How to Pass Prop Firm One Step Evaluation on the First Attempt in 2026

Jan 28, 2026

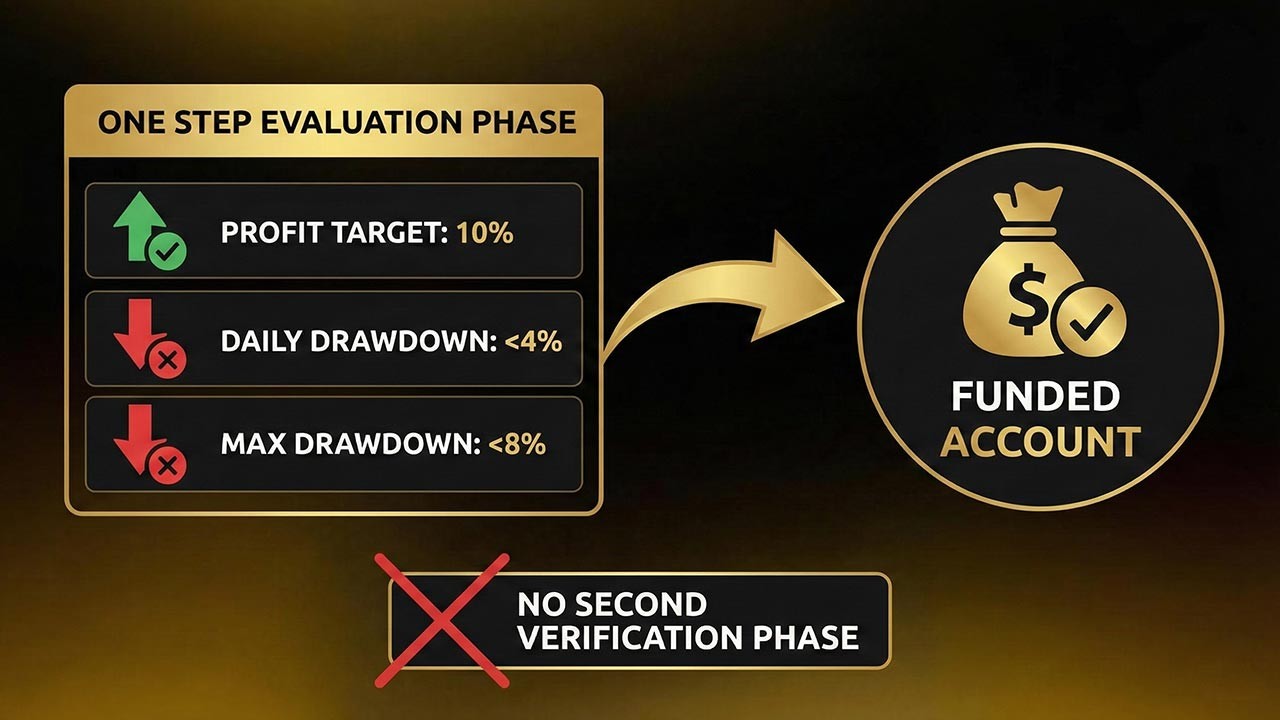

Passing a one step evaluation may sound straightforward. One challenge. One profit target. One chance to get funded.

Yet in 2026, thousands of traders still fail their first attempt, not because they lack trading skills, but because they misunderstand what a prop firm is actually testing.

A one step evaluation prop firm model removes the second verification phase and offers faster access to capital. However, this simplicity comes with stricter discipline requirements. There is no recovery phase, no second opportunity, and no margin for emotional mistakes.

This complete guide explains exactly how to pass a one step evaluation on your first attempt, using realistic strategies based on how prop firms actually structure their challenges today.

What Is a Prop Firm Challenge?

Before focusing on the one step model, it’s important to understand what is a prop firm challenge.

A prop firm challenge is an evaluation process where traders prove their ability to manage risk and generate profits under strict rules. Many traders begin by learning what a funded forex trading account actually is before attempting an evaluation. Moreover, traders do not risk their own capital. Instead, they trade a simulated account and earn funding after meeting performance requirements.

Most prop firm challenges test three core skills:

Risk management discipline

Emotional consistency

Ability to follow predefined rules

The one step evaluation is simply a modern variation of this model.

