Best Indicators for cTrader to Pass Funded Account Evaluations in 2026

Dec 15, 2025

Passing a funded account evaluation in 2026 requires more than discipline and risk management—it requires a clean, rule-driven trading system built on the best cTrader indicators that help you avoid low-quality setups. Although indicators do not guarantee profits, the right cTrader indicators can guide your decision-making, reduce impulsive entries, and help you operate within strict evaluation rules such as maximum drawdown and daily loss limits.

Most traders fail prop firm challenges not because they lack skill but because they lack structure. That’s where the right indicator stack becomes a strategic advantage. This article breaks down the best cTrader indicators for trend, momentum, volatility, liquidity, and timing - built specifically for traders aiming to pass funded account evaluations in 2026.

Why Indicators Matter in Funded Account Evaluations

Funded evaluations (including cTrader-focused prop firms such as Pipstone Capital) test a trader’s ability to follow rules under pressure. These rules often include:

Daily loss limits

Maximum overall drawdown

Minimum trading days

Profit targets

Consistent risk management

Restrictions on gambling strategies

Your trading plan must therefore be simple, repeatable, and easy to execute. cTrader indicators help you do exactly that by filtering out bad market conditions, structuring your entries, and ensuring you only take high-probability trades that fit your evaluation rules.

When used correctly, the best cTrader indicators give you clarity about when to trade, when not to trade, and how to size your positions without violating risk parameters.

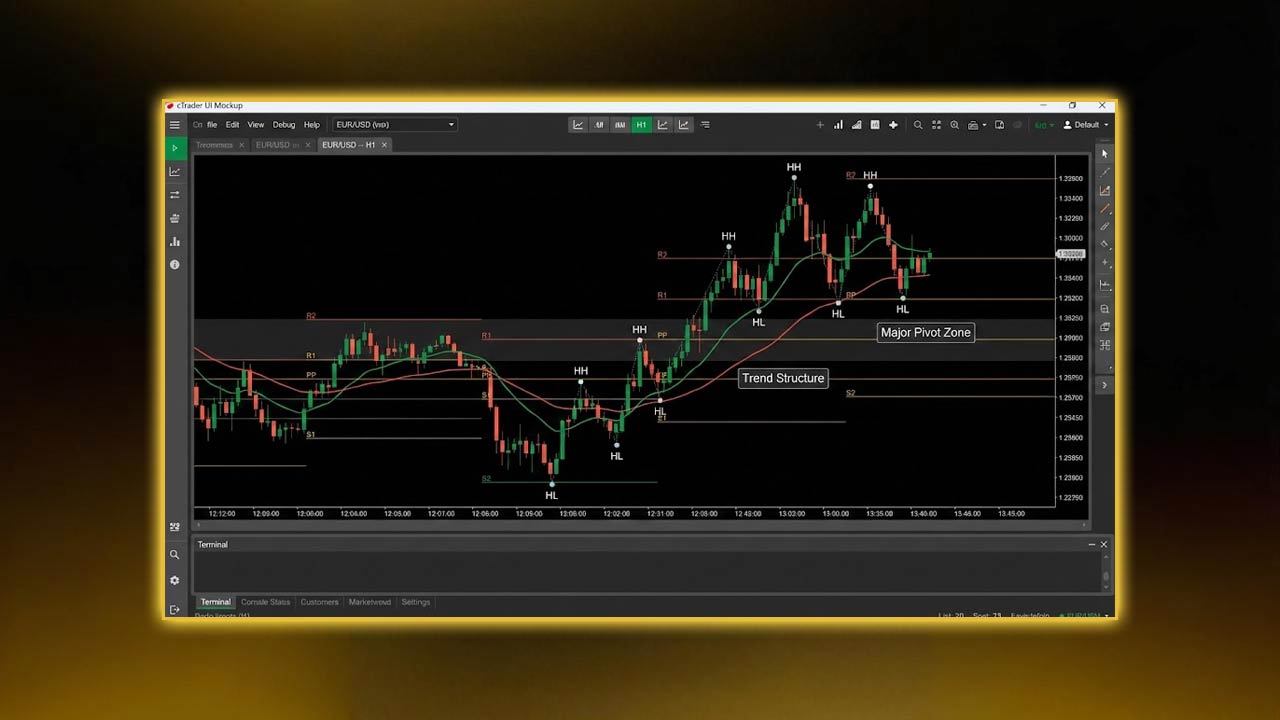

1. Trend Filters: EMAs and Higher-Timeframe Structure

Why trend indicators matter

Most failed evaluations happen because traders fight the trend or try to predict reversals. To avoid this, you need cTrader indicators that clearly define directional bias.

Key Trend Indicators to Use

a) 20 & 50 EMA (Exponential Moving Averages)

These are among the best cTrader indicators for defining trend and momentum on higher timeframes such as H1 or H4.

A prop-friendly rule using EMAs:

Only enter a buy when price is above both EMAs

Only enter a sell when price is below both EMAs

If price is crossing repeatedly → market is choppy → no trades

This rule alone prevents dozens of low-probability trades that would destroy a funded evaluation. For traders who want a deeper breakdown of evaluation mechanics, check the full guide on how to pass a forex prop firm challenge.

