Best cTrader Prop Firms for Low-Spread Funded Accounts

Nov 26, 2025

Most traders want tight spreads, fast execution, and a fair funding model. That’s why many traders search for cTrader prop firms. The platform feels smooth, works well with fast strategies, and gives you the depth and clarity you need during live conditions. The challenge is simple: not many prop firms use cTrader, and even fewer offer real low-spread conditions that stay tight during active sessions and don’t widen too much when volatility rises.

This guide reviews the best prop firms that use cTrader, starting with the strongest option today: Pipstone Capital.

1. Pipstone Capital - The Best cTrader Prop Firm for Low-Spread Funded Accounts

Pipstone Capital stands at the top because it gives traders the conditions they need to pass and grow. The goal is simple. Give traders real trading conditions, fast execution, and a clear path to scaling. The prop firm supports cTrader for traders who want a modern, clean, and secure platform. You can also learn more about using the platform in Pipstone’s guide on how to use cTrader for prop firm challenges.

Why Pipstone Is #1

Up to 100% profit split

Raw spreads from major liquidity providers

Fast execution on all instruments

Daily news trading allowed

No time limits on challenges

True funding up to $400,000

24-hour guaranteed payouts

$5K and $100K accounts among the most popular options

cTrader supported for a transparent trading experience

The focus is to help traders pass and scale, not rely on failure fees

2. FundingPips

FundingPips is one of the most known prop firms using cTrader. The firm allows fast payouts, simple rules, and access to cTrader across challenge and funded stages.

Key Highlights

Tight variable spreads

Good for day trading and swing trading

Simple rules

Global availability

Some traders have mentioned spread variance, so it’s important to test their feed during active hours. But overall, it is one of the stronger alternatives.

3. FunderPro

FunderPro is another strong name for anyone asking what prop firms use cTrader. Their model focuses on simple rules, fast account setup, and low trading costs.

Key Highlights

Zero-commission trading model

Tight variable spreads

Good for discretionary and algo traders

Smooth experience

If you run fast setups, you should still track spreads on your main pairs. But overall, traders like the speed and the ease of use.

4. PipFarm

PipFarm is smaller, but it is unique because it focuses on cTrader as the main platform. It fits traders who want a clean, simple, cTrader-only environment.

Key Highlights

cTrader-exclusive

Scaling up to high capital

Simple rules

Smooth execution environment

It’s a good pick if you want a niche firm that puts cTrader first. Still, check spreads and liquidity during major sessions.

5. Blue Guardian

Blue Guardian is a popular prop firm that offers cTrader in certain account configurations. They focus on rule clarity, trader education, and payout consistency.

Key Highlights

cTrader available on selected plans

Good reputation

Clear trading rules

Consistent payouts

It’s not a pure cTrader prop firm, but the platform is offered and supported, which makes it suitable for traders who prefer it.

Why Traders Choose cTrader for Prop Trading

Most cTrader prop firms attract traders who want low spread, smooth execution, and a stable feed. The platform gives more transparency than many other tools by showing clearer pricing, cleaner execution data, and better order flow visibility.

Main Advantages of Using cTrader for Prop Challenges

Depth of Market (DoM) shows real liquidity layers

Fast charting tools

Built-in risk management

Clean interface for scalping

Better visibility during news events

Custom indicators and cBots for automated setups, which you can explore in Pipstone’s guide to the Ultimate cTrader cBot Strategy

When spreads matter, cTrader usually gives better clarity. For a deeper comparison, see Pipstone’s breakdown of cTrader vs MT5 for Prop Firms. This is why most traders who want low-cost entries prefer prop firms with cTrader.