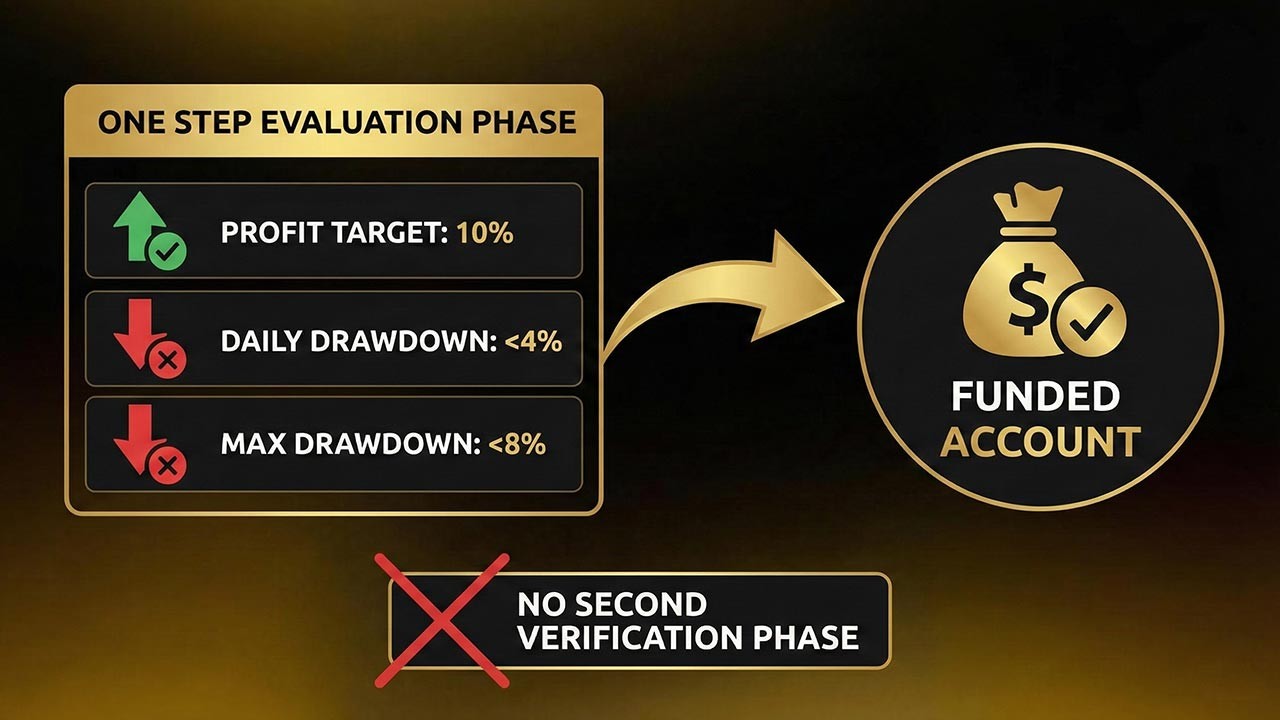

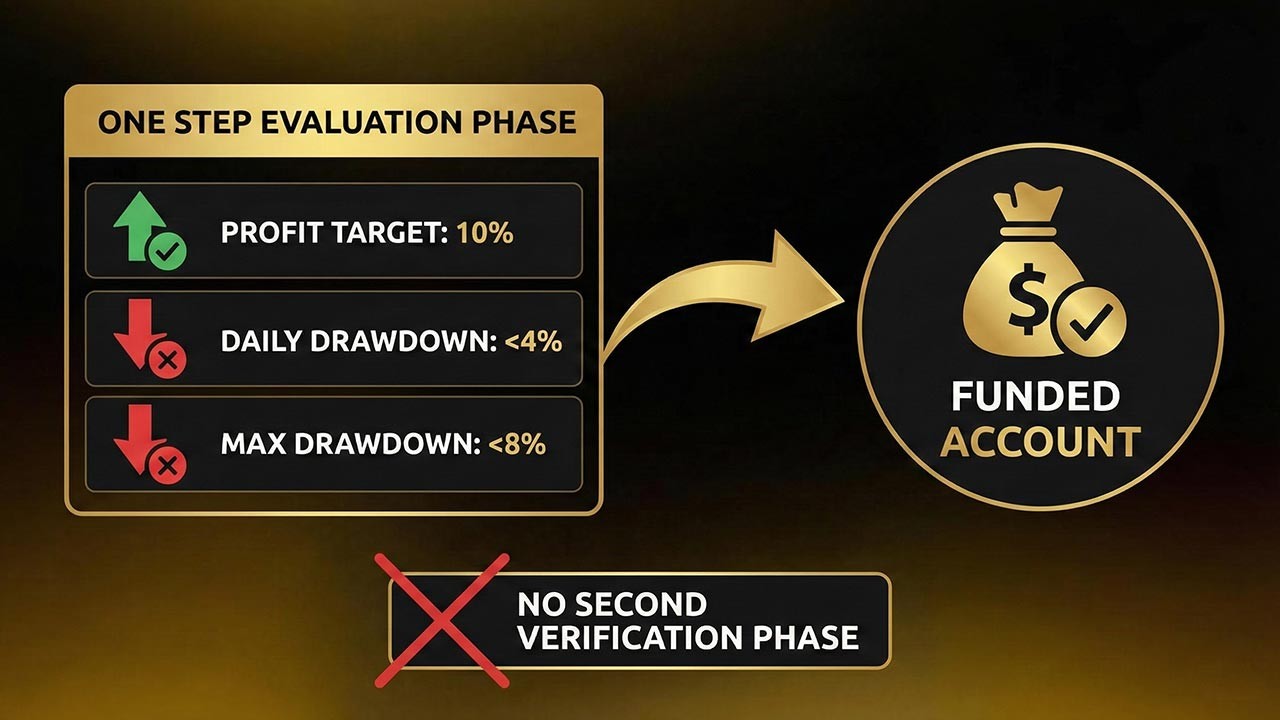

What Is a One Step Evaluation in Prop Firms?

A one step evaluation is a prop firm challenge that contains only one trading phase. Unlike traditional evaluations, there is no second verification step.

Once traders hit the profit target while respecting drawdown rules, they receive a funded account immediately. This process is part of how funded trading accounts actually work from evaluation to payout.

A typical one step prop firm evaluation includes:

One profit target (usually 8–12%)

Daily drawdown limit (commonly 4–5%)

Maximum overall drawdown (6–8%)

Minimum trading days (varies by firm)

No strict time limit in most cases

This structure makes the one step evaluation prop firm model attractive, but also unforgiving. This process is part of what prop trading is and how funding works, helping traders understand how evaluations transition into real capital allocation and long-term funded trading.

Difference Between 1 Step and 2 Step Funded Account

Understanding the difference between 1 step and 2 step funded account models helps traders choose the right challenge.

One Step Evaluation

Single evaluation phase

Faster access to funding

Higher psychological pressure

No recovery or verification stage

Two Step Funded Account

Phase one profit target

Phase two verification stage

Lower pressure per phase

Longer funding timeline

While two-step challenges allow mistakes to be corrected later, a one step evaluation rewards traders who already have strong discipline and consistency.

In 2026, many serious traders actively favor firms that operate without artificial consistency requirements, as these rules often restrict legitimate trading performance. This is why prop firms with no consistency rule are widely preferred by disciplined traders who want evaluation rules based on real risk management rather than forced profit distribution.

Why Most Traders Fail One Step Evaluation Challenges

Most traders do not fail because of poor strategy.

They fail because of behavior.

The most common reasons include:

Overtrading early in the challenge

Using excessive lot sizes

Ignoring floating drawdown rules

Attempting to pass too quickly

Revenge trading after small losses

A one step evaluation compresses risk into a short window. Every trade carries weight.

Step 1: Learn the Rules Like a Risk Manager

Passing a one step evaluation starts with rule mastery.

Before placing a trade, you must fully understand how the firm measures risk, not how you personally track it. Many traders assume drawdown rules work the same across all prop firms, which leads to accidental violations even on profitable accounts.

Before trading, you should clearly know:

How daily drawdown is calculated and whether it is based on balance, equity, or the highest intraday value

Whether floating losses are included in drawdown calculations

When the trading day officially resets according to the firm’s server time

How maximum drawdown is enforced and whether it is static or trailing

Misunderstanding even one of these rules can instantly fail a one step evaluation, regardless of overall profitability. This is why experienced traders treat the rulebook like a risk manager would — because most failed accounts violate rules, not profitability.

Traders looking to go deeper into execution discipline can also review how to pass a funded account challenge, which expands on rule adherence, mindset, and evaluation best practices.

Step 2: Choose Proper Risk Per Trade

Risk management is the foundation of every successful one step evaluation.

In a one step evaluation, profit targets are secondary to drawdown control. Prop firms are not looking for traders who can make money quickly — they are looking for traders who can protect capital under pressure.

Professional traders typically risk:

0.25% to 0.5% per trade

This level of risk may feel small, but it aligns perfectly with how prop firm drawdowns are structured. When maximum drawdown sits around 6%, risking more than 1% per trade leaves almost no room for normal losing streaks.

Why so low?