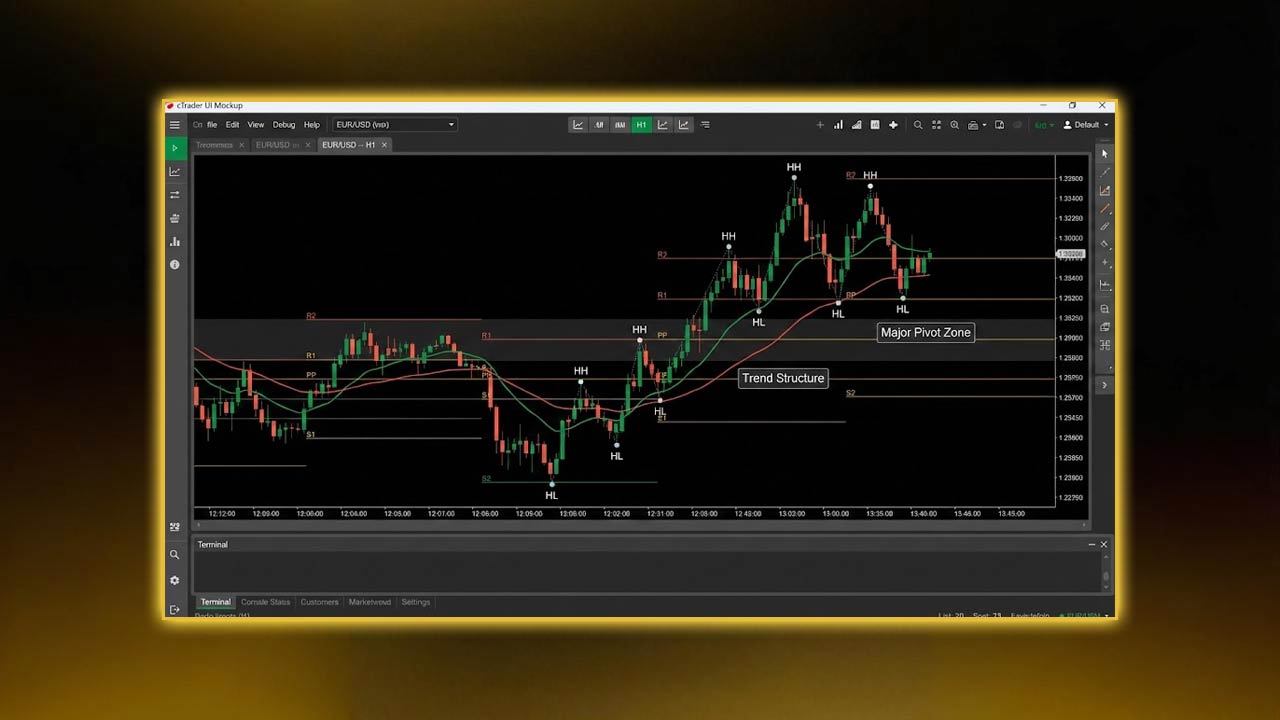

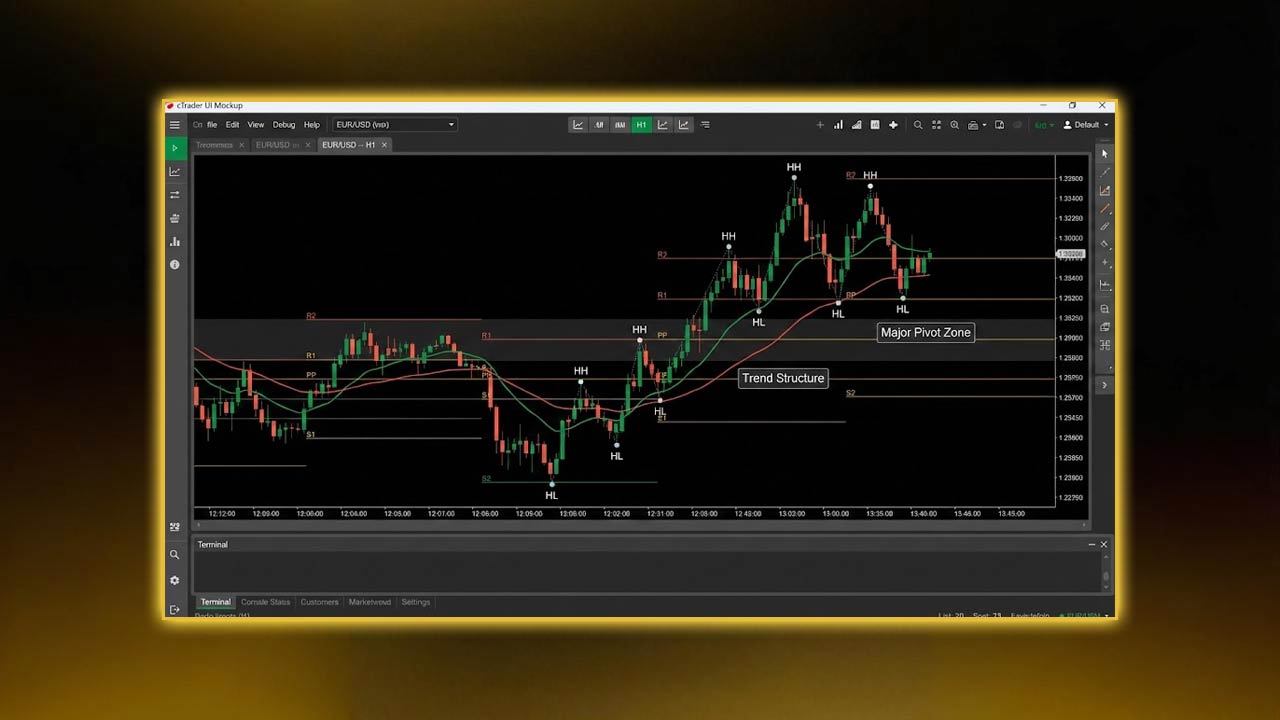

b) Higher-Timeframe Market Structure

Using EMAs in combination with key structural levels (higher highs, lower lows) gives you confirmation that you’re aligned with institutional order flow.

How this helps funded accounts

Trading in the direction of the dominant trend increases win probability and reduces emotional trading, which is essential for maintaining tight drawdown limits. To strengthen your platform skills, you can also review our guide about how to use cTrader platform effectively, which walks through the interface and tools these indicators rely on.

2. Support, Resistance & Pivot-Based Tools

How price levels strengthen your evaluation performance

Key levels help you avoid entering trades just before the market reverses. This is especially important when your evaluation has strict loss limits.

One of the best cTrader indicators for this purpose is:

Pivot Points

Pivot Points automatically map probable support and resistance zones. They work exceptionally well in trending markets and help you:

Set logical stop losses

Identify take-profit zones

Avoid trading into major obstacles

A simple prop-friendly rule:

“I only execute a trade when the trend direction (from EMAs) matches a pivot-zone reaction.”

This ensures that your entries are clean, safe, and backed by structure. If you want a broader understanding of account milestones, here’s a detailed explanation of what a funded account is and how traders qualify for one

3. Momentum Confirmation: How RSI Works Best in Evaluations

RSI is one of the most popular cTrader indicators, but many traders misuse it by buying oversold dips during strong downtrends or selling overbought rallies in strong uptrends.

A prop-friendly way to use RSI

Use RSI to confirm trend continuation, not reversals

Look for RSI > 50 when buying in an uptrend

Look for RSI < 50 when selling in a downtrend

Why this matters

Momentum confirmation helps reduce false signals and keeps your trading decisions aligned with market strength - essential when trying to pass a challenge with tight risk boundaries. You can also review our educational article on risk management in prop trading to reinforce your risk assessment skills.

4. Volatility & Stop Loss Placement: ATR

The Average True Range (ATR) is one of the best cTrader indicators for managing stop losses and position sizing.

