cTrader vs MT5: Which Platform Works Best for Prop Firms?

Nov 21, 2025

Your trading platform shapes your speed, focus, and execution in a prop-firm challenge. When traders compare cTrader vs MT5, they look for a platform that supports fast decisions and clean workflows. Prop trading rewards clarity and control, so the right platform can lift your performance during funded-account phases.

Today, traders also want to understand mt4 vs mt5 vs cTrader comparison, and how modern platforms fit fast markets. MT5 is common. It works well but feels older. cTrader is modern, smooth, and transparent. In a challenge where seconds matter, these small differences can decide how you perform.

This guide breaks down cTrader vs MT5 and also compares tools that matter most to prop traders.

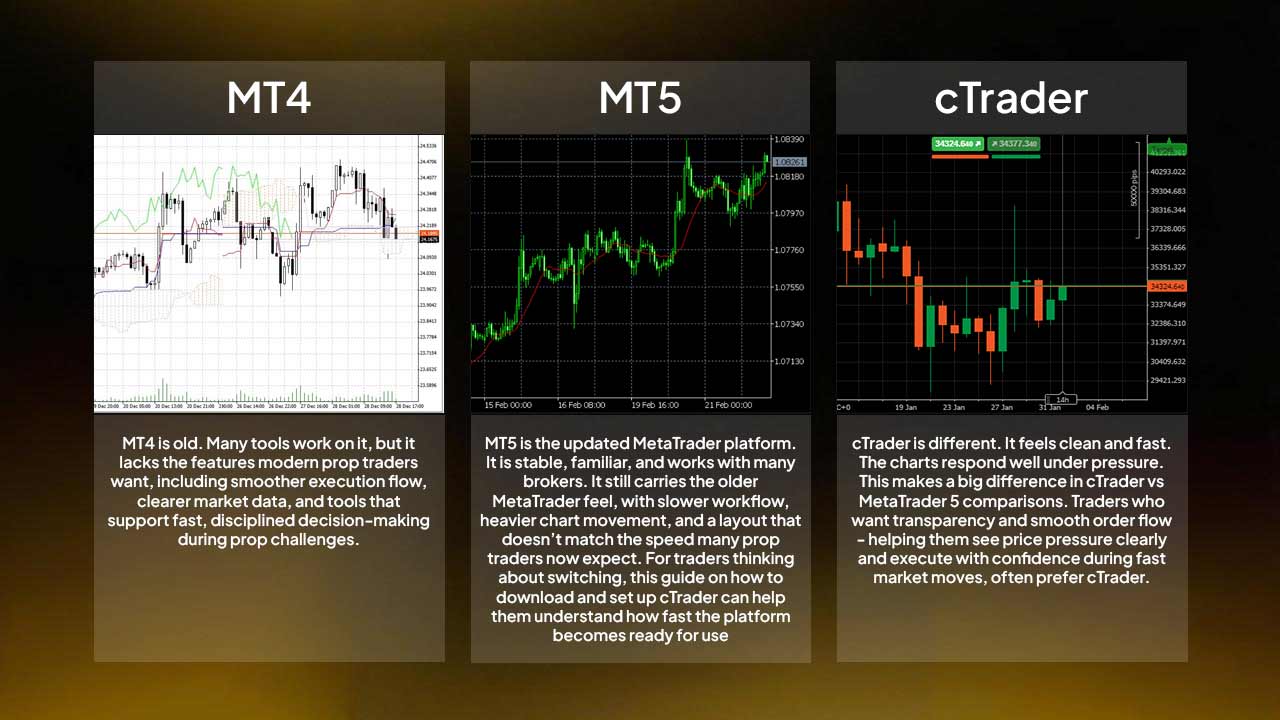

1. Platform Overview: MT4 vs MT5 vs cTrader

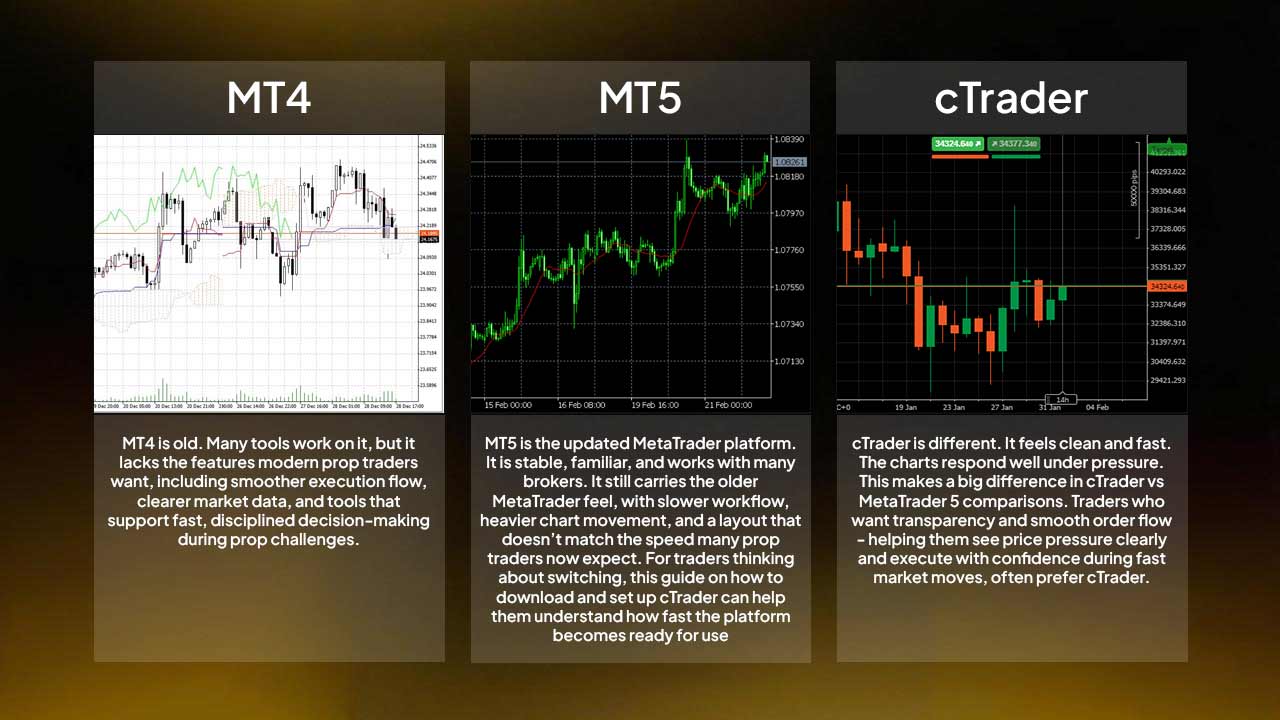

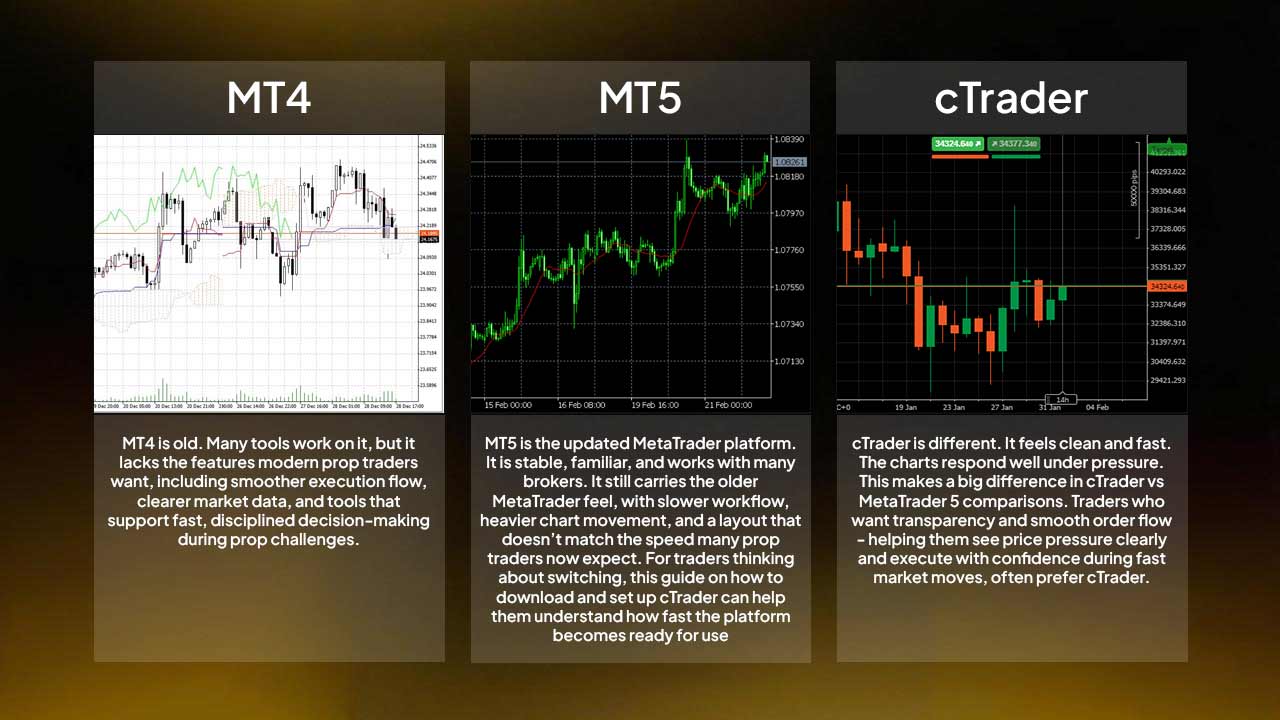

When traders think about mt4 vs mt5 vs cTrader, they see three different levels of platform evolution, with each platform showing a clear shift in speed, structure, and the type of control traders get during real‑time market moves.

MT4

MT4 is old. Many tools work on it, but it lacks the features modern prop traders want, including smoother execution flow, clearer market data, and tools that support fast, disciplined decision‑making during prop challenges.

MT5

MT5 is the updated MetaTrader platform. It is stable, familiar, and works with many brokers. It still carries the older MetaTrader feel, with slower workflow, heavier chart movement, and a layout that doesn’t match the speed many prop traders now expect.

cTrader

cTrader is different. It feels clean and fast. The charts respond well under pressure. This makes a big difference in cTrader vs MetaTrader 5 comparisons. Traders who want transparency and smooth order flow - helping them see price pressure clearly and execute with confidence during fast market moves, often prefer cTrader.

2. User Interface

A major reason traders look for a trading tool is the difference in layout and interaction, since the platform should support fast decisions without slowing the trader down.

MT5 interface

MT5 is full of tools but uses an older structure. It is functional but takes more clicks and more steps. It works well if you already know MetaTrader. But when comparing mt5 vs cTrader, the difference in flow is clear, because MT5 feels heavier while cTrader keeps everything moving fast and simple during live trading.

