How Much Money Can You Make With a Forex Funded Account in 2026?

Jan 23, 2026

Forex funded accounts have completely changed how traders approach the markets. Instead of risking personal savings or needing tens of thousands of dollars to trade full-time, traders can now access large trading capital through proprietary trading firms - often called prop firms.

But the big question remains:

How much money can you really make with a forex funded account in 2026?

The honest answer is not a fixed number. Earnings vary widely depending on your skill, discipline, account size, and consistency. Some traders make a few hundred dollars per month, while others generate five-figure payouts consistently. Many attempt funded trading, but only a small percentage turn it into long-term income.

Let’s break down what realistic earnings look like in 2026 - without hype, without false promises, and based on how funded trading actually works.

What Is a Forex Funded Account?

A forex funded account allows traders to trade with capital provided by a prop trading firm instead of their own money. If you are new to the model, this guide on what is proprietary trading and how it works explains why many traders are shifting toward funded accounts.

The process usually works like this:

You purchase an evaluation or challenge.

You trade under predefined rules such as maximum drawdown and daily loss limits.

If you pass the evaluation, the firm provides a funded trading account.

You earn a percentage of the profits you generate.

Most firms offer profit splits ranging from 70% to 90%, with some programs reaching higher percentages after consistent performance.

This structure removes the biggest barrier most traders face, lack of capital - while still rewarding discipline and risk management.

For a deeper breakdown, this article on what a funded account forex is explains the requirements in detail.