Why ATR is vital for funded evaluations

It prevents your stop loss from being too tight

It ensures volatility is accounted for

It helps calculate proper position sizes

It protects you from random spikes

A simple ATR-based rule:

“My stop loss is always 1.5–2× ATR, and my position size adjusts automatically to maintain fixed risk.”

This helps protect your daily loss limit and your overall evaluation account balance. For a deeper breakdown of how these volatility-based decisions fit into real trading conditions, read our full guide on risk management on cTrader, which expands on stop placement, volatility handling, and evaluation drawdown protection.

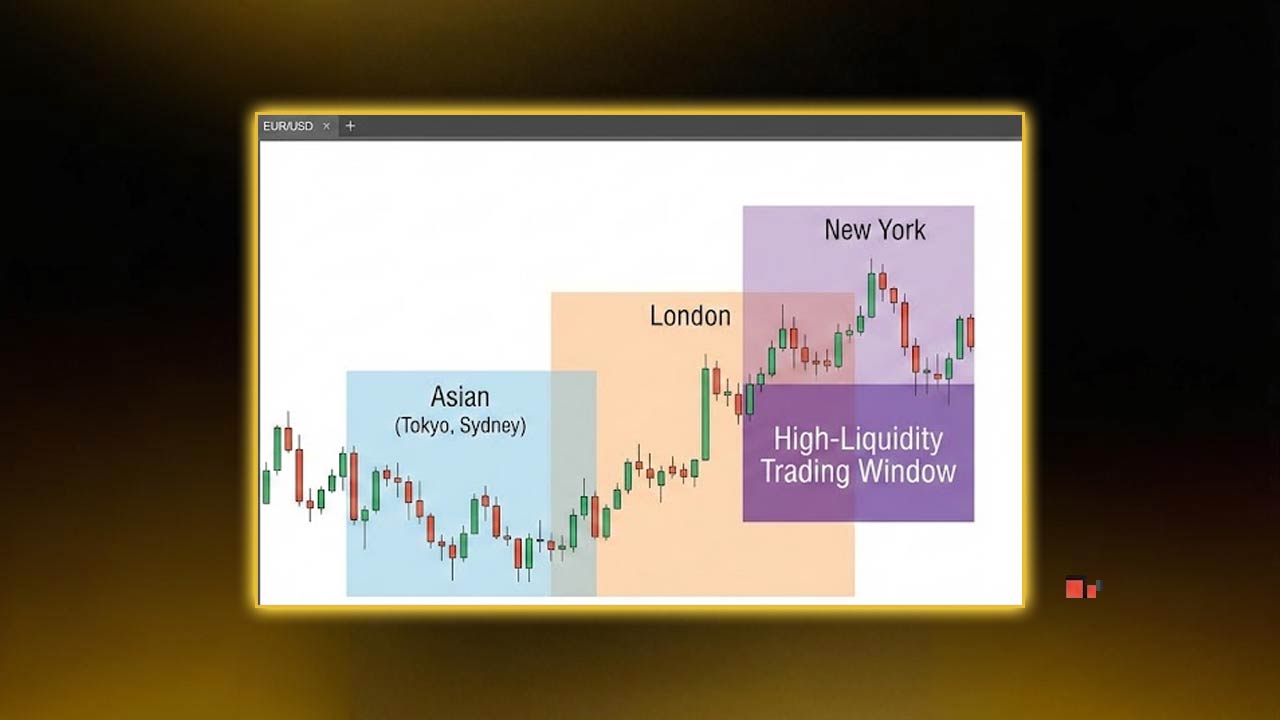