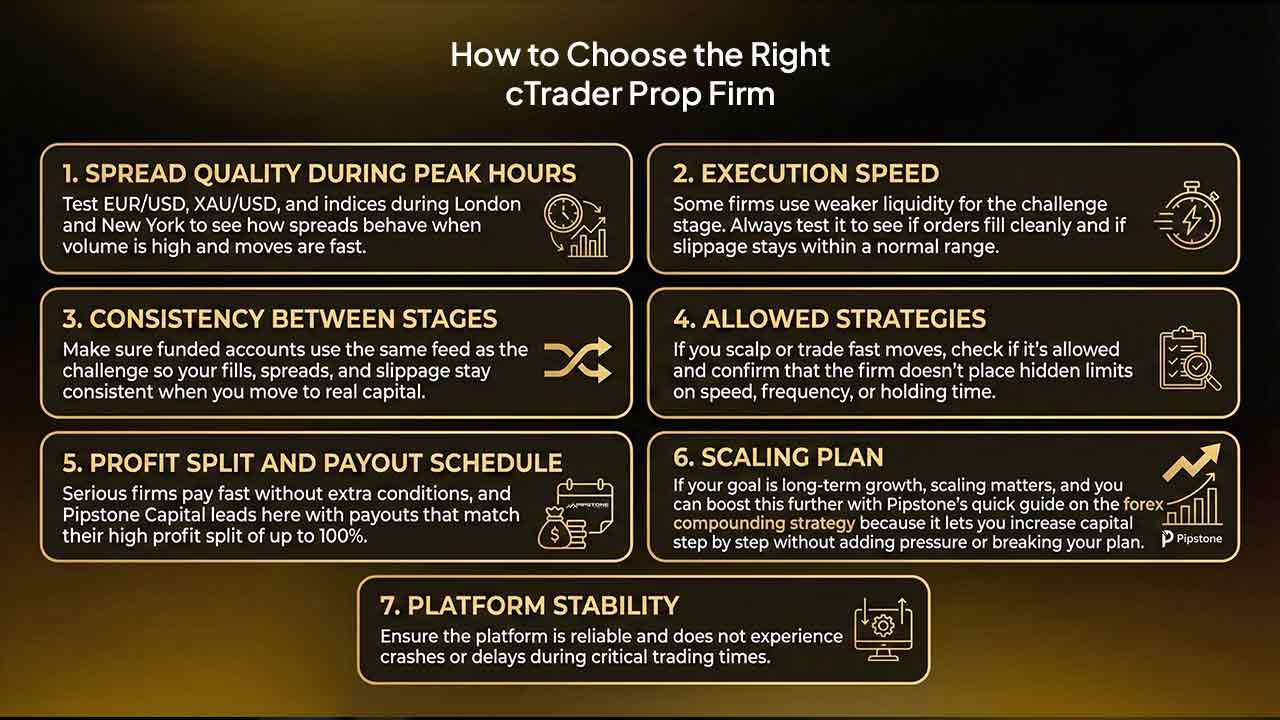

How to Choose the Right cTrader Prop Firm

Not all prop firms offer the same conditions. Even if they list cTrader, spreads and liquidity can differ between challenge and funded accounts, especially if the firm uses different liquidity pools or adjusts spread settings between stages.

Here’s what to check before picking a firm:

1. Spread quality during peak hours

Test EUR/USD, XAU/USD, and indices during London and New York to see how spreads behave when volume is high and moves are fast.

2. Execution speed

Some firms use weaker liquidity for the challenge stage. Always test it to see if orders fill cleanly and if slippage stays within a normal range.

3. Consistency between stages

Make sure funded accounts use the same feed as the challenge so your fills, spreads, and slippage stay consistent when you move to real capital.

4. Allowed strategies

If you scalp or trade fast moves, check if it’s allowed and confirm that the firm doesn’t place hidden limits on speed, frequency, or holding time. We suggest checking our guide on best scalping forex stratregies.

5. Profit split and payout schedule

Serious firms pay fast without extra conditions, and Pipstone Capital leads here with payouts that match their high profit split of up to 100%.

6. Scaling plan

If your goal is long-term growth, scaling matters, and you can boost this further with Pipstone’s quick guide on the forex compounding strategy because it lets you increase capital step by step without adding pressure or breaking your plan.