Because even a solid strategy can experience 4–6 consecutive losses. With high risk per trade, those losses can immediately breach drawdown limits. With controlled risk, the account survives and the edge has time to play out. This approach mirrors the same risk management in forex proprietary trading principles used by consistently funded traders to survive drawdowns, control losses, and protect capital over the long term.

Lower risk provides:

More emotional stability during losing trades

Protection from normal drawdown cycles

Flexibility to continue trading after setbacks

Long-term survival within strict evaluation rules

In a one step evaluation, staying in the game is more important than making fast profits. Traders who respect this principle dramatically increase their chances of passing on the first attempt.

Step 3: Stop Trying to Pass Fast

Speed is the silent killer of one step evaluations.

Most traders fail not because their strategy is unprofitable, but because they rush the process. The pressure to pass quickly often leads to oversized positions, emotional entries, and unnecessary exposure to drawdown limits.

Trying to pass in two or three days almost always results in broken rules. A single losing streak during aggressive trading can erase days of gains and immediately violate daily or maximum drawdown.

Instead, successful traders approach the one step evaluation as a slow accumulation process rather than a sprint.

Aim for:

0.5% to 1% growth per trading day

This pace allows trades to be taken only when conditions are clear, without forcing setups or increasing lot sizes out of impatience.

At this controlled rate, a 10% profit target is reached safely within two to three weeks — well inside most prop firm rules, while maintaining emotional stability and full drawdown protection.

In a one step evaluation, patience is not a weakness. It is the strategy that keeps you funded.

For traders who want a broader framework that applies across different firms and challenge types, this mindset is also covered in how to pass a prop firm challenge, which breaks down execution discipline, risk limits, and evaluation psychology in more detail.