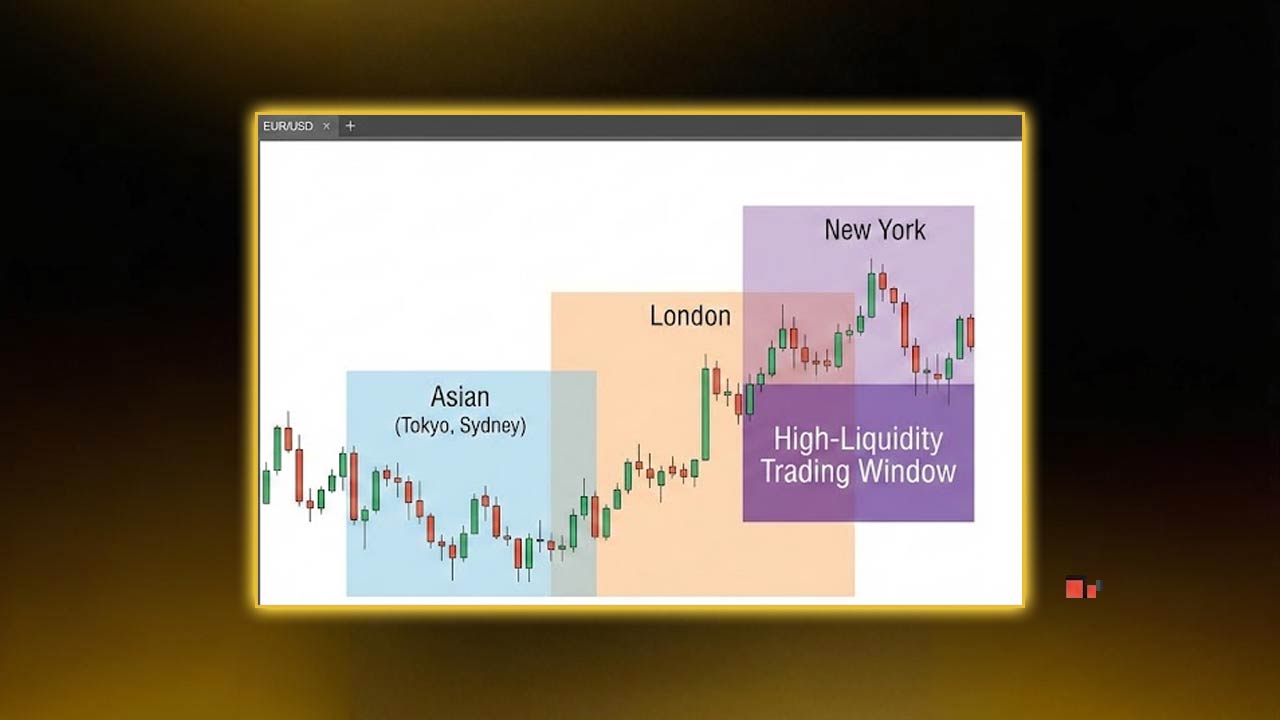

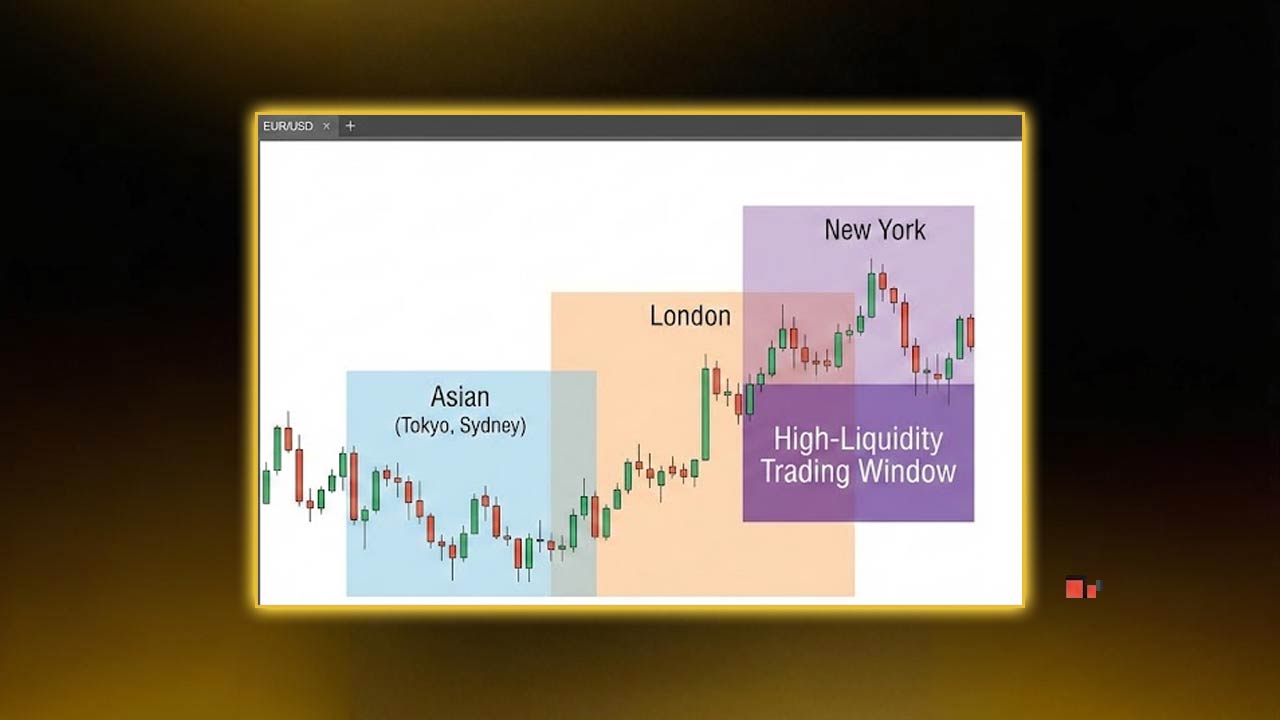

5. Session Indicators: Trade Only During High-Quality Times

Trading during low-liquidity sessions - especially Asian session on some forex pairs—causes unnecessary drawdowns. Session indicators are therefore essential cTrader indicators for funded trading.

Why session tools matter

They highlight London, New York, and Asian sessions

They let you trade when volatility and liquidity are optimal

They help you avoid choppy, slow markets

They keep trading time consistent (great for data review and discipline)

A strong rule to follow:

“Only trade during London Open to New York Open overlap.”

This time window historically provides the cleanest setups.

