What Is Prop Trading and Why Most Traders Are Switching in 2025

Jul 22, 2025

What is prop trading? It's when a firm gives traders money to trade. These traders don’t use their own cash. They use company funds. If they make a profit, the firm takes a cut. The trader keeps the rest.

This is not new. Big banks used to do it a lot before 2008. But after the financial crisis, regulators stepped in. Banks had to pull back. That opened space for new types of prop firms to grow. Today, in 2025, what is prop trading is being asked by thousands of new traders each month as the model grows fast.

One example is Pipstone Capital. It backs skilled traders with real capital and zero gimmicks. The focus is on fair rules, consistent funding, and payouts tied to actual performance—not passing some trick challenge.

So why are more traders switching to prop firms? Here's a breakdown.

1. What Is Prop Trading's Edge? Less Risk, More Capital

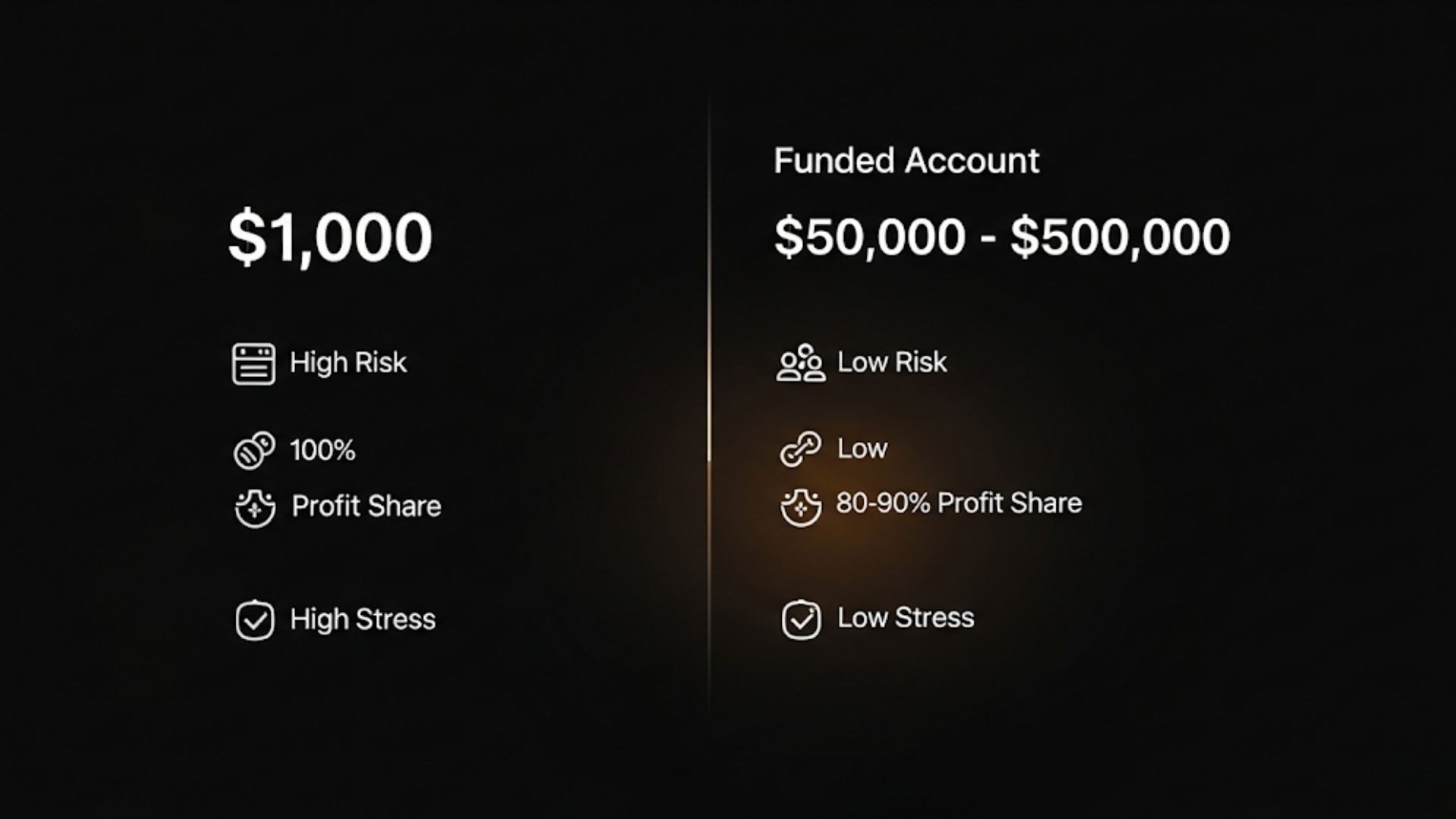

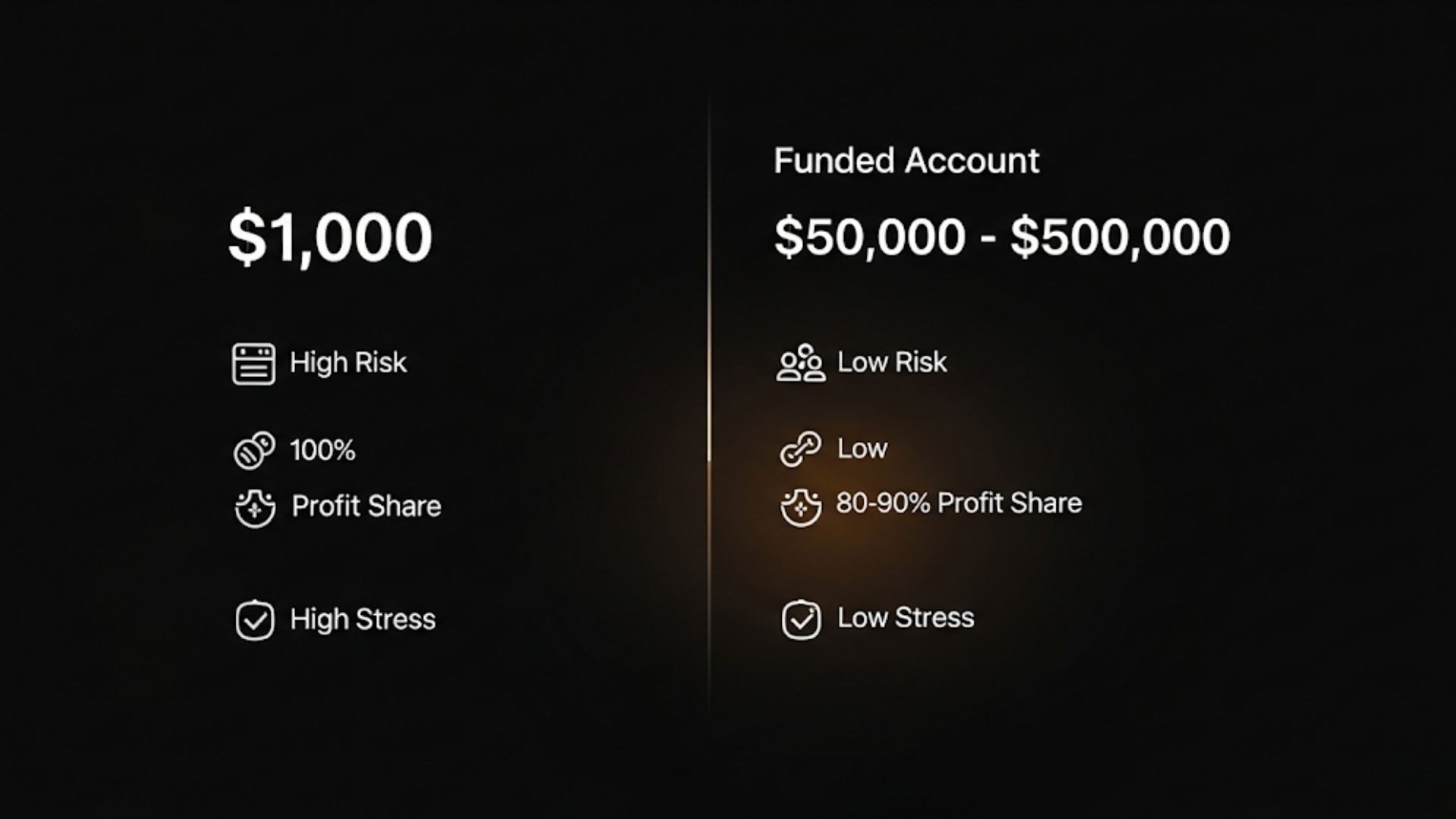

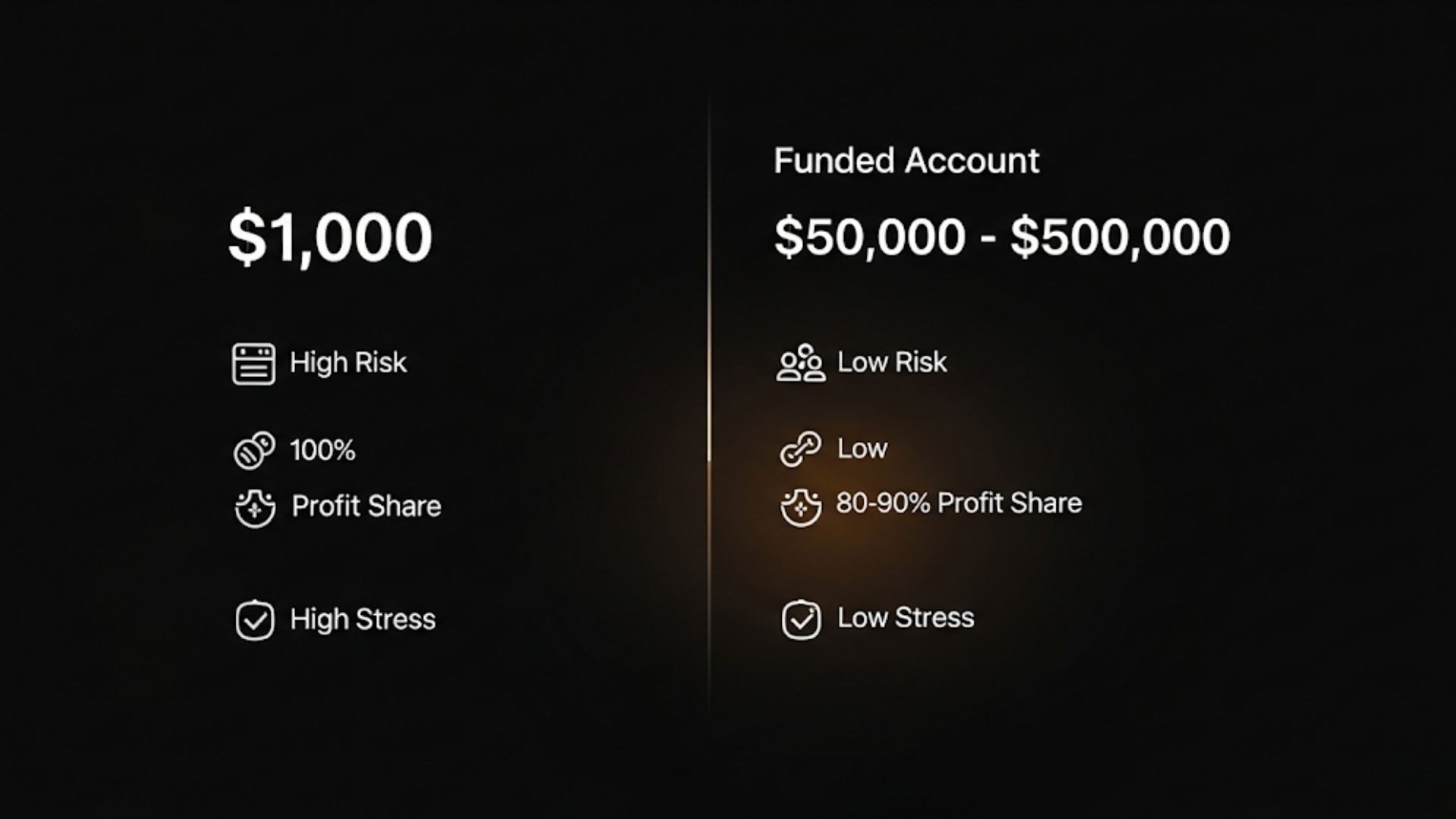

Most new traders don’t have much capital. Maybe $1,000. Maybe less. It’s hard to grow that fast.

What is prop trading's biggest draw? Firms give traders access to much more. Some offer $50,000. Others go up to $500,000 or more.

If a trader wins, they share profits with the firm. Usually 70% or more goes to the trader. Some firms offer up to 90%.

If a trader loses, it’s not their money on the line. The worst-case scenario is losing access to the account. Not losing their own cash. To see how this setup differs from other models, check our guide on traditional trading vs prop trading.

Some firms go a step further. Pipstone Capital is one of them. It funds traders based on real skill, not trick evaluations. There's no fake pressure to hit fast targets. If you can manage risk and stay consistent, they scale you up and let your results speak. That kind of setup is rare—and it’s why many serious traders are taking notice.

That’s why traders find prop trading less stressful.

Here’s a quick recap of why prop firm trading model stands out:

You get access to large capital, not your own.

Most profit splits favor the trader—some up to 90%.

You risk the firm’s funds, not your savings.

No pressure to rush trades if the firm rewards consistency.

Skilled traders can grow funding over time.

Rules are fair and clear. No surprises.

Want to understand how that works in more detail? Check out our article on what is funded account in forex.

2. You Don’t Need to Be Rich to Start

With prop firms, you can start with as little as $100 to $500.

This small amount covers a test or challenge. The firm checks your trading skills. If you pass the funded account challenge, you get access to real capital.

Compare that to starting your own account. You’d need thousands to make decent gains.