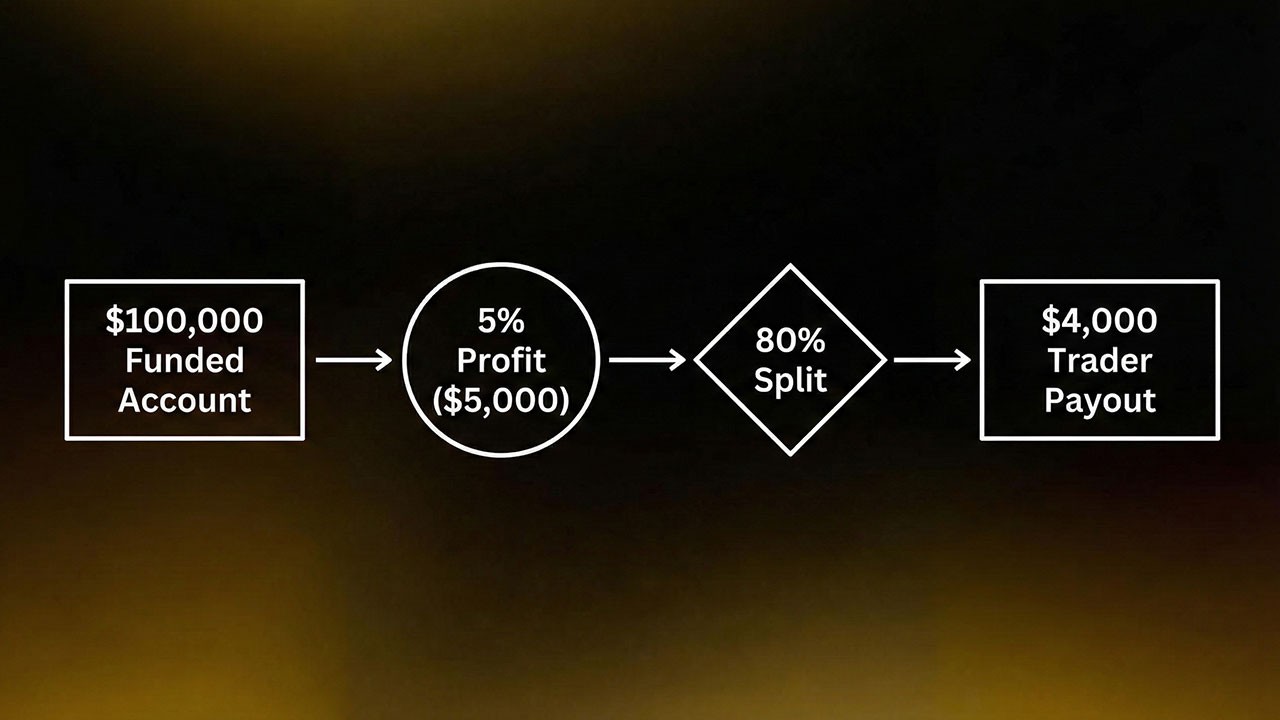

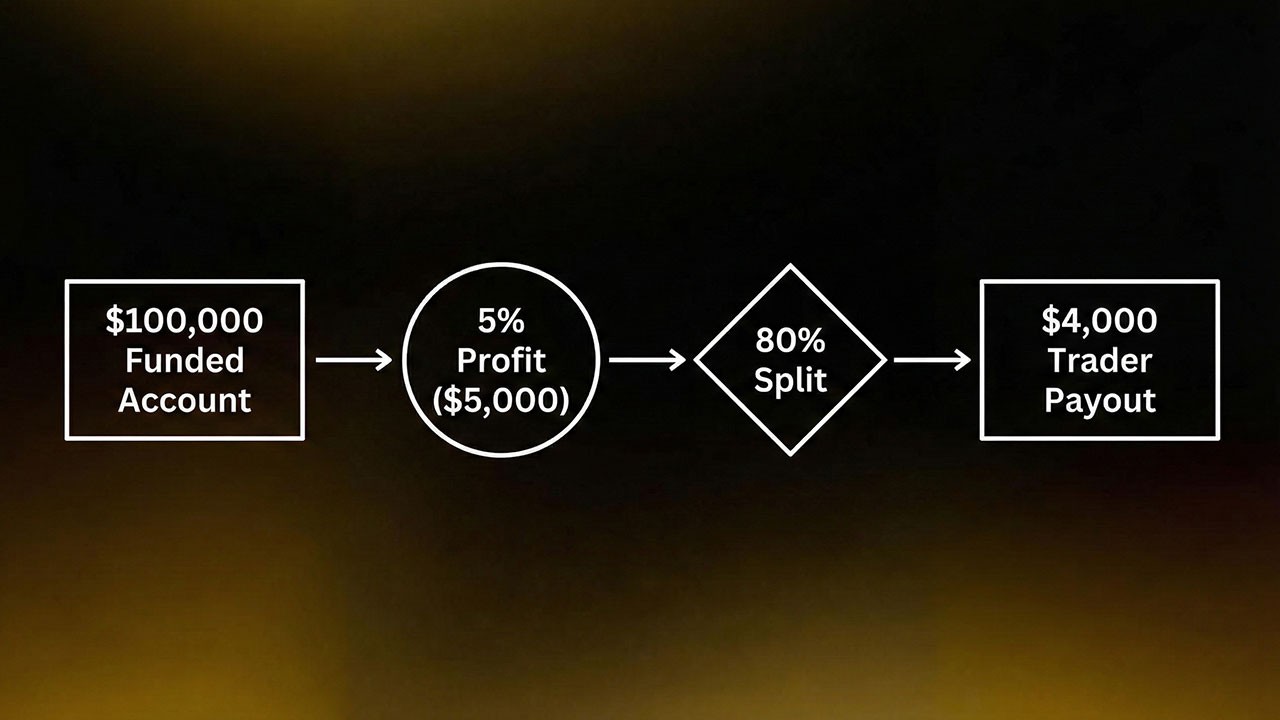

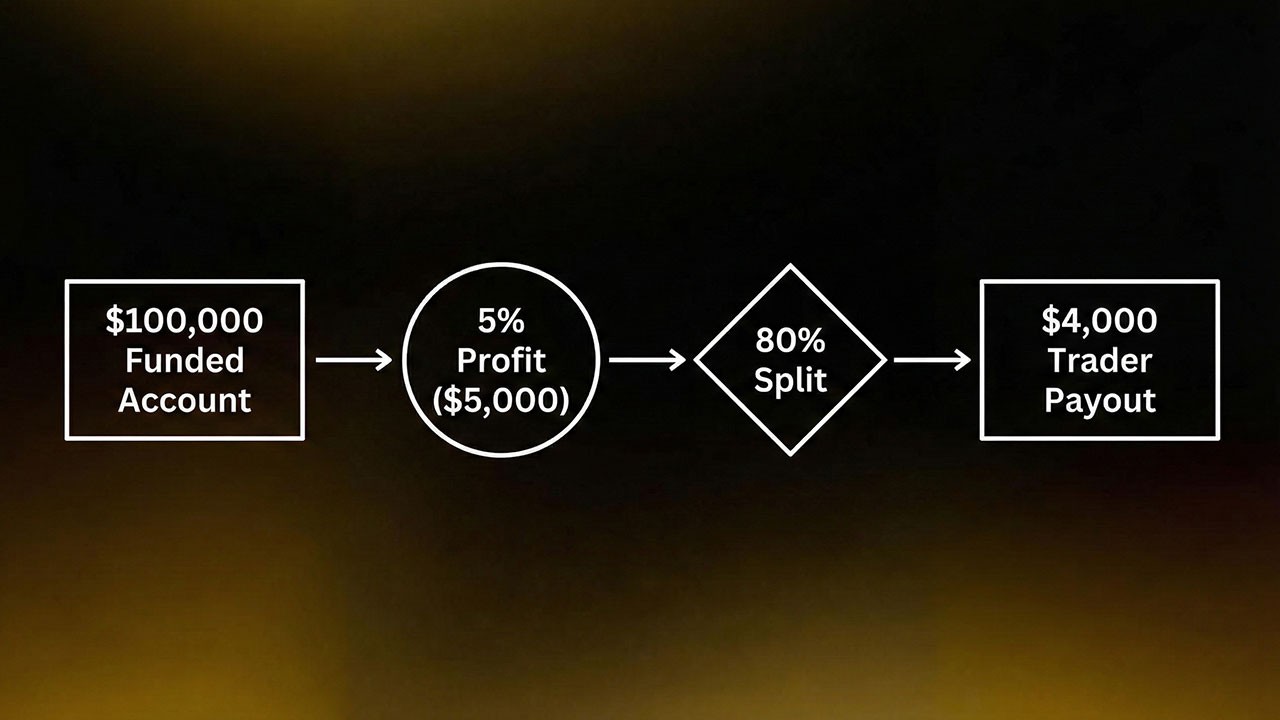

How Funded Traders Make Money

Funded traders earn income through profit sharing.