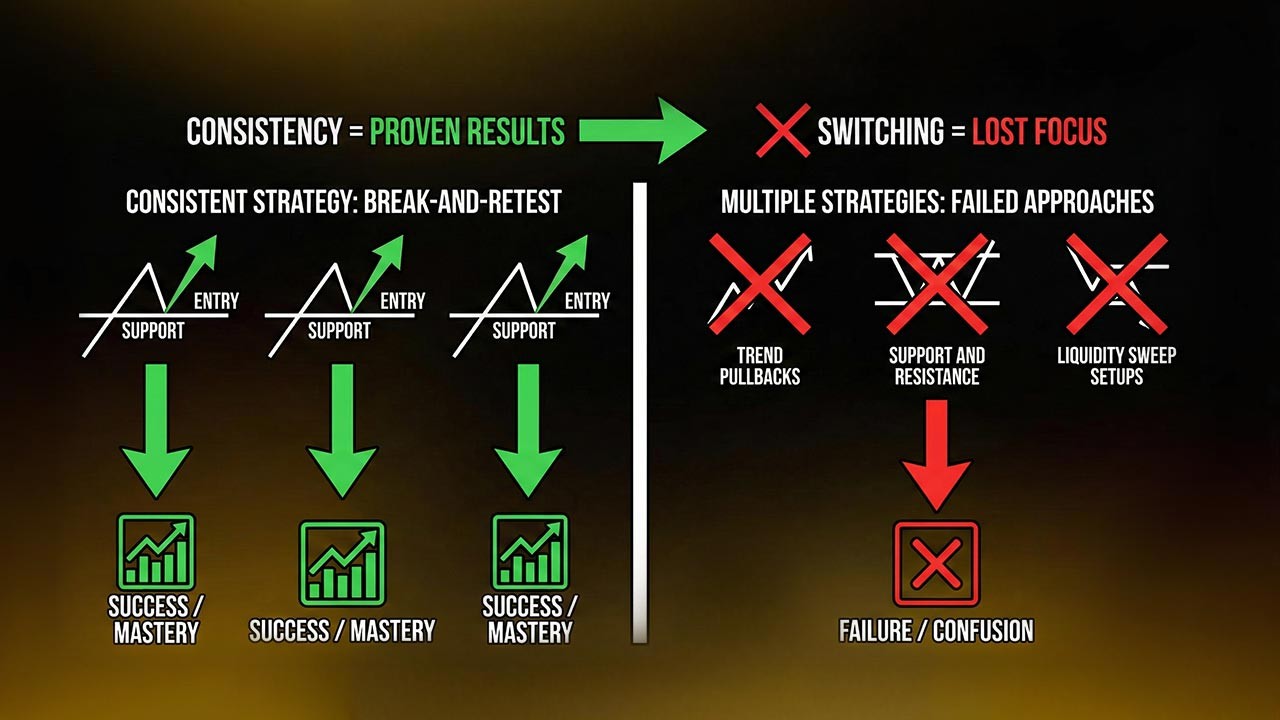

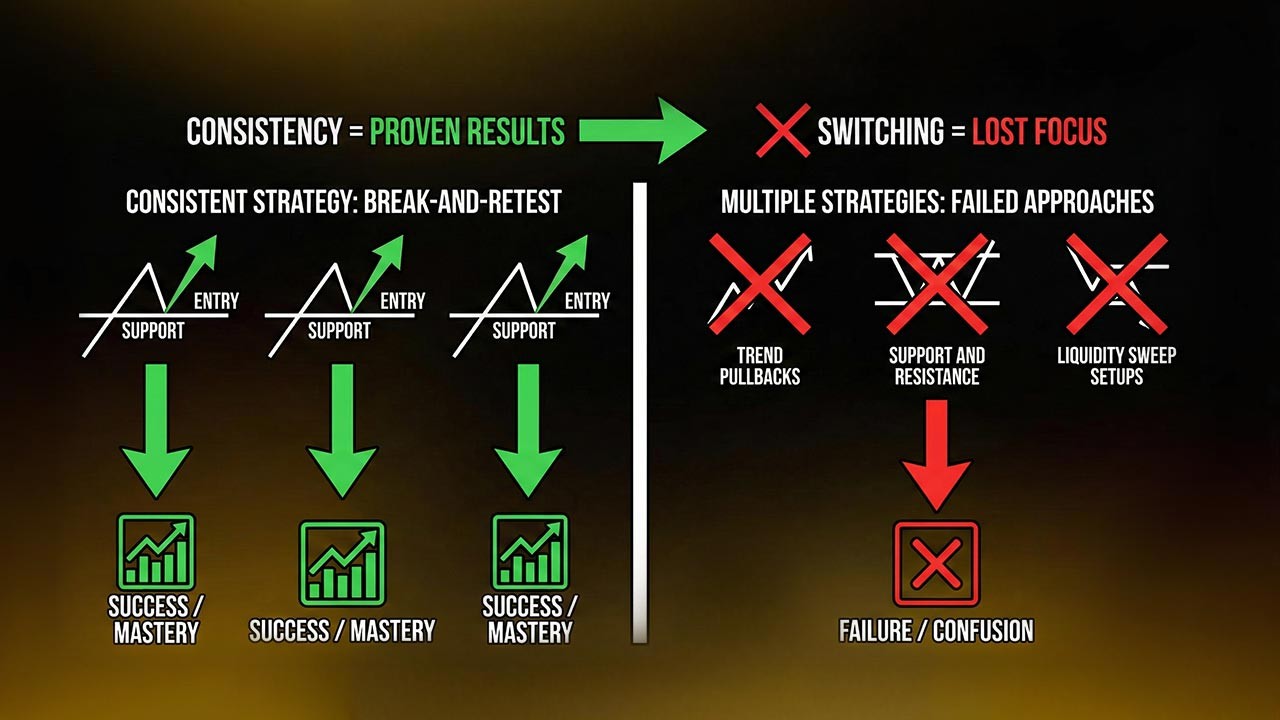

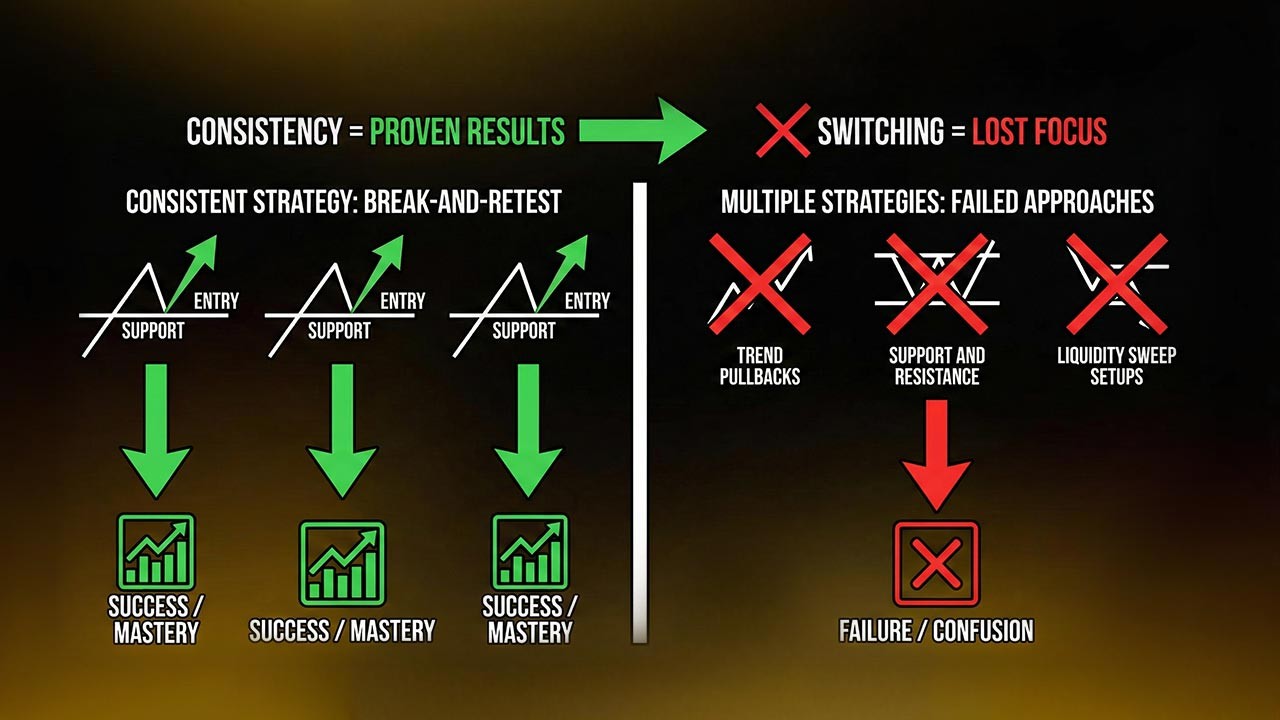

Step 4: Trade Only One Strategy

A one step evaluation prop firm rewards consistency, not creativity.

During an evaluation, prop firms are not assessing how many strategies you know. They are assessing whether you can execute the same process repeatedly under pressure. Constantly changing strategies introduces hesitation, late entries, missed exits, and emotional decision-making.

Choose one proven trading approach and commit fully:

Break-and-retest

Trend pullbacks

Support and resistance

Liquidity sweep setups

Whichever method you choose, it should already be backtested, forward-tested, and familiar to you. The evaluation phase is not the time to experiment or adapt new systems based on recent losses.

Switching systems mid-challenge often happens after a losing trade, not because the strategy failed, but because confidence dropped. This emotional response leads to inconsistent execution, mismatched risk parameters, and conflicting trade logic, all of which increase drawdown exposure.

In a one step evaluation, repetition builds confidence. Confidence improves execution. And consistent execution is exactly what prop firms want to see before allocating real capital.

Step 5: Avoid High-Impact News

Even when allowed, trading major economic news is one of the fastest ways to fail a one step evaluation.

High-impact releases cause:

Slippage

Spread expansion

Execution delays

Instant drawdown breaches

Avoid trading during:

CPI

FOMC

NFP

Interest rate decisions

Capital protection always outweighs opportunity.

Step 6: Trade Highly Liquid Instruments Only

The safest instruments during a one step evaluation include:

EUR/USD

GBP/USD

USD/JPY

XAU/USD (with reduced lot size)

These markets are preferred because they offer the deepest liquidity, most stable price behavior, and the most predictable execution conditions across global trading sessions.

High liquidity means tighter spreads, faster order filling, and far less exposure to slippage, especially during active sessions such as London and New York. This is critical in a one step evaluation, where even small execution issues can push an account closer to daily or maximum drawdown limits.

Major forex pairs tend to respect technical levels more cleanly, making stop placement more reliable and reducing the chance of random price spikes. Gold can also be traded safely when position size is reduced, as its volatility allows profit potential without requiring large lot exposure.

By focusing only on highly liquid instruments, traders minimize unnecessary risk and allow their strategy to perform under stable market conditions, which significantly improves survival and consistency throughout the one step evaluation.

Step 7: Focus on Capital Preservation

Passing a one step evaluation is not about maximizing profits.

It is about avoiding losses.

Professional traders focus on:

Preserving drawdown buffer

Trading only high-probability setups

Protecting equity first

When downside is controlled, upside becomes inevitable - and understanding how much money you can realistically make with a funded account helps frame that growth with realistic expectations around risk, payouts, and long-term sustainability.

Step 8: Follow a Structured Daily Routine

Consistency comes from routine.

A simple daily process may include:

Check the economic calendar

Mark key price levels

Define daily bias

Set maximum daily risk

Stop after two losses

Journal every trade

Routine removes emotion, and prop firms fund discipline. Traders who want a clearer framework for entries, exits, risk limits, and journaling can also review our best trading plan, which outlines a structured approach aligned with prop firm evaluation rules.