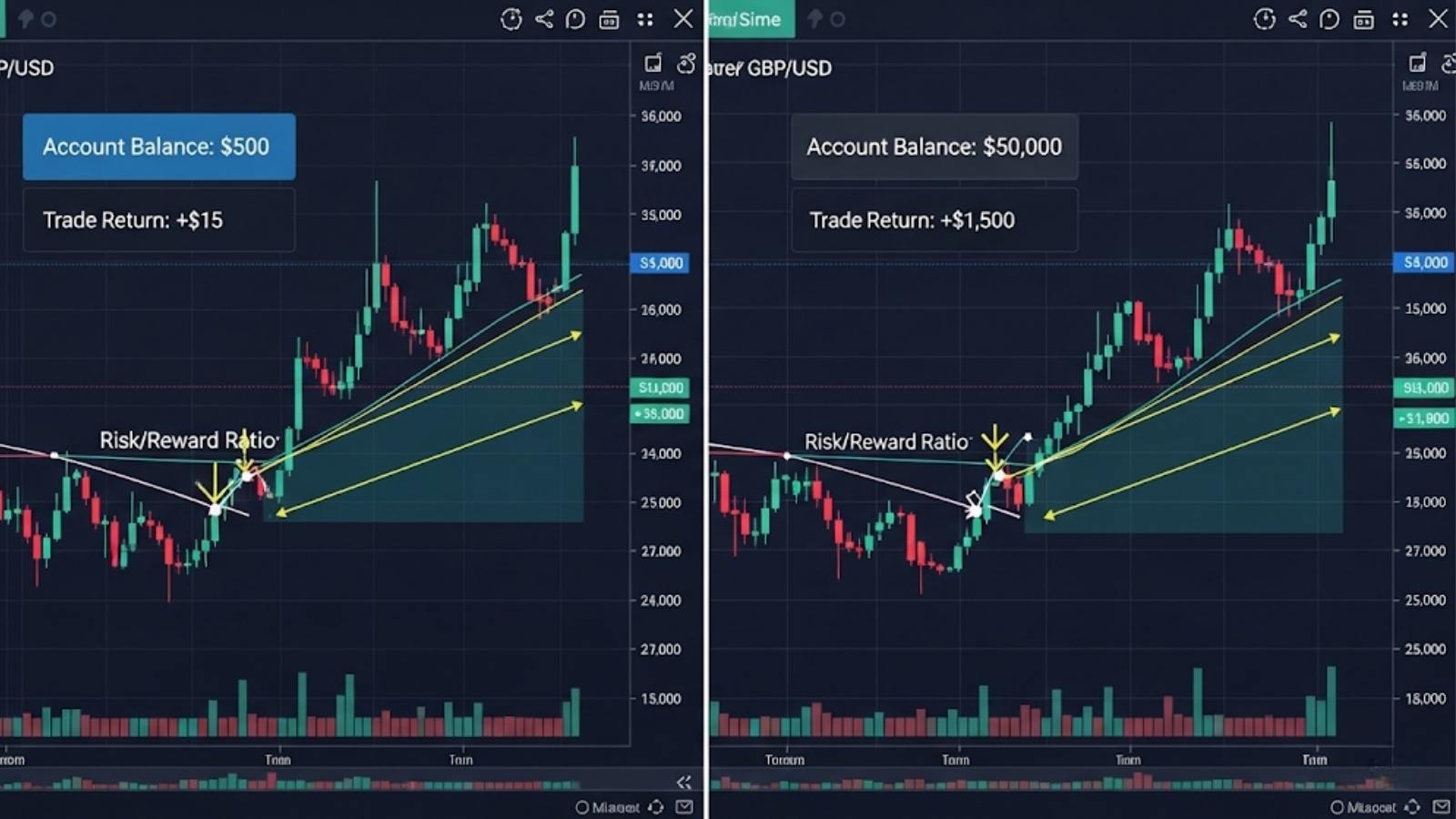

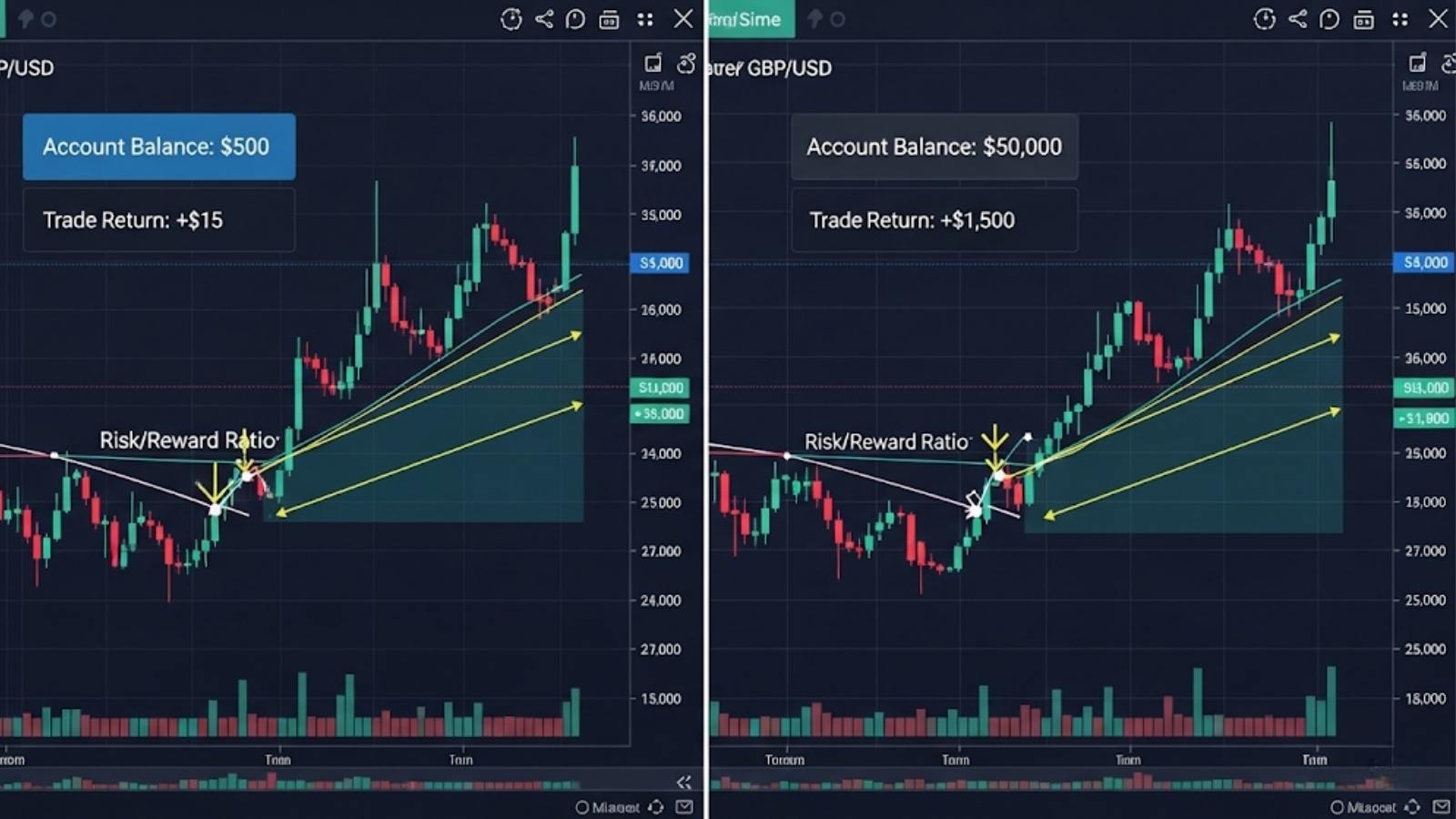

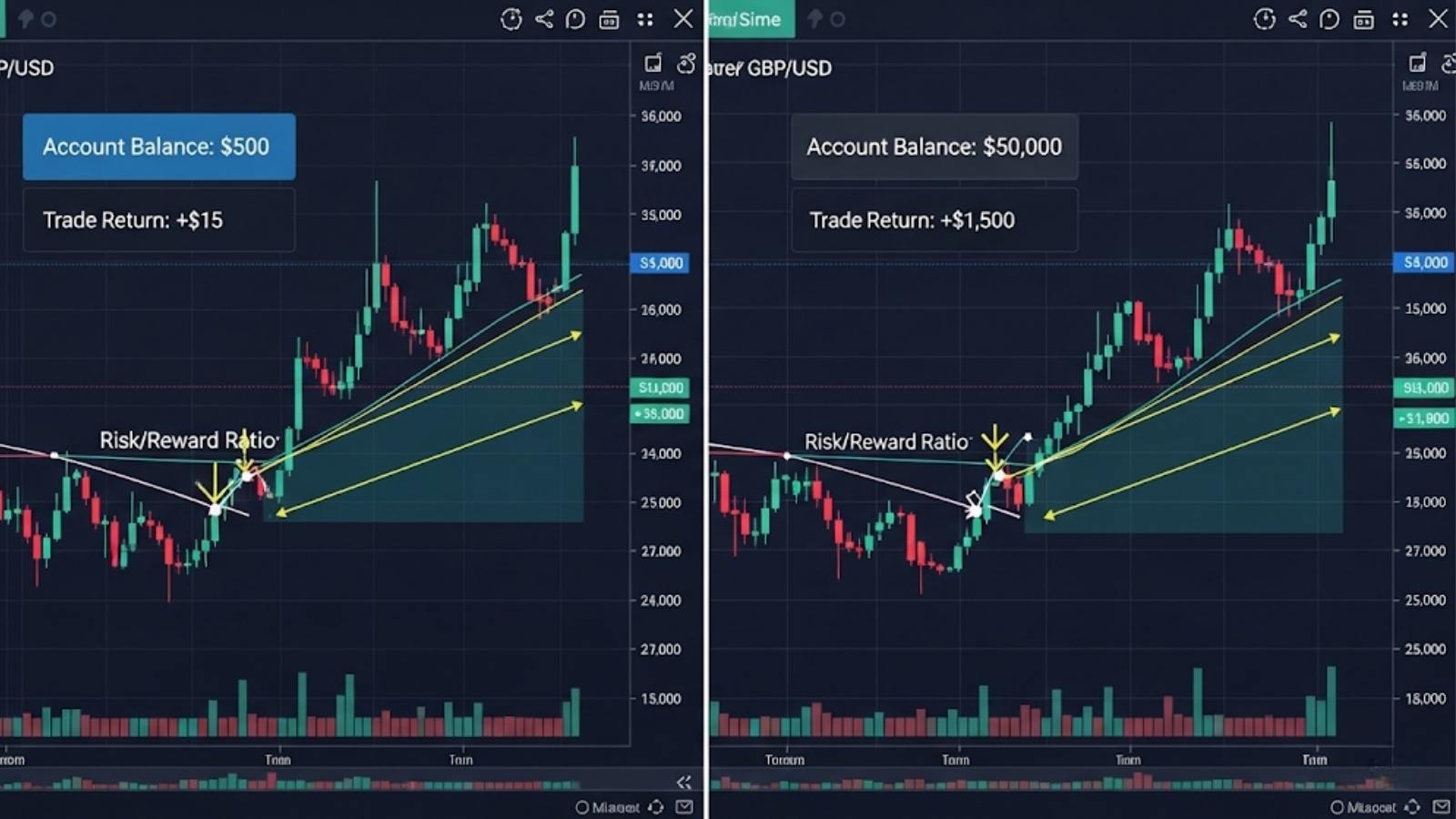

Take a basic forex trade: say you spot a clean setup on GBP/USD with a tight stop. You risk 1% to aim for 3% in return. With your own $500, that's a $5 risk to maybe make $15. Not bad, but it won't move the needle.

Now imagine trading a $50,000 funded account. Same setup, same risk control. You’re risking $500 to target $1,500. That adds up fast—and you're not touching your own savings.

What is prop trading if not a low-barrier chance to scale? You don’t need a finance degree or family money.

It’s also why many ask what is prop trading in forex—since it's a common entry point for new traders.

3. Flexible Work, Anywhere

Most prop firms let you trade from home. Or a coffee shop. Or anywhere with Wi-Fi.

There are no dress codes. No office politics. No commute.

All you need is a laptop and a trading plan. Some use a simple setup—a trading platform, news feed, and basic chart tools. Nothing fancy.

This freedom draws in people from all walks of life. Teachers. Engineers. Even college students. One guy trades GBP/JPY during the London session from a shared apartment in Manila. Another monitors Nasdaq futures from his camper van in Spain.

They want a chance to earn more. They want control over their time. Prop trading gives them that shot without forcing them into a rigid schedule or draining their savings.

4. What Is Prop Trading Offering? A Big Variety of Firms and Programs

In 2025, there are more prop firms than ever. Some focus on forex. Others on stocks or crypto.