If you make money on the account, the firm takes its portion, and you keep the rest. The firm absorbs the trading losses as long as you follow the rules.

For example:

Account size: $100,000

Monthly profit: 5% ($5,000)

Profit split: 80%

Your payout would be:

$4,000 for that month

There is no salary, no guaranteed income, and no fixed return. Everything depends on trading performance. For a deeper breakdown, see this guide on how traders make money with funded accounts.

Typical Prop Trading Account Sizes in 2026

Most prop firms in 2026 offer funded accounts ranging from:

$5,000

$10,000

$25,000

$50,000

$100,000

$200,000+

Some traders also combine multiple accounts, allowing them to manage total capital well above $200,000 if permitted by firm rules.

The larger the account, the greater the income potential - but also the greater the responsibility for proper risk control.

Before choosing an account size, it helps to understand margin trading vs leverage trading, as these directly affect position sizing and risk.

Realistic Monthly Profit Expectations From Funded Accounts

One of the biggest misconceptions is expecting extremely high monthly returns.

Professional funded traders typically target:

2%–5% per month consistently

This may not sound impressive at first, but when applied to large capital, the numbers add up quickly.

Traders who struggle to stay within these limits often lack proper structure. This guide on risk management in prop trading forex explains why consistency matters more than high returns.

Example Earnings by Account Size

$25,000 funded account

3% profit = $750

80% split = $600 payout

$50,000 funded account

4% profit = $2,000

80% split = $1,600 payout

$100,000 funded account

5% profit = $5,000

80% split = $4,000 payout

$200,000 funded account

4% profit = $8,000

80% split = $6,400 payout

These numbers reflect realistic trading - not gambling, not over-leveraging, and not rule-breaking behavior.

Can You Make a Living From Funded Trading?

Yes - but only under certain conditions.

Industry data suggests:

Only 7%–15% of traders pass evaluation challenges.

Of those funded traders, roughly 20% receive payouts consistently.

A much smaller percentage turn it into stable full-time income.

This means funded trading is not easy money. It rewards discipline, patience, and long-term thinking - not emotional trading.

Passing the evaluation phase is one of the hardest parts. These tips for passing a funded account challenge outline what most successful traders focus on.

Annual Income Potential in 2026 as a Funded Trader

Based on current industry averages, funded trader earnings often fall into these ranges:

Beginner Funded Traders

$500 – $2,000 per month

$6,000 – $24,000 per year

Intermediate Consistent Traders

$3,000 – $7,000 per month

$36,000 – $84,000 per year

Advanced or Scaled Traders

$10,000 – $30,000+ per month

$120,000 – $300,000+ per year

These figures assume proper scaling, consistent profitability, and adherence to trading rules.

Many profitable traders follow structured routines similar to those outlined in a complete funded trading plan for consistency.

Why Scaling Matters More Than Strategy

One of the biggest income drivers in funded trading is account scaling. Scaling becomes far easier when traders apply proven forex trading strategies used by funded traders.

Many firms increase a trader’s capital after:

Multiple profitable payout cycles

Respecting drawdown limits

Maintaining consistent risk behavior

A trader making 3% per month on a $50,000 account earns far less than the same trader making 3% on a $300,000 account.

Skill remains the same - capital changes everything.

What Limits Your Income?

Several factors directly affect how much money you can make:

1. Drawdown Rules

Every firm enforces strict loss limits. Breaking them results in account termination, regardless of previous profits.

2. Consistency Requirements

Many firms monitor whether profits come from stable trading or single oversized trades.

3. Psychological Pressure

Trading larger capital increases emotional stress. Many traders fail not because of strategy, but mindset.

4. Market Conditions

Forex markets do not behave the same every month. Volatility shifts, ranges tighten, and trends change.

Income is rarely linear.

Understanding basic price behavior is essential. Traders who master forex technical analysis effectively tend to manage drawdown more consistently.

Payout Frequency in 2026

Most firms now offer:

Weekly payouts

Bi-weekly payouts

Monthly payouts

Shorter payout cycles often come with slightly lower profit splits, while longer cycles offer higher percentages.

Traders must balance consistency with payout structure to maximize long-term returns.