7. Platform stability

cTrader should run smoothly during news, not freeze or widen too much.

Who Should Use a cTrader Prop Firm?

cTrader works well for traders who:

scalp

day trade

trade gold (XAU/USD)

Trade Currency Pairs

trade indices

need tight spreads

run cBots

prefer clean charting.

Mobile traders can also improve their setup with Pipstone’s guide on the best cTrader app settings for prop trading.

If your system depends on speed, low spreads, or accurate order flow, then choosing prop firms using cTrader is the smart move.

FAQ: cTrader Prop Firms

1. What prop firms use cTrader?

Pipstone Capital, FundingPips, FunderPro, PipFarm, and Blue Guardian all offer cTrader access.

2. Are cTrader prop firms better for scalpers?

Yes. cTrader usually gives faster order handling, better DoM visibility, tighter spreads, and a clearer view of how price reacts when volume hits the market.

3. Which cTrader prop firm is best for low spreads?

Pipstone Capital stands out due to raw spreads, fast execution, and no time limits.

4. Can I use cBots on cTrader with prop firms?

Some firms allow it, and Pipstone Capital supports it with clear rules that give traders room to run automated setups safely.

5. Do all prop firms offer cTrader?

No. Most prop firms use MT4/MT5. Only a few support cTrader.

Best cTrader Prop Firms for Low-Spread Funded Accounts

Nov 26, 2025

Most traders want tight spreads, fast execution, and a fair funding model. That’s why many traders search for cTrader prop firms. The platform feels smooth, works well with fast strategies, and gives you the depth and clarity you need during live conditions. The challenge is simple: not many prop firms use cTrader, and even fewer offer real low-spread conditions that stay tight during active sessions and don’t widen too much when volatility rises.

This guide reviews the best prop firms that use cTrader, starting with the strongest option today: Pipstone Capital.

1. Pipstone Capital - The Best cTrader Prop Firm for Low-Spread Funded Accounts

Pipstone Capital stands at the top because it gives traders the conditions they need to pass and grow. The goal is simple. Give traders real trading conditions, fast execution, and a clear path to scaling. The prop firm supports cTrader for traders who want a modern, clean, and secure platform. You can also learn more about using the platform in Pipstone’s guide on how to use cTrader for prop firm challenges.

Why Pipstone Is #1

Up to 100% profit split

Raw spreads from major liquidity providers

Fast execution on all instruments

Daily news trading allowed

No time limits on challenges

True funding up to $400,000

24-hour guaranteed payouts

$5K and $100K accounts among the most popular options

cTrader supported for a transparent trading experience

The focus is to help traders pass and scale, not rely on failure fees

2. FundingPips

FundingPips is one of the most known prop firms using cTrader. The firm allows fast payouts, simple rules, and access to cTrader across challenge and funded stages.

Key Highlights

Tight variable spreads

Good for day trading and swing trading

Simple rules

Global availability

Some traders have mentioned spread variance, so it’s important to test their feed during active hours. But overall, it is one of the stronger alternatives.

3. FunderPro

FunderPro is another strong name for anyone asking what prop firms use cTrader. Their model focuses on simple rules, fast account setup, and low trading costs.

Key Highlights

Zero-commission trading model

Tight variable spreads

Good for discretionary and algo traders

Smooth experience

If you run fast setups, you should still track spreads on your main pairs. But overall, traders like the speed and the ease of use.

4. PipFarm

PipFarm is smaller, but it is unique because it focuses on cTrader as the main platform. It fits traders who want a clean, simple, cTrader-only environment.

Key Highlights

cTrader-exclusive

Scaling up to high capital

Simple rules

Smooth execution environment

It’s a good pick if you want a niche firm that puts cTrader first. Still, check spreads and liquidity during major sessions.

5. Blue Guardian

Blue Guardian is a popular prop firm that offers cTrader in certain account configurations. They focus on rule clarity, trader education, and payout consistency.

