the guide on best indicators for cTrader to pass prop firm challenges, where structure‑based tools are favored over signal‑driven strategies.

Best Timeframes for the cTrader Support and Resistance Indicator

Choosing the correct timeframe is more important than the indicator itself.

Higher Timeframes (H4 – Daily)

Higher timeframes allow the cTrader support and resistance indicator to:

Define major market structure

Establish directional bias

Identify clear invalidation levels

These timeframes are ideal for traders who want fewer but higher‑quality setups, which is a core requirement when trading under evaluation rules. This aligns closely with our guide on how to pass a prop firm challenge, where trade selectivity is emphasized.

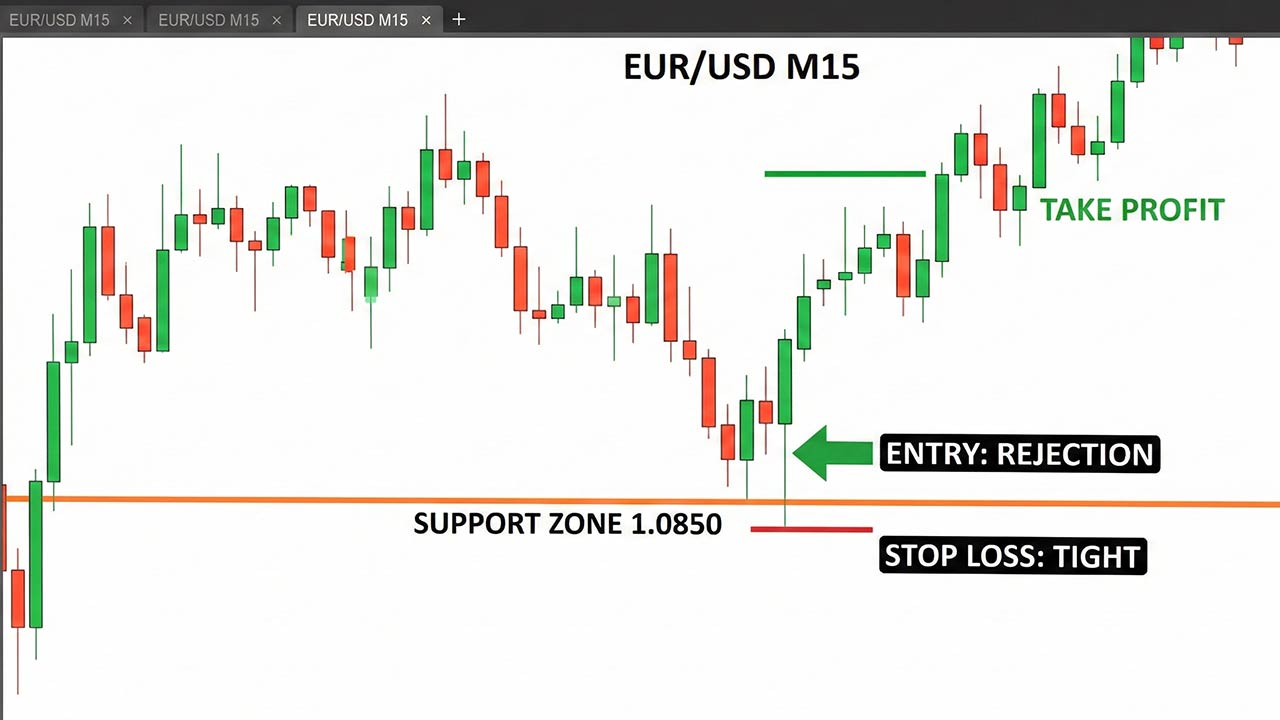

Entry Timeframes (M15 – M30)

Entry timeframes help traders:

Refine entries near indicator zones

Spot rejection or break‑and‑retest behavior

Keep stop‑loss distances controlled

Avoid relying on a cTrader support and resistance indicator on very low timeframes unless you have a tested execution model.

