How to Use the cTrader Simulator to Practice Forex Prop Firm Trading

Jan 13, 2026

If you’re preparing for a forex prop firm challenge, practicing in the right environment matters just as much as your strategy. Many traders fail not because their system is weak, but because they haven’t trained under realistic conditions. This is where the cTrader simulator becomes a powerful tool.

In this guide, you’ll learn how to use the cTrader simulator step by step, how to structure your practice like a real prop firm account, and how traders preparing for forex prop firms like Pipstone Capital can use it to sharpen execution, discipline, and risk control before trading real capital.

Why Simulation Is Critical for Prop Firm Traders

Prop firm trading is different from personal retail trading. You’re not just trying to make money. You’re trying to follow rules.

Most prop firms enforce:

Maximum daily drawdown

Overall drawdown limits

Fixed or relative risk rules

Profit targets

Psychological pressure from evaluation phases

A simulator lets you experience all of this without financial consequences. It creates a safe space to make mistakes, refine your process, and build consistency before you step into a live or funded environment.

What Is the cTrader Simulator?

The cTrader simulator is a practice environment that allows traders to:

Trade in real market conditions

Use historical or live price data

Execute trades exactly as they would in a real account

Analyze performance with detailed trade statistics

Unlike basic demo accounts, the simulator helps you practice with intent, not just place random trades. It’s especially useful for traders targeting prop firms that value precision and discipline.

Why cTrader Is Ideal for Prop Firm Preparation

cTrader is widely used by professional traders because of its clean interface and execution-focused design. For prop firm traders, it offers key advantages:

Clear depth-of-market and order execution

Advanced charting without clutter

Precise stop-loss and take-profit placement

Strong risk management tools

Transparent trade history and analytics

Firms like Pipstone Capital favor platforms like cTrader because they encourage structured, rules-based trading rather than impulsive behavior.

Step 1: Setting Up cTrader for Simulation Trading

Before placing a single trade, your simulator setup must reflect real prop firm conditions.

Choose the Right Account Parameters

Match your simulator account to a realistic prop firm profile:

Starting balance (e.g., $10,000, $50,000, or $100,000)

Leverage similar to what the firm offers

Base currency aligned with the challenge

This matters because risk percentages feel very different depending on account size. If you want a practical walkthrough beyond simulation, this pairs well with learning how to use cTrader for funded account challenges, which breaks down real challenge execution on the same platform.

Use Clean Charts

Avoid overloading your charts. Most prop traders fail by adding too many indicators. Start with:

One or two core indicators

Clear support and resistance levels

A consistent timeframe structure

Simulation is about clarity, not complexity.

Step 2: Define Your Prop Firm Rules Before Trading

The biggest mistake traders make in simulators is trading without rules. Treat your simulator like a strict evaluation phase.

Before starting, write down:

Maximum risk per trade (usually 0.5%–1%)

Maximum daily loss

Maximum number of trades per day

Trading session times

Instruments you are allowed to trade

For example, if you’re preparing for Pipstone Capital, simulate their no-time-pressure environment while still respecting drawdown and risk discipline. This works best when your simulator rules are aligned with a structured framework like the winning trading plan to pass your forex funded account challenge, so every simulated session follows the same logic you would use in a real evaluation.

Step 3: Simulate Real Market Conditions

The value of the cTrader simulator comes from realism.

Trade Only During Active Sessions

Avoid random trading at low-liquidity hours. Focus on:

London session

New York session

London–New York overlap

This trains you to read momentum, volatility, and price behavior under conditions that matter in prop firm trading.

Avoid Overtrading

One of the silent killers in prop firm challenges is overtrading. Use the simulator to:

Practice patience

Wait for high-quality setups

Accept that some days are no-trade days

Simulation is where discipline is built. This is also where understanding what prop trading is and why traders are switching helps frame simulation as professional preparation, not casual practice.

Step 4: Practice Risk Management Like a Funded Trader

Risk management is the real skill prop firms evaluate.