Key Highlights

cTrader available on selected plans

Good reputation

Clear trading rules

Consistent payouts

It’s not a pure cTrader prop firm, but the platform is offered and supported, which makes it suitable for traders who prefer it.

Why Traders Choose cTrader for Prop Trading

Most cTrader prop firms attract traders who want low spread, smooth execution, and a stable feed. The platform gives more transparency than many other tools by showing clearer pricing, cleaner execution data, and better order flow visibility.

Main Advantages of Using cTrader for Prop Challenges

Depth of Market (DoM) shows real liquidity layers

Fast charting tools

Built-in risk management

Clean interface for scalping

Better visibility during news events

Custom indicators and cBots for automated setups, which you can explore in Pipstone’s guide to the Ultimate cTrader cBot Strategy

When spreads matter, cTrader usually gives better clarity. For a deeper comparison, see Pipstone’s breakdown of cTrader vs MT5 for Prop Firms. This is why most traders who want low-cost entries prefer prop firms with cTrader.

How to Choose the Right cTrader Prop Firm

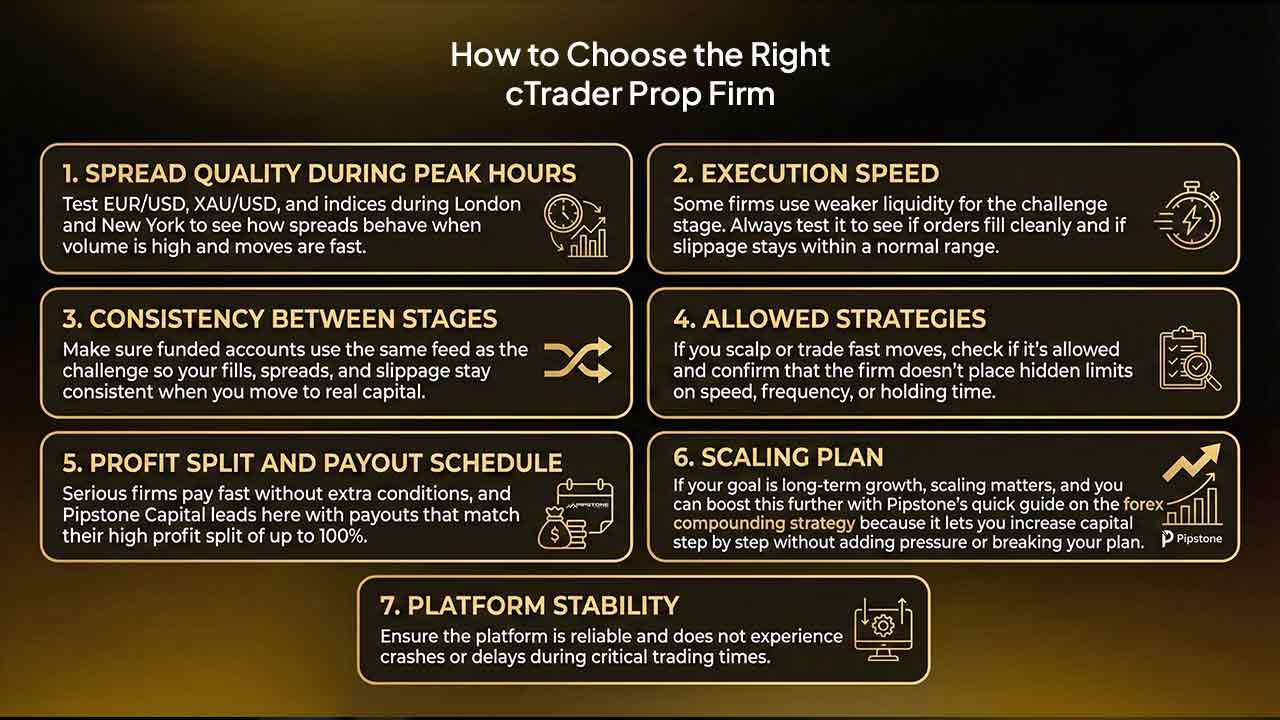

Not all prop firms offer the same conditions. Even if they list cTrader, spreads and liquidity can differ between challenge and funded accounts, especially if the firm uses different liquidity pools or adjusts spread settings between stages.