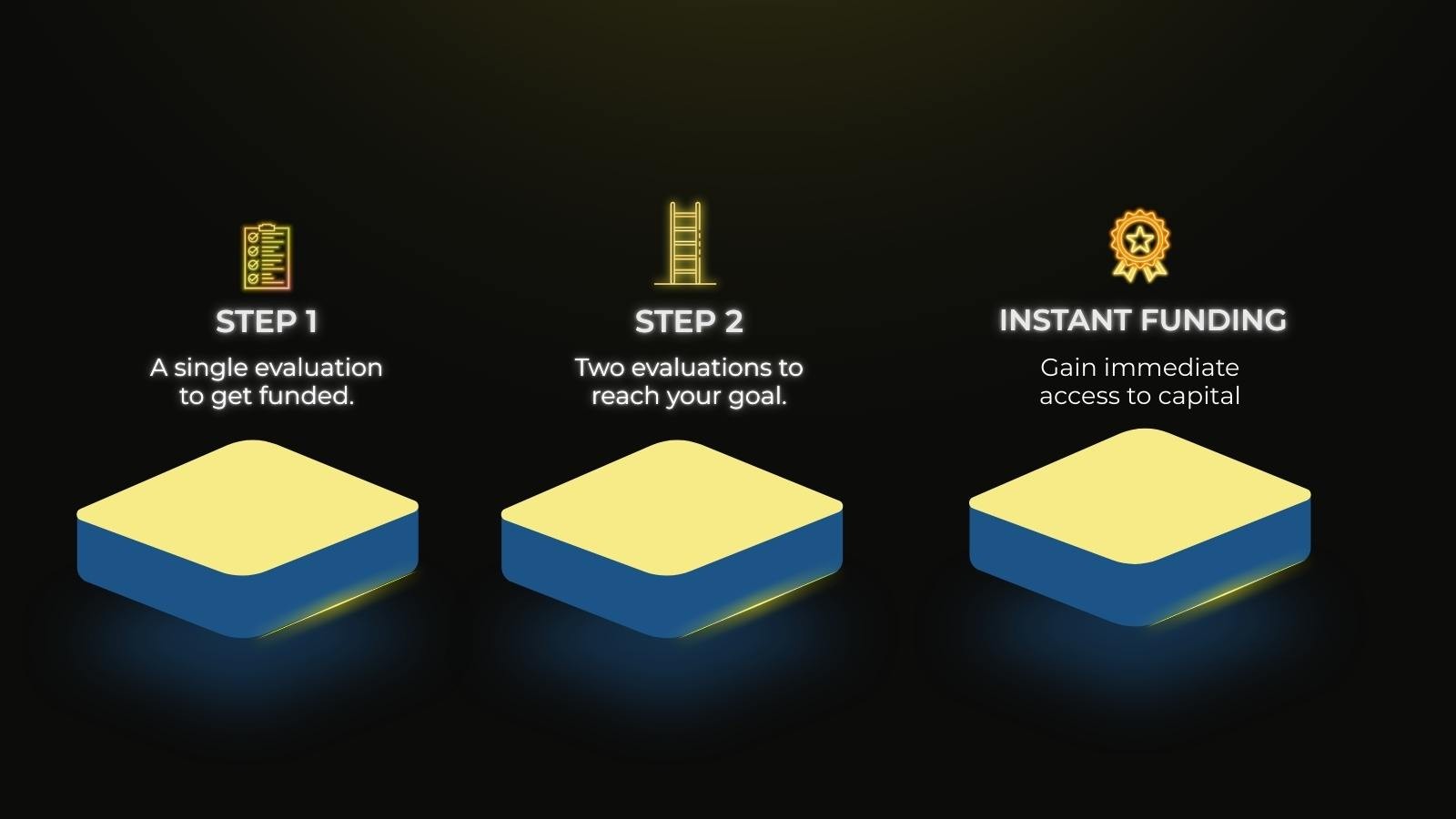

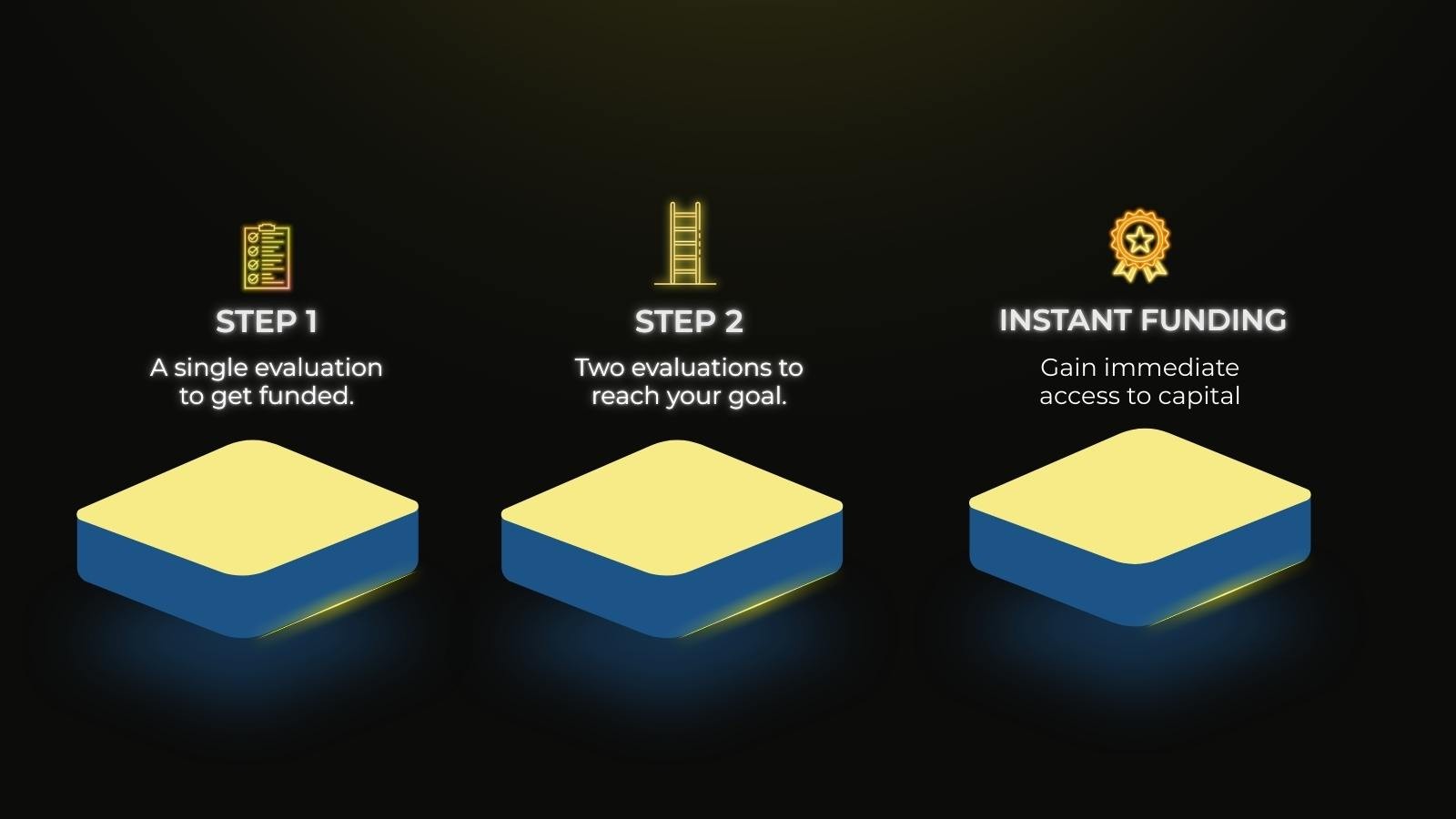

You can pick from many types of trading programs:

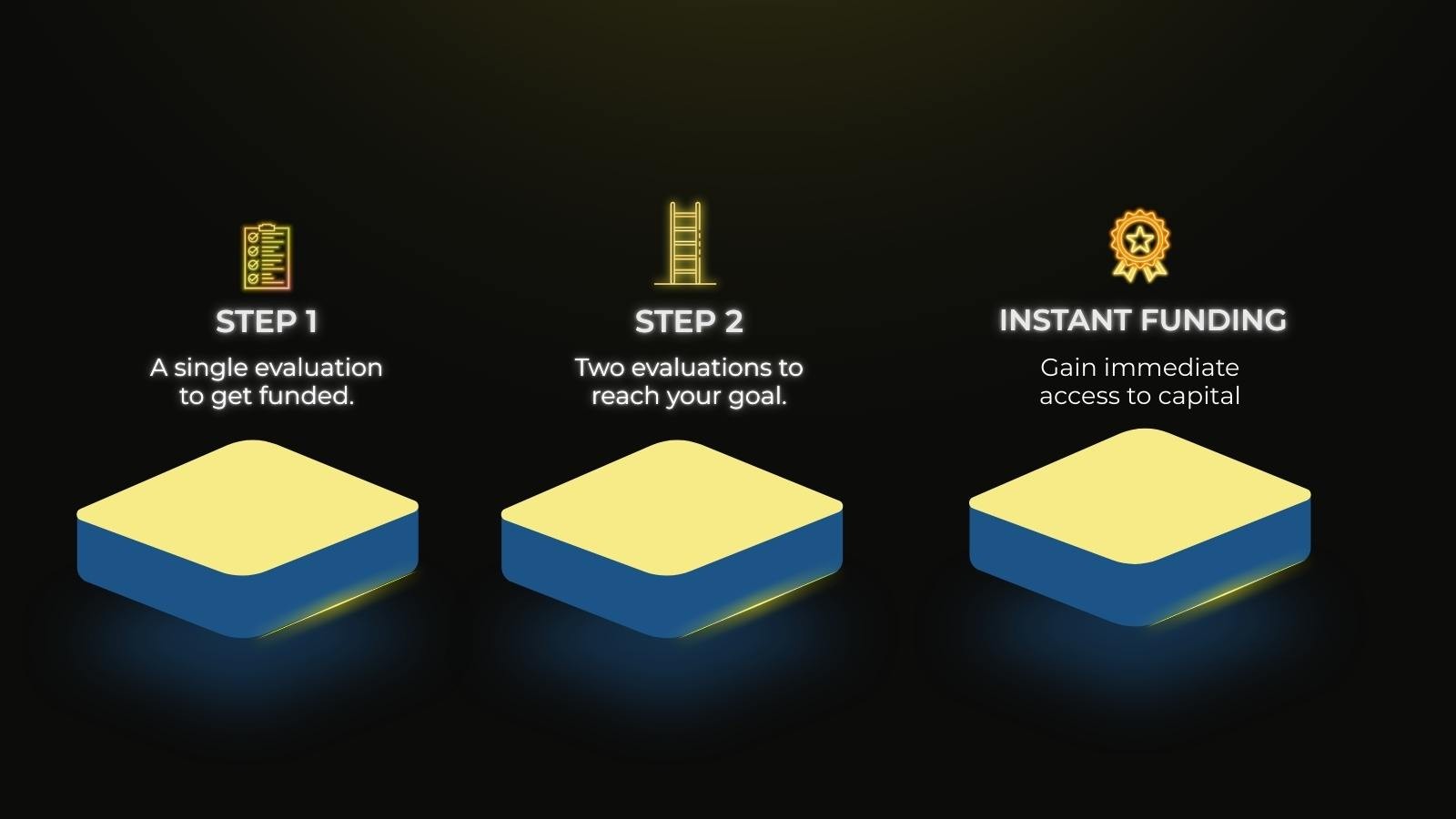

One-step evaluations

Two-step challenges

Instant funding (rare, but growing)

Some firms give bonuses during the test phase. Others let you scale up to $1 million if you perform well.

Pipstone Capital stands out by focusing on real skill and steady growth. There's no pressure to trade aggressively just to pass a test. Instead, traders build a track record with real accounts and get scaled up based on consistency and control. Their system is simple: trade well, manage risk, get rewarded. They offer a $5,000 challenge account to start, giving new traders a real shot to prove themselves without overextending.

If you're unsure what is prop trading in forex, Pipstone makes it easy to learn while trading in live markets.

5. Smart Rules That Help You Grow

Prop firms don’t just throw money at you. They have rules. But these rules are fair.

You must stay within a daily and total drawdown limit. This helps protect capital.

Many firms use systems like Edge Scores. These track your skill, discipline, and risk control.

Say you're trading EUR/USD and spot a key support bounce after a strong news drop. You enter long with a 30-pip stop and a 60-pip target. You size the trade so it risks exactly 1% of your account. It hits target. That’s a clean 2:1 win within your limits.

You log the trade, update your stats, and stay within rules. After a few months of results like that, your score goes up. So does your funding.

Some firms double your funding every few months. Others raise your profit split if you stay consistent.

It’s a clear path forward.

6. Fast Payouts and Real Rewards in Prop Trading

Gone are the days of waiting weeks to get paid.

Many prop firms now pay within 24 hours. Some offer same-day payouts through bank transfer or crypto.

You also get rewards during test phases. For example, FundedNext pays 15% of challenge profits. That means even before getting fully funded, you can still earn while proving your skills.

Say you’re trading gold and catch a clean $10 move using proper risk. You hit a $500 gain during the challenge. Some firms pay that out fast—even if you haven’t reached the full account yet.

This gives traders motivation. Even early wins turn into real payouts.

When someone asks, "what is prop trading really good for?" the answer often includes fast, direct income from results.

7. New Tools and Better Support

Today’s prop firms give more than just capital.

They offer tools, dashboards, and analytics. You can track your trades, monitor stats, and tweak your strategy. Let’s say you overtrade around news events—you’ll spot that in your logs. You can fix it.

Some firms also offer mentorship, videos, and live coaching. These used to cost thousands. Now they're often built into the platform. A good example is the support offered through a match trader prop firm, where education and tools come packaged with the trading platform.

You might get weekly trade reviews, Q&A sessions, or tips from funded traders. It’s like having a coach and community on standby.

If you’re learning what is prop trading, these tools give you an edge most solo traders never had.

8. Clear Rules, No Surprises

Traders used to hate hidden rules. News event bans. No overnight trades. Random disqualifications.

That’s changed.

Top firms now list all rules upfront. They even allow high-risk trades like holding during news.

This makes it easier to plan and stay within limits.

9. What Is Prop Trading Compared to a Job? Better Than Traditional Work

Prop trading can replace a job. Not right away, but with time.

If a trader scales to $100k or more, even a few percent a month can bring solid income.

The best part? You answer to no one. You set your hours. You keep most of the profits.

For many, that’s worth more than job security.

What is prop trading offering that jobs can't? Freedom, potential, and personal growth.

10. It's Still Hard, But Fair

Prop trading is not easy. Most people fail their first challenge.

But it's fair.

You get real chances. You get feedback. You can try again.

And once you pass the forex prop firm challenge, you’re not risking your own savings.

That’s a big win in today’s economy.

This is why so many are searching "what is prop trading" and seeing it as a better option.

If you're asking what is prop trading in forex, it's the same model—just applied to currency markets with global liquidity and high volume.

Conclusion

In 2025, prop trading is no longer a niche. It's a new way forward for everyday traders.

It offers capital, freedom, support, and income potential—without the huge personal risk.

If you’ve ever wondered what is prop trading and why it matters now, the answer is clear.

Or if you’ve asked what is prop trading in forex, the answer is simple too—it’s your chance to trade global currencies without risking your own funds.

That’s why so many traders are switching.

If you can trade with skill and control, prop firms are ready to back you.

Pipstone Capital makes that promise concrete. They’re built around one idea: consistent performance matters more than flashy wins. There are no resets, no artificial pressure, and no fine print that ruins your progress. You build a real track record over time—and they match it with real capital, clear rules, and payouts that grow with you. Spreads are tight too, which helps traders keep more of what they earn. It’s prop trading built for traders who treat it like a profession.

What Is Prop Trading and Why Most Traders Are Switching in 2025

Jul 22, 2025

What is prop trading? It's when a firm gives traders money to trade. These traders don’t use their own cash. They use company funds. If they make a profit, the firm takes a cut. The trader keeps the rest.

This is not new. Big banks used to do it a lot before 2008. But after the financial crisis, regulators stepped in. Banks had to pull back. That opened space for new types of prop firms to grow. Today, in 2025, what is prop trading is being asked by thousands of new traders each month as the model grows fast.

One example is Pipstone Capital. It backs skilled traders with real capital and zero gimmicks. The focus is on fair rules, consistent funding, and payouts tied to actual performance—not passing some trick challenge.

So why are more traders switching to prop firms? Here's a breakdown.

1. What Is Prop Trading's Edge? Less Risk, More Capital

Most new traders don’t have much capital. Maybe $1,000. Maybe less. It’s hard to grow that fast.

What is prop trading's biggest draw? Firms give traders access to much more. Some offer $50,000. Others go up to $500,000 or more.

If a trader wins, they share profits with the firm. Usually 70% or more goes to the trader. Some firms offer up to 90%.

If a trader loses, it’s not their money on the line. The worst-case scenario is losing access to the account. Not losing their own cash. To see how this setup differs from other models, check our guide on traditional trading vs prop trading.