High‑Probability Entry Models Using Support and Resistance Indicator

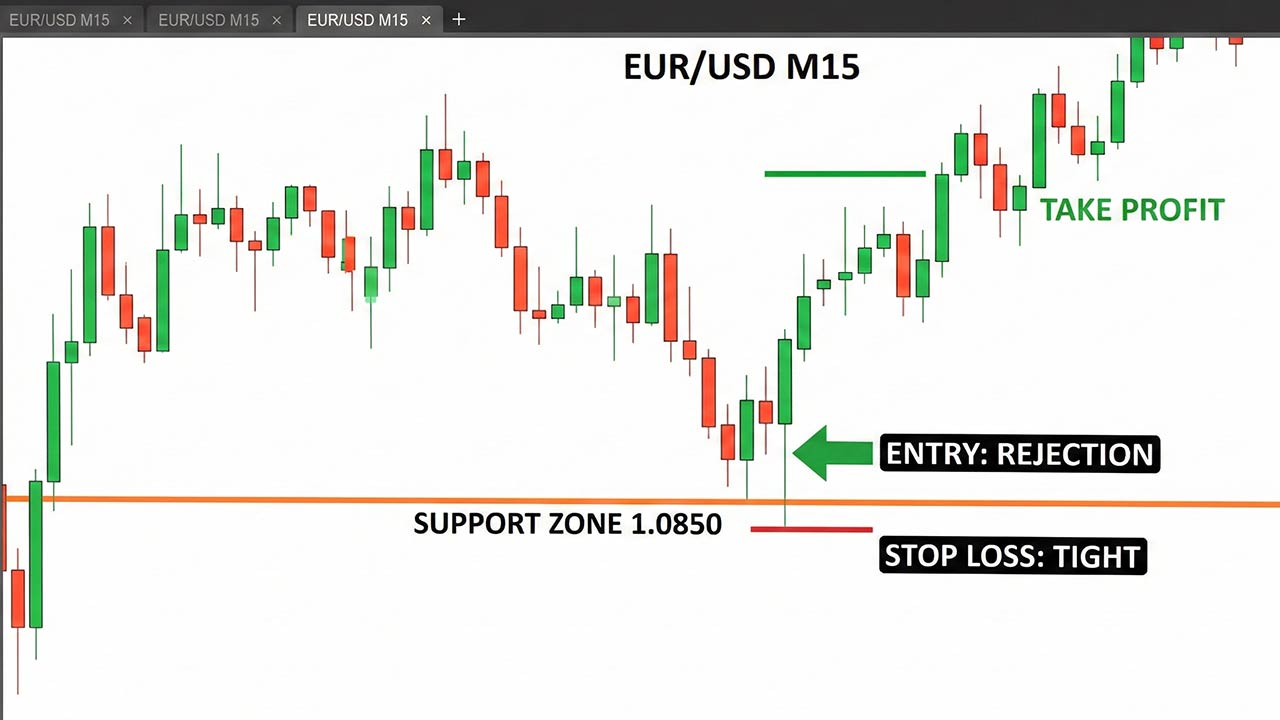

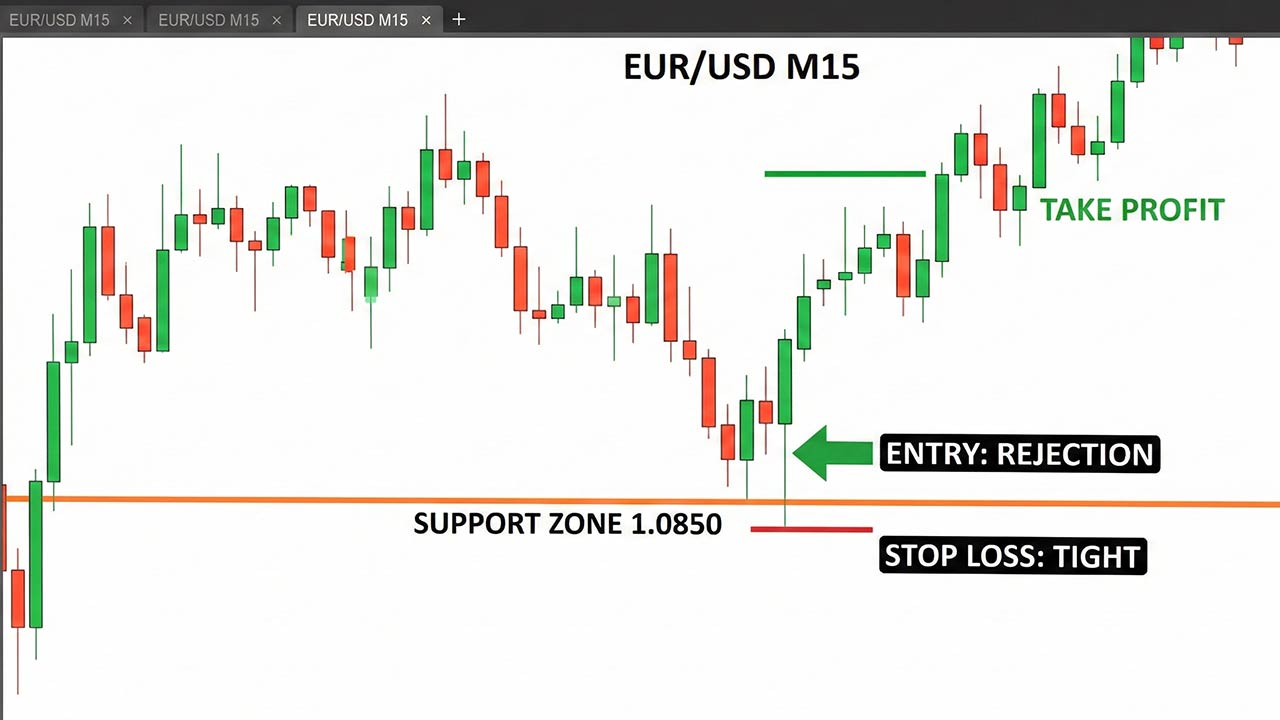

Rejection‑Based Entries

Best for: traders who want tight invalidation and fewer trades.

How it works:

Price reaches a support or resistance zone identified by the indicator

Clear rejection appears

Entry is taken after confirmation

Stop‑loss is placed beyond the zone

This model works well with a cTrader support and resistance indicator because invalidation is clearly defined.

Break and Retest Entries

Best for: structure‑based continuation trades.

How it works:

Price breaks a key indicator level with momentum

Pulls back to retest the zone

Old resistance becomes support (or vice versa)

Entry follows confirmation

This avoids chasing price and improves risk‑to‑reward consistency.

