How Traders Actually Make Money With Funded Forex Accounts in 2026

Jan 26, 2026

Making money online through forex trading has changed dramatically over the last few years. In 2026, more traders are choosing funded forex trading accounts instead of risking their own savings - and for good reason.

Rather than depositing thousands of dollars upfront, traders can now trade with capital provided by proprietary trading firms. This model allows skilled traders to access large accounts, keep most of the profits, and limit their personal financial risk.

But while funded trading offers opportunity, it is not a shortcut to easy money. Understanding how funded accounts actually work, and how traders make money from them - is critical before getting started.

This guide explains exactly how to make money with a funded forex trading account in 2026, step by step, without hype or unrealistic promises.

What Is a Funded Forex Trading Account?

A funded forex trading account is an account provided by a proprietary trading firm (often called a “prop firm”). Instead of trading your own money, you trade the firm’s capital.

Here’s how it works in simple terms:

You pay a one-time evaluation fee

You complete a trading challenge

If you meet the profit target and respect risk rules, you receive a funded account

You trade real capital

You keep a large percentage of the profits

Most firms offer account sizes ranging from $5,000 to $400,000+, depending on the program.

In 2026, funded accounts have become one of the most accessible ways for retail traders to trade professionally without large personal deposits.

Traders who are new to this model often start by learning what a funded forex account is and how qualification works, which explains the evaluation structure and capital access in more detail.

Why Funded Trading Is Popular in 2026

Several factors have driven the growth of funded trading:

1. Rising Cost of Living

Many traders simply cannot afford to risk $10,000–$50,000 of personal capital.

Funded accounts remove that barrier.

2. Access to Larger Capital

Making 5% on a $1,000 account is very different from making 5% on a $100,000 account.

Funded trading increases earning potential without increasing personal risk.

3. High Profit Splits

Most prop firms now offer 80%–95% profit splits, allowing traders to keep the majority of what they earn.

4. No Long-Term Contracts

Traders are usually free to leave at any time. If you perform well, you stay funded. If not, you can retry.

How the Evaluation Challenge Works

Before you receive a funded account, you must pass an evaluation.

While rules differ slightly between firms, most challenges in 2026 include:

Profit target: usually 8%–10%

Maximum daily loss: around 4%–5%

Maximum total drawdown: 8%–12%

Minimum trading days: typically 3–5 days

For example:

You choose a $100,000 account

Profit target: 10% ($10,000)

Maximum drawdown: 10% ($10,000)

Your goal is simple:

reach the profit target without breaking risk rules.

Once passed, you move to the funded phase. Many traders improve their success rate by following proven methods outlined in guides on how to pass a funded forex challenge, especially when dealing with strict drawdown rules.

How Traders Actually Make Money With Funded Accounts

Making money with a funded forex account happens in three stages.

1. Passing the Evaluation Consistently

The first source of income potential is simply getting funded.

Many traders fail not because they lack strategy, but because they:

Overtrade

Use lot sizes that are too large

Chase losses

Ignore drawdown rules

In 2026, successful traders approach challenges conservatively.

Instead of trying to pass in one day, they aim for:

1%–2% gains per trade

2–5 trades per week

Capital preservation first

The objective is survival, not speed. Traders who struggle at this stage often overlook proper position sizing, which is why understanding margin trading vs leverage in prop trading becomes essential before increasing lot sizes.

2. Trading the Funded Account

Once funded, the pressure decreases significantly.

There is no profit target - only risk rules.

This allows traders to focus on:

Consistent execution

Smaller drawdowns

Stable monthly returns

Most profitable funded traders aim for:

3%–6% monthly growth

That may sound small, but on large capital it becomes meaningful.

Example:

$100,000 funded account

5% monthly profit = $5,000

90% profit split = $4,500 paid to trader

This income is generated without risking personal savings. At this stage, experienced traders focus heavily on structured execution supported by professional risk management principles used in prop trading to maintain account longevity.