cTrader interface

cTrader uses a modern UI. The platform feels light and reacts quickly. Chart windows are wide. Workspaces are flexible. Order placement takes fewer clicks. Traders who compare cTrader vs MetaTrader 5 often mention reduced stress and smoother decision-making on cTrader. Traders who want a full walkthrough can check the guide on how to use cTrader for funded accounts, which breaks down workspace setup and smooth workflow steps.

3. Charting and Execution Speed

Execution is one of the biggest reasons traders compare MetaTrader 5 vs cTrader in prop trading.

MT5 charting and execution

MT5 gives strong charting with many indicators. The tools are reliable, but switching layouts and managing charts feels slower. Execution depends on broker setup.

cTrader charting and execution

cTrader offers clean charts, sharp movement, and smooth zooming. Chart updates feel real-time. Order execution responds fast because the platform is built with modern standards. Traders comparing cTrader vs MT5 often say they feel more confident during fast market conditions.

4. Order Types and Transparency

Traders look at mt5 vs cTrader order features to see which platform gives more control.

MT5 order tools

MT5 supports all major order types. But some advanced tools require add-ons or manual setup. Traders who compare cTrader vs MetaTrader 5 often point out that MT5 hides some execution info.

cTrader order tools

cTrader includes advanced stops, clear execution cost, fast order entry, and Depth of Market. DOM is one of the main reasons traders favor cTrader. You see liquidity, slippage, and levels instantly.

5. Automation and Coding: Nothing Beats cTrader

Algo traders compare mt4 vs mt5 vs cTrader to pick the platform that fits their strategy.

MT5 automation

MT5 uses MQL5. You get thousands of EAs. If you rely on automation heavily, MT5 is better.

cTrader automation

cTrader uses C# for cBots. Coding feels clean and modern. Cloud automation is built in. The library is smaller than MT5, but many traders prefer C# over MQL5 because it is more flexible, giving traders cleaner code structure, easier debugging, and a smoother workflow when building or adjusting automated strategies. Traders who want to automate their trading can learn how cBots work through the cTrader cBot strategy guide, which explains how automation fits into prop challenges.