Some firms go a step further. Pipstone Capital is one of them. It funds traders based on real skill, not trick evaluations. There's no fake pressure to hit fast targets. If you can manage risk and stay consistent, they scale you up and let your results speak. That kind of setup is rare—and it’s why many serious traders are taking notice.

That’s why traders find prop trading less stressful.

Here’s a quick recap of why prop firm trading model stands out:

You get access to large capital, not your own.

Most profit splits favor the trader—some up to 90%.

You risk the firm’s funds, not your savings.

No pressure to rush trades if the firm rewards consistency.

Skilled traders can grow funding over time.

Rules are fair and clear. No surprises.

Want to understand how that works in more detail? Check out our article on what is funded account in forex.

2. You Don’t Need to Be Rich to Start

With prop firms, you can start with as little as $100 to $500.

This small amount covers a test or challenge. The firm checks your trading skills. If you pass the funded account challenge, you get access to real capital.

Compare that to starting your own account. You’d need thousands to make decent gains.

Take a basic forex trade: say you spot a clean setup on GBP/USD with a tight stop. You risk 1% to aim for 3% in return. With your own $500, that's a $5 risk to maybe make $15. Not bad, but it won't move the needle.

Now imagine trading a $50,000 funded account. Same setup, same risk control. You’re risking $500 to target $1,500. That adds up fast—and you're not touching your own savings.

What is prop trading if not a low-barrier chance to scale? You don’t need a finance degree or family money.

It’s also why many ask what is prop trading in forex—since it's a common entry point for new traders.

3. Flexible Work, Anywhere

Most prop firms let you trade from home. Or a coffee shop. Or anywhere with Wi-Fi.

There are no dress codes. No office politics. No commute.

All you need is a laptop and a trading plan. Some use a simple setup—a trading platform, news feed, and basic chart tools. Nothing fancy.

This freedom draws in people from all walks of life. Teachers. Engineers. Even college students. One guy trades GBP/JPY during the London session from a shared apartment in Manila. Another monitors Nasdaq futures from his camper van in Spain.

They want a chance to earn more. They want control over their time. Prop trading gives them that shot without forcing them into a rigid schedule or draining their savings.

4. What Is Prop Trading Offering? A Big Variety of Firms and Programs

In 2025, there are more prop firms than ever. Some focus on forex. Others on stocks or crypto.

You can pick from many types of trading programs:

One-step evaluations

Two-step challenges

Instant funding (rare, but growing)

Some firms give bonuses during the test phase. Others let you scale up to $1 million if you perform well.

Pipstone Capital stands out by focusing on real skill and steady growth. There's no pressure to trade aggressively just to pass a test. Instead, traders build a track record with real accounts and get scaled up based on consistency and control. Their system is simple: trade well, manage risk, get rewarded. They offer a $5,000 challenge account to start, giving new traders a real shot to prove themselves without overextending.

If you're unsure what is prop trading in forex, Pipstone makes it easy to learn while trading in live markets.

5. Smart Rules That Help You Grow

Prop firms don’t just throw money at you. They have rules. But these rules are fair.

You must stay within a daily and total drawdown limit. This helps protect capital.

Many firms use systems like Edge Scores. These track your skill, discipline, and risk control.

Say you're trading EUR/USD and spot a key support bounce after a strong news drop. You enter long with a 30-pip stop and a 60-pip target. You size the trade so it risks exactly 1% of your account. It hits target. That’s a clean 2:1 win within your limits.

You log the trade, update your stats, and stay within rules. After a few months of results like that, your score goes up. So does your funding.

Some firms double your funding every few months. Others raise your profit split if you stay consistent.

It’s a clear path forward.

6. Fast Payouts and Real Rewards in Prop Trading

Gone are the days of waiting weeks to get paid.

Many prop firms now pay within 24 hours. Some offer same-day payouts through bank transfer or crypto.

You also get rewards during test phases. For example, FundedNext pays 15% of challenge profits. That means even before getting fully funded, you can still earn while proving your skills.

Say you’re trading gold and catch a clean $10 move using proper risk. You hit a $500 gain during the challenge. Some firms pay that out fast—even if you haven’t reached the full account yet.

This gives traders motivation. Even early wins turn into real payouts.

When someone asks, "what is prop trading really good for?" the answer often includes fast, direct income from results.

7. New Tools and Better Support

Today’s prop firms give more than just capital.

They offer tools, dashboards, and analytics. You can track your trades, monitor stats, and tweak your strategy. Let’s say you overtrade around news events—you’ll spot that in your logs. You can fix it.

Some firms also offer mentorship, videos, and live coaching. These used to cost thousands. Now they're often built into the platform. A good example is the support offered through a match trader prop firm, where education and tools come packaged with the trading platform.

You might get weekly trade reviews, Q&A sessions, or tips from funded traders. It’s like having a coach and community on standby.

If you’re learning what is prop trading, these tools give you an edge most solo traders never had.

8. Clear Rules, No Surprises

Traders used to hate hidden rules. News event bans. No overnight trades. Random disqualifications.

That’s changed.

Top firms now list all rules upfront. They even allow high-risk trades like holding during news.

This makes it easier to plan and stay within limits.

9. What Is Prop Trading Compared to a Job? Better Than Traditional Work

Prop trading can replace a job. Not right away, but with time.

If a trader scales to $100k or more, even a few percent a month can bring solid income.

The best part? You answer to no one. You set your hours. You keep most of the profits.

For many, that’s worth more than job security.

What is prop trading offering that jobs can't? Freedom, potential, and personal growth.

10. It's Still Hard, But Fair

Prop trading is not easy. Most people fail their first challenge.

But it's fair.

You get real chances. You get feedback. You can try again.

And once you pass the forex prop firm challenge, you’re not risking your own savings.

That’s a big win in today’s economy.

This is why so many are searching "what is prop trading" and seeing it as a better option.

If you're asking what is prop trading in forex, it's the same model—just applied to currency markets with global liquidity and high volume.

Conclusion

In 2025, prop trading is no longer a niche. It's a new way forward for everyday traders.

It offers capital, freedom, support, and income potential—without the huge personal risk.

If you’ve ever wondered what is prop trading and why it matters now, the answer is clear.

Or if you’ve asked what is prop trading in forex, the answer is simple too—it’s your chance to trade global currencies without risking your own funds.

That’s why so many traders are switching.

If you can trade with skill and control, prop firms are ready to back you.

Pipstone Capital makes that promise concrete. They’re built around one idea: consistent performance matters more than flashy wins. There are no resets, no artificial pressure, and no fine print that ruins your progress. You build a real track record over time—and they match it with real capital, clear rules, and payouts that grow with you. Spreads are tight too, which helps traders keep more of what they earn. It’s prop trading built for traders who treat it like a profession.

What Is Prop Trading and Why Most Traders Are Switching in 2025

Jul 22, 2025

What is prop trading? It's when a firm gives traders money to trade. These traders don’t use their own cash. They use company funds. If they make a profit, the firm takes a cut. The trader keeps the rest.

This is not new. Big banks used to do it a lot before 2008. But after the financial crisis, regulators stepped in. Banks had to pull back. That opened space for new types of prop firms to grow. Today, in 2025, what is prop trading is being asked by thousands of new traders each month as the model grows fast.

One example is Pipstone Capital. It backs skilled traders with real capital and zero gimmicks. The focus is on fair rules, consistent funding, and payouts tied to actual performance—not passing some trick challenge.