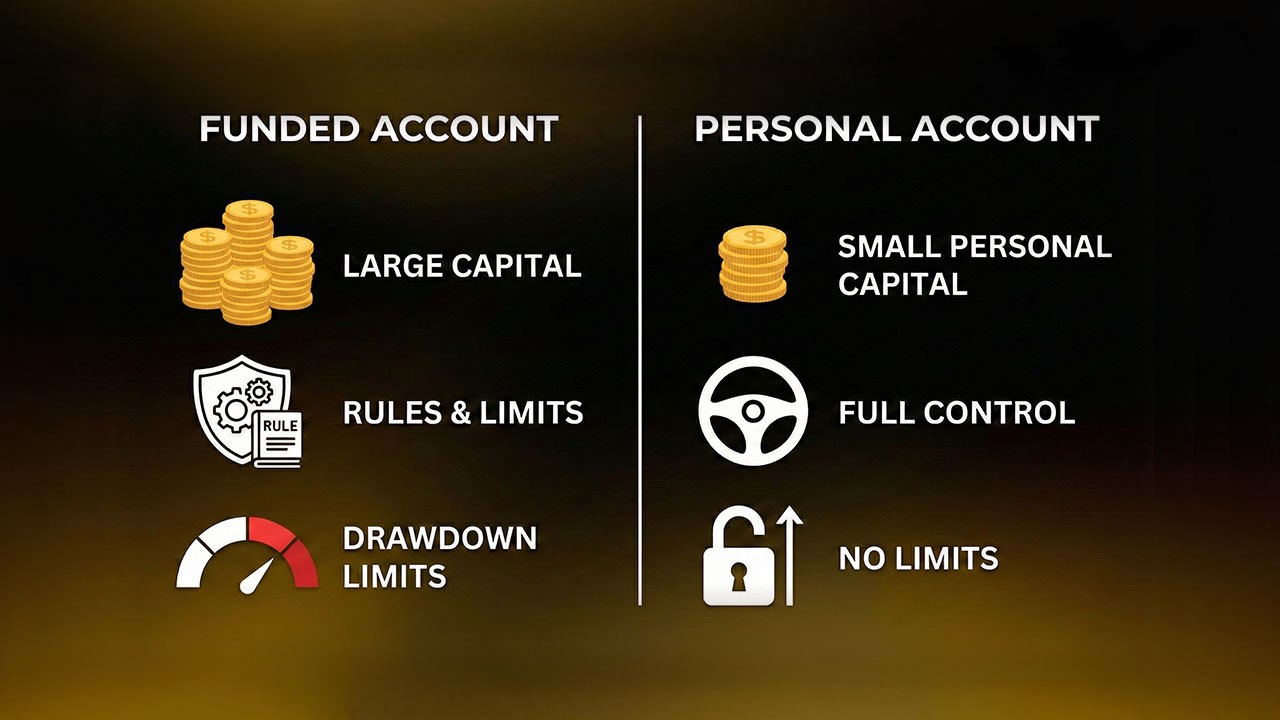

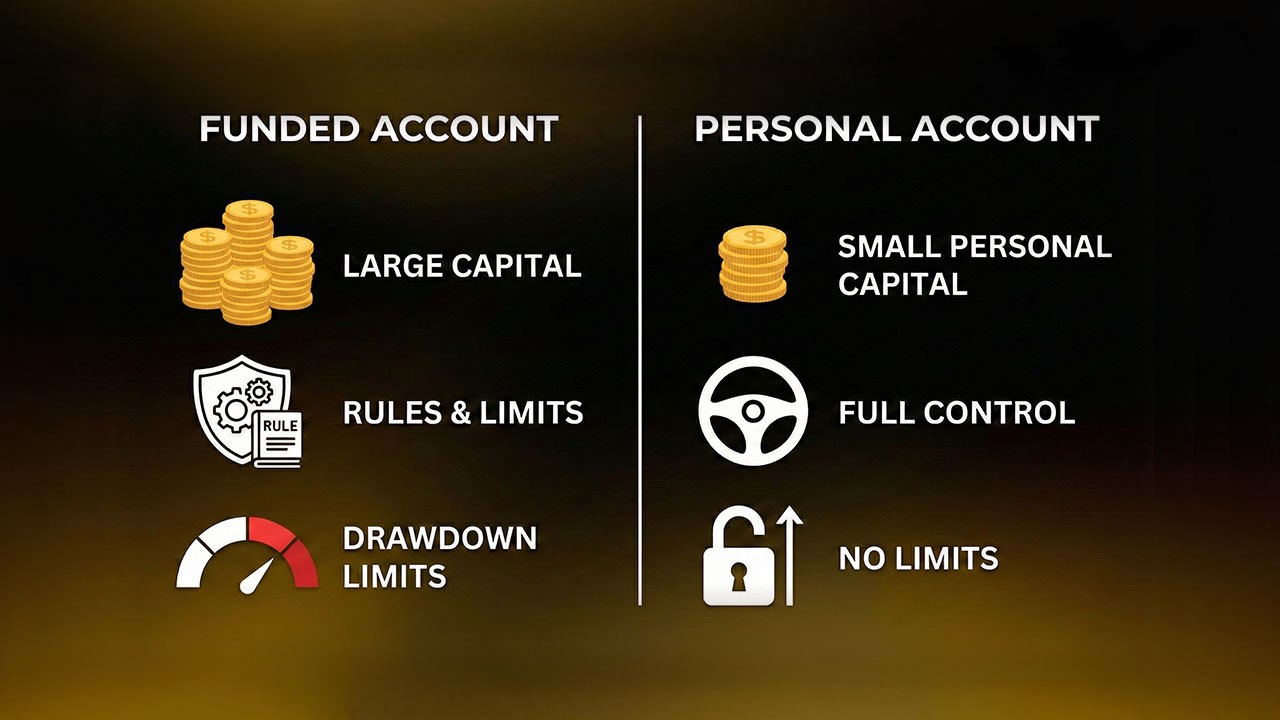

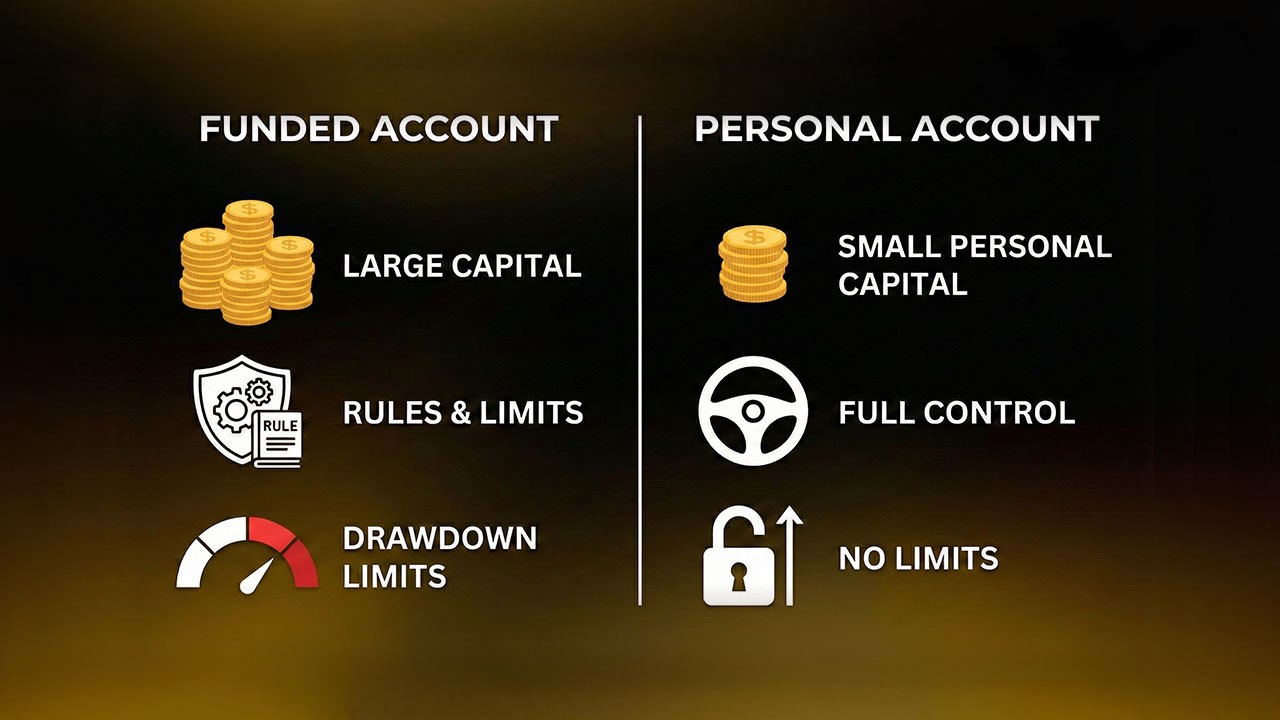

Is Funded Trading Better Than Trading Your Own Money?

For most traders, yes.

Benefits include:

Access to large capital

Limited personal financial risk

Structured risk management

Ability to scale faster

However, funded trading requires strict discipline. You are trading under rules - not complete freedom.

Final Thoughts: What’s Realistic in 2026?

In 2026, forex funded accounts remain one of the most accessible paths for traders who lack capital but possess skill.

However:

It is not guaranteed income

It is not passive

It is not easy

Realistically:

Many traders will earn side income

Fewer will achieve full-time income

Only disciplined traders will scale long term

Forex prop firms like Pipstone Capital have contributed to this shift by offering structured funded challenges, high capital allocations, and trader‑friendly conditions designed for long‑term consistency.

Those who focus on small monthly gains, protect drawdown, and treat trading like a business - not a casino - have the highest chance of success.

A funded account doesn’t make you profitable.

It only magnifies who you already are as a trader.

Frequently Asked Questions

What happens if you lose money on a funded account?

If you lose money but stay within the firm’s drawdown limits, the firm absorbs the loss and your account remains active. If you exceed the maximum daily or overall drawdown, the funded account is breached and closed. You do not owe the firm money beyond the challenge or evaluation fee.

Are funded accounts real money?