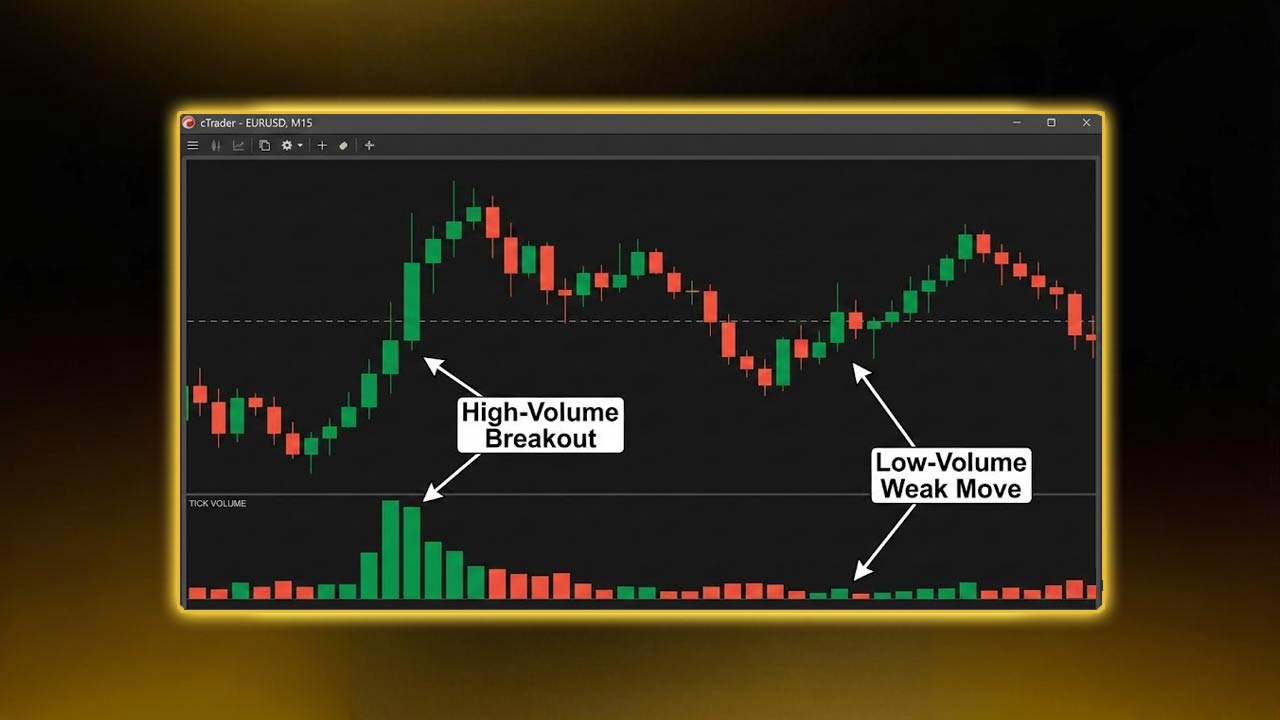

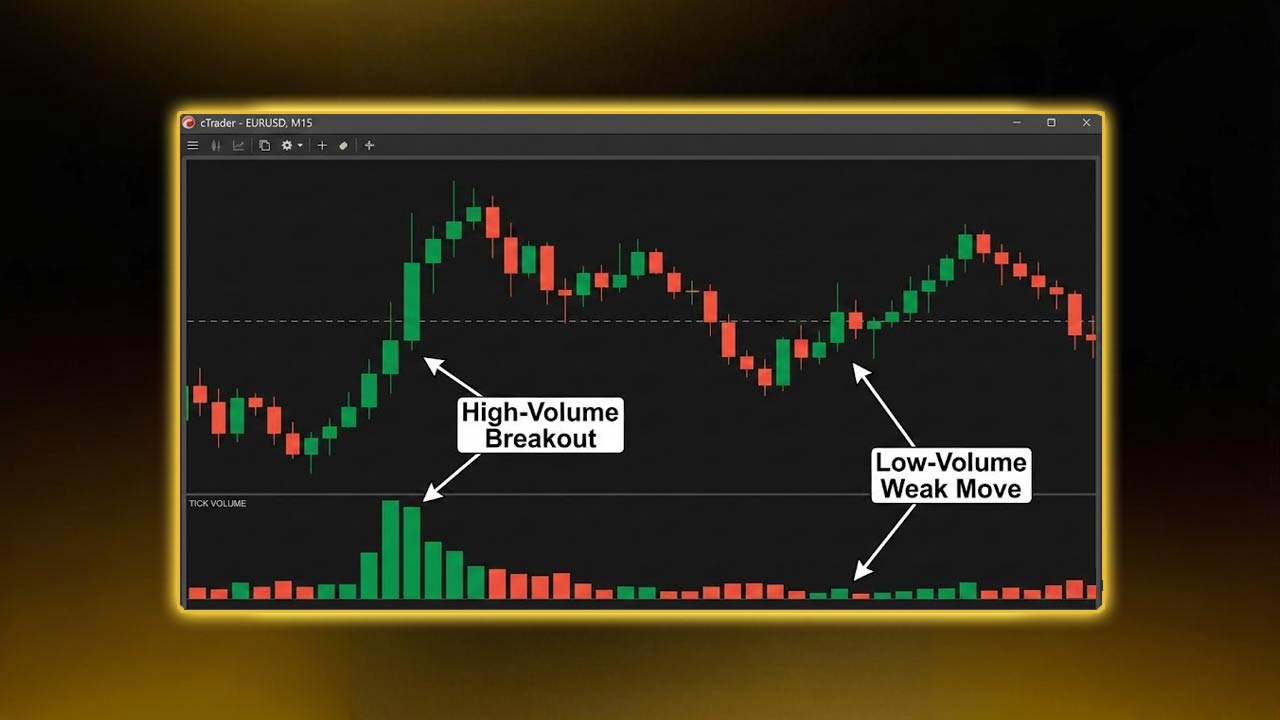

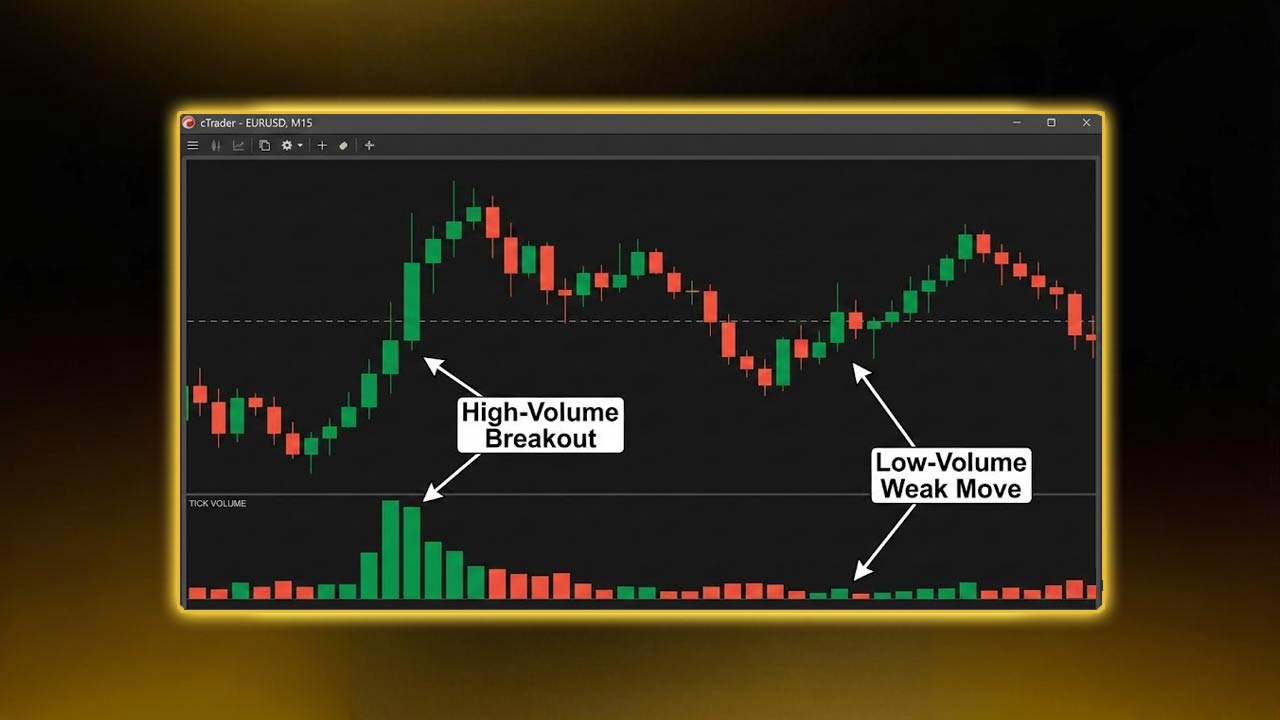

6. Volume & Liquidity Indicators: Optional but Useful

Although forex is decentralized, tick-volume indicators on cTrader provide useful insight into relative activity.

How these cTrader indicators help:

They filter out low-volume periods

They help validate breakouts

They highlight liquidity grabs

They improve your ability to time entries

These aren’t mandatory to pass an evaluation, but when used correctly, they help fine-tune entries and reduce unnecessary losses. To better understand why many traders choose this platform, explore our breakdown of the best cTrader prop firms for low‑spread funded accounts

7. A Complete cTrader Evaluation Template You Can Use in 2026

Below is a clean, prop-firm-friendly template built using the best cTrader indicators.