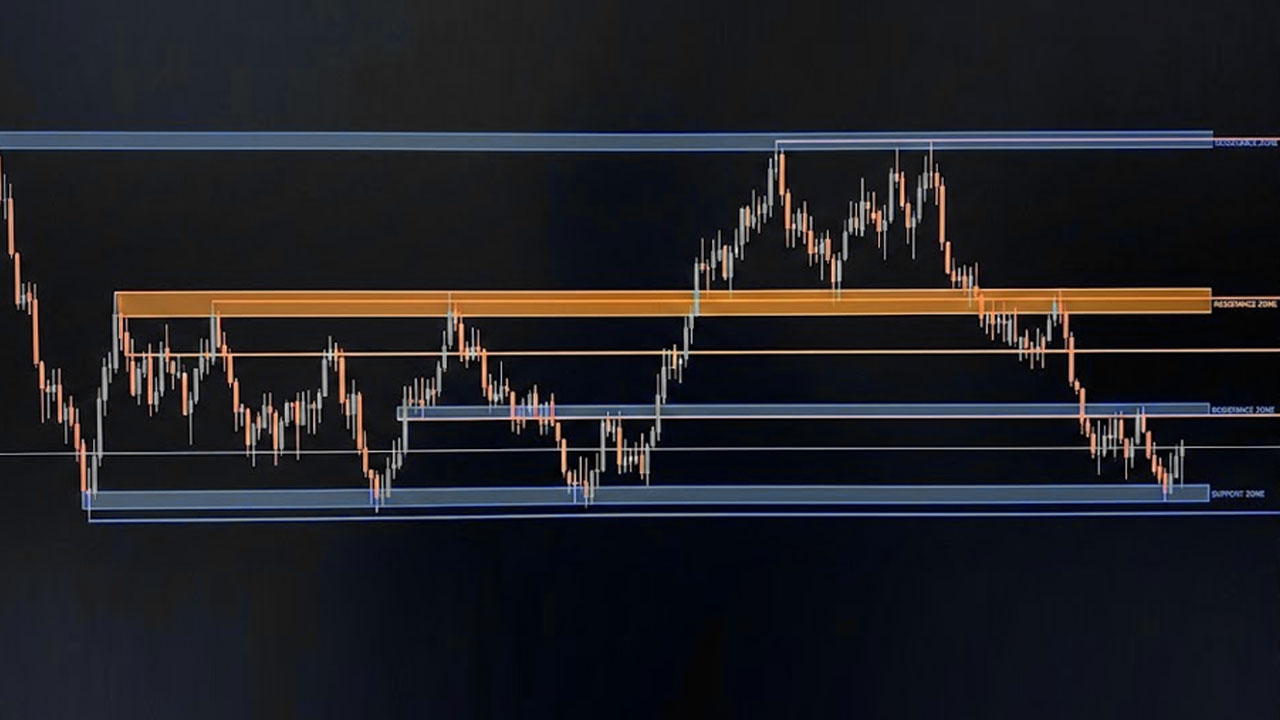

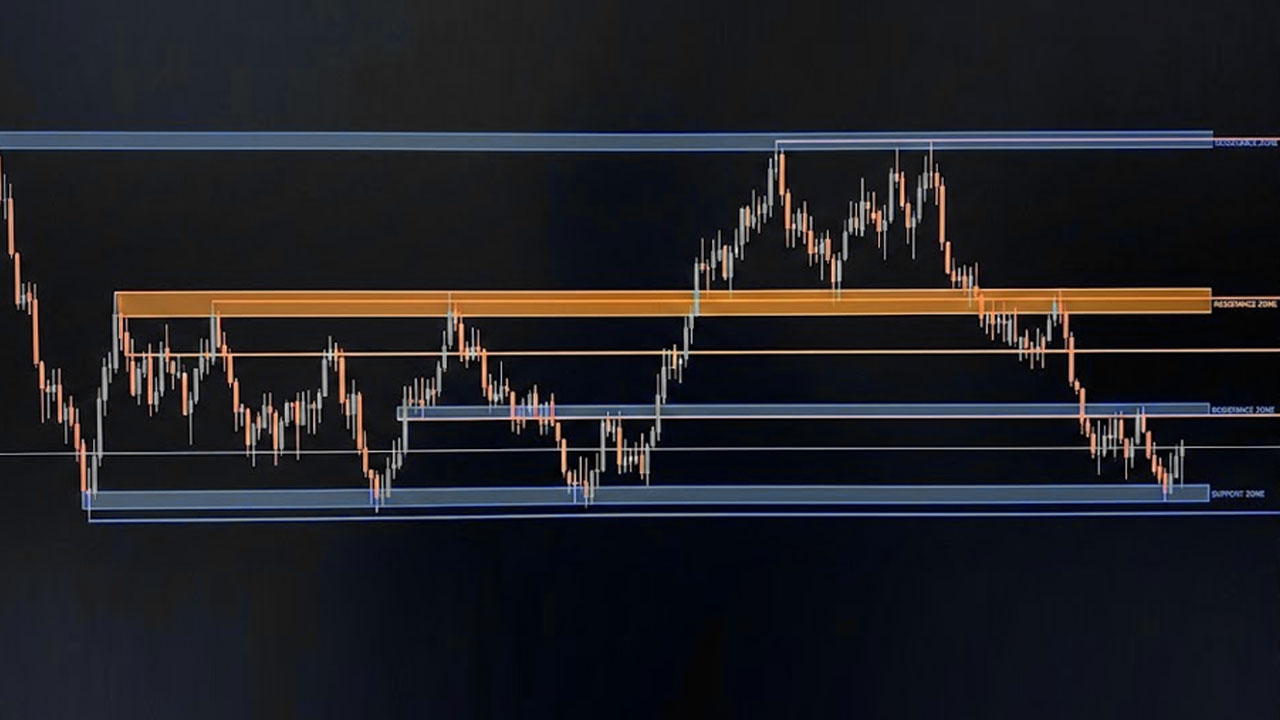

Range‑Based Entries

When markets are sideways, the cTrader support and resistance indicator helps traders:

Buy near support zones

Sell near resistance zones

Define clear targets and stops

Range trading works best during low‑volatility sessions and requires patience.

Common Mistakes When Using a cTrader Support and Resistance Indicator

Many traders fail not because of strategy, but because of execution errors.

Common mistakes include:

Drawing or accepting too many indicator levels

Trading every touch without confirmation

Ignoring higher‑timeframe structure

Moving stop‑losses emotionally

Treating the cTrader support and resistance indicator as a signal

In funded trading, these mistakes are punished quickly, especially within structured prop environments. Traders unfamiliar with these rules should review what prop trading is and how funded trading works, as expectations differ significantly from personal accounts.

Risk Management Around Support and Resistance Indicator

Entries matter, but risk management matters more.

Proper Stop Placement

Stops should be placed beyond the indicator zone, not inside it

If price invalidates the level, the trade idea is wrong

Position Sizing

Risk per trade stays fixed

Lot size adjusts to stop‑loss distance

Risk is never increased to recover losses

This approach mirrors how professional traders manage capital and directly reflects the principles outlined in our article on risk management tools in cTrader, where protecting drawdown is prioritized over aggressive growth.