Yes. Once funded, trades are executed on live or simulated environments backed by real capital allocation models. Profits are paid out in real money according to the firm’s profit‑split rules, which is why strict risk management and drawdown limits are enforced.

How much profit do you keep on a funded account?

Most forex prop firms allow traders to keep between 70% and 90% of the profits they generate. Some programs offer higher splits after consistent payouts or scaling milestones, depending on the firm’s rules and payout structure.

How Much Money Can You Make With a Forex Funded Account in 2026?

Jan 23, 2026

Forex funded accounts have completely changed how traders approach the markets. Instead of risking personal savings or needing tens of thousands of dollars to trade full-time, traders can now access large trading capital through proprietary trading firms - often called prop firms.

But the big question remains:

How much money can you really make with a forex funded account in 2026?

The honest answer is not a fixed number. Earnings vary widely depending on your skill, discipline, account size, and consistency. Some traders make a few hundred dollars per month, while others generate five-figure payouts consistently. Many attempt funded trading, but only a small percentage turn it into long-term income.

Let’s break down what realistic earnings look like in 2026 - without hype, without false promises, and based on how funded trading actually works.

What Is a Forex Funded Account?

A forex funded account allows traders to trade with capital provided by a prop trading firm instead of their own money. If you are new to the model, this guide on what is proprietary trading and how it works explains why many traders are shifting toward funded accounts.

The process usually works like this:

You purchase an evaluation or challenge.

You trade under predefined rules such as maximum drawdown and daily loss limits.

If you pass the evaluation, the firm provides a funded trading account.

You earn a percentage of the profits you generate.

Most firms offer profit splits ranging from 70% to 90%, with some programs reaching higher percentages after consistent performance.

This structure removes the biggest barrier most traders face, lack of capital - while still rewarding discipline and risk management.

For a deeper breakdown, this article on what a funded account forex is explains the requirements in detail.

How Funded Traders Make Money

Funded traders earn income through profit sharing.

If you make money on the account, the firm takes its portion, and you keep the rest. The firm absorbs the trading losses as long as you follow the rules.

For example:

Account size: $100,000

Monthly profit: 5% ($5,000)

Profit split: 80%

Your payout would be:

$4,000 for that month

There is no salary, no guaranteed income, and no fixed return. Everything depends on trading performance. For a deeper breakdown, see this guide on how traders make money with funded accounts.

Typical Prop Trading Account Sizes in 2026

Most prop firms in 2026 offer funded accounts ranging from:

$5,000

$10,000

$25,000

$50,000

$100,000

$200,000+

Some traders also combine multiple accounts, allowing them to manage total capital well above $200,000 if permitted by firm rules.

The larger the account, the greater the income potential - but also the greater the responsibility for proper risk control.

Before choosing an account size, it helps to understand margin trading vs leverage trading, as these directly affect position sizing and risk.

Realistic Monthly Profit Expectations From Funded Accounts

One of the biggest misconceptions is expecting extremely high monthly returns.

Professional funded traders typically target:

2%–5% per month consistently

This may not sound impressive at first, but when applied to large capital, the numbers add up quickly.

Traders who struggle to stay within these limits often lack proper structure. This guide on risk management in prop trading forex explains why consistency matters more than high returns.

Example Earnings by Account Size

$25,000 funded account

3% profit = $750

80% split = $600 payout

$50,000 funded account

4% profit = $2,000

80% split = $1,600 payout

$100,000 funded account

5% profit = $5,000

80% split = $4,000 payout

$200,000 funded account

4% profit = $8,000

80% split = $6,400 payout

These numbers reflect realistic trading - not gambling, not over-leveraging, and not rule-breaking behavior.

Can You Make a Living From Funded Trading?

Yes - but only under certain conditions.

Industry data suggests:

Only 7%–15% of traders pass evaluation challenges.

Of those funded traders, roughly 20% receive payouts consistently.

A much smaller percentage turn it into stable full-time income.

This means funded trading is not easy money. It rewards discipline, patience, and long-term thinking - not emotional trading.

Passing the evaluation phase is one of the hardest parts. These tips for passing a funded account challenge outline what most successful traders focus on.

Annual Income Potential in 2026 as a Funded Trader

Based on current industry averages, funded trader earnings often fall into these ranges:

Beginner Funded Traders

$500 – $2,000 per month

$6,000 – $24,000 per year

Intermediate Consistent Traders

$3,000 – $7,000 per month

$36,000 – $84,000 per year

Advanced or Scaled Traders

$10,000 – $30,000+ per month

$120,000 – $300,000+ per year

These figures assume proper scaling, consistent profitability, and adherence to trading rules.

Many profitable traders follow structured routines similar to those outlined in a complete funded trading plan for consistency.

Why Scaling Matters More Than Strategy

One of the biggest income drivers in funded trading is account scaling. Scaling becomes far easier when traders apply proven forex trading strategies used by funded traders.

Many firms increase a trader’s capital after:

Multiple profitable payout cycles

Respecting drawdown limits

Maintaining consistent risk behavior

A trader making 3% per month on a $50,000 account earns far less than the same trader making 3% on a $300,000 account.