Here’s what to check before picking a firm:

1. Spread quality during peak hours

Test EUR/USD, XAU/USD, and indices during London and New York to see how spreads behave when volume is high and moves are fast.

2. Execution speed

Some firms use weaker liquidity for the challenge stage. Always test it to see if orders fill cleanly and if slippage stays within a normal range.

3. Consistency between stages

Make sure funded accounts use the same feed as the challenge so your fills, spreads, and slippage stay consistent when you move to real capital.

4. Allowed strategies

If you scalp or trade fast moves, check if it’s allowed and confirm that the firm doesn’t place hidden limits on speed, frequency, or holding time. We suggest checking our guide on best scalping forex stratregies.

5. Profit split and payout schedule

Serious firms pay fast without extra conditions, and Pipstone Capital leads here with payouts that match their high profit split of up to 100%.

6. Scaling plan

If your goal is long-term growth, scaling matters, and you can boost this further with Pipstone’s quick guide on the forex compounding strategy because it lets you increase capital step by step without adding pressure or breaking your plan.

7. Platform stability

cTrader should run smoothly during news, not freeze or widen too much.

Who Should Use a cTrader Prop Firm?

cTrader works well for traders who:

scalp

day trade

trade gold (XAU/USD)

Trade Currency Pairs

trade indices

need tight spreads

run cBots

prefer clean charting.

Mobile traders can also improve their setup with Pipstone’s guide on the best cTrader app settings for prop trading.

If your system depends on speed, low spreads, or accurate order flow, then choosing prop firms using cTrader is the smart move.

FAQ: cTrader Prop Firms

1. What prop firms use cTrader?

Pipstone Capital, FundingPips, FunderPro, PipFarm, and Blue Guardian all offer cTrader access.

2. Are cTrader prop firms better for scalpers?

Yes. cTrader usually gives faster order handling, better DoM visibility, tighter spreads, and a clearer view of how price reacts when volume hits the market.

3. Which cTrader prop firm is best for low spreads?

Pipstone Capital stands out due to raw spreads, fast execution, and no time limits.

4. Can I use cBots on cTrader with prop firms?

Some firms allow it, and Pipstone Capital supports it with clear rules that give traders room to run automated setups safely.

5. Do all prop firms offer cTrader?

No. Most prop firms use MT4/MT5. Only a few support cTrader.

Best cTrader Prop Firms for Low-Spread Funded Accounts

Nov 26, 2025

Most traders want tight spreads, fast execution, and a fair funding model. That’s why many traders search for cTrader prop firms. The platform feels smooth, works well with fast strategies, and gives you the depth and clarity you need during live conditions. The challenge is simple: not many prop firms use cTrader, and even fewer offer real low-spread conditions that stay tight during active sessions and don’t widen too much when volatility rises.

This guide reviews the best prop firms that use cTrader, starting with the strongest option today: Pipstone Capital.

1. Pipstone Capital - The Best cTrader Prop Firm for Low-Spread Funded Accounts

Pipstone Capital stands at the top because it gives traders the conditions they need to pass and grow. The goal is simple. Give traders real trading conditions, fast execution, and a clear path to scaling. The prop firm supports cTrader for traders who want a modern, clean, and secure platform. You can also learn more about using the platform in Pipstone’s guide on how to use cTrader for prop firm challenges.

Why Pipstone Is #1

Up to 100% profit split

Raw spreads from major liquidity providers

Fast execution on all instruments

Daily news trading allowed

No time limits on challenges

True funding up to $400,000

24-hour guaranteed payouts

$5K and $100K accounts among the most popular options

cTrader supported for a transparent trading experience

The focus is to help traders pass and scale, not rely on failure fees

2. FundingPips

FundingPips is one of the most known prop firms using cTrader. The firm allows fast payouts, simple rules, and access to cTrader across challenge and funded stages.