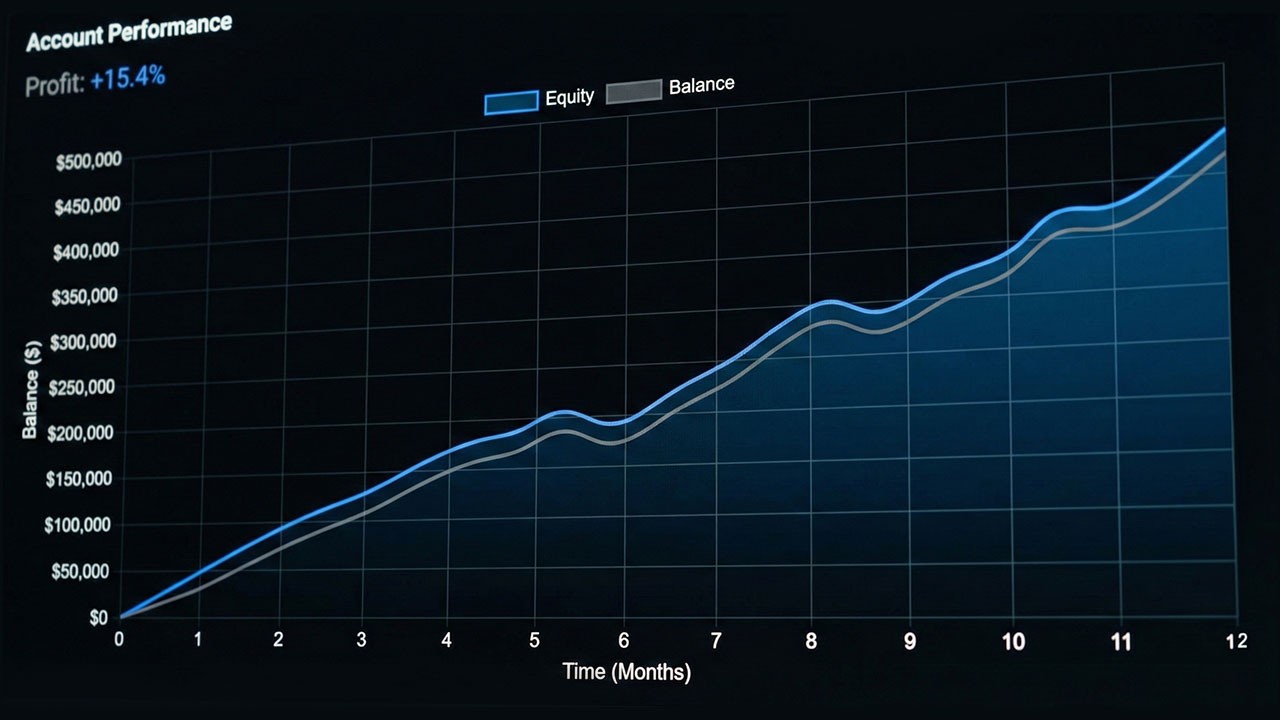

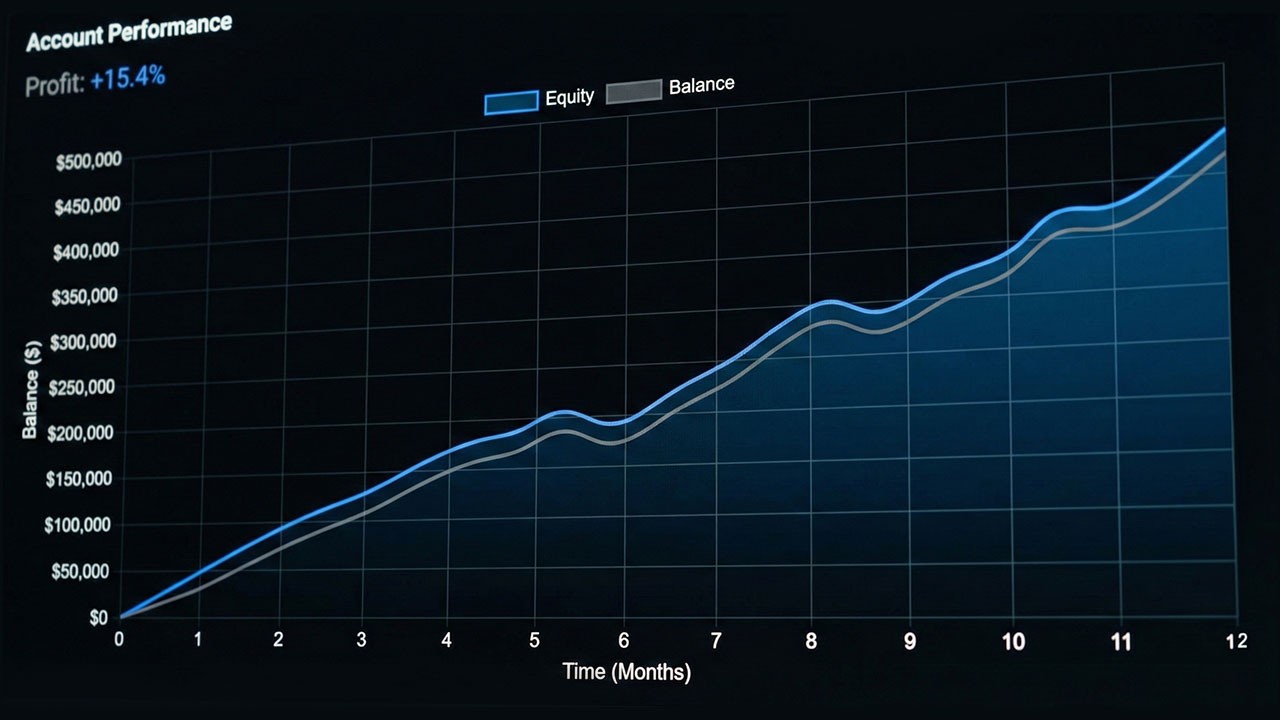

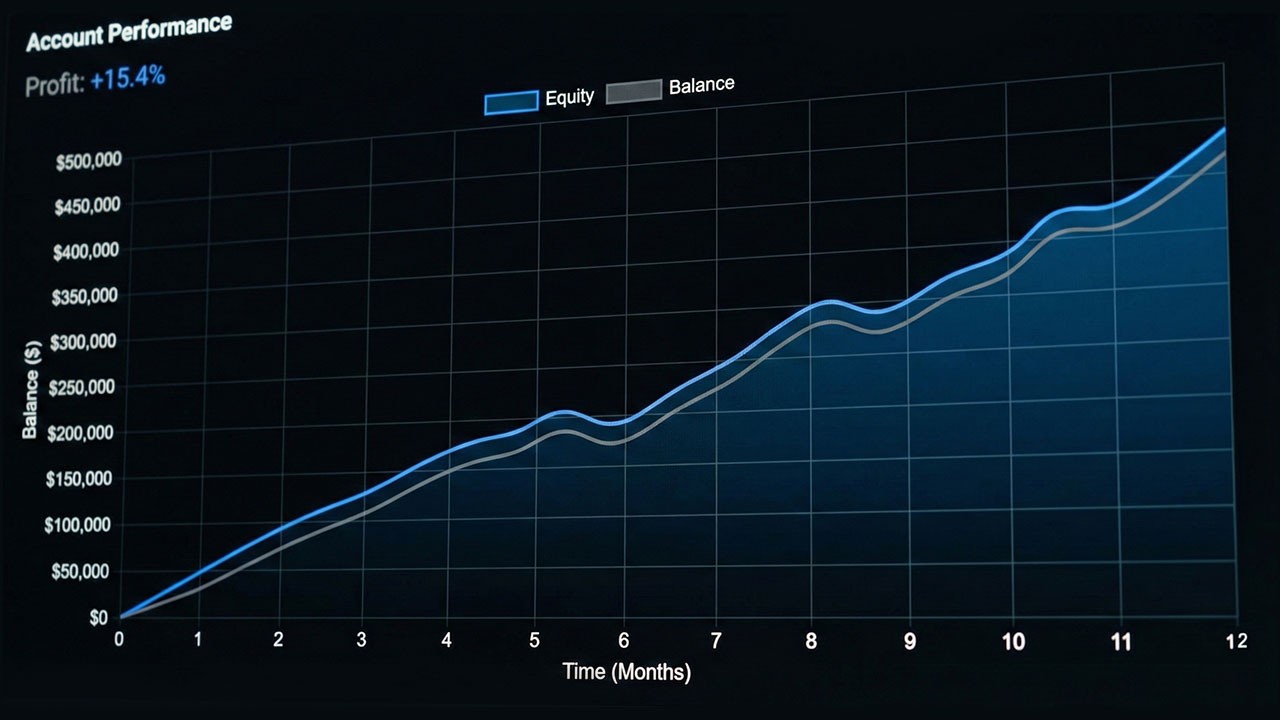

3. Scaling Capital Over Time

Many firms offer account scaling.

If a trader remains profitable for several months, capital can increase.

Example:

Start with $50,000

Scale to $100,000

Then $200,000

Eventually $400,000+

In 2026, scaling is one of the biggest advantages of funded trading.

Even modest monthly returns become significant as capital grows. This compounding effect is closely tied to realistic earning expectations, which are explained further in how much money you can make with a funded account.

How Much Money Can You Make in 2026?

There is no fixed income - earnings depend on performance and discipline.

However, realistic monthly scenarios look like this:

Account Size | Monthly Return | Trader Payout (90%) |

$25,000 | 4% | $900 |

$50,000 | 5% | $2,250 |

$100,000 | 5% | $4,500 |

$200,000 | 4% | $7,200 |

$400,000 | 3% | $10,800 |

These are not guarantees, but they show why funded trading attracts serious traders.

What Makes Traders Fail

Despite the opportunity, most traders fail funded accounts due to the same mistakes:

Overleveraging

Trying to pass fast usually leads to drawdown violations.

Emotional Trading

Revenge trades remain the number one account killer.

Ignoring Risk Limits

A profitable strategy means nothing if drawdown rules are broken.

No Trading Plan

Random entries lead to inconsistent results.

Funded accounts reward discipline - not aggression. Traders who consistently fail often ignore basic execution rules covered in essential forex trading techniques for funded account traders.

Strategies That Work Best in Funded Accounts

In 2026, the most successful funded traders typically use:

Forex scalping (1–15 minute charts)

Intraday structure trading

Support and resistance

Trend continuation setups

News-aware but not news gambling strategies

The strategy itself matters less than risk control. Many traders enhance execution by using platform‑specific tools such as cTrader indicators, which help reduce emotional decision‑making.

Risk Management Is Everything

Most funded traders risk:

0.25%–1% per trade

This allows:

Multiple losing trades without violating drawdown

Emotional stability

Long-term account survival

In funded trading, staying funded is more important than making large profits quickly.

Is Funded Forex Trading Worth It in 2026?

For the right trader - yes.

Funded accounts are ideal for:

Traders with proven strategies but limited capital

Disciplined individuals who follow rules

Traders focused on consistency over gambling

Anyone wanting exposure to large capital safely

They are not suitable for:

Get-rich-quick seekers

High-risk gamblers

Traders who struggle with discipline

Final Thoughts

A funded forex trading account is not a shortcut - but it is a powerful opportunity, especially when trading with a prop firm like Pipstone Capital, which provides traders with access to large funded accounts, flexible trading conditions, and up to 100% profit splits.

In 2026, traders can:

Access six-figure capital

Trade without risking personal savings

Keep up to 95% of profits

Scale accounts over time

Build consistent online income

Success does not come from aggressive trading or luck.

It comes from:

Risk management

Emotional control

Patience

Consistency

Treat funded trading like a professional business that requires discipline, and it can become one of the most realistic ways to make money online through forex in 2026.