Combining the cTrader Support and Resistance Indicator With Confirmation Tools

The cTrader support and resistance indicator works best when paired with light confirmation.

Effective confirmations include:

RSI divergence at indicator zones

EMA confluence

Previous day high or low

Session highs and lows

Two confirmations are enough. More often leads to hesitation and missed trades.

Final Thoughts: Trade Levels, Not Feelings

Mastering the cTrader support and resistance indicator is not about finding a perfect setting. It’s about understanding how price behaves around real decision zones and executing with discipline.

When you combine:

Clean higher‑timeframe mapping

A reliable cTrader support and resistance indicator

A defined entry model

Logical invalidation and stop placement

Proper position sizing

You naturally improve entry quality without increasing trade frequency.

This is also the execution mindset expected in a prop‑firm environment like Pipstone Capital, where traders are evaluated on discipline and controlled risk rather than trade volume. Using the cTrader support and resistance indicator to define clear levels, tight invalidation, and measured position sizing aligns directly with how professional prop traders are expected to operate.

Trade the level. Respect invalidation. Manage risk.

That is how consistency is built using the cTrader support and resistance indicator.

FAQ: cTrader Support and Resistance Indicator

Is a cTrader support and resistance indicator enough on its own?

No. A cTrader support and resistance indicator provides structure, but entries should always be confirmed with price action and risk management rules.

Which timeframe works best with a cTrader support and resistance indicator?

Higher timeframes such as H1, H4, and Daily provide the most reliable zones. Lower timeframes are best used only for execution.

Do funded traders rely on a cTrader support and resistance indicator?

Yes, but only as context. Funded traders use the indicator to identify zones, then apply strict entry models and risk controls.

Master the cTrader Support and Resistance Indicator for Better Entries

Dec 29, 2025

The cTrader support and resistance indicator is one of the most effective tools traders can use to improve entry timing, control risk, and trade with structure instead of emotion. Support and resistance define market behavior, reveal where price reacts, and help traders plan trades with clarity. When applied correctly on cTrader, a well‑used support and resistance indicator can significantly improve entry quality - especially for traders operating under funded or prop‑style rules.

This guide focuses on practical execution, not theory. It’s written for traders who want cleaner entries, controlled risk, and consistency, the mindset required when trading capital in a professional or funded trading environment.

What cTrader Support and Resistance Indicator Actually Represents

A cTrader support and resistance indicator highlights decision zones created by real market participants.

Support is an area where buying pressure has repeatedly absorbed selling

Resistance is an area where selling pressure has repeatedly capped price advances

These zones exist because:

Institutions and algorithms place orders around key price levels

Liquidity clusters near previous highs and lows

Price revisits areas where strong reactions occurred before

For funded and prop traders, this matters because:

Entries must be planned, not impulsive

Risk must be defined before execution

Drawdown limits must be respected

The cTrader support and resistance indicator helps visualize this structure clearly and consistently.

How cTrader Approaches Support and Resistance

cTrader is well suited for structure-based trading because it prioritizes clean charts and precise tools, which is one of the main reasons many prop traders prefer it over other platforms when comparing cTrader vs MT5 for prop firm trading.

The cTrader support and resistance indicator works by analyzing historical price reactions and plotting zones where price is statistically more likely to react again.

On cTrader, support and resistance can be identified using:

Manual drawing tools

Automatic cTrader support and resistance indicators

Price action combined with confirmation tools

The goal is not to predict price, but to react to it intelligently using the indicator as contextual guidance. Traders who are still getting familiar with the platform often benefit from understanding how to trade on cTrader for prop firm challenges, as platform execution and chart behavior play a direct role in level‑based trading.

Manual Support and Resistance on cTrader (Still the Foundation)

Even with a strong cTrader support and resistance indicator, manual level marking remains essential.

How to Mark High‑Quality Levels Manually

Follow these rules:

Start from H4 or H1 timeframes

Identify areas where price reacted multiple times

Extend levels forward, not backward

Treat levels as zones, not single prices

Manual mapping improves your understanding of what the cTrader support and resistance indicator is showing and prevents blind reliance on automation.

Using Trendlines as Dynamic Support and Resistance

Trendlines act as dynamic support and resistance and complement a cTrader support and resistance indicator when:

The trend is clearly defined

Swing highs or lows are respected

Lines are not forced to fit price

Dynamic levels are useful for trailing stops and managing trades once price moves away from the zone. This becomes especially important during funded evaluations, where execution delays or platform instability can affect trade management around dynamic levels, as explained in cTrader connectivity issues during prop challenges.