Fixed Risk Per Trade

Use a consistent percentage risk on every trade. This helps you:

Control drawdowns

Maintain emotional stability

Build predictable equity curves

Traders who want to go deeper here often follow a structured approach to risk management in cTrader, which aligns position sizing, stops, and drawdown control with prop firm rules.

Stop-Loss Discipline

Never move stop-losses in cTrader simulator unless your strategy allows it. If you wouldn’t do it in a funded account, don’t do it here.

Risk-to-Reward Awareness

Use simulation to test:

Whether 1:2 or 1:3 setups fit your psychology

How often your strategy hits targets versus stops

How drawdowns feel emotionally

This self-awareness is critical before trading real capital. Many traders reinforce this by reviewing forex trading techniques that improve discipline and execution alongside their simulator performance.

Step 5: Journal Every Simulated Trade

A simulator without journaling is wasted effort.

After each trade, record:

Entry and exit reasons

Time of day

Market structure

Emotional state

Whether rules were followed

Over time, patterns emerge. Journaling also helps traders decide whether discretionary execution or automation fits them better, which is explored further in building a winning cTrader cBot strategy for prop traders. You’ll see whether losses come from poor analysis or poor discipline. Prop firms don’t fail traders for losing trades. They fail traders for rule-breaking behavior.

Step 6: Review Performance Weekly, Not Daily

Many traders sabotage themselves by checking results too often.

Use the cTrader analytics to review performance weekly:

Win rate

Average risk-to-reward

Drawdown depth

Consistency of execution

This long-term view mirrors how prop firms assess traders. It also aligns closely with how funded forex accounts work and how traders qualify for them, where consistency outweighs short-term spikes. Short-term fluctuations matter far less than steady, controlled performance.