FAQs

Are funded forex trading accounts real money?

Yes. Once you pass the evaluation, you trade with real capital provided by the prop firm. While the firm manages overall risk exposure, profits generated on a funded account are real and eligible for withdrawal according to the firm’s payout rules.

What happens if you lose money on a funded account?

If losses stay within the allowed drawdown limits, the account remains active. If a risk rule is violated, the funded account is closed. Traders can usually restart by purchasing a new evaluation, but personal losses are limited to the initial fee.

How much profit do traders usually keep?

Most prop firms offer profit splits between 80% and 95%. This means the trader keeps the majority of profits, while the firm takes a smaller percentage in exchange for providing capital and covering trading risk.

How Traders Actually Make Money With Funded Forex Accounts in 2026

Jan 26, 2026

Making money online through forex trading has changed dramatically over the last few years. In 2026, more traders are choosing funded forex trading accounts instead of risking their own savings - and for good reason.

Rather than depositing thousands of dollars upfront, traders can now trade with capital provided by proprietary trading firms. This model allows skilled traders to access large accounts, keep most of the profits, and limit their personal financial risk.

But while funded trading offers opportunity, it is not a shortcut to easy money. Understanding how funded accounts actually work, and how traders make money from them - is critical before getting started.

This guide explains exactly how to make money with a funded forex trading account in 2026, step by step, without hype or unrealistic promises.

What Is a Funded Forex Trading Account?

A funded forex trading account is an account provided by a proprietary trading firm (often called a “prop firm”). Instead of trading your own money, you trade the firm’s capital.

Here’s how it works in simple terms:

You pay a one-time evaluation fee

You complete a trading challenge

If you meet the profit target and respect risk rules, you receive a funded account

You trade real capital

You keep a large percentage of the profits

Most firms offer account sizes ranging from $5,000 to $400,000+, depending on the program.

In 2026, funded accounts have become one of the most accessible ways for retail traders to trade professionally without large personal deposits.

Traders who are new to this model often start by learning what a funded forex account is and how qualification works, which explains the evaluation structure and capital access in more detail.

Why Funded Trading Is Popular in 2026

Several factors have driven the growth of funded trading:

1. Rising Cost of Living

Many traders simply cannot afford to risk $10,000–$50,000 of personal capital.

Funded accounts remove that barrier.

2. Access to Larger Capital

Making 5% on a $1,000 account is very different from making 5% on a $100,000 account.

Funded trading increases earning potential without increasing personal risk.

3. High Profit Splits

Most prop firms now offer 80%–95% profit splits, allowing traders to keep the majority of what they earn.

4. No Long-Term Contracts

Traders are usually free to leave at any time. If you perform well, you stay funded. If not, you can retry.

How the Evaluation Challenge Works

Before you receive a funded account, you must pass an evaluation.

While rules differ slightly between firms, most challenges in 2026 include:

Profit target: usually 8%–10%

Maximum daily loss: around 4%–5%

Maximum total drawdown: 8%–12%

Minimum trading days: typically 3–5 days

For example:

You choose a $100,000 account

Profit target: 10% ($10,000)

Maximum drawdown: 10% ($10,000)

Your goal is simple:

reach the profit target without breaking risk rules.

Once passed, you move to the funded phase. Many traders improve their success rate by following proven methods outlined in guides on how to pass a funded forex challenge, especially when dealing with strict drawdown rules.

How Traders Actually Make Money With Funded Accounts

Making money with a funded forex account happens in three stages.

1. Passing the Evaluation Consistently

The first source of income potential is simply getting funded.

Many traders fail not because they lack strategy, but because they:

Overtrade

Use lot sizes that are too large

Chase losses

Ignore drawdown rules

In 2026, successful traders approach challenges conservatively.

Instead of trying to pass in one day, they aim for:

1%–2% gains per trade

2–5 trades per week

Capital preservation first

The objective is survival, not speed. Traders who struggle at this stage often overlook proper position sizing, which is why understanding margin trading vs leverage in prop trading becomes essential before increasing lot sizes.