Skill remains the same - capital changes everything.

What Limits Your Income?

Several factors directly affect how much money you can make:

1. Drawdown Rules

Every firm enforces strict loss limits. Breaking them results in account termination, regardless of previous profits.

2. Consistency Requirements

Many firms monitor whether profits come from stable trading or single oversized trades.

3. Psychological Pressure

Trading larger capital increases emotional stress. Many traders fail not because of strategy, but mindset.

4. Market Conditions

Forex markets do not behave the same every month. Volatility shifts, ranges tighten, and trends change.

Income is rarely linear.

Understanding basic price behavior is essential. Traders who master forex technical analysis effectively tend to manage drawdown more consistently.

Payout Frequency in 2026

Most firms now offer:

Weekly payouts

Bi-weekly payouts

Monthly payouts

Shorter payout cycles often come with slightly lower profit splits, while longer cycles offer higher percentages.

Traders must balance consistency with payout structure to maximize long-term returns.

Is Funded Trading Better Than Trading Your Own Money?

For most traders, yes.

Benefits include:

Access to large capital

Limited personal financial risk

Structured risk management

Ability to scale faster

However, funded trading requires strict discipline. You are trading under rules - not complete freedom.

Final Thoughts: What’s Realistic in 2026?

In 2026, forex funded accounts remain one of the most accessible paths for traders who lack capital but possess skill.

However:

It is not guaranteed income

It is not passive

It is not easy

Realistically:

Many traders will earn side income

Fewer will achieve full-time income

Only disciplined traders will scale long term

Forex prop firms like Pipstone Capital have contributed to this shift by offering structured funded challenges, high capital allocations, and trader‑friendly conditions designed for long‑term consistency.

Those who focus on small monthly gains, protect drawdown, and treat trading like a business - not a casino - have the highest chance of success.

A funded account doesn’t make you profitable.

It only magnifies who you already are as a trader.

Frequently Asked Questions

What happens if you lose money on a funded account?

If you lose money but stay within the firm’s drawdown limits, the firm absorbs the loss and your account remains active. If you exceed the maximum daily or overall drawdown, the funded account is breached and closed. You do not owe the firm money beyond the challenge or evaluation fee.

Are funded accounts real money?

Yes. Once funded, trades are executed on live or simulated environments backed by real capital allocation models. Profits are paid out in real money according to the firm’s profit‑split rules, which is why strict risk management and drawdown limits are enforced.

How much profit do you keep on a funded account?

Most forex prop firms allow traders to keep between 70% and 90% of the profits they generate. Some programs offer higher splits after consistent payouts or scaling milestones, depending on the firm’s rules and payout structure.

How Much Money Can You Make With a Forex Funded Account in 2026?

Jan 23, 2026

Forex funded accounts have completely changed how traders approach the markets. Instead of risking personal savings or needing tens of thousands of dollars to trade full-time, traders can now access large trading capital through proprietary trading firms - often called prop firms.

But the big question remains:

How much money can you really make with a forex funded account in 2026?

The honest answer is not a fixed number. Earnings vary widely depending on your skill, discipline, account size, and consistency. Some traders make a few hundred dollars per month, while others generate five-figure payouts consistently. Many attempt funded trading, but only a small percentage turn it into long-term income.

Let’s break down what realistic earnings look like in 2026 - without hype, without false promises, and based on how funded trading actually works.

What Is a Forex Funded Account?

A forex funded account allows traders to trade with capital provided by a prop trading firm instead of their own money. If you are new to the model, this guide on what is proprietary trading and how it works explains why many traders are shifting toward funded accounts.

The process usually works like this:

You purchase an evaluation or challenge.

You trade under predefined rules such as maximum drawdown and daily loss limits.

If you pass the evaluation, the firm provides a funded trading account.

You earn a percentage of the profits you generate.

Most firms offer profit splits ranging from 70% to 90%, with some programs reaching higher percentages after consistent performance.

This structure removes the biggest barrier most traders face, lack of capital - while still rewarding discipline and risk management.

For a deeper breakdown, this article on what a funded account forex is explains the requirements in detail.

How Funded Traders Make Money

Funded traders earn income through profit sharing.

If you make money on the account, the firm takes its portion, and you keep the rest. The firm absorbs the trading losses as long as you follow the rules.

For example:

Account size: $100,000

Monthly profit: 5% ($5,000)

Profit split: 80%

Your payout would be:

$4,000 for that month

There is no salary, no guaranteed income, and no fixed return. Everything depends on trading performance. For a deeper breakdown, see this guide on how traders make money with funded accounts.

Typical Prop Trading Account Sizes in 2026

Most prop firms in 2026 offer funded accounts ranging from:

$5,000

$10,000

$25,000

$50,000

$100,000

$200,000+

Some traders also combine multiple accounts, allowing them to manage total capital well above $200,000 if permitted by firm rules.

The larger the account, the greater the income potential - but also the greater the responsibility for proper risk control.