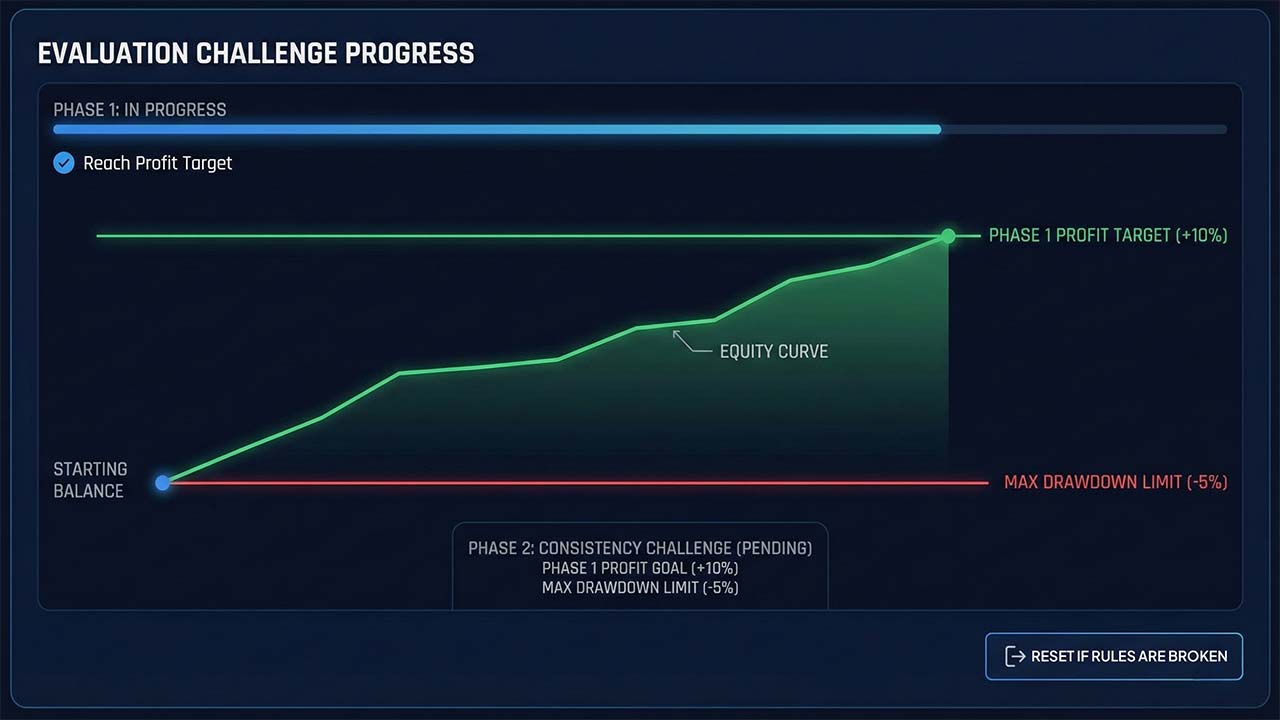

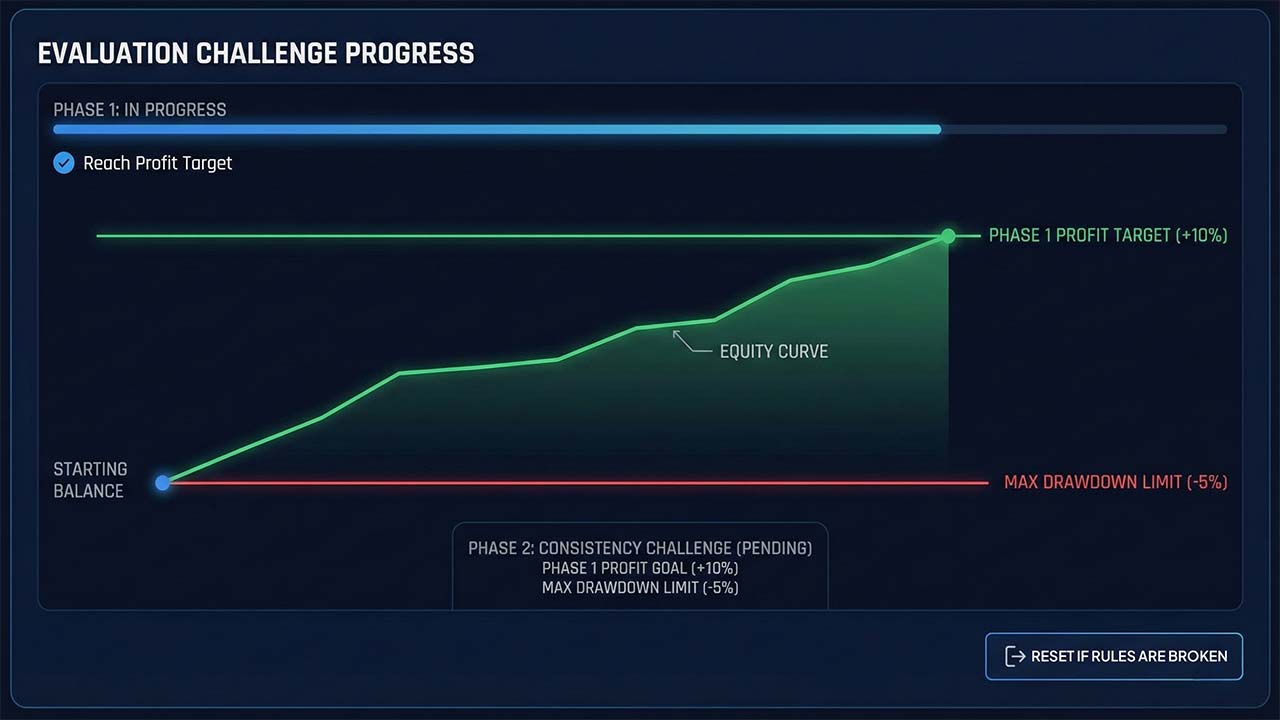

Step 7: Simulate Evaluation Phases Properly

To truly prepare for a prop firm challenge, structure your cTrader simulator like an evaluation.