2. Trading the Funded Account

Once funded, the pressure decreases significantly.

There is no profit target - only risk rules.

This allows traders to focus on:

Consistent execution

Smaller drawdowns

Stable monthly returns

Most profitable funded traders aim for:

3%–6% monthly growth

That may sound small, but on large capital it becomes meaningful.

Example:

$100,000 funded account

5% monthly profit = $5,000

90% profit split = $4,500 paid to trader

This income is generated without risking personal savings. At this stage, experienced traders focus heavily on structured execution supported by professional risk management principles used in prop trading to maintain account longevity.

3. Scaling Capital Over Time

Many firms offer account scaling.

If a trader remains profitable for several months, capital can increase.

Example:

Start with $50,000

Scale to $100,000

Then $200,000

Eventually $400,000+

In 2026, scaling is one of the biggest advantages of funded trading.

Even modest monthly returns become significant as capital grows. This compounding effect is closely tied to realistic earning expectations, which are explained further in how much money you can make with a funded account.

How Much Money Can You Make in 2026?

There is no fixed income - earnings depend on performance and discipline.

However, realistic monthly scenarios look like this:

Account Size | Monthly Return | Trader Payout (90%) |

$25,000 | 4% | $900 |

$50,000 | 5% | $2,250 |

$100,000 | 5% | $4,500 |

$200,000 | 4% | $7,200 |

$400,000 | 3% | $10,800 |

These are not guarantees, but they show why funded trading attracts serious traders.

What Makes Traders Fail

Despite the opportunity, most traders fail funded accounts due to the same mistakes:

Overleveraging

Trying to pass fast usually leads to drawdown violations.

Emotional Trading

Revenge trades remain the number one account killer.

Ignoring Risk Limits

A profitable strategy means nothing if drawdown rules are broken.

No Trading Plan

Random entries lead to inconsistent results.

Funded accounts reward discipline - not aggression. Traders who consistently fail often ignore basic execution rules covered in essential forex trading techniques for funded account traders.

Strategies That Work Best in Funded Accounts

In 2026, the most successful funded traders typically use:

Forex scalping (1–15 minute charts)

Intraday structure trading

Support and resistance

Trend continuation setups

News-aware but not news gambling strategies

The strategy itself matters less than risk control. Many traders enhance execution by using platform‑specific tools such as cTrader indicators, which help reduce emotional decision‑making.

Risk Management Is Everything

Most funded traders risk:

0.25%–1% per trade

This allows:

Multiple losing trades without violating drawdown

Emotional stability

Long-term account survival

In funded trading, staying funded is more important than making large profits quickly.

Is Funded Forex Trading Worth It in 2026?

For the right trader - yes.

Funded accounts are ideal for:

Traders with proven strategies but limited capital

Disciplined individuals who follow rules

Traders focused on consistency over gambling

Anyone wanting exposure to large capital safely

They are not suitable for:

Get-rich-quick seekers

High-risk gamblers

Traders who struggle with discipline

Final Thoughts

A funded forex trading account is not a shortcut - but it is a powerful opportunity, especially when trading with a prop firm like Pipstone Capital, which provides traders with access to large funded accounts, flexible trading conditions, and up to 100% profit splits.

In 2026, traders can:

Access six-figure capital

Trade without risking personal savings

Keep up to 95% of profits

Scale accounts over time

Build consistent online income

Success does not come from aggressive trading or luck.

It comes from:

Risk management

Emotional control

Patience

Consistency

Treat funded trading like a professional business that requires discipline, and it can become one of the most realistic ways to make money online through forex in 2026.

FAQs

Are funded forex trading accounts real money?

Yes. Once you pass the evaluation, you trade with real capital provided by the prop firm. While the firm manages overall risk exposure, profits generated on a funded account are real and eligible for withdrawal according to the firm’s payout rules.

What happens if you lose money on a funded account?