Higher-Timeframe Chart (H4 & H1)

20 EMA + 50 EMA → trend direction

Pivot Points → major levels

Structure → higher highs/lows or lower highs/lows

Execution Timeframe (M15 or M5)

20 EMA → micro trend confirmation

RSI (confirming direction with 50 level)

ATR → stop loss & lot size calculation

Session indicator → active only during preferred window

Entry Conditions

Trend aligns on higher timeframes

RSI breaks into trend direction (above/below 50)

ATR confirms reasonable stop placement

Price reacts at a logical pivot or structure level

If all four conditions are not met → no trade.

Risk Management Rules for Passing Evaluations

Fixed risk per trade (0.5–1% depending on evaluation rules)

Never exceed daily loss limits

Maximum 2–3 trades per session

Stop loss always based on ATR

No revenge trading

These rules, combined with the best cTrader indicators, create a consistent, repeatable method that aligns with the expectations of modern prop firms such as Pipstone Capital in 2026. For traders who want to backtest this system, Pipstone Capital provides a helpful article on how to backtest prop firm strategies using cTrader cBot automation.

Why Pipstone’s cTrader Environment Gives Traders an Edge

Passing a funded account evaluation in 2026 is less about predicting markets and more about controlling behavior, using structure, and following strict rules. The best cTrader indicators act as a support system that helps you maintain consistency, filter bad setups, and trade only when conditions are ideal.

This aligns well with Pipstone Capital’s trader-first environment, where there are no consistency rules, transparent evaluation metrics, low-latency cTrader execution, and a structure designed to reward disciplined trading rather than force unnecessary trading activity. This makes it a strong choice for traders looking for a reliable forex prop firm.

If you build your plan around EMAs, Pivot Points, RSI, ATR, and session indicators, while applying strict risk management - you give yourself the best possible chance to pass your evaluation and become a funded trader.

FAQ: cTrader Indicators

1. What are the best cTrader indicators for passing funded account evaluations?

The best cTrader indicators include EMAs, Pivot Points, RSI, ATR, and session indicators. Together, they provide trend, momentum, volatility, and timing information—everything needed to trade safely within evaluation limits.

2. How many cTrader indicators should I use at once?

Most successful traders use 4–6 cTrader indicators maximum. Too many creates analysis paralysis and lowers win rate.

3. Are cTrader indicators enough to pass an evaluation?

Indicators help provide structure, but your success depends on risk management, emotional discipline, and sticking to your rules.

4. Can I use custom indicators on cTrader for my prop challenge?

Yes, but it’s better to use simple, universally understood tools. Most funded traders succeed with standard cTrader indicators.

5. Should I use these indicators differently depending on the asset?

Volatility-based indicators like ATR may need adjustment for indices, metals, or volatile forex pairs, but the core rules remain the same.

Best Indicators for cTrader to Pass Funded Account Evaluations in 2026

Dec 15, 2025

Passing a funded account evaluation in 2026 requires more than discipline and risk management—it requires a clean, rule-driven trading system built on the best cTrader indicators that help you avoid low-quality setups. Although indicators do not guarantee profits, the right cTrader indicators can guide your decision-making, reduce impulsive entries, and help you operate within strict evaluation rules such as maximum drawdown and daily loss limits.

Most traders fail prop firm challenges not because they lack skill but because they lack structure. That’s where the right indicator stack becomes a strategic advantage. This article breaks down the best cTrader indicators for trend, momentum, volatility, liquidity, and timing - built specifically for traders aiming to pass funded account evaluations in 2026.

Why Indicators Matter in Funded Account Evaluations

Funded evaluations (including cTrader-focused prop firms such as Pipstone Capital) test a trader’s ability to follow rules under pressure. These rules often include:

Daily loss limits

Maximum overall drawdown

Minimum trading days

Profit targets

Consistent risk management

Restrictions on gambling strategies

Your trading plan must therefore be simple, repeatable, and easy to execute. cTrader indicators help you do exactly that by filtering out bad market conditions, structuring your entries, and ensuring you only take high-probability trades that fit your evaluation rules.

When used correctly, the best cTrader indicators give you clarity about when to trade, when not to trade, and how to size your positions without violating risk parameters.

1. Trend Filters: EMAs and Higher-Timeframe Structure

Why trend indicators matter

Most failed evaluations happen because traders fight the trend or try to predict reversals. To avoid this, you need cTrader indicators that clearly define directional bias.

Key Trend Indicators to Use

a) 20 & 50 EMA (Exponential Moving Averages)

These are among the best cTrader indicators for defining trend and momentum on higher timeframes such as H1 or H4.

A prop-friendly rule using EMAs:

Only enter a buy when price is above both EMAs

Only enter a sell when price is below both EMAs

If price is crossing repeatedly → market is choppy → no trades

This rule alone prevents dozens of low-probability trades that would destroy a funded evaluation. For traders who want a deeper breakdown of evaluation mechanics, check the full guide on how to pass a forex prop firm challenge.

b) Higher-Timeframe Market Structure

Using EMAs in combination with key structural levels (higher highs, lower lows) gives you confirmation that you’re aligned with institutional order flow.

How this helps funded accounts

Trading in the direction of the dominant trend increases win probability and reduces emotional trading, which is essential for maintaining tight drawdown limits. To strengthen your platform skills, you can also review our guide about how to use cTrader platform effectively, which walks through the interface and tools these indicators rely on.

2. Support, Resistance & Pivot-Based Tools

How price levels strengthen your evaluation performance

Key levels help you avoid entering trades just before the market reverses. This is especially important when your evaluation has strict loss limits.

One of the best cTrader indicators for this purpose is:

Pivot Points

Pivot Points automatically map probable support and resistance zones. They work exceptionally well in trending markets and help you:

Set logical stop losses

Identify take-profit zones

Avoid trading into major obstacles

A simple prop-friendly rule:

“I only execute a trade when the trend direction (from EMAs) matches a pivot-zone reaction.”

This ensures that your entries are clean, safe, and backed by structure. If you want a broader understanding of account milestones, here’s a detailed explanation of what a funded account is and how traders qualify for one

3. Momentum Confirmation: How RSI Works Best in Evaluations

RSI is one of the most popular cTrader indicators, but many traders misuse it by buying oversold dips during strong downtrends or selling overbought rallies in strong uptrends.

A prop-friendly way to use RSI

Use RSI to confirm trend continuation, not reversals

Look for RSI > 50 when buying in an uptrend

Look for RSI < 50 when selling in a downtrend

Why this matters

Momentum confirmation helps reduce false signals and keeps your trading decisions aligned with market strength - essential when trying to pass a challenge with tight risk boundaries. You can also review our educational article on risk management in prop trading to reinforce your risk assessment skills.