Phase-Based Simulation

Phase 1: Reach a profit target without breaking rules

Phase 2: Maintain consistency with reduced pressure

Reset if rules are broken

This mental framing trains you to handle pressure before it’s real. Traders who prefer slower, structure-based approaches often test this phase using concepts from swing trading forex strategies to reduce overtrading during evaluations.

Common Mistakes Traders Make in cTrader Simulation

Even with a powerful simulator, many traders practice the wrong way.

Treating Simulation Casually

If you don’t respect simulator losses, you won’t respect real losses.

Ignoring Drawdown Rules

Prop firm failures almost always come from drawdown violations, not lack of strategy.

Strategy Hopping

Simulation is not for testing ten strategies at once. Pick one system and refine it.

How Pipstone Capital Traders Use Simulation Effectively

Traders preparing for Pipstone Capital often use the cTrader simulator to:

Practice under no-time-limit conditions

Focus on precision instead of rushing profits

Build confidence before scaling accounts

Develop consistency without emotional pressure

When to Move From Simulator to Live or Challenge Accounts

You’re ready to transition when:

You follow rules automatically

Drawdowns stay controlled

Losses no longer trigger emotional reactions

Your process feels repeatable, not forced

If you can’t stay disciplined in simulation, real money will only amplify the problem.

Final Thoughts

The cTrader simulator is not just a practice tool. It’s a training ground for professional behavior.

When cTrader Simulator is used correctly, it helps you:

Think like a funded trader

Respect risk

Build emotional control

Prepare for real prop firm evaluations

Whether you’re aiming for your first challenge or scaling toward larger accounts, structured simulation is one of the smartest steps you can take. For traders targeting firms like Pipstone Capital with no consistency rule, mastering the simulator often becomes the difference between repeated failures and long-term success.

Frequently Asked Questions (FAQ): CTrader Simulator

Is the cTrader simulator the same as a demo account?

Not exactly. A standard demo account lets you trade live market prices, but most traders use it casually. The cTrader simulator is effective only when you structure it like a real prop firm account, with fixed rules, defined risk, and strict drawdown limits. The discipline you apply is what makes the difference.

Can I use the cTrader simulator to prepare specifically for prop firm challenges?

Yes. The simulator is one of the best tools for prop firm preparation because it allows you to practice execution, risk control, and emotional discipline under realistic conditions. When used correctly, it mirrors how you should trade during an evaluation or funded phase.

How long should I practice in the cTrader simulator before taking a challenge?

There is no fixed timeline, but most traders benefit from at least 4–8 weeks of rule-based simulation. You should only move forward once you can follow your rules consistently and keep drawdowns under control without emotional reactions.

What risk percentage should I use in the simulator?

Most prop firm traders practice with 0.5% to 1% risk per trade. This range helps you survive losing streaks while staying aligned with typical prop firm drawdown rules. The exact number matters less than staying consistent.

Should I test multiple strategies in the simulator?

No. Strategy hopping is one of the biggest mistakes traders make. Use the simulator to refine one clear trading approach, not to experiment endlessly. Prop firms reward consistency, not complexity.

How to Use the cTrader Simulator to Practice Forex Prop Firm Trading

Jan 13, 2026

If you’re preparing for a forex prop firm challenge, practicing in the right environment matters just as much as your strategy. Many traders fail not because their system is weak, but because they haven’t trained under realistic conditions. This is where the cTrader simulator becomes a powerful tool.

In this guide, you’ll learn how to use the cTrader simulator step by step, how to structure your practice like a real prop firm account, and how traders preparing for forex prop firms like Pipstone Capital can use it to sharpen execution, discipline, and risk control before trading real capital.

Why Simulation Is Critical for Prop Firm Traders

Prop firm trading is different from personal retail trading. You’re not just trying to make money. You’re trying to follow rules.

Most prop firms enforce:

Maximum daily drawdown

Overall drawdown limits

Fixed or relative risk rules

Profit targets

Psychological pressure from evaluation phases

A simulator lets you experience all of this without financial consequences. It creates a safe space to make mistakes, refine your process, and build consistency before you step into a live or funded environment.