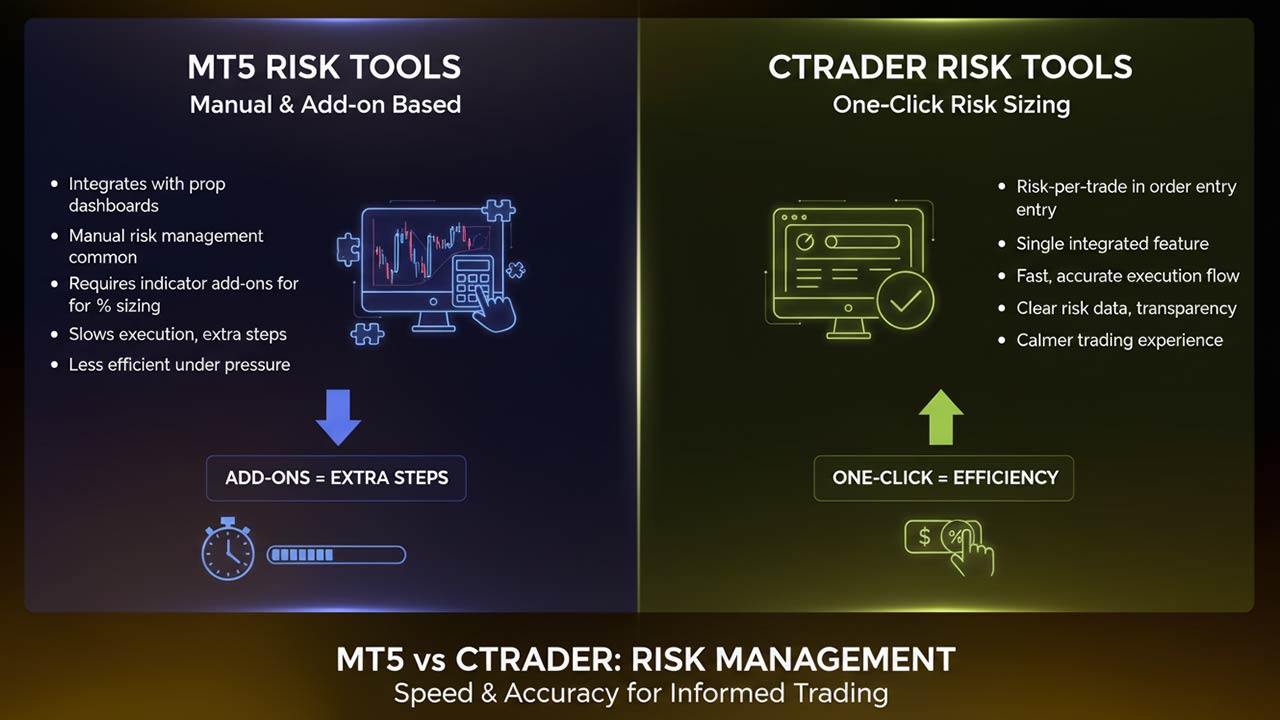

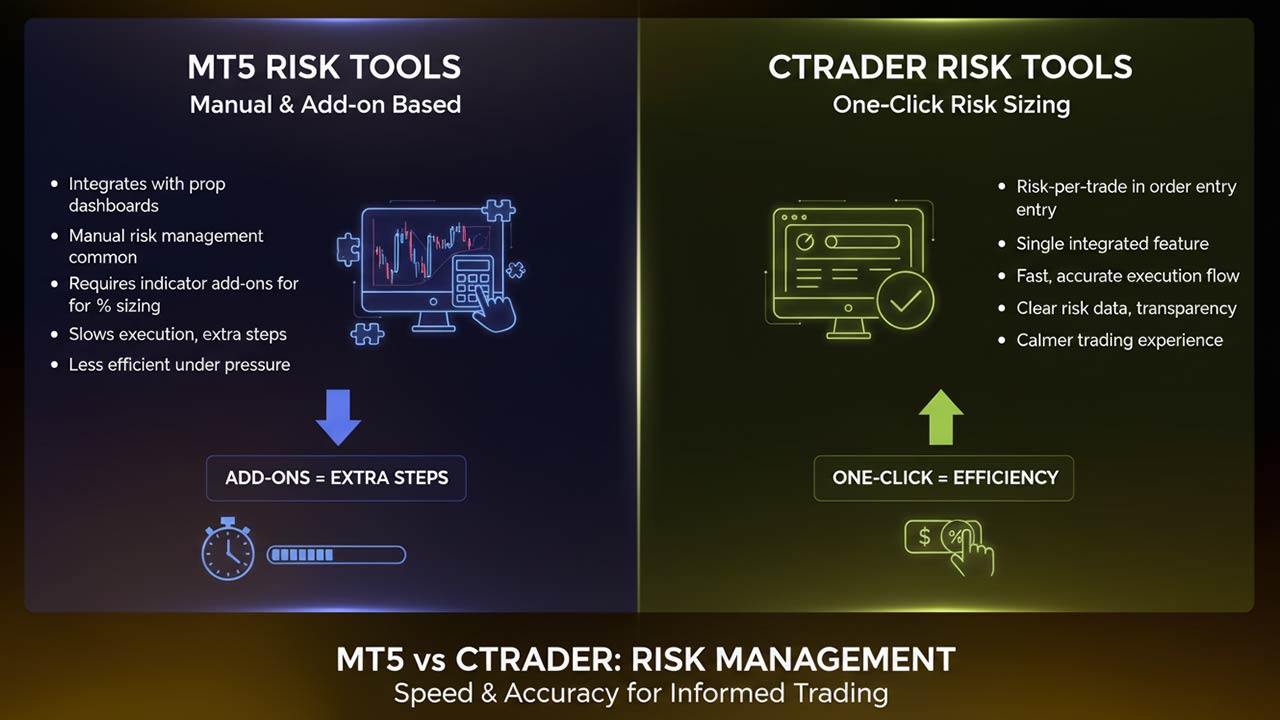

6. Risk Management Tools: cTrader vs MT5 Which Is Better

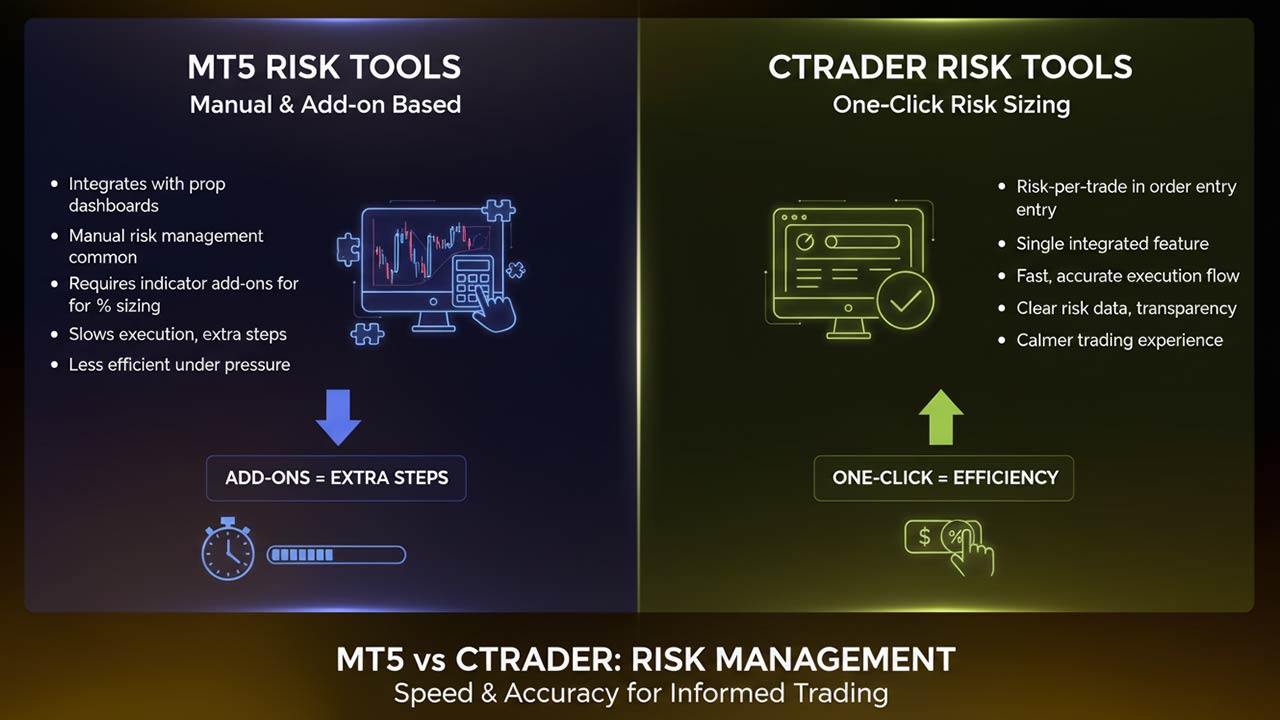

Prop-firm rules demand strict risk control. Traders often search for the best trading tool for staying inside drawdown limits.

MT5 risk tools

MT5 integrates well with prop dashboards, but manual risk management is common. Traders need indicator add-ons to size risk by percentage, which slows them down and forces extra steps during live trading when speed and accuracy matter most.

cTrader risk tools

cTrader allows risk-per-trade sizing directly during order entry. This single feature makes many traders pick cTrader in the mt5 vs cTrader comparison. Transparency helps traders avoid emotional decisions by giving them clear risk data, smooth execution flow, and a calmer trading experience.

7. Prop Trading Performance

Prop-firm trading requires speed, clarity, and clean execution. This is where the cTrader vs MetaTrader 5 comparison becomes clear.

Where cTrader helps prop traders

Faster workflow

Smooth chart movement

Transparent order flow

Liquidity view through DOM

Clean stops and limit controls

Less chart clutter

Fewer execution errors

These points make cTrader vs MT5 tilt strongly toward cTrader for fast strategies because the platform reacts quickly, keeps the chart clean, and helps traders make decisions without hesitation during intense market moves.

Where MetaTrader 5 helps prop traders

MT5 helps traders who use:

Expert Advisors

Custom indicators

Multi-asset strategies

But for manual intraday trading, cTrader feels more modern. That is why most traders comparing MetaTrader 5 vs cTrader prefer cTrader for discretionary challenge phases.

8. Mobile and Web Experience

When comparing cTrader vs MT5 vs MT4, mobile usability plays a big part.

MT5’s mobile app is functional but basic. It lacks customization and modern chart controls.

cTrader’s mobile app feels fast, polished, and complete. You can manage watchlists, access trade history, and adjust settings just like on desktop. The web version is equally smooth, syncing layouts across devices. However, adjusting your cTrader app settings for prop trading can significantly improve your performance and boost your chances of passing prop firm challenges.

For traders traveling or trading across devices during prop firm evaluations, cTrader keeps performance consistent and reliable.