Using the cTrader Support and Resistance Indicator Effectively

A cTrader support and resistance indicator should be used as an assistant, not a signal generator.

What a Good cTrader Support and Resistance Indicator Should Do

A quality indicator should:

Plot clear zones, not excessive lines

Adapt to changing market structure

Work consistently across timeframes

Avoid aggressive repainting

The best cTrader support and resistance indicator settings favor clarity over quantity.

How Funded Traders Use the Indicator

Professional traders do not enter trades just because the cTrader support and resistance indicator highlights a level.

Instead:

The indicator defines the zone

Price action confirms the setup

Risk is calculated before execution

This workflow supports discipline and repeatability - both essential in funded and prop trading environments. The same principles are expanded further in the guide on best indicators for cTrader to pass prop firm challenges, where structure‑based tools are favored over signal‑driven strategies.

Best Timeframes for the cTrader Support and Resistance Indicator

Choosing the correct timeframe is more important than the indicator itself.

Higher Timeframes (H4 – Daily)

Higher timeframes allow the cTrader support and resistance indicator to:

Define major market structure

Establish directional bias

Identify clear invalidation levels

These timeframes are ideal for traders who want fewer but higher‑quality setups, which is a core requirement when trading under evaluation rules. This aligns closely with our guide on how to pass a prop firm challenge, where trade selectivity is emphasized.

Entry Timeframes (M15 – M30)

Entry timeframes help traders:

Refine entries near indicator zones

Spot rejection or break‑and‑retest behavior

Keep stop‑loss distances controlled

Avoid relying on a cTrader support and resistance indicator on very low timeframes unless you have a tested execution model.

High‑Probability Entry Models Using Support and Resistance Indicator

Rejection‑Based Entries

Best for: traders who want tight invalidation and fewer trades.

How it works:

Price reaches a support or resistance zone identified by the indicator

Clear rejection appears

Entry is taken after confirmation

Stop‑loss is placed beyond the zone

This model works well with a cTrader support and resistance indicator because invalidation is clearly defined.

Break and Retest Entries

Best for: structure‑based continuation trades.

How it works:

Price breaks a key indicator level with momentum

Pulls back to retest the zone

Old resistance becomes support (or vice versa)

Entry follows confirmation

This avoids chasing price and improves risk‑to‑reward consistency.

Range‑Based Entries

When markets are sideways, the cTrader support and resistance indicator helps traders:

Buy near support zones

Sell near resistance zones

Define clear targets and stops

Range trading works best during low‑volatility sessions and requires patience.

Common Mistakes When Using a cTrader Support and Resistance Indicator

Many traders fail not because of strategy, but because of execution errors.

Common mistakes include:

Drawing or accepting too many indicator levels

Trading every touch without confirmation

Ignoring higher‑timeframe structure

Moving stop‑losses emotionally

Treating the cTrader support and resistance indicator as a signal

In funded trading, these mistakes are punished quickly, especially within structured prop environments. Traders unfamiliar with these rules should review what prop trading is and how funded trading works, as expectations differ significantly from personal accounts.

Risk Management Around Support and Resistance Indicator

Entries matter, but risk management matters more.

Proper Stop Placement

Stops should be placed beyond the indicator zone, not inside it

If price invalidates the level, the trade idea is wrong

Position Sizing

Risk per trade stays fixed

Lot size adjusts to stop‑loss distance

Risk is never increased to recover losses

This approach mirrors how professional traders manage capital and directly reflects the principles outlined in our article on risk management tools in cTrader, where protecting drawdown is prioritized over aggressive growth.

Combining the cTrader Support and Resistance Indicator With Confirmation Tools

The cTrader support and resistance indicator works best when paired with light confirmation.

Effective confirmations include:

RSI divergence at indicator zones

EMA confluence

Previous day high or low

Session highs and lows

Two confirmations are enough. More often leads to hesitation and missed trades.

Final Thoughts: Trade Levels, Not Feelings

Mastering the cTrader support and resistance indicator is not about finding a perfect setting. It’s about understanding how price behaves around real decision zones and executing with discipline.

When you combine:

Clean higher‑timeframe mapping

A reliable cTrader support and resistance indicator

A defined entry model

Logical invalidation and stop placement

Proper position sizing

You naturally improve entry quality without increasing trade frequency.