Step 9: Stop Trading After Reaching Daily Target

Many traders fail a one step evaluation after already being profitable.

This usually happens after a strong winning trade or a good trading session. Instead of protecting gains, traders feel pressure to accelerate progress and push for more profits on the same day. That shift in mindset often leads to lower-quality setups, larger position sizes, and emotional decision-making.

Once your daily goal is reached:

Stop trading

Protect gains

Reset emotionally

Continuing to trade after hitting a daily target exposes the account to unnecessary risk. Even a small loss can trigger emotional responses such as revenge trading or overconfidence, both of which dramatically increase drawdown exposure.

Prop firms do not reward how much you trade, they reward how well you protect capital. Locking in daily gains allows consistency to compound naturally across trading days.

Overtrading is responsible for more failed challenges than losing strategies because it turns profitable days into rule violations. Knowing when to stop is often the final skill traders must master to pass a one step evaluation.

Step 10: Treat the Evaluation Like a Funded Account

Traders who pass their one step evaluation on the first attempt behave like professionals from day one.

They do not:

Gamble

Increase lot size emotionally

Chase losses

Break rules

They trade as capital managers, not gamblers. This mindset reflects how consistently profitable traders focus on structured execution, controlled risk, and sustainability, which is exactly how professionals approach generating consistent income with funded forex accounts once they receive live capital.

Common One Step Evaluation Mistakes to Avoid

Risking over 1% per trade

Trading during news events

Ignoring floating drawdown

Changing strategies mid-challenge

Overtrading to meet minimum days

Avoiding these mistakes dramatically increases pass probability.

Final Thoughts

Passing a one step evaluation on the first attempt in 2026 is not about strategy complexity.

It is about discipline, patience, and rule mastery.

When traders focus on capital preservation, follow a structured plan, and respect drawdown limits, the profit target becomes a matter of time, not luck.

This is also why traders gravitate toward prop firms like Pipstone Capital, which emphasize realistic trading conditions, clear drawdown rules, flexible trading styles, and a high profit-split structure designed for long-term consistency rather than short-term gambling.

In the modern prop trading landscape, consistency beats aggression every single time.

Frequently Asked Questions (FAQs): One Step Prop Firm

What is a prop firm challenge?

A prop firm challenge is an evaluation process where traders must demonstrate profitability and risk control before receiving access to funded trading capital.

Is a one step evaluation harder than a two-step challenge?

A one step evaluation is faster but less forgiving. The difference between 1 step and 2 step funded account models lies mainly in pressure and recovery opportunity.

How long does it take to pass a one step prop firm evaluation?

Most traders who pass successfully do so within 10–20 trading days using conservative risk management.

Can beginners pass a one step evaluation?

Yes, but only if they understand risk management deeply and avoid aggressive trading behavior.

Why do prop firms offer one step evaluation models?

One step evaluation prop firm structures allow firms to identify disciplined traders faster while offering quicker funding opportunities.

How to Pass Prop Firm One Step Evaluation on the First Attempt in 2026

Jan 28, 2026

Passing a one step evaluation may sound straightforward. One challenge. One profit target. One chance to get funded.

Yet in 2026, thousands of traders still fail their first attempt, not because they lack trading skills, but because they misunderstand what a prop firm is actually testing.

A one step evaluation prop firm model removes the second verification phase and offers faster access to capital. However, this simplicity comes with stricter discipline requirements. There is no recovery phase, no second opportunity, and no margin for emotional mistakes.

This complete guide explains exactly how to pass a one step evaluation on your first attempt, using realistic strategies based on how prop firms actually structure their challenges today.

What Is a Prop Firm Challenge?

Before focusing on the one step model, it’s important to understand what is a prop firm challenge.

A prop firm challenge is an evaluation process where traders prove their ability to manage risk and generate profits under strict rules. Many traders begin by learning what a funded forex trading account actually is before attempting an evaluation. Moreover, traders do not risk their own capital. Instead, they trade a simulated account and earn funding after meeting performance requirements.

Most prop firm challenges test three core skills:

Risk management discipline

Emotional consistency

Ability to follow predefined rules

The one step evaluation is simply a modern variation of this model.

What Is a One Step Evaluation in Prop Firms?

A one step evaluation is a prop firm challenge that contains only one trading phase. Unlike traditional evaluations, there is no second verification step.

Once traders hit the profit target while respecting drawdown rules, they receive a funded account immediately. This process is part of how funded trading accounts actually work from evaluation to payout.

A typical one step prop firm evaluation includes:

One profit target (usually 8–12%)

Daily drawdown limit (commonly 4–5%)

Maximum overall drawdown (6–8%)

Minimum trading days (varies by firm)

No strict time limit in most cases

This structure makes the one step evaluation prop firm model attractive, but also unforgiving. This process is part of what prop trading is and how funding works, helping traders understand how evaluations transition into real capital allocation and long-term funded trading.

Difference Between 1 Step and 2 Step Funded Account

Understanding the difference between 1 step and 2 step funded account models helps traders choose the right challenge.

One Step Evaluation

Single evaluation phase

Faster access to funding

Higher psychological pressure

No recovery or verification stage

Two Step Funded Account

Phase one profit target

Phase two verification stage

Lower pressure per phase

Longer funding timeline

While two-step challenges allow mistakes to be corrected later, a one step evaluation rewards traders who already have strong discipline and consistency.

In 2026, many serious traders actively favor firms that operate without artificial consistency requirements, as these rules often restrict legitimate trading performance. This is why prop firms with no consistency rule are widely preferred by disciplined traders who want evaluation rules based on real risk management rather than forced profit distribution.

Why Most Traders Fail One Step Evaluation Challenges

Most traders do not fail because of poor strategy.

They fail because of behavior.

The most common reasons include:

Overtrading early in the challenge

Using excessive lot sizes

Ignoring floating drawdown rules

Attempting to pass too quickly

Revenge trading after small losses

A one step evaluation compresses risk into a short window. Every trade carries weight.

Step 1: Learn the Rules Like a Risk Manager

Passing a one step evaluation starts with rule mastery.

Before placing a trade, you must fully understand how the firm measures risk, not how you personally track it. Many traders assume drawdown rules work the same across all prop firms, which leads to accidental violations even on profitable accounts.

Before trading, you should clearly know:

How daily drawdown is calculated and whether it is based on balance, equity, or the highest intraday value

Whether floating losses are included in drawdown calculations

When the trading day officially resets according to the firm’s server time

How maximum drawdown is enforced and whether it is static or trailing

Misunderstanding even one of these rules can instantly fail a one step evaluation, regardless of overall profitability. This is why experienced traders treat the rulebook like a risk manager would — because most failed accounts violate rules, not profitability.