4. Volatility & Stop Loss Placement: ATR

The Average True Range (ATR) is one of the best cTrader indicators for managing stop losses and position sizing.

Why ATR is vital for funded evaluations

It prevents your stop loss from being too tight

It ensures volatility is accounted for

It helps calculate proper position sizes

It protects you from random spikes

A simple ATR-based rule:

“My stop loss is always 1.5–2× ATR, and my position size adjusts automatically to maintain fixed risk.”

This helps protect your daily loss limit and your overall evaluation account balance. For a deeper breakdown of how these volatility-based decisions fit into real trading conditions, read our full guide on risk management on cTrader, which expands on stop placement, volatility handling, and evaluation drawdown protection.

5. Session Indicators: Trade Only During High-Quality Times

Trading during low-liquidity sessions - especially Asian session on some forex pairs—causes unnecessary drawdowns. Session indicators are therefore essential cTrader indicators for funded trading.

Why session tools matter

They highlight London, New York, and Asian sessions

They let you trade when volatility and liquidity are optimal

They help you avoid choppy, slow markets

They keep trading time consistent (great for data review and discipline)

A strong rule to follow:

“Only trade during London Open to New York Open overlap.”

This time window historically provides the cleanest setups.

6. Volume & Liquidity Indicators: Optional but Useful

Although forex is decentralized, tick-volume indicators on cTrader provide useful insight into relative activity.

How these cTrader indicators help:

They filter out low-volume periods

They help validate breakouts

They highlight liquidity grabs

They improve your ability to time entries

These aren’t mandatory to pass an evaluation, but when used correctly, they help fine-tune entries and reduce unnecessary losses. To better understand why many traders choose this platform, explore our breakdown of the best cTrader prop firms for low‑spread funded accounts

7. A Complete cTrader Evaluation Template You Can Use in 2026

Below is a clean, prop-firm-friendly template built using the best cTrader indicators.

Higher-Timeframe Chart (H4 & H1)

20 EMA + 50 EMA → trend direction

Pivot Points → major levels

Structure → higher highs/lows or lower highs/lows

Execution Timeframe (M15 or M5)

20 EMA → micro trend confirmation

RSI (confirming direction with 50 level)

ATR → stop loss & lot size calculation

Session indicator → active only during preferred window

Entry Conditions

Trend aligns on higher timeframes

RSI breaks into trend direction (above/below 50)

ATR confirms reasonable stop placement

Price reacts at a logical pivot or structure level

If all four conditions are not met → no trade.

Risk Management Rules for Passing Evaluations

Fixed risk per trade (0.5–1% depending on evaluation rules)

Never exceed daily loss limits

Maximum 2–3 trades per session

Stop loss always based on ATR

No revenge trading

These rules, combined with the best cTrader indicators, create a consistent, repeatable method that aligns with the expectations of modern prop firms such as Pipstone Capital in 2026. For traders who want to backtest this system, Pipstone Capital provides a helpful article on how to backtest prop firm strategies using cTrader cBot automation.

Why Pipstone’s cTrader Environment Gives Traders an Edge

Passing a funded account evaluation in 2026 is less about predicting markets and more about controlling behavior, using structure, and following strict rules. The best cTrader indicators act as a support system that helps you maintain consistency, filter bad setups, and trade only when conditions are ideal.

This aligns well with Pipstone Capital’s trader-first environment, where there are no consistency rules, transparent evaluation metrics, low-latency cTrader execution, and a structure designed to reward disciplined trading rather than force unnecessary trading activity. This makes it a strong choice for traders looking for a reliable forex prop firm.

If you build your plan around EMAs, Pivot Points, RSI, ATR, and session indicators, while applying strict risk management - you give yourself the best possible chance to pass your evaluation and become a funded trader.

FAQ: cTrader Indicators

1. What are the best cTrader indicators for passing funded account evaluations?

The best cTrader indicators include EMAs, Pivot Points, RSI, ATR, and session indicators. Together, they provide trend, momentum, volatility, and timing information—everything needed to trade safely within evaluation limits.

2. How many cTrader indicators should I use at once?

Most successful traders use 4–6 cTrader indicators maximum. Too many creates analysis paralysis and lowers win rate.

3. Are cTrader indicators enough to pass an evaluation?

Indicators help provide structure, but your success depends on risk management, emotional discipline, and sticking to your rules.

4. Can I use custom indicators on cTrader for my prop challenge?

Yes, but it’s better to use simple, universally understood tools. Most funded traders succeed with standard cTrader indicators.

5. Should I use these indicators differently depending on the asset?

Volatility-based indicators like ATR may need adjustment for indices, metals, or volatile forex pairs, but the core rules remain the same.

Best Indicators for cTrader to Pass Funded Account Evaluations in 2026

Dec 15, 2025

Passing a funded account evaluation in 2026 requires more than discipline and risk management—it requires a clean, rule-driven trading system built on the best cTrader indicators that help you avoid low-quality setups. Although indicators do not guarantee profits, the right cTrader indicators can guide your decision-making, reduce impulsive entries, and help you operate within strict evaluation rules such as maximum drawdown and daily loss limits.

Most traders fail prop firm challenges not because they lack skill but because they lack structure. That’s where the right indicator stack becomes a strategic advantage. This article breaks down the best cTrader indicators for trend, momentum, volatility, liquidity, and timing - built specifically for traders aiming to pass funded account evaluations in 2026.

Why Indicators Matter in Funded Account Evaluations

Funded evaluations (including cTrader-focused prop firms such as Pipstone Capital) test a trader’s ability to follow rules under pressure. These rules often include:

Daily loss limits

Maximum overall drawdown

Minimum trading days

Profit targets

Consistent risk management

Restrictions on gambling strategies

Your trading plan must therefore be simple, repeatable, and easy to execute. cTrader indicators help you do exactly that by filtering out bad market conditions, structuring your entries, and ensuring you only take high-probability trades that fit your evaluation rules.

When used correctly, the best cTrader indicators give you clarity about when to trade, when not to trade, and how to size your positions without violating risk parameters.

1. Trend Filters: EMAs and Higher-Timeframe Structure

Why trend indicators matter

Most failed evaluations happen because traders fight the trend or try to predict reversals. To avoid this, you need cTrader indicators that clearly define directional bias.

Key Trend Indicators to Use

a) 20 & 50 EMA (Exponential Moving Averages)

These are among the best cTrader indicators for defining trend and momentum on higher timeframes such as H1 or H4.