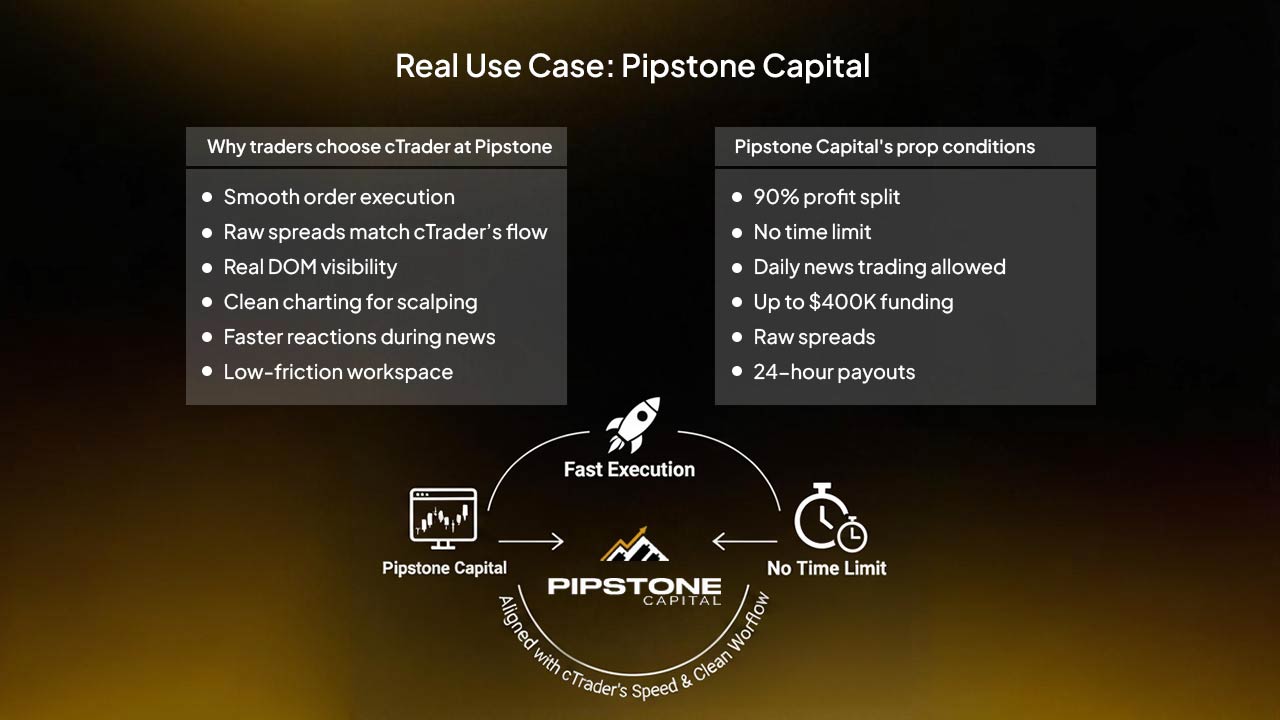

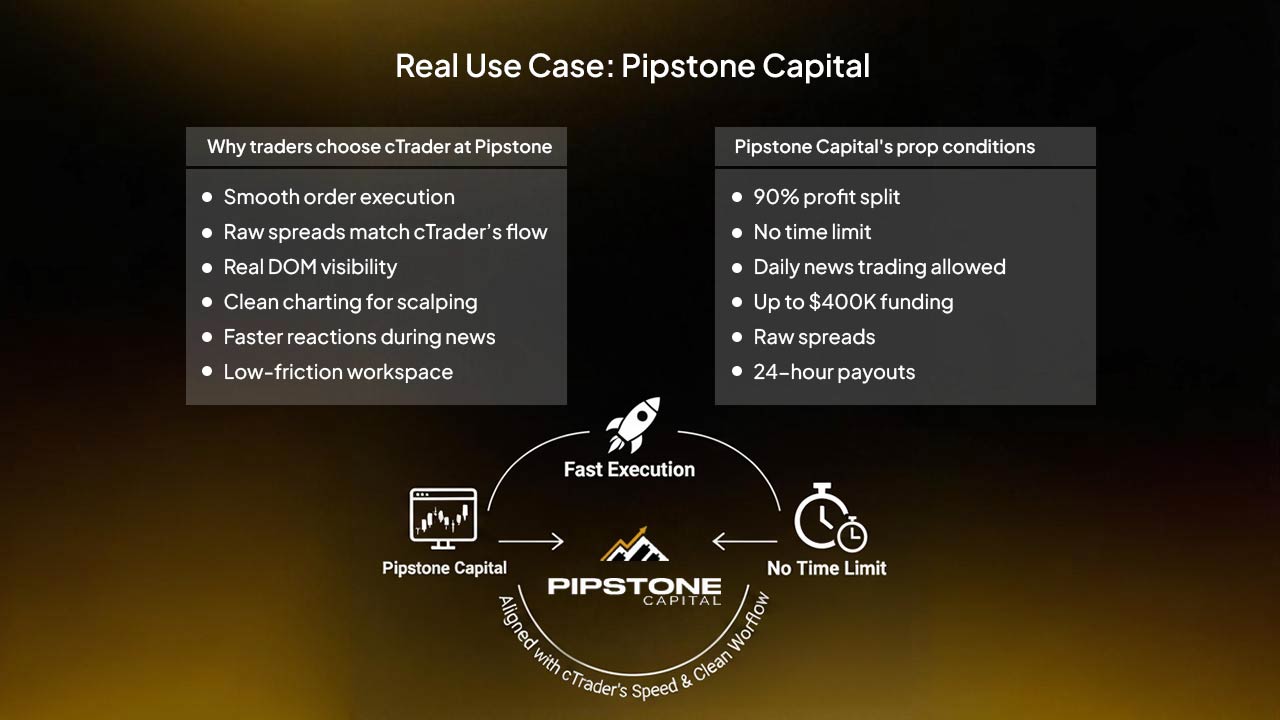

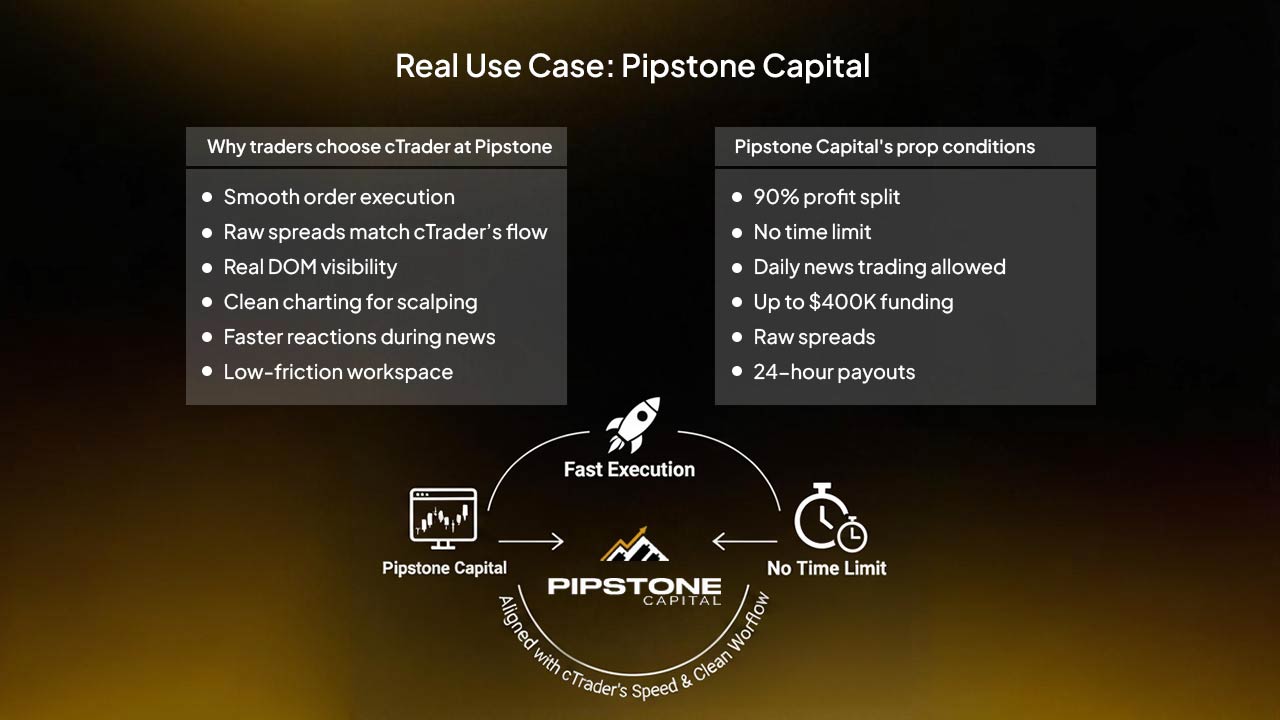

9. Real Use Case: Pipstone Capital

Pipstone Capital supports cTrader, due to the fact that many traders lean toward cTrader because it matches the firm’s fast environment.

Why traders choose cTrader at Pipstone

Smooth order execution

Raw spreads match cTrader’s flow

Real DOM visibility

Clean charting for scalping

Faster reactions during news

Low-friction workspace

Pipstone Capital's prop conditions

90% profit split

No time limit

Daily news trading allowed

Up to $400K funding

Raw spreads

24-hour payouts

But for discretionary manual traders, the smoother feel of cTrader reinforces its edge in the cTrader vs MT5 debate.

10. Backtesting and Reporting

cTrader vs MetaTrader 5 comparisons often highlight backtesting accuracy.

MT5 allows multi-threaded backtesting with downloadable tick data. It’s detailed but time-intensive.

cTrader’s backtester is simpler and visual. You can simulate live spreads, review graphs instantly, and export reports for analysis. For prop traders testing drawdown or target rules, cTrader’s reporting makes adjustments easier.