So why are more traders switching to prop firms? Here's a breakdown.

1. What Is Prop Trading's Edge? Less Risk, More Capital

Most new traders don’t have much capital. Maybe $1,000. Maybe less. It’s hard to grow that fast.

What is prop trading's biggest draw? Firms give traders access to much more. Some offer $50,000. Others go up to $500,000 or more.

If a trader wins, they share profits with the firm. Usually 70% or more goes to the trader. Some firms offer up to 90%.

If a trader loses, it’s not their money on the line. The worst-case scenario is losing access to the account. Not losing their own cash. To see how this setup differs from other models, check our guide on traditional trading vs prop trading.

Some firms go a step further. Pipstone Capital is one of them. It funds traders based on real skill, not trick evaluations. There's no fake pressure to hit fast targets. If you can manage risk and stay consistent, they scale you up and let your results speak. That kind of setup is rare—and it’s why many serious traders are taking notice.

That’s why traders find prop trading less stressful.

Here’s a quick recap of why prop firm trading model stands out:

You get access to large capital, not your own.

Most profit splits favor the trader—some up to 90%.

You risk the firm’s funds, not your savings.

No pressure to rush trades if the firm rewards consistency.

Skilled traders can grow funding over time.

Rules are fair and clear. No surprises.

Want to understand how that works in more detail? Check out our article on what is funded account in forex.

2. You Don’t Need to Be Rich to Start

With prop firms, you can start with as little as $100 to $500.

This small amount covers a test or challenge. The firm checks your trading skills. If you pass the funded account challenge, you get access to real capital.

Compare that to starting your own account. You’d need thousands to make decent gains.

Take a basic forex trade: say you spot a clean setup on GBP/USD with a tight stop. You risk 1% to aim for 3% in return. With your own $500, that's a $5 risk to maybe make $15. Not bad, but it won't move the needle.

Now imagine trading a $50,000 funded account. Same setup, same risk control. You’re risking $500 to target $1,500. That adds up fast—and you're not touching your own savings.

What is prop trading if not a low-barrier chance to scale? You don’t need a finance degree or family money.

It’s also why many ask what is prop trading in forex—since it's a common entry point for new traders.

3. Flexible Work, Anywhere

Most prop firms let you trade from home. Or a coffee shop. Or anywhere with Wi-Fi.

There are no dress codes. No office politics. No commute.

All you need is a laptop and a trading plan. Some use a simple setup—a trading platform, news feed, and basic chart tools. Nothing fancy.

This freedom draws in people from all walks of life. Teachers. Engineers. Even college students. One guy trades GBP/JPY during the London session from a shared apartment in Manila. Another monitors Nasdaq futures from his camper van in Spain.

They want a chance to earn more. They want control over their time. Prop trading gives them that shot without forcing them into a rigid schedule or draining their savings.

4. What Is Prop Trading Offering? A Big Variety of Firms and Programs

In 2025, there are more prop firms than ever. Some focus on forex. Others on stocks or crypto.

You can pick from many types of trading programs:

One-step evaluations

Two-step challenges

Instant funding (rare, but growing)

Some firms give bonuses during the test phase. Others let you scale up to $1 million if you perform well.

Pipstone Capital stands out by focusing on real skill and steady growth. There's no pressure to trade aggressively just to pass a test. Instead, traders build a track record with real accounts and get scaled up based on consistency and control. Their system is simple: trade well, manage risk, get rewarded. They offer a $5,000 challenge account to start, giving new traders a real shot to prove themselves without overextending.

If you're unsure what is prop trading in forex, Pipstone makes it easy to learn while trading in live markets.

5. Smart Rules That Help You Grow

Prop firms don’t just throw money at you. They have rules. But these rules are fair.

You must stay within a daily and total drawdown limit. This helps protect capital.

Many firms use systems like Edge Scores. These track your skill, discipline, and risk control.

Say you're trading EUR/USD and spot a key support bounce after a strong news drop. You enter long with a 30-pip stop and a 60-pip target. You size the trade so it risks exactly 1% of your account. It hits target. That’s a clean 2:1 win within your limits.

You log the trade, update your stats, and stay within rules. After a few months of results like that, your score goes up. So does your funding.

Some firms double your funding every few months. Others raise your profit split if you stay consistent.

It’s a clear path forward.

6. Fast Payouts and Real Rewards in Prop Trading

Gone are the days of waiting weeks to get paid.

Many prop firms now pay within 24 hours. Some offer same-day payouts through bank transfer or crypto.

You also get rewards during test phases. For example, FundedNext pays 15% of challenge profits. That means even before getting fully funded, you can still earn while proving your skills.

Say you’re trading gold and catch a clean $10 move using proper risk. You hit a $500 gain during the challenge. Some firms pay that out fast—even if you haven’t reached the full account yet.

This gives traders motivation. Even early wins turn into real payouts.

When someone asks, "what is prop trading really good for?" the answer often includes fast, direct income from results.

7. New Tools and Better Support

Today’s prop firms give more than just capital.

They offer tools, dashboards, and analytics. You can track your trades, monitor stats, and tweak your strategy. Let’s say you overtrade around news events—you’ll spot that in your logs. You can fix it.

Some firms also offer mentorship, videos, and live coaching. These used to cost thousands. Now they're often built into the platform. A good example is the support offered through a match trader prop firm, where education and tools come packaged with the trading platform.

You might get weekly trade reviews, Q&A sessions, or tips from funded traders. It’s like having a coach and community on standby.

If you’re learning what is prop trading, these tools give you an edge most solo traders never had.

8. Clear Rules, No Surprises

Traders used to hate hidden rules. News event bans. No overnight trades. Random disqualifications.

That’s changed.

Top firms now list all rules upfront. They even allow high-risk trades like holding during news.

This makes it easier to plan and stay within limits.

9. What Is Prop Trading Compared to a Job? Better Than Traditional Work

Prop trading can replace a job. Not right away, but with time.

If a trader scales to $100k or more, even a few percent a month can bring solid income.

The best part? You answer to no one. You set your hours. You keep most of the profits.

For many, that’s worth more than job security.

What is prop trading offering that jobs can't? Freedom, potential, and personal growth.

10. It's Still Hard, But Fair

Prop trading is not easy. Most people fail their first challenge.

But it's fair.

You get real chances. You get feedback. You can try again.

And once you pass the forex prop firm challenge, you’re not risking your own savings.

That’s a big win in today’s economy.

This is why so many are searching "what is prop trading" and seeing it as a better option.

If you're asking what is prop trading in forex, it's the same model—just applied to currency markets with global liquidity and high volume.

Conclusion

In 2025, prop trading is no longer a niche. It's a new way forward for everyday traders.

It offers capital, freedom, support, and income potential—without the huge personal risk.

If you’ve ever wondered what is prop trading and why it matters now, the answer is clear.

Or if you’ve asked what is prop trading in forex, the answer is simple too—it’s your chance to trade global currencies without risking your own funds.

That’s why so many traders are switching.

If you can trade with skill and control, prop firms are ready to back you.

Pipstone Capital makes that promise concrete. They’re built around one idea: consistent performance matters more than flashy wins. There are no resets, no artificial pressure, and no fine print that ruins your progress. You build a real track record over time—and they match it with real capital, clear rules, and payouts that grow with you. Spreads are tight too, which helps traders keep more of what they earn. It’s prop trading built for traders who treat it like a profession.