A prop-friendly rule using EMAs:

Only enter a buy when price is above both EMAs

Only enter a sell when price is below both EMAs

If price is crossing repeatedly → market is choppy → no trades

This rule alone prevents dozens of low-probability trades that would destroy a funded evaluation. For traders who want a deeper breakdown of evaluation mechanics, check the full guide on how to pass a forex prop firm challenge.

b) Higher-Timeframe Market Structure

Using EMAs in combination with key structural levels (higher highs, lower lows) gives you confirmation that you’re aligned with institutional order flow.

How this helps funded accounts

Trading in the direction of the dominant trend increases win probability and reduces emotional trading, which is essential for maintaining tight drawdown limits. To strengthen your platform skills, you can also review our guide about how to use cTrader platform effectively, which walks through the interface and tools these indicators rely on.

2. Support, Resistance & Pivot-Based Tools

How price levels strengthen your evaluation performance

Key levels help you avoid entering trades just before the market reverses. This is especially important when your evaluation has strict loss limits.

One of the best cTrader indicators for this purpose is:

Pivot Points

Pivot Points automatically map probable support and resistance zones. They work exceptionally well in trending markets and help you:

Set logical stop losses

Identify take-profit zones

Avoid trading into major obstacles

A simple prop-friendly rule:

“I only execute a trade when the trend direction (from EMAs) matches a pivot-zone reaction.”

This ensures that your entries are clean, safe, and backed by structure. If you want a broader understanding of account milestones, here’s a detailed explanation of what a funded account is and how traders qualify for one

3. Momentum Confirmation: How RSI Works Best in Evaluations

RSI is one of the most popular cTrader indicators, but many traders misuse it by buying oversold dips during strong downtrends or selling overbought rallies in strong uptrends.

A prop-friendly way to use RSI

Use RSI to confirm trend continuation, not reversals

Look for RSI > 50 when buying in an uptrend

Look for RSI < 50 when selling in a downtrend

Why this matters

Momentum confirmation helps reduce false signals and keeps your trading decisions aligned with market strength - essential when trying to pass a challenge with tight risk boundaries. You can also review our educational article on risk management in prop trading to reinforce your risk assessment skills.

4. Volatility & Stop Loss Placement: ATR

The Average True Range (ATR) is one of the best cTrader indicators for managing stop losses and position sizing.

Why ATR is vital for funded evaluations

It prevents your stop loss from being too tight

It ensures volatility is accounted for

It helps calculate proper position sizes

It protects you from random spikes

A simple ATR-based rule:

“My stop loss is always 1.5–2× ATR, and my position size adjusts automatically to maintain fixed risk.”

This helps protect your daily loss limit and your overall evaluation account balance. For a deeper breakdown of how these volatility-based decisions fit into real trading conditions, read our full guide on risk management on cTrader, which expands on stop placement, volatility handling, and evaluation drawdown protection.

5. Session Indicators: Trade Only During High-Quality Times

Trading during low-liquidity sessions - especially Asian session on some forex pairs—causes unnecessary drawdowns. Session indicators are therefore essential cTrader indicators for funded trading.

Why session tools matter

They highlight London, New York, and Asian sessions

They let you trade when volatility and liquidity are optimal

They help you avoid choppy, slow markets

They keep trading time consistent (great for data review and discipline)

A strong rule to follow:

“Only trade during London Open to New York Open overlap.”

This time window historically provides the cleanest setups.

6. Volume & Liquidity Indicators: Optional but Useful

Although forex is decentralized, tick-volume indicators on cTrader provide useful insight into relative activity.

How these cTrader indicators help:

They filter out low-volume periods

They help validate breakouts

They highlight liquidity grabs

They improve your ability to time entries

These aren’t mandatory to pass an evaluation, but when used correctly, they help fine-tune entries and reduce unnecessary losses. To better understand why many traders choose this platform, explore our breakdown of the best cTrader prop firms for low‑spread funded accounts

7. A Complete cTrader Evaluation Template You Can Use in 2026

Below is a clean, prop-firm-friendly template built using the best cTrader indicators.

Higher-Timeframe Chart (H4 & H1)

20 EMA + 50 EMA → trend direction

Pivot Points → major levels

Structure → higher highs/lows or lower highs/lows

Execution Timeframe (M15 or M5)

20 EMA → micro trend confirmation

RSI (confirming direction with 50 level)

ATR → stop loss & lot size calculation

Session indicator → active only during preferred window

Entry Conditions

Trend aligns on higher timeframes

RSI breaks into trend direction (above/below 50)

ATR confirms reasonable stop placement

Price reacts at a logical pivot or structure level

If all four conditions are not met → no trade.

Risk Management Rules for Passing Evaluations

Fixed risk per trade (0.5–1% depending on evaluation rules)

Never exceed daily loss limits

Maximum 2–3 trades per session

Stop loss always based on ATR

No revenge trading

These rules, combined with the best cTrader indicators, create a consistent, repeatable method that aligns with the expectations of modern prop firms such as Pipstone Capital in 2026. For traders who want to backtest this system, Pipstone Capital provides a helpful article on how to backtest prop firm strategies using cTrader cBot automation.

Why Pipstone’s cTrader Environment Gives Traders an Edge

Passing a funded account evaluation in 2026 is less about predicting markets and more about controlling behavior, using structure, and following strict rules. The best cTrader indicators act as a support system that helps you maintain consistency, filter bad setups, and trade only when conditions are ideal.

This aligns well with Pipstone Capital’s trader-first environment, where there are no consistency rules, transparent evaluation metrics, low-latency cTrader execution, and a structure designed to reward disciplined trading rather than force unnecessary trading activity. This makes it a strong choice for traders looking for a reliable forex prop firm.

If you build your plan around EMAs, Pivot Points, RSI, ATR, and session indicators, while applying strict risk management - you give yourself the best possible chance to pass your evaluation and become a funded trader.

FAQ: cTrader Indicators

1. What are the best cTrader indicators for passing funded account evaluations?

The best cTrader indicators include EMAs, Pivot Points, RSI, ATR, and session indicators. Together, they provide trend, momentum, volatility, and timing information—everything needed to trade safely within evaluation limits.

2. How many cTrader indicators should I use at once?

Most successful traders use 4–6 cTrader indicators maximum. Too many creates analysis paralysis and lowers win rate.

3. Are cTrader indicators enough to pass an evaluation?

Indicators help provide structure, but your success depends on risk management, emotional discipline, and sticking to your rules.

4. Can I use custom indicators on cTrader for my prop challenge?

Yes, but it’s better to use simple, universally understood tools. Most funded traders succeed with standard cTrader indicators.

5. Should I use these indicators differently depending on the asset?

Volatility-based indicators like ATR may need adjustment for indices, metals, or volatile forex pairs, but the core rules remain the same.