If losses stay within the allowed drawdown limits, the account remains active. If a risk rule is violated, the funded account is closed. Traders can usually restart by purchasing a new evaluation, but personal losses are limited to the initial fee.

How much profit do traders usually keep?

Most prop firms offer profit splits between 80% and 95%. This means the trader keeps the majority of profits, while the firm takes a smaller percentage in exchange for providing capital and covering trading risk.

How Traders Actually Make Money With Funded Forex Accounts in 2026

Jan 26, 2026

Making money online through forex trading has changed dramatically over the last few years. In 2026, more traders are choosing funded forex trading accounts instead of risking their own savings - and for good reason.

Rather than depositing thousands of dollars upfront, traders can now trade with capital provided by proprietary trading firms. This model allows skilled traders to access large accounts, keep most of the profits, and limit their personal financial risk.

But while funded trading offers opportunity, it is not a shortcut to easy money. Understanding how funded accounts actually work, and how traders make money from them - is critical before getting started.

This guide explains exactly how to make money with a funded forex trading account in 2026, step by step, without hype or unrealistic promises.

What Is a Funded Forex Trading Account?

A funded forex trading account is an account provided by a proprietary trading firm (often called a “prop firm”). Instead of trading your own money, you trade the firm’s capital.

Here’s how it works in simple terms:

You pay a one-time evaluation fee

You complete a trading challenge

If you meet the profit target and respect risk rules, you receive a funded account

You trade real capital

You keep a large percentage of the profits

Most firms offer account sizes ranging from $5,000 to $400,000+, depending on the program.

In 2026, funded accounts have become one of the most accessible ways for retail traders to trade professionally without large personal deposits.

Traders who are new to this model often start by learning what a funded forex account is and how qualification works, which explains the evaluation structure and capital access in more detail.

Why Funded Trading Is Popular in 2026

Several factors have driven the growth of funded trading:

1. Rising Cost of Living

Many traders simply cannot afford to risk $10,000–$50,000 of personal capital.

Funded accounts remove that barrier.

2. Access to Larger Capital

Making 5% on a $1,000 account is very different from making 5% on a $100,000 account.

Funded trading increases earning potential without increasing personal risk.

3. High Profit Splits

Most prop firms now offer 80%–95% profit splits, allowing traders to keep the majority of what they earn.

4. No Long-Term Contracts

Traders are usually free to leave at any time. If you perform well, you stay funded. If not, you can retry.

How the Evaluation Challenge Works

Before you receive a funded account, you must pass an evaluation.

While rules differ slightly between firms, most challenges in 2026 include:

Profit target: usually 8%–10%

Maximum daily loss: around 4%–5%

Maximum total drawdown: 8%–12%

Minimum trading days: typically 3–5 days

For example:

You choose a $100,000 account

Profit target: 10% ($10,000)

Maximum drawdown: 10% ($10,000)

Your goal is simple:

reach the profit target without breaking risk rules.

Once passed, you move to the funded phase. Many traders improve their success rate by following proven methods outlined in guides on how to pass a funded forex challenge, especially when dealing with strict drawdown rules.

How Traders Actually Make Money With Funded Accounts

Making money with a funded forex account happens in three stages.

1. Passing the Evaluation Consistently

The first source of income potential is simply getting funded.

Many traders fail not because they lack strategy, but because they:

Overtrade

Use lot sizes that are too large

Chase losses

Ignore drawdown rules

In 2026, successful traders approach challenges conservatively.

Instead of trying to pass in one day, they aim for:

1%–2% gains per trade

2–5 trades per week

Capital preservation first

The objective is survival, not speed. Traders who struggle at this stage often overlook proper position sizing, which is why understanding margin trading vs leverage in prop trading becomes essential before increasing lot sizes.

2. Trading the Funded Account

Once funded, the pressure decreases significantly.

There is no profit target - only risk rules.

This allows traders to focus on:

Consistent execution

Smaller drawdowns

Stable monthly returns

Most profitable funded traders aim for:

3%–6% monthly growth

That may sound small, but on large capital it becomes meaningful.