11. Final Comparison: MetaTrader 5 vs cTrader for Prop Trading

Here is the simple breakdown when comparing metatrader 5 vs cTrader:

cTrader is best for:

Scalping

Intraday trading

Fast execution

DOM-based entries

Clean charting

Smooth workflow

Low-friction decision making

MT5 is best for:

EA traders

Traders using large indicator libraries

Traders needing MQL5 tools

But for real-time performance under prop challenge pressure, cTrader gives traders an edge for speed and clarity by helping them react faster, read price action more cleanly, and place precise orders without hesitation. This smoother flow reduces mistakes during volatile moves and supports better discipline through each phase of the prop challenge.

Conclusion

When comparing cTrader vs MT5, both platforms can help you pass a prop‑firm challenge, especially with prop firms like Pipstone Capital that offer raw spreads, no time limits, and fast conditions that reward clean execution. Also Pipstone Capital recognizes this by offering cTrader to traders who aim for funded accounts up to $400,000.

cTrader gives you a smoother, faster, and more modern trading experience, which fits Pipstone Capital’s high‑speed environment well. MT5 is reliable and strong for automation, but cTrader reduces friction, improves focus, and supports better decision-making. In fast markets, that edge matters, and many traders who value transparency and speed choose cTrader over MT5 to perform better during funded‑account phases.

FAQs About cTrader vs MT5

What is the main difference between cTrader and MT5?

cTrader is known for its modern interface and advanced order types, while MT5 is popular for its vast library of custom indicators and expert advisors.

Which platform is better for prop trading?

Many prop firms prefer cTrader for its transparency and risk management features, which align well with challenge rules.

Is cTrader faster than MT5?

cTrader is generally considered to have lower latency and faster execution speeds due to its server infrastructure.

Can I use custom bots on both platforms?

Yes. MT5 uses Expert Advisors (EAs) written in MQL5, while cTrader uses cBots written in C#, offering powerful automation on both.

Which platform has better charting tools?

Both are excellent, but cTrader offers more built-in advanced chart types and a cleaner interface out of the box.

cTrader vs MT5: Which Platform Works Best for Prop Firms?

Nov 21, 2025

Your trading platform shapes your speed, focus, and execution in a prop-firm challenge. When traders compare cTrader vs MT5, they look for a platform that supports fast decisions and clean workflows. Prop trading rewards clarity and control, so the right platform can lift your performance during funded-account phases.

Today, traders also want to understand mt4 vs mt5 vs cTrader comparison, and how modern platforms fit fast markets. MT5 is common. It works well but feels older. cTrader is modern, smooth, and transparent. In a challenge where seconds matter, these small differences can decide how you perform.

This guide breaks down cTrader vs MT5 and also compares tools that matter most to prop traders.

1. Platform Overview: MT4 vs MT5 vs cTrader

When traders think about mt4 vs mt5 vs cTrader, they see three different levels of platform evolution, with each platform showing a clear shift in speed, structure, and the type of control traders get during real‑time market moves.

MT4

MT4 is old. Many tools work on it, but it lacks the features modern prop traders want, including smoother execution flow, clearer market data, and tools that support fast, disciplined decision‑making during prop challenges.

MT5

MT5 is the updated MetaTrader platform. It is stable, familiar, and works with many brokers. It still carries the older MetaTrader feel, with slower workflow, heavier chart movement, and a layout that doesn’t match the speed many prop traders now expect.

cTrader

cTrader is different. It feels clean and fast. The charts respond well under pressure. This makes a big difference in cTrader vs MetaTrader 5 comparisons. Traders who want transparency and smooth order flow - helping them see price pressure clearly and execute with confidence during fast market moves, often prefer cTrader.

2. User Interface

A major reason traders look for a trading tool is the difference in layout and interaction, since the platform should support fast decisions without slowing the trader down.

MT5 interface

MT5 is full of tools but uses an older structure. It is functional but takes more clicks and more steps. It works well if you already know MetaTrader. But when comparing mt5 vs cTrader, the difference in flow is clear, because MT5 feels heavier while cTrader keeps everything moving fast and simple during live trading.

cTrader interface

cTrader uses a modern UI. The platform feels light and reacts quickly. Chart windows are wide. Workspaces are flexible. Order placement takes fewer clicks. Traders who compare cTrader vs MetaTrader 5 often mention reduced stress and smoother decision-making on cTrader. Traders who want a full walkthrough can check the guide on how to use cTrader for funded accounts, which breaks down workspace setup and smooth workflow steps.

3. Charting and Execution Speed

Execution is one of the biggest reasons traders compare MetaTrader 5 vs cTrader in prop trading.

MT5 charting and execution

MT5 gives strong charting with many indicators. The tools are reliable, but switching layouts and managing charts feels slower. Execution depends on broker setup.

cTrader charting and execution

cTrader offers clean charts, sharp movement, and smooth zooming. Chart updates feel real-time. Order execution responds fast because the platform is built with modern standards. Traders comparing cTrader vs MT5 often say they feel more confident during fast market conditions.

4. Order Types and Transparency

Traders look at mt5 vs cTrader order features to see which platform gives more control.

MT5 order tools

MT5 supports all major order types. But some advanced tools require add-ons or manual setup. Traders who compare cTrader vs MetaTrader 5 often point out that MT5 hides some execution info.

cTrader order tools

cTrader includes advanced stops, clear execution cost, fast order entry, and Depth of Market. DOM is one of the main reasons traders favor cTrader. You see liquidity, slippage, and levels instantly.

5. Automation and Coding: Nothing Beats cTrader

Algo traders compare mt4 vs mt5 vs cTrader to pick the platform that fits their strategy.

MT5 automation

MT5 uses MQL5. You get thousands of EAs. If you rely on automation heavily, MT5 is better.

cTrader automation

cTrader uses C# for cBots. Coding feels clean and modern. Cloud automation is built in. The library is smaller than MT5, but many traders prefer C# over MQL5 because it is more flexible, giving traders cleaner code structure, easier debugging, and a smoother workflow when building or adjusting automated strategies. Traders who want to automate their trading can learn how cBots work through the cTrader cBot strategy guide, which explains how automation fits into prop challenges.

6. Risk Management Tools: cTrader vs MT5 Which Is Better

Prop-firm rules demand strict risk control. Traders often search for the best trading tool for staying inside drawdown limits.

MT5 risk tools

MT5 integrates well with prop dashboards, but manual risk management is common. Traders need indicator add-ons to size risk by percentage, which slows them down and forces extra steps during live trading when speed and accuracy matter most.

cTrader risk tools

cTrader allows risk-per-trade sizing directly during order entry. This single feature makes many traders pick cTrader in the mt5 vs cTrader comparison. Transparency helps traders avoid emotional decisions by giving them clear risk data, smooth execution flow, and a calmer trading experience.