Key Highlights

Tight variable spreads

Good for day trading and swing trading

Simple rules

Global availability

Some traders have mentioned spread variance, so it’s important to test their feed during active hours. But overall, it is one of the stronger alternatives.

3. FunderPro

FunderPro is another strong name for anyone asking what prop firms use cTrader. Their model focuses on simple rules, fast account setup, and low trading costs.

Key Highlights

Zero-commission trading model

Tight variable spreads

Good for discretionary and algo traders

Smooth experience

If you run fast setups, you should still track spreads on your main pairs. But overall, traders like the speed and the ease of use.

4. PipFarm

PipFarm is smaller, but it is unique because it focuses on cTrader as the main platform. It fits traders who want a clean, simple, cTrader-only environment.

Key Highlights

cTrader-exclusive

Scaling up to high capital

Simple rules

Smooth execution environment

It’s a good pick if you want a niche firm that puts cTrader first. Still, check spreads and liquidity during major sessions.

5. Blue Guardian

Blue Guardian is a popular prop firm that offers cTrader in certain account configurations. They focus on rule clarity, trader education, and payout consistency.

Key Highlights

cTrader available on selected plans

Good reputation

Clear trading rules

Consistent payouts

It’s not a pure cTrader prop firm, but the platform is offered and supported, which makes it suitable for traders who prefer it.

Why Traders Choose cTrader for Prop Trading

Most cTrader prop firms attract traders who want low spread, smooth execution, and a stable feed. The platform gives more transparency than many other tools by showing clearer pricing, cleaner execution data, and better order flow visibility.

Main Advantages of Using cTrader for Prop Challenges

Depth of Market (DoM) shows real liquidity layers

Fast charting tools

Built-in risk management

Clean interface for scalping

Better visibility during news events

Custom indicators and cBots for automated setups, which you can explore in Pipstone’s guide to the Ultimate cTrader cBot Strategy

When spreads matter, cTrader usually gives better clarity. For a deeper comparison, see Pipstone’s breakdown of cTrader vs MT5 for Prop Firms. This is why most traders who want low-cost entries prefer prop firms with cTrader.