Traders looking to go deeper into execution discipline can also review how to pass a funded account challenge, which expands on rule adherence, mindset, and evaluation best practices.

Step 2: Choose Proper Risk Per Trade

Risk management is the foundation of every successful one step evaluation.

In a one step evaluation, profit targets are secondary to drawdown control. Prop firms are not looking for traders who can make money quickly — they are looking for traders who can protect capital under pressure.

Professional traders typically risk:

0.25% to 0.5% per trade

This level of risk may feel small, but it aligns perfectly with how prop firm drawdowns are structured. When maximum drawdown sits around 6%, risking more than 1% per trade leaves almost no room for normal losing streaks.

Why so low?

Because even a solid strategy can experience 4–6 consecutive losses. With high risk per trade, those losses can immediately breach drawdown limits. With controlled risk, the account survives and the edge has time to play out. This approach mirrors the same risk management in forex proprietary trading principles used by consistently funded traders to survive drawdowns, control losses, and protect capital over the long term.

Lower risk provides:

More emotional stability during losing trades

Protection from normal drawdown cycles

Flexibility to continue trading after setbacks

Long-term survival within strict evaluation rules

In a one step evaluation, staying in the game is more important than making fast profits. Traders who respect this principle dramatically increase their chances of passing on the first attempt.

Step 3: Stop Trying to Pass Fast

Speed is the silent killer of one step evaluations.

Most traders fail not because their strategy is unprofitable, but because they rush the process. The pressure to pass quickly often leads to oversized positions, emotional entries, and unnecessary exposure to drawdown limits.

Trying to pass in two or three days almost always results in broken rules. A single losing streak during aggressive trading can erase days of gains and immediately violate daily or maximum drawdown.

Instead, successful traders approach the one step evaluation as a slow accumulation process rather than a sprint.

Aim for:

0.5% to 1% growth per trading day

This pace allows trades to be taken only when conditions are clear, without forcing setups or increasing lot sizes out of impatience.

At this controlled rate, a 10% profit target is reached safely within two to three weeks — well inside most prop firm rules, while maintaining emotional stability and full drawdown protection.

In a one step evaluation, patience is not a weakness. It is the strategy that keeps you funded.

For traders who want a broader framework that applies across different firms and challenge types, this mindset is also covered in how to pass a prop firm challenge, which breaks down execution discipline, risk limits, and evaluation psychology in more detail.

Step 4: Trade Only One Strategy

A one step evaluation prop firm rewards consistency, not creativity.

During an evaluation, prop firms are not assessing how many strategies you know. They are assessing whether you can execute the same process repeatedly under pressure. Constantly changing strategies introduces hesitation, late entries, missed exits, and emotional decision-making.

Choose one proven trading approach and commit fully:

Break-and-retest

Trend pullbacks

Support and resistance

Liquidity sweep setups

Whichever method you choose, it should already be backtested, forward-tested, and familiar to you. The evaluation phase is not the time to experiment or adapt new systems based on recent losses.

Switching systems mid-challenge often happens after a losing trade, not because the strategy failed, but because confidence dropped. This emotional response leads to inconsistent execution, mismatched risk parameters, and conflicting trade logic, all of which increase drawdown exposure.

In a one step evaluation, repetition builds confidence. Confidence improves execution. And consistent execution is exactly what prop firms want to see before allocating real capital.

Step 5: Avoid High-Impact News

Even when allowed, trading major economic news is one of the fastest ways to fail a one step evaluation.

High-impact releases cause:

Slippage

Spread expansion

Execution delays

Instant drawdown breaches

Avoid trading during:

CPI

FOMC

NFP

Interest rate decisions

Capital protection always outweighs opportunity.

Step 6: Trade Highly Liquid Instruments Only

The safest instruments during a one step evaluation include:

EUR/USD

GBP/USD

USD/JPY

XAU/USD (with reduced lot size)

These markets are preferred because they offer the deepest liquidity, most stable price behavior, and the most predictable execution conditions across global trading sessions.

High liquidity means tighter spreads, faster order filling, and far less exposure to slippage, especially during active sessions such as London and New York. This is critical in a one step evaluation, where even small execution issues can push an account closer to daily or maximum drawdown limits.

Major forex pairs tend to respect technical levels more cleanly, making stop placement more reliable and reducing the chance of random price spikes. Gold can also be traded safely when position size is reduced, as its volatility allows profit potential without requiring large lot exposure.

By focusing only on highly liquid instruments, traders minimize unnecessary risk and allow their strategy to perform under stable market conditions, which significantly improves survival and consistency throughout the one step evaluation.

Step 7: Focus on Capital Preservation

Passing a one step evaluation is not about maximizing profits.

It is about avoiding losses.

Professional traders focus on:

Preserving drawdown buffer

Trading only high-probability setups

Protecting equity first

When downside is controlled, upside becomes inevitable - and understanding how much money you can realistically make with a funded account helps frame that growth with realistic expectations around risk, payouts, and long-term sustainability.

Step 8: Follow a Structured Daily Routine

Consistency comes from routine.

A simple daily process may include:

Check the economic calendar

Mark key price levels

Define daily bias

Set maximum daily risk

Stop after two losses

Journal every trade

Routine removes emotion, and prop firms fund discipline. Traders who want a clearer framework for entries, exits, risk limits, and journaling can also review our best trading plan, which outlines a structured approach aligned with prop firm evaluation rules.

Step 9: Stop Trading After Reaching Daily Target

Many traders fail a one step evaluation after already being profitable.

This usually happens after a strong winning trade or a good trading session. Instead of protecting gains, traders feel pressure to accelerate progress and push for more profits on the same day. That shift in mindset often leads to lower-quality setups, larger position sizes, and emotional decision-making.

Once your daily goal is reached:

Stop trading

Protect gains

Reset emotionally

Continuing to trade after hitting a daily target exposes the account to unnecessary risk. Even a small loss can trigger emotional responses such as revenge trading or overconfidence, both of which dramatically increase drawdown exposure.

Prop firms do not reward how much you trade, they reward how well you protect capital. Locking in daily gains allows consistency to compound naturally across trading days.

Overtrading is responsible for more failed challenges than losing strategies because it turns profitable days into rule violations. Knowing when to stop is often the final skill traders must master to pass a one step evaluation.

Step 10: Treat the Evaluation Like a Funded Account

Traders who pass their one step evaluation on the first attempt behave like professionals from day one.

They do not:

Gamble

Increase lot size emotionally

Chase losses

Break rules

They trade as capital managers, not gamblers. This mindset reflects how consistently profitable traders focus on structured execution, controlled risk, and sustainability, which is exactly how professionals approach generating consistent income with funded forex accounts once they receive live capital.