This is also the execution mindset expected in a prop‑firm environment like Pipstone Capital, where traders are evaluated on discipline and controlled risk rather than trade volume. Using the cTrader support and resistance indicator to define clear levels, tight invalidation, and measured position sizing aligns directly with how professional prop traders are expected to operate.

Trade the level. Respect invalidation. Manage risk.

That is how consistency is built using the cTrader support and resistance indicator.

FAQ: cTrader Support and Resistance Indicator

Is a cTrader support and resistance indicator enough on its own?

No. A cTrader support and resistance indicator provides structure, but entries should always be confirmed with price action and risk management rules.

Which timeframe works best with a cTrader support and resistance indicator?

Higher timeframes such as H1, H4, and Daily provide the most reliable zones. Lower timeframes are best used only for execution.

Do funded traders rely on a cTrader support and resistance indicator?

Yes, but only as context. Funded traders use the indicator to identify zones, then apply strict entry models and risk controls.

Master the cTrader Support and Resistance Indicator for Better Entries

Dec 29, 2025

The cTrader support and resistance indicator is one of the most effective tools traders can use to improve entry timing, control risk, and trade with structure instead of emotion. Support and resistance define market behavior, reveal where price reacts, and help traders plan trades with clarity. When applied correctly on cTrader, a well‑used support and resistance indicator can significantly improve entry quality - especially for traders operating under funded or prop‑style rules.

This guide focuses on practical execution, not theory. It’s written for traders who want cleaner entries, controlled risk, and consistency, the mindset required when trading capital in a professional or funded trading environment.

What cTrader Support and Resistance Indicator Actually Represents

A cTrader support and resistance indicator highlights decision zones created by real market participants.

Support is an area where buying pressure has repeatedly absorbed selling

Resistance is an area where selling pressure has repeatedly capped price advances

These zones exist because:

Institutions and algorithms place orders around key price levels

Liquidity clusters near previous highs and lows

Price revisits areas where strong reactions occurred before

For funded and prop traders, this matters because:

Entries must be planned, not impulsive

Risk must be defined before execution

Drawdown limits must be respected

The cTrader support and resistance indicator helps visualize this structure clearly and consistently.

How cTrader Approaches Support and Resistance

cTrader is well suited for structure-based trading because it prioritizes clean charts and precise tools, which is one of the main reasons many prop traders prefer it over other platforms when comparing cTrader vs MT5 for prop firm trading.

The cTrader support and resistance indicator works by analyzing historical price reactions and plotting zones where price is statistically more likely to react again.

On cTrader, support and resistance can be identified using:

Manual drawing tools

Automatic cTrader support and resistance indicators

Price action combined with confirmation tools

The goal is not to predict price, but to react to it intelligently using the indicator as contextual guidance. Traders who are still getting familiar with the platform often benefit from understanding how to trade on cTrader for prop firm challenges, as platform execution and chart behavior play a direct role in level‑based trading.

Manual Support and Resistance on cTrader (Still the Foundation)

Even with a strong cTrader support and resistance indicator, manual level marking remains essential.

How to Mark High‑Quality Levels Manually

Follow these rules:

Start from H4 or H1 timeframes

Identify areas where price reacted multiple times

Extend levels forward, not backward

Treat levels as zones, not single prices

Manual mapping improves your understanding of what the cTrader support and resistance indicator is showing and prevents blind reliance on automation.

Using Trendlines as Dynamic Support and Resistance

Trendlines act as dynamic support and resistance and complement a cTrader support and resistance indicator when:

The trend is clearly defined

Swing highs or lows are respected

Lines are not forced to fit price

Dynamic levels are useful for trailing stops and managing trades once price moves away from the zone. This becomes especially important during funded evaluations, where execution delays or platform instability can affect trade management around dynamic levels, as explained in cTrader connectivity issues during prop challenges.

Using the cTrader Support and Resistance Indicator Effectively

A cTrader support and resistance indicator should be used as an assistant, not a signal generator.

What a Good cTrader Support and Resistance Indicator Should Do

A quality indicator should:

Plot clear zones, not excessive lines

Adapt to changing market structure

Work consistently across timeframes

Avoid aggressive repainting

The best cTrader support and resistance indicator settings favor clarity over quantity.

How Funded Traders Use the Indicator

Professional traders do not enter trades just because the cTrader support and resistance indicator highlights a level.

Instead:

The indicator defines the zone

Price action confirms the setup

Risk is calculated before execution

This workflow supports discipline and repeatability - both essential in funded and prop trading environments. The same principles are expanded further in the guide on best indicators for cTrader to pass prop firm challenges, where structure‑based tools are favored over signal‑driven strategies.