Before choosing an account size, it helps to understand margin trading vs leverage trading, as these directly affect position sizing and risk.

Realistic Monthly Profit Expectations From Funded Accounts

One of the biggest misconceptions is expecting extremely high monthly returns.

Professional funded traders typically target:

2%–5% per month consistently

This may not sound impressive at first, but when applied to large capital, the numbers add up quickly.

Traders who struggle to stay within these limits often lack proper structure. This guide on risk management in prop trading forex explains why consistency matters more than high returns.

Example Earnings by Account Size

$25,000 funded account

3% profit = $750

80% split = $600 payout

$50,000 funded account

4% profit = $2,000

80% split = $1,600 payout

$100,000 funded account

5% profit = $5,000

80% split = $4,000 payout

$200,000 funded account

4% profit = $8,000

80% split = $6,400 payout

These numbers reflect realistic trading - not gambling, not over-leveraging, and not rule-breaking behavior.

Can You Make a Living From Funded Trading?

Yes - but only under certain conditions.

Industry data suggests:

Only 7%–15% of traders pass evaluation challenges.

Of those funded traders, roughly 20% receive payouts consistently.

A much smaller percentage turn it into stable full-time income.

This means funded trading is not easy money. It rewards discipline, patience, and long-term thinking - not emotional trading.

Passing the evaluation phase is one of the hardest parts. These tips for passing a funded account challenge outline what most successful traders focus on.

Annual Income Potential in 2026 as a Funded Trader

Based on current industry averages, funded trader earnings often fall into these ranges:

Beginner Funded Traders

$500 – $2,000 per month

$6,000 – $24,000 per year

Intermediate Consistent Traders

$3,000 – $7,000 per month

$36,000 – $84,000 per year

Advanced or Scaled Traders

$10,000 – $30,000+ per month

$120,000 – $300,000+ per year

These figures assume proper scaling, consistent profitability, and adherence to trading rules.

Many profitable traders follow structured routines similar to those outlined in a complete funded trading plan for consistency.

Why Scaling Matters More Than Strategy

One of the biggest income drivers in funded trading is account scaling. Scaling becomes far easier when traders apply proven forex trading strategies used by funded traders.

Many firms increase a trader’s capital after:

Multiple profitable payout cycles

Respecting drawdown limits

Maintaining consistent risk behavior

A trader making 3% per month on a $50,000 account earns far less than the same trader making 3% on a $300,000 account.

Skill remains the same - capital changes everything.

What Limits Your Income?

Several factors directly affect how much money you can make:

1. Drawdown Rules

Every firm enforces strict loss limits. Breaking them results in account termination, regardless of previous profits.

2. Consistency Requirements

Many firms monitor whether profits come from stable trading or single oversized trades.

3. Psychological Pressure

Trading larger capital increases emotional stress. Many traders fail not because of strategy, but mindset.

4. Market Conditions

Forex markets do not behave the same every month. Volatility shifts, ranges tighten, and trends change.

Income is rarely linear.

Understanding basic price behavior is essential. Traders who master forex technical analysis effectively tend to manage drawdown more consistently.

Payout Frequency in 2026

Most firms now offer:

Weekly payouts

Bi-weekly payouts

Monthly payouts

Shorter payout cycles often come with slightly lower profit splits, while longer cycles offer higher percentages.

Traders must balance consistency with payout structure to maximize long-term returns.

Is Funded Trading Better Than Trading Your Own Money?

For most traders, yes.

Benefits include:

Access to large capital

Limited personal financial risk

Structured risk management

Ability to scale faster

However, funded trading requires strict discipline. You are trading under rules - not complete freedom.

Final Thoughts: What’s Realistic in 2026?

In 2026, forex funded accounts remain one of the most accessible paths for traders who lack capital but possess skill.

However:

It is not guaranteed income

It is not passive

It is not easy

Realistically:

Many traders will earn side income

Fewer will achieve full-time income

Only disciplined traders will scale long term

Forex prop firms like Pipstone Capital have contributed to this shift by offering structured funded challenges, high capital allocations, and trader‑friendly conditions designed for long‑term consistency.

Those who focus on small monthly gains, protect drawdown, and treat trading like a business - not a casino - have the highest chance of success.

A funded account doesn’t make you profitable.

It only magnifies who you already are as a trader.

Frequently Asked Questions

What happens if you lose money on a funded account?

If you lose money but stay within the firm’s drawdown limits, the firm absorbs the loss and your account remains active. If you exceed the maximum daily or overall drawdown, the funded account is breached and closed. You do not owe the firm money beyond the challenge or evaluation fee.

Are funded accounts real money?

Yes. Once funded, trades are executed on live or simulated environments backed by real capital allocation models. Profits are paid out in real money according to the firm’s profit‑split rules, which is why strict risk management and drawdown limits are enforced.

How much profit do you keep on a funded account?

Most forex prop firms allow traders to keep between 70% and 90% of the profits they generate. Some programs offer higher splits after consistent payouts or scaling milestones, depending on the firm’s rules and payout structure.