What Is the cTrader Simulator?

The cTrader simulator is a practice environment that allows traders to:

Trade in real market conditions

Use historical or live price data

Execute trades exactly as they would in a real account

Analyze performance with detailed trade statistics

Unlike basic demo accounts, the simulator helps you practice with intent, not just place random trades. It’s especially useful for traders targeting prop firms that value precision and discipline.

Why cTrader Is Ideal for Prop Firm Preparation

cTrader is widely used by professional traders because of its clean interface and execution-focused design. For prop firm traders, it offers key advantages:

Clear depth-of-market and order execution

Advanced charting without clutter

Precise stop-loss and take-profit placement

Strong risk management tools

Transparent trade history and analytics

Firms like Pipstone Capital favor platforms like cTrader because they encourage structured, rules-based trading rather than impulsive behavior.

Step 1: Setting Up cTrader for Simulation Trading

Before placing a single trade, your simulator setup must reflect real prop firm conditions.

Choose the Right Account Parameters

Match your simulator account to a realistic prop firm profile:

Starting balance (e.g., $10,000, $50,000, or $100,000)

Leverage similar to what the firm offers

Base currency aligned with the challenge

This matters because risk percentages feel very different depending on account size. If you want a practical walkthrough beyond simulation, this pairs well with learning how to use cTrader for funded account challenges, which breaks down real challenge execution on the same platform.

Use Clean Charts

Avoid overloading your charts. Most prop traders fail by adding too many indicators. Start with:

One or two core indicators

Clear support and resistance levels

A consistent timeframe structure

Simulation is about clarity, not complexity.

Step 2: Define Your Prop Firm Rules Before Trading

The biggest mistake traders make in simulators is trading without rules. Treat your simulator like a strict evaluation phase.

Before starting, write down:

Maximum risk per trade (usually 0.5%–1%)

Maximum daily loss

Maximum number of trades per day

Trading session times

Instruments you are allowed to trade

For example, if you’re preparing for Pipstone Capital, simulate their no-time-pressure environment while still respecting drawdown and risk discipline. This works best when your simulator rules are aligned with a structured framework like the winning trading plan to pass your forex funded account challenge, so every simulated session follows the same logic you would use in a real evaluation.

Step 3: Simulate Real Market Conditions

The value of the cTrader simulator comes from realism.

Trade Only During Active Sessions

Avoid random trading at low-liquidity hours. Focus on:

London session

New York session

London–New York overlap

This trains you to read momentum, volatility, and price behavior under conditions that matter in prop firm trading.

Avoid Overtrading

One of the silent killers in prop firm challenges is overtrading. Use the simulator to:

Practice patience

Wait for high-quality setups

Accept that some days are no-trade days

Simulation is where discipline is built. This is also where understanding what prop trading is and why traders are switching helps frame simulation as professional preparation, not casual practice.

Step 4: Practice Risk Management Like a Funded Trader

Risk management is the real skill prop firms evaluate.

Fixed Risk Per Trade

Use a consistent percentage risk on every trade. This helps you:

Control drawdowns

Maintain emotional stability

Build predictable equity curves

Traders who want to go deeper here often follow a structured approach to risk management in cTrader, which aligns position sizing, stops, and drawdown control with prop firm rules.

Stop-Loss Discipline

Never move stop-losses in cTrader simulator unless your strategy allows it. If you wouldn’t do it in a funded account, don’t do it here.

Risk-to-Reward Awareness

Use simulation to test:

Whether 1:2 or 1:3 setups fit your psychology

How often your strategy hits targets versus stops

How drawdowns feel emotionally

This self-awareness is critical before trading real capital. Many traders reinforce this by reviewing forex trading techniques that improve discipline and execution alongside their simulator performance.

Step 5: Journal Every Simulated Trade

A simulator without journaling is wasted effort.