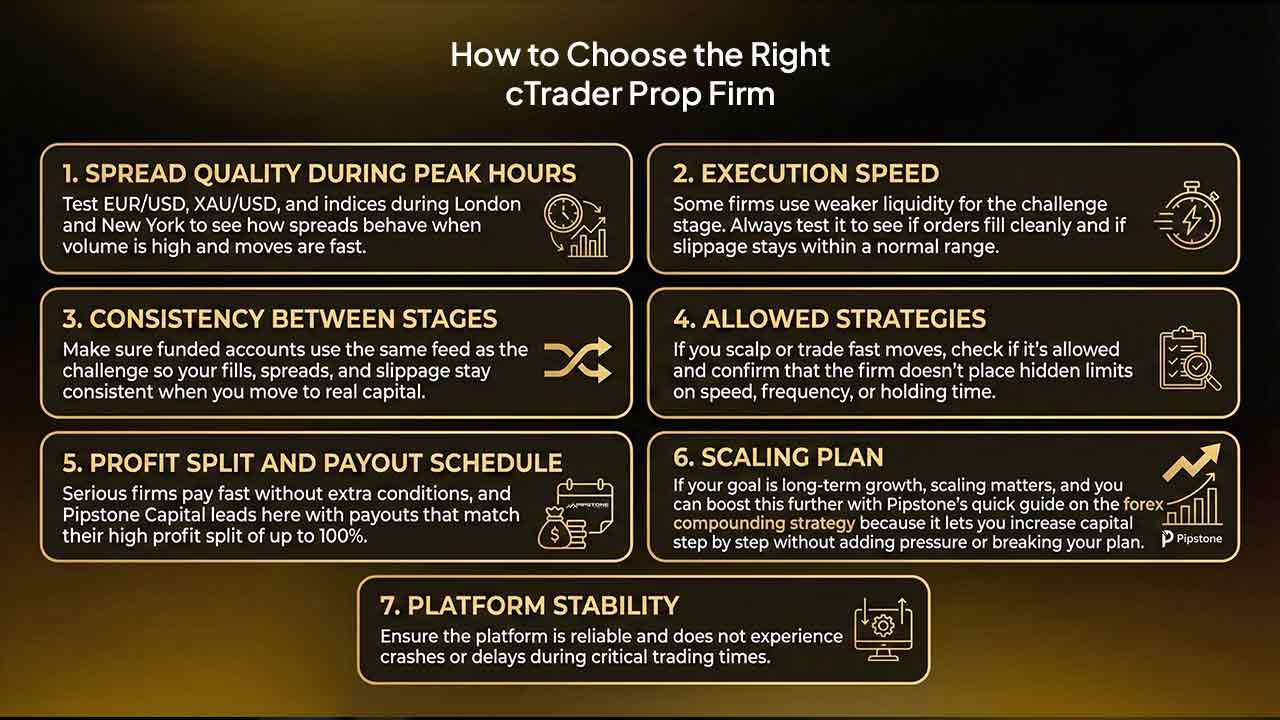

How to Choose the Right cTrader Prop Firm

Not all prop firms offer the same conditions. Even if they list cTrader, spreads and liquidity can differ between challenge and funded accounts, especially if the firm uses different liquidity pools or adjusts spread settings between stages.

Here’s what to check before picking a firm:

1. Spread quality during peak hours

Test EUR/USD, XAU/USD, and indices during London and New York to see how spreads behave when volume is high and moves are fast.

2. Execution speed

Some firms use weaker liquidity for the challenge stage. Always test it to see if orders fill cleanly and if slippage stays within a normal range.

3. Consistency between stages

Make sure funded accounts use the same feed as the challenge so your fills, spreads, and slippage stay consistent when you move to real capital.

4. Allowed strategies

If you scalp or trade fast moves, check if it’s allowed and confirm that the firm doesn’t place hidden limits on speed, frequency, or holding time. We suggest checking our guide on best scalping forex stratregies.

5. Profit split and payout schedule

Serious firms pay fast without extra conditions, and Pipstone Capital leads here with payouts that match their high profit split of up to 100%.

6. Scaling plan

If your goal is long-term growth, scaling matters, and you can boost this further with Pipstone’s quick guide on the forex compounding strategy because it lets you increase capital step by step without adding pressure or breaking your plan.

7. Platform stability

cTrader should run smoothly during news, not freeze or widen too much.

Who Should Use a cTrader Prop Firm?

cTrader works well for traders who:

scalp

day trade

trade gold (XAU/USD)

Trade Currency Pairs

trade indices

need tight spreads

run cBots

prefer clean charting.

Mobile traders can also improve their setup with Pipstone’s guide on the best cTrader app settings for prop trading.

If your system depends on speed, low spreads, or accurate order flow, then choosing prop firms using cTrader is the smart move.

FAQ: cTrader Prop Firms

1. What prop firms use cTrader?

Pipstone Capital, FundingPips, FunderPro, PipFarm, and Blue Guardian all offer cTrader access.

2. Are cTrader prop firms better for scalpers?

Yes. cTrader usually gives faster order handling, better DoM visibility, tighter spreads, and a clearer view of how price reacts when volume hits the market.

3. Which cTrader prop firm is best for low spreads?

Pipstone Capital stands out due to raw spreads, fast execution, and no time limits.

4. Can I use cBots on cTrader with prop firms?

Some firms allow it, and Pipstone Capital supports it with clear rules that give traders room to run automated setups safely.

5. Do all prop firms offer cTrader?

No. Most prop firms use MT4/MT5. Only a few support cTrader.