Best Timeframes for the cTrader Support and Resistance Indicator

Choosing the correct timeframe is more important than the indicator itself.

Higher Timeframes (H4 – Daily)

Higher timeframes allow the cTrader support and resistance indicator to:

Define major market structure

Establish directional bias

Identify clear invalidation levels

These timeframes are ideal for traders who want fewer but higher‑quality setups, which is a core requirement when trading under evaluation rules. This aligns closely with our guide on how to pass a prop firm challenge, where trade selectivity is emphasized.

Entry Timeframes (M15 – M30)

Entry timeframes help traders:

Refine entries near indicator zones

Spot rejection or break‑and‑retest behavior

Keep stop‑loss distances controlled

Avoid relying on a cTrader support and resistance indicator on very low timeframes unless you have a tested execution model.

High‑Probability Entry Models Using Support and Resistance Indicator

Rejection‑Based Entries

Best for: traders who want tight invalidation and fewer trades.

How it works:

Price reaches a support or resistance zone identified by the indicator

Clear rejection appears

Entry is taken after confirmation

Stop‑loss is placed beyond the zone

This model works well with a cTrader support and resistance indicator because invalidation is clearly defined.

Break and Retest Entries

Best for: structure‑based continuation trades.

How it works:

Price breaks a key indicator level with momentum

Pulls back to retest the zone

Old resistance becomes support (or vice versa)

Entry follows confirmation

This avoids chasing price and improves risk‑to‑reward consistency.

Range‑Based Entries

When markets are sideways, the cTrader support and resistance indicator helps traders:

Buy near support zones

Sell near resistance zones

Define clear targets and stops

Range trading works best during low‑volatility sessions and requires patience.

Common Mistakes When Using a cTrader Support and Resistance Indicator

Many traders fail not because of strategy, but because of execution errors.

Common mistakes include:

Drawing or accepting too many indicator levels

Trading every touch without confirmation

Ignoring higher‑timeframe structure

Moving stop‑losses emotionally

Treating the cTrader support and resistance indicator as a signal

In funded trading, these mistakes are punished quickly, especially within structured prop environments. Traders unfamiliar with these rules should review what prop trading is and how funded trading works, as expectations differ significantly from personal accounts.

Risk Management Around Support and Resistance Indicator

Entries matter, but risk management matters more.

Proper Stop Placement

Stops should be placed beyond the indicator zone, not inside it

If price invalidates the level, the trade idea is wrong

Position Sizing

Risk per trade stays fixed

Lot size adjusts to stop‑loss distance

Risk is never increased to recover losses

This approach mirrors how professional traders manage capital and directly reflects the principles outlined in our article on risk management tools in cTrader, where protecting drawdown is prioritized over aggressive growth.

Combining the cTrader Support and Resistance Indicator With Confirmation Tools

The cTrader support and resistance indicator works best when paired with light confirmation.

Effective confirmations include:

RSI divergence at indicator zones

EMA confluence

Previous day high or low

Session highs and lows

Two confirmations are enough. More often leads to hesitation and missed trades.

Final Thoughts: Trade Levels, Not Feelings

Mastering the cTrader support and resistance indicator is not about finding a perfect setting. It’s about understanding how price behaves around real decision zones and executing with discipline.

When you combine:

Clean higher‑timeframe mapping

A reliable cTrader support and resistance indicator

A defined entry model

Logical invalidation and stop placement

Proper position sizing

You naturally improve entry quality without increasing trade frequency.

This is also the execution mindset expected in a prop‑firm environment like Pipstone Capital, where traders are evaluated on discipline and controlled risk rather than trade volume. Using the cTrader support and resistance indicator to define clear levels, tight invalidation, and measured position sizing aligns directly with how professional prop traders are expected to operate.

Trade the level. Respect invalidation. Manage risk.

That is how consistency is built using the cTrader support and resistance indicator.

FAQ: cTrader Support and Resistance Indicator

Is a cTrader support and resistance indicator enough on its own?

No. A cTrader support and resistance indicator provides structure, but entries should always be confirmed with price action and risk management rules.

Which timeframe works best with a cTrader support and resistance indicator?

Higher timeframes such as H1, H4, and Daily provide the most reliable zones. Lower timeframes are best used only for execution.

Do funded traders rely on a cTrader support and resistance indicator?

Yes, but only as context. Funded traders use the indicator to identify zones, then apply strict entry models and risk controls.