Common One Step Evaluation Mistakes to Avoid

Risking over 1% per trade

Trading during news events

Ignoring floating drawdown

Changing strategies mid-challenge

Overtrading to meet minimum days

Avoiding these mistakes dramatically increases pass probability.

Final Thoughts

Passing a one step evaluation on the first attempt in 2026 is not about strategy complexity.

It is about discipline, patience, and rule mastery.

When traders focus on capital preservation, follow a structured plan, and respect drawdown limits, the profit target becomes a matter of time, not luck.

This is also why traders gravitate toward prop firms like Pipstone Capital, which emphasize realistic trading conditions, clear drawdown rules, flexible trading styles, and a high profit-split structure designed for long-term consistency rather than short-term gambling.

In the modern prop trading landscape, consistency beats aggression every single time.

Frequently Asked Questions (FAQs): One Step Prop Firm

What is a prop firm challenge?

A prop firm challenge is an evaluation process where traders must demonstrate profitability and risk control before receiving access to funded trading capital.

Is a one step evaluation harder than a two-step challenge?

A one step evaluation is faster but less forgiving. The difference between 1 step and 2 step funded account models lies mainly in pressure and recovery opportunity.

How long does it take to pass a one step prop firm evaluation?

Most traders who pass successfully do so within 10–20 trading days using conservative risk management.

Can beginners pass a one step evaluation?

Yes, but only if they understand risk management deeply and avoid aggressive trading behavior.

Why do prop firms offer one step evaluation models?

One step evaluation prop firm structures allow firms to identify disciplined traders faster while offering quicker funding opportunities.

How to Pass Prop Firm One Step Evaluation on the First Attempt in 2026

Jan 28, 2026

Passing a one step evaluation may sound straightforward. One challenge. One profit target. One chance to get funded.

Yet in 2026, thousands of traders still fail their first attempt, not because they lack trading skills, but because they misunderstand what a prop firm is actually testing.

A one step evaluation prop firm model removes the second verification phase and offers faster access to capital. However, this simplicity comes with stricter discipline requirements. There is no recovery phase, no second opportunity, and no margin for emotional mistakes.

This complete guide explains exactly how to pass a one step evaluation on your first attempt, using realistic strategies based on how prop firms actually structure their challenges today.

What Is a Prop Firm Challenge?

Before focusing on the one step model, it’s important to understand what is a prop firm challenge.

A prop firm challenge is an evaluation process where traders prove their ability to manage risk and generate profits under strict rules. Many traders begin by learning what a funded forex trading account actually is before attempting an evaluation. Moreover, traders do not risk their own capital. Instead, they trade a simulated account and earn funding after meeting performance requirements.

Most prop firm challenges test three core skills:

Risk management discipline

Emotional consistency

Ability to follow predefined rules

The one step evaluation is simply a modern variation of this model.

What Is a One Step Evaluation in Prop Firms?

A one step evaluation is a prop firm challenge that contains only one trading phase. Unlike traditional evaluations, there is no second verification step.

Once traders hit the profit target while respecting drawdown rules, they receive a funded account immediately. This process is part of how funded trading accounts actually work from evaluation to payout.

A typical one step prop firm evaluation includes:

One profit target (usually 8–12%)

Daily drawdown limit (commonly 4–5%)

Maximum overall drawdown (6–8%)

Minimum trading days (varies by firm)

No strict time limit in most cases

This structure makes the one step evaluation prop firm model attractive, but also unforgiving. This process is part of what prop trading is and how funding works, helping traders understand how evaluations transition into real capital allocation and long-term funded trading.

Difference Between 1 Step and 2 Step Funded Account

Understanding the difference between 1 step and 2 step funded account models helps traders choose the right challenge.

One Step Evaluation

Single evaluation phase

Faster access to funding

Higher psychological pressure

No recovery or verification stage

Two Step Funded Account

Phase one profit target

Phase two verification stage

Lower pressure per phase

Longer funding timeline

While two-step challenges allow mistakes to be corrected later, a one step evaluation rewards traders who already have strong discipline and consistency.

In 2026, many serious traders actively favor firms that operate without artificial consistency requirements, as these rules often restrict legitimate trading performance. This is why prop firms with no consistency rule are widely preferred by disciplined traders who want evaluation rules based on real risk management rather than forced profit distribution.

Why Most Traders Fail One Step Evaluation Challenges

Most traders do not fail because of poor strategy.

They fail because of behavior.

The most common reasons include:

Overtrading early in the challenge

Using excessive lot sizes

Ignoring floating drawdown rules

Attempting to pass too quickly

Revenge trading after small losses

A one step evaluation compresses risk into a short window. Every trade carries weight.

Step 1: Learn the Rules Like a Risk Manager

Passing a one step evaluation starts with rule mastery.

Before placing a trade, you must fully understand how the firm measures risk, not how you personally track it. Many traders assume drawdown rules work the same across all prop firms, which leads to accidental violations even on profitable accounts.

Before trading, you should clearly know:

How daily drawdown is calculated and whether it is based on balance, equity, or the highest intraday value

Whether floating losses are included in drawdown calculations

When the trading day officially resets according to the firm’s server time

How maximum drawdown is enforced and whether it is static or trailing

Misunderstanding even one of these rules can instantly fail a one step evaluation, regardless of overall profitability. This is why experienced traders treat the rulebook like a risk manager would — because most failed accounts violate rules, not profitability.

Traders looking to go deeper into execution discipline can also review how to pass a funded account challenge, which expands on rule adherence, mindset, and evaluation best practices.

Step 2: Choose Proper Risk Per Trade

Risk management is the foundation of every successful one step evaluation.

In a one step evaluation, profit targets are secondary to drawdown control. Prop firms are not looking for traders who can make money quickly — they are looking for traders who can protect capital under pressure.

Professional traders typically risk:

0.25% to 0.5% per trade

This level of risk may feel small, but it aligns perfectly with how prop firm drawdowns are structured. When maximum drawdown sits around 6%, risking more than 1% per trade leaves almost no room for normal losing streaks.

Why so low?

Because even a solid strategy can experience 4–6 consecutive losses. With high risk per trade, those losses can immediately breach drawdown limits. With controlled risk, the account survives and the edge has time to play out. This approach mirrors the same risk management in forex proprietary trading principles used by consistently funded traders to survive drawdowns, control losses, and protect capital over the long term.

Lower risk provides:

More emotional stability during losing trades

Protection from normal drawdown cycles

Flexibility to continue trading after setbacks

Long-term survival within strict evaluation rules

In a one step evaluation, staying in the game is more important than making fast profits. Traders who respect this principle dramatically increase their chances of passing on the first attempt.

Step 3: Stop Trying to Pass Fast

Speed is the silent killer of one step evaluations.

Most traders fail not because their strategy is unprofitable, but because they rush the process. The pressure to pass quickly often leads to oversized positions, emotional entries, and unnecessary exposure to drawdown limits.