Example:

$100,000 funded account

5% monthly profit = $5,000

90% profit split = $4,500 paid to trader

This income is generated without risking personal savings. At this stage, experienced traders focus heavily on structured execution supported by professional risk management principles used in prop trading to maintain account longevity.

3. Scaling Capital Over Time

Many firms offer account scaling.

If a trader remains profitable for several months, capital can increase.

Example:

Start with $50,000

Scale to $100,000

Then $200,000

Eventually $400,000+

In 2026, scaling is one of the biggest advantages of funded trading.

Even modest monthly returns become significant as capital grows. This compounding effect is closely tied to realistic earning expectations, which are explained further in how much money you can make with a funded account.

How Much Money Can You Make in 2026?

There is no fixed income - earnings depend on performance and discipline.

However, realistic monthly scenarios look like this:

Account Size | Monthly Return | Trader Payout (90%) |

$25,000 | 4% | $900 |

$50,000 | 5% | $2,250 |

$100,000 | 5% | $4,500 |

$200,000 | 4% | $7,200 |

$400,000 | 3% | $10,800 |

These are not guarantees, but they show why funded trading attracts serious traders.

What Makes Traders Fail

Despite the opportunity, most traders fail funded accounts due to the same mistakes:

Overleveraging

Trying to pass fast usually leads to drawdown violations.

Emotional Trading

Revenge trades remain the number one account killer.

Ignoring Risk Limits

A profitable strategy means nothing if drawdown rules are broken.

No Trading Plan

Random entries lead to inconsistent results.

Funded accounts reward discipline - not aggression. Traders who consistently fail often ignore basic execution rules covered in essential forex trading techniques for funded account traders.

Strategies That Work Best in Funded Accounts

In 2026, the most successful funded traders typically use:

Forex scalping (1–15 minute charts)

Intraday structure trading

Support and resistance

Trend continuation setups

News-aware but not news gambling strategies

The strategy itself matters less than risk control. Many traders enhance execution by using platform‑specific tools such as cTrader indicators, which help reduce emotional decision‑making.

Risk Management Is Everything

Most funded traders risk:

0.25%–1% per trade

This allows:

Multiple losing trades without violating drawdown

Emotional stability

Long-term account survival

In funded trading, staying funded is more important than making large profits quickly.

Is Funded Forex Trading Worth It in 2026?

For the right trader - yes.

Funded accounts are ideal for:

Traders with proven strategies but limited capital

Disciplined individuals who follow rules

Traders focused on consistency over gambling

Anyone wanting exposure to large capital safely

They are not suitable for:

Get-rich-quick seekers

High-risk gamblers

Traders who struggle with discipline

Final Thoughts

A funded forex trading account is not a shortcut - but it is a powerful opportunity, especially when trading with a prop firm like Pipstone Capital, which provides traders with access to large funded accounts, flexible trading conditions, and up to 100% profit splits.

In 2026, traders can:

Access six-figure capital

Trade without risking personal savings

Keep up to 95% of profits

Scale accounts over time

Build consistent online income

Success does not come from aggressive trading or luck.

It comes from:

Risk management

Emotional control

Patience

Consistency

Treat funded trading like a professional business that requires discipline, and it can become one of the most realistic ways to make money online through forex in 2026.

FAQs

Are funded forex trading accounts real money?

Yes. Once you pass the evaluation, you trade with real capital provided by the prop firm. While the firm manages overall risk exposure, profits generated on a funded account are real and eligible for withdrawal according to the firm’s payout rules.

What happens if you lose money on a funded account?

If losses stay within the allowed drawdown limits, the account remains active. If a risk rule is violated, the funded account is closed. Traders can usually restart by purchasing a new evaluation, but personal losses are limited to the initial fee.

How much profit do traders usually keep?

Most prop firms offer profit splits between 80% and 95%. This means the trader keeps the majority of profits, while the firm takes a smaller percentage in exchange for providing capital and covering trading risk.