After each trade, record:

Entry and exit reasons

Time of day

Market structure

Emotional state

Whether rules were followed

Over time, patterns emerge. Journaling also helps traders decide whether discretionary execution or automation fits them better, which is explored further in building a winning cTrader cBot strategy for prop traders. You’ll see whether losses come from poor analysis or poor discipline. Prop firms don’t fail traders for losing trades. They fail traders for rule-breaking behavior.

Step 6: Review Performance Weekly, Not Daily

Many traders sabotage themselves by checking results too often.

Use the cTrader analytics to review performance weekly:

Win rate

Average risk-to-reward

Drawdown depth

Consistency of execution

This long-term view mirrors how prop firms assess traders. It also aligns closely with how funded forex accounts work and how traders qualify for them, where consistency outweighs short-term spikes. Short-term fluctuations matter far less than steady, controlled performance.

Step 7: Simulate Evaluation Phases Properly

To truly prepare for a prop firm challenge, structure your cTrader simulator like an evaluation.

Phase-Based Simulation

Phase 1: Reach a profit target without breaking rules

Phase 2: Maintain consistency with reduced pressure

Reset if rules are broken

This mental framing trains you to handle pressure before it’s real. Traders who prefer slower, structure-based approaches often test this phase using concepts from swing trading forex strategies to reduce overtrading during evaluations.

Common Mistakes Traders Make in cTrader Simulation

Even with a powerful simulator, many traders practice the wrong way.

Treating Simulation Casually

If you don’t respect simulator losses, you won’t respect real losses.

Ignoring Drawdown Rules

Prop firm failures almost always come from drawdown violations, not lack of strategy.

Strategy Hopping

Simulation is not for testing ten strategies at once. Pick one system and refine it.

How Pipstone Capital Traders Use Simulation Effectively

Traders preparing for Pipstone Capital often use the cTrader simulator to:

Practice under no-time-limit conditions

Focus on precision instead of rushing profits

Build confidence before scaling accounts

Develop consistency without emotional pressure

When to Move From Simulator to Live or Challenge Accounts

You’re ready to transition when:

You follow rules automatically

Drawdowns stay controlled

Losses no longer trigger emotional reactions

Your process feels repeatable, not forced

If you can’t stay disciplined in simulation, real money will only amplify the problem.

Final Thoughts

The cTrader simulator is not just a practice tool. It’s a training ground for professional behavior.

When cTrader Simulator is used correctly, it helps you:

Think like a funded trader

Respect risk

Build emotional control

Prepare for real prop firm evaluations

Whether you’re aiming for your first challenge or scaling toward larger accounts, structured simulation is one of the smartest steps you can take. For traders targeting firms like Pipstone Capital with no consistency rule, mastering the simulator often becomes the difference between repeated failures and long-term success.

Frequently Asked Questions (FAQ): CTrader Simulator

Is the cTrader simulator the same as a demo account?

Not exactly. A standard demo account lets you trade live market prices, but most traders use it casually. The cTrader simulator is effective only when you structure it like a real prop firm account, with fixed rules, defined risk, and strict drawdown limits. The discipline you apply is what makes the difference.

Can I use the cTrader simulator to prepare specifically for prop firm challenges?

Yes. The simulator is one of the best tools for prop firm preparation because it allows you to practice execution, risk control, and emotional discipline under realistic conditions. When used correctly, it mirrors how you should trade during an evaluation or funded phase.

How long should I practice in the cTrader simulator before taking a challenge?

There is no fixed timeline, but most traders benefit from at least 4–8 weeks of rule-based simulation. You should only move forward once you can follow your rules consistently and keep drawdowns under control without emotional reactions.

What risk percentage should I use in the simulator?

Most prop firm traders practice with 0.5% to 1% risk per trade. This range helps you survive losing streaks while staying aligned with typical prop firm drawdown rules. The exact number matters less than staying consistent.

Should I test multiple strategies in the simulator?

No. Strategy hopping is one of the biggest mistakes traders make. Use the simulator to refine one clear trading approach, not to experiment endlessly. Prop firms reward consistency, not complexity.