7. Prop Trading Performance

Prop-firm trading requires speed, clarity, and clean execution. This is where the cTrader vs MetaTrader 5 comparison becomes clear.

Where cTrader helps prop traders

Faster workflow

Smooth chart movement

Transparent order flow

Liquidity view through DOM

Clean stops and limit controls

Less chart clutter

Fewer execution errors

These points make cTrader vs MT5 tilt strongly toward cTrader for fast strategies because the platform reacts quickly, keeps the chart clean, and helps traders make decisions without hesitation during intense market moves.

Where MetaTrader 5 helps prop traders

MT5 helps traders who use:

Expert Advisors

Custom indicators

Multi-asset strategies

But for manual intraday trading, cTrader feels more modern. That is why most traders comparing MetaTrader 5 vs cTrader prefer cTrader for discretionary challenge phases.

8. Mobile and Web Experience

When comparing cTrader vs MT5 vs MT4, mobile usability plays a big part.

MT5’s mobile app is functional but basic. It lacks customization and modern chart controls.

cTrader’s mobile app feels fast, polished, and complete. You can manage watchlists, access trade history, and adjust settings just like on desktop. The web version is equally smooth, syncing layouts across devices. However, adjusting your cTrader app settings for prop trading can significantly improve your performance and boost your chances of passing prop firm challenges.

For traders traveling or trading across devices during prop firm evaluations, cTrader keeps performance consistent and reliable.

9. Real Use Case: Pipstone Capital

Pipstone Capital supports cTrader, due to the fact that many traders lean toward cTrader because it matches the firm’s fast environment.

Why traders choose cTrader at Pipstone

Smooth order execution

Raw spreads match cTrader’s flow

Real DOM visibility

Clean charting for scalping

Faster reactions during news

Low-friction workspace

Pipstone Capital's prop conditions

90% profit split

No time limit

Daily news trading allowed

Up to $400K funding

Raw spreads

24-hour payouts

But for discretionary manual traders, the smoother feel of cTrader reinforces its edge in the cTrader vs MT5 debate.

10. Backtesting and Reporting

cTrader vs MetaTrader 5 comparisons often highlight backtesting accuracy.

MT5 allows multi-threaded backtesting with downloadable tick data. It’s detailed but time-intensive.

cTrader’s backtester is simpler and visual. You can simulate live spreads, review graphs instantly, and export reports for analysis. For prop traders testing drawdown or target rules, cTrader’s reporting makes adjustments easier.

11. Final Comparison: MetaTrader 5 vs cTrader for Prop Trading

Here is the simple breakdown when comparing metatrader 5 vs cTrader:

cTrader is best for:

Scalping

Intraday trading

Fast execution

DOM-based entries

Clean charting

Smooth workflow

Low-friction decision making

MT5 is best for:

EA traders

Traders using large indicator libraries

Traders needing MQL5 tools

But for real-time performance under prop challenge pressure, cTrader gives traders an edge for speed and clarity by helping them react faster, read price action more cleanly, and place precise orders without hesitation. This smoother flow reduces mistakes during volatile moves and supports better discipline through each phase of the prop challenge.

Conclusion

When comparing cTrader vs MT5, both platforms can help you pass a prop‑firm challenge, especially with prop firms like Pipstone Capital that offer raw spreads, no time limits, and fast conditions that reward clean execution. Also Pipstone Capital recognizes this by offering cTrader to traders who aim for funded accounts up to $400,000.

cTrader gives you a smoother, faster, and more modern trading experience, which fits Pipstone Capital’s high‑speed environment well. MT5 is reliable and strong for automation, but cTrader reduces friction, improves focus, and supports better decision-making. In fast markets, that edge matters, and many traders who value transparency and speed choose cTrader over MT5 to perform better during funded‑account phases.

FAQs About cTrader vs MT5

What is the main difference between cTrader and MT5?

cTrader is known for its modern interface and advanced order types, while MT5 is popular for its vast library of custom indicators and expert advisors.

Which platform is better for prop trading?

Many prop firms prefer cTrader for its transparency and risk management features, which align well with challenge rules.

Is cTrader faster than MT5?

cTrader is generally considered to have lower latency and faster execution speeds due to its server infrastructure.

Can I use custom bots on both platforms?

Yes. MT5 uses Expert Advisors (EAs) written in MQL5, while cTrader uses cBots written in C#, offering powerful automation on both.

Which platform has better charting tools?

Both are excellent, but cTrader offers more built-in advanced chart types and a cleaner interface out of the box.

cTrader vs MT5: Which Platform Works Best for Prop Firms?

Nov 21, 2025

Your trading platform shapes your speed, focus, and execution in a prop-firm challenge. When traders compare cTrader vs MT5, they look for a platform that supports fast decisions and clean workflows. Prop trading rewards clarity and control, so the right platform can lift your performance during funded-account phases.

Today, traders also want to understand mt4 vs mt5 vs cTrader comparison, and how modern platforms fit fast markets. MT5 is common. It works well but feels older. cTrader is modern, smooth, and transparent. In a challenge where seconds matter, these small differences can decide how you perform.

This guide breaks down cTrader vs MT5 and also compares tools that matter most to prop traders.

1. Platform Overview: MT4 vs MT5 vs cTrader

When traders think about mt4 vs mt5 vs cTrader, they see three different levels of platform evolution, with each platform showing a clear shift in speed, structure, and the type of control traders get during real‑time market moves.

MT4

MT4 is old. Many tools work on it, but it lacks the features modern prop traders want, including smoother execution flow, clearer market data, and tools that support fast, disciplined decision‑making during prop challenges.

MT5

MT5 is the updated MetaTrader platform. It is stable, familiar, and works with many brokers. It still carries the older MetaTrader feel, with slower workflow, heavier chart movement, and a layout that doesn’t match the speed many prop traders now expect.

cTrader

cTrader is different. It feels clean and fast. The charts respond well under pressure. This makes a big difference in cTrader vs MetaTrader 5 comparisons. Traders who want transparency and smooth order flow - helping them see price pressure clearly and execute with confidence during fast market moves, often prefer cTrader.

2. User Interface

A major reason traders look for a trading tool is the difference in layout and interaction, since the platform should support fast decisions without slowing the trader down.

MT5 interface

MT5 is full of tools but uses an older structure. It is functional but takes more clicks and more steps. It works well if you already know MetaTrader. But when comparing mt5 vs cTrader, the difference in flow is clear, because MT5 feels heavier while cTrader keeps everything moving fast and simple during live trading.

cTrader interface

cTrader uses a modern UI. The platform feels light and reacts quickly. Chart windows are wide. Workspaces are flexible. Order placement takes fewer clicks. Traders who compare cTrader vs MetaTrader 5 often mention reduced stress and smoother decision-making on cTrader. Traders who want a full walkthrough can check the guide on how to use cTrader for funded accounts, which breaks down workspace setup and smooth workflow steps.