Trying to pass in two or three days almost always results in broken rules. A single losing streak during aggressive trading can erase days of gains and immediately violate daily or maximum drawdown.

Instead, successful traders approach the one step evaluation as a slow accumulation process rather than a sprint.

Aim for:

0.5% to 1% growth per trading day

This pace allows trades to be taken only when conditions are clear, without forcing setups or increasing lot sizes out of impatience.

At this controlled rate, a 10% profit target is reached safely within two to three weeks — well inside most prop firm rules, while maintaining emotional stability and full drawdown protection.

In a one step evaluation, patience is not a weakness. It is the strategy that keeps you funded.

For traders who want a broader framework that applies across different firms and challenge types, this mindset is also covered in how to pass a prop firm challenge, which breaks down execution discipline, risk limits, and evaluation psychology in more detail.

Step 4: Trade Only One Strategy

A one step evaluation prop firm rewards consistency, not creativity.

During an evaluation, prop firms are not assessing how many strategies you know. They are assessing whether you can execute the same process repeatedly under pressure. Constantly changing strategies introduces hesitation, late entries, missed exits, and emotional decision-making.

Choose one proven trading approach and commit fully:

Break-and-retest

Trend pullbacks

Support and resistance

Liquidity sweep setups

Whichever method you choose, it should already be backtested, forward-tested, and familiar to you. The evaluation phase is not the time to experiment or adapt new systems based on recent losses.

Switching systems mid-challenge often happens after a losing trade, not because the strategy failed, but because confidence dropped. This emotional response leads to inconsistent execution, mismatched risk parameters, and conflicting trade logic, all of which increase drawdown exposure.

In a one step evaluation, repetition builds confidence. Confidence improves execution. And consistent execution is exactly what prop firms want to see before allocating real capital.

Step 5: Avoid High-Impact News

Even when allowed, trading major economic news is one of the fastest ways to fail a one step evaluation.

High-impact releases cause:

Slippage

Spread expansion

Execution delays

Instant drawdown breaches

Avoid trading during:

CPI

FOMC

NFP

Interest rate decisions

Capital protection always outweighs opportunity.

Step 6: Trade Highly Liquid Instruments Only

The safest instruments during a one step evaluation include:

EUR/USD

GBP/USD

USD/JPY

XAU/USD (with reduced lot size)

These markets are preferred because they offer the deepest liquidity, most stable price behavior, and the most predictable execution conditions across global trading sessions.

High liquidity means tighter spreads, faster order filling, and far less exposure to slippage, especially during active sessions such as London and New York. This is critical in a one step evaluation, where even small execution issues can push an account closer to daily or maximum drawdown limits.

Major forex pairs tend to respect technical levels more cleanly, making stop placement more reliable and reducing the chance of random price spikes. Gold can also be traded safely when position size is reduced, as its volatility allows profit potential without requiring large lot exposure.

By focusing only on highly liquid instruments, traders minimize unnecessary risk and allow their strategy to perform under stable market conditions, which significantly improves survival and consistency throughout the one step evaluation.

Step 7: Focus on Capital Preservation

Passing a one step evaluation is not about maximizing profits.

It is about avoiding losses.

Professional traders focus on:

Preserving drawdown buffer

Trading only high-probability setups

Protecting equity first

When downside is controlled, upside becomes inevitable - and understanding how much money you can realistically make with a funded account helps frame that growth with realistic expectations around risk, payouts, and long-term sustainability.

Step 8: Follow a Structured Daily Routine

Consistency comes from routine.

A simple daily process may include:

Check the economic calendar

Mark key price levels

Define daily bias

Set maximum daily risk

Stop after two losses

Journal every trade

Routine removes emotion, and prop firms fund discipline. Traders who want a clearer framework for entries, exits, risk limits, and journaling can also review our best trading plan, which outlines a structured approach aligned with prop firm evaluation rules.

Step 9: Stop Trading After Reaching Daily Target

Many traders fail a one step evaluation after already being profitable.

This usually happens after a strong winning trade or a good trading session. Instead of protecting gains, traders feel pressure to accelerate progress and push for more profits on the same day. That shift in mindset often leads to lower-quality setups, larger position sizes, and emotional decision-making.

Once your daily goal is reached:

Stop trading

Protect gains

Reset emotionally

Continuing to trade after hitting a daily target exposes the account to unnecessary risk. Even a small loss can trigger emotional responses such as revenge trading or overconfidence, both of which dramatically increase drawdown exposure.

Prop firms do not reward how much you trade, they reward how well you protect capital. Locking in daily gains allows consistency to compound naturally across trading days.

Overtrading is responsible for more failed challenges than losing strategies because it turns profitable days into rule violations. Knowing when to stop is often the final skill traders must master to pass a one step evaluation.

Step 10: Treat the Evaluation Like a Funded Account

Traders who pass their one step evaluation on the first attempt behave like professionals from day one.

They do not:

Gamble

Increase lot size emotionally

Chase losses

Break rules

They trade as capital managers, not gamblers. This mindset reflects how consistently profitable traders focus on structured execution, controlled risk, and sustainability, which is exactly how professionals approach generating consistent income with funded forex accounts once they receive live capital.

Common One Step Evaluation Mistakes to Avoid

Risking over 1% per trade

Trading during news events

Ignoring floating drawdown

Changing strategies mid-challenge

Overtrading to meet minimum days

Avoiding these mistakes dramatically increases pass probability.

Final Thoughts

Passing a one step evaluation on the first attempt in 2026 is not about strategy complexity.

It is about discipline, patience, and rule mastery.

When traders focus on capital preservation, follow a structured plan, and respect drawdown limits, the profit target becomes a matter of time, not luck.

This is also why traders gravitate toward prop firms like Pipstone Capital, which emphasize realistic trading conditions, clear drawdown rules, flexible trading styles, and a high profit-split structure designed for long-term consistency rather than short-term gambling.

In the modern prop trading landscape, consistency beats aggression every single time.

Frequently Asked Questions (FAQs): One Step Prop Firm

What is a prop firm challenge?

A prop firm challenge is an evaluation process where traders must demonstrate profitability and risk control before receiving access to funded trading capital.

Is a one step evaluation harder than a two-step challenge?

A one step evaluation is faster but less forgiving. The difference between 1 step and 2 step funded account models lies mainly in pressure and recovery opportunity.

How long does it take to pass a one step prop firm evaluation?

Most traders who pass successfully do so within 10–20 trading days using conservative risk management.

Can beginners pass a one step evaluation?

Yes, but only if they understand risk management deeply and avoid aggressive trading behavior.

Why do prop firms offer one step evaluation models?

One step evaluation prop firm structures allow firms to identify disciplined traders faster while offering quicker funding opportunities.