3. Charting and Execution Speed

Execution is one of the biggest reasons traders compare MetaTrader 5 vs cTrader in prop trading.

MT5 charting and execution

MT5 gives strong charting with many indicators. The tools are reliable, but switching layouts and managing charts feels slower. Execution depends on broker setup.

cTrader charting and execution

cTrader offers clean charts, sharp movement, and smooth zooming. Chart updates feel real-time. Order execution responds fast because the platform is built with modern standards. Traders comparing cTrader vs MT5 often say they feel more confident during fast market conditions.

4. Order Types and Transparency

Traders look at mt5 vs cTrader order features to see which platform gives more control.

MT5 order tools

MT5 supports all major order types. But some advanced tools require add-ons or manual setup. Traders who compare cTrader vs MetaTrader 5 often point out that MT5 hides some execution info.

cTrader order tools

cTrader includes advanced stops, clear execution cost, fast order entry, and Depth of Market. DOM is one of the main reasons traders favor cTrader. You see liquidity, slippage, and levels instantly.

5. Automation and Coding: Nothing Beats cTrader

Algo traders compare mt4 vs mt5 vs cTrader to pick the platform that fits their strategy.

MT5 automation

MT5 uses MQL5. You get thousands of EAs. If you rely on automation heavily, MT5 is better.

cTrader automation

cTrader uses C# for cBots. Coding feels clean and modern. Cloud automation is built in. The library is smaller than MT5, but many traders prefer C# over MQL5 because it is more flexible, giving traders cleaner code structure, easier debugging, and a smoother workflow when building or adjusting automated strategies. Traders who want to automate their trading can learn how cBots work through the cTrader cBot strategy guide, which explains how automation fits into prop challenges.

6. Risk Management Tools: cTrader vs MT5 Which Is Better

Prop-firm rules demand strict risk control. Traders often search for the best trading tool for staying inside drawdown limits.

MT5 risk tools

MT5 integrates well with prop dashboards, but manual risk management is common. Traders need indicator add-ons to size risk by percentage, which slows them down and forces extra steps during live trading when speed and accuracy matter most.

cTrader risk tools

cTrader allows risk-per-trade sizing directly during order entry. This single feature makes many traders pick cTrader in the mt5 vs cTrader comparison. Transparency helps traders avoid emotional decisions by giving them clear risk data, smooth execution flow, and a calmer trading experience.

7. Prop Trading Performance

Prop-firm trading requires speed, clarity, and clean execution. This is where the cTrader vs MetaTrader 5 comparison becomes clear.

Where cTrader helps prop traders

Faster workflow

Smooth chart movement

Transparent order flow

Liquidity view through DOM

Clean stops and limit controls

Less chart clutter

Fewer execution errors

These points make cTrader vs MT5 tilt strongly toward cTrader for fast strategies because the platform reacts quickly, keeps the chart clean, and helps traders make decisions without hesitation during intense market moves.

Where MetaTrader 5 helps prop traders

MT5 helps traders who use:

Expert Advisors

Custom indicators

Multi-asset strategies

But for manual intraday trading, cTrader feels more modern. That is why most traders comparing MetaTrader 5 vs cTrader prefer cTrader for discretionary challenge phases.

8. Mobile and Web Experience

When comparing cTrader vs MT5 vs MT4, mobile usability plays a big part.

MT5’s mobile app is functional but basic. It lacks customization and modern chart controls.

cTrader’s mobile app feels fast, polished, and complete. You can manage watchlists, access trade history, and adjust settings just like on desktop. The web version is equally smooth, syncing layouts across devices. However, adjusting your cTrader app settings for prop trading can significantly improve your performance and boost your chances of passing prop firm challenges.

For traders traveling or trading across devices during prop firm evaluations, cTrader keeps performance consistent and reliable.

9. Real Use Case: Pipstone Capital

Pipstone Capital supports cTrader, due to the fact that many traders lean toward cTrader because it matches the firm’s fast environment.

Why traders choose cTrader at Pipstone

Smooth order execution

Raw spreads match cTrader’s flow

Real DOM visibility

Clean charting for scalping

Faster reactions during news

Low-friction workspace

Pipstone Capital's prop conditions

90% profit split

No time limit

Daily news trading allowed

Up to $400K funding

Raw spreads

24-hour payouts

But for discretionary manual traders, the smoother feel of cTrader reinforces its edge in the cTrader vs MT5 debate.

10. Backtesting and Reporting

cTrader vs MetaTrader 5 comparisons often highlight backtesting accuracy.

MT5 allows multi-threaded backtesting with downloadable tick data. It’s detailed but time-intensive.

cTrader’s backtester is simpler and visual. You can simulate live spreads, review graphs instantly, and export reports for analysis. For prop traders testing drawdown or target rules, cTrader’s reporting makes adjustments easier.

11. Final Comparison: MetaTrader 5 vs cTrader for Prop Trading

Here is the simple breakdown when comparing metatrader 5 vs cTrader:

cTrader is best for:

Scalping

Intraday trading

Fast execution

DOM-based entries

Clean charting

Smooth workflow

Low-friction decision making

MT5 is best for:

EA traders

Traders using large indicator libraries

Traders needing MQL5 tools

But for real-time performance under prop challenge pressure, cTrader gives traders an edge for speed and clarity by helping them react faster, read price action more cleanly, and place precise orders without hesitation. This smoother flow reduces mistakes during volatile moves and supports better discipline through each phase of the prop challenge.

Conclusion

When comparing cTrader vs MT5, both platforms can help you pass a prop‑firm challenge, especially with prop firms like Pipstone Capital that offer raw spreads, no time limits, and fast conditions that reward clean execution. Also Pipstone Capital recognizes this by offering cTrader to traders who aim for funded accounts up to $400,000.

cTrader gives you a smoother, faster, and more modern trading experience, which fits Pipstone Capital’s high‑speed environment well. MT5 is reliable and strong for automation, but cTrader reduces friction, improves focus, and supports better decision-making. In fast markets, that edge matters, and many traders who value transparency and speed choose cTrader over MT5 to perform better during funded‑account phases.

FAQs About cTrader vs MT5

What is the main difference between cTrader and MT5?

cTrader is known for its modern interface and advanced order types, while MT5 is popular for its vast library of custom indicators and expert advisors.

Which platform is better for prop trading?

Many prop firms prefer cTrader for its transparency and risk management features, which align well with challenge rules.

Is cTrader faster than MT5?

cTrader is generally considered to have lower latency and faster execution speeds due to its server infrastructure.

Can I use custom bots on both platforms?

Yes. MT5 uses Expert Advisors (EAs) written in MQL5, while cTrader uses cBots written in C#, offering powerful automation on both.

Which platform has better charting tools?

Both are excellent, but cTrader offers more built-in advanced chart types and a cleaner interface out of the box.