Gold Trading Strategy in 2026: Adapting to Market Volatility

Feb 18, 2026

Gold has always held a special place in trading. In 2026, that role feels even stronger. Traders are no longer treating gold like a simple commodity. It now behaves more like a reaction to fear, policy changes, and global money flow.

Price moves faster than before. Trends form quickly and can reverse without warning. This forces traders to adjust how they approach XAUUSD. Old fixed strategies no longer work on their own. Adaptation is now the real edge.

This guide explains how gold behaves in 2026 and how traders can adjust their strategy to match market volatility. It presents a practical gold trading strategy that reflects how professionals approach modern markets. Throughout this article, you will see how a best gold trading strategy is built from context, timing, and discipline rather than indicators alone.

Why Gold Moves Differently in 2026

Gold reacts to confidence. When markets feel uncertain, money moves into gold. When risk appetite rises, gold often slows or pulls back.

Several forces drive price action today:

Interest rate expectations

Inflation fears

Central bank decisions

Geopolitical tension

Strength or weakness of the US dollar

Gold often moves before news becomes official. Traders react to expectations, not just outcomes. A hint of policy change can move price hundreds of pips.

This means traders must watch the bigger picture first. Charts alone are not enough.

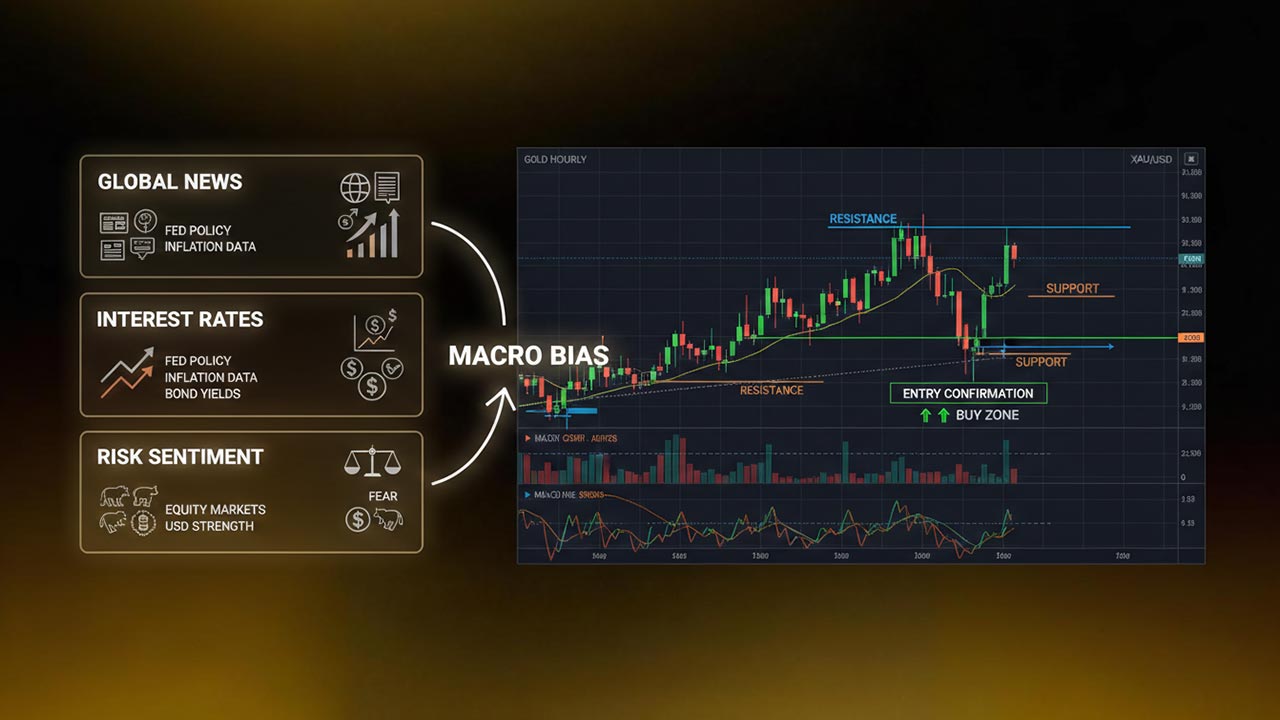

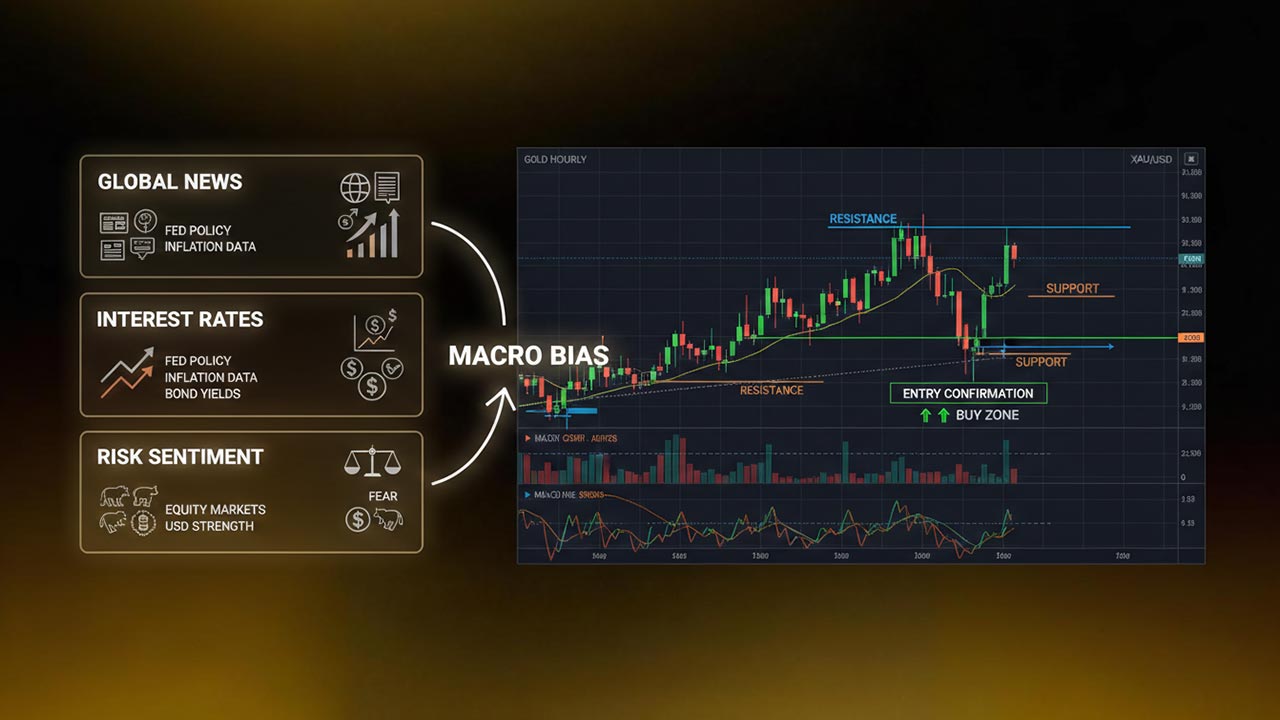

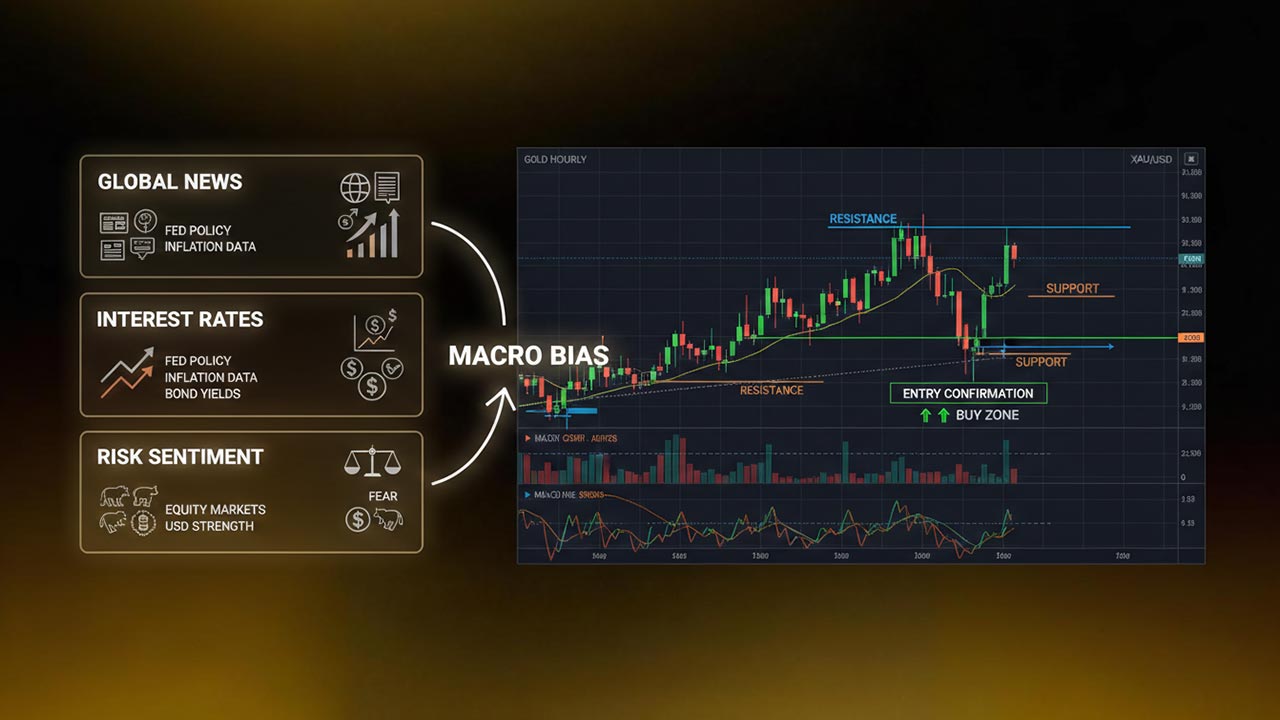

The Core Rule: Macro First, Technicals Second in a Gold Trading Strategy

Many beginners start with indicators. Professional traders begin with context. Every profitable gold trading strategy starts with understanding why price moves before deciding how to trade it.

Before entering any trade, ask one question:

Is the market seeking safety or risk?

If fear dominates, gold usually trends higher. If markets chase growth, gold may struggle or move sideways.

Once bias is clear, technical analysis helps find timing. Support and resistance levels become entry zones, not prediction tools.

This simple order matters:

Understand market mood

Choose direction bias

Wait for price confirmation

Enter with controlled risk

Skipping the first step leads to poor trades.

Understanding Market Conditions in 2026

Gold no longer stays in one behavior for long. Traders must identify the current market type.

There are four main environments.

1. Trending Markets in Gold Strategy Trading

Strong trends appear when macro pressure builds. Rate cuts, inflation shocks, or crisis events can push gold steadily higher. When large funds move into gold, price rarely moves in a straight line. Instead, it trends in waves made of impulses and pullbacks.

In trending markets:

Buy pullbacks during bullish phases

Sell rallies during bearish phases

Avoid trading against momentum

A pullback is not a reversal. It is often just profit taking before the next move. Many traders lose money by selling strong uptrends too early. The safer approach is waiting for price to return to support inside the trend.

Gold Example trade (bullish trend):

Gold breaks above a major resistance at 2,350 after weak inflation data. The daily chart shows higher highs forming. Instead of buying the breakout candle, a trader waits.

Price pulls back to 2,330, which was previous resistance and now acts as support. On the 4H chart, candles slow down and buyers step back in. A bullish structure forms with a higher low.

Entry: Buy near 2,332 after confirmation.

Stop loss: Below the pullback low at 2,318.

Target: Previous high near 2,380 or trend continuation.

The idea is simple. Trade with institutional flow, not against it. Trends often continue longer than expected, which is why patience during pullbacks produces cleaner entries.

Gold trends often last weeks once institutions align. Many traders consider trend continuation setups part of the best strategy to trade gold because momentum supports cleaner entries.

2. Range Markets and Gold Forex Trading Strategies

Sometimes uncertainty freezes direction. Price moves between clear highs and lows without commitment. Buyers and sellers stay balanced, which keeps gold trapped inside a visible box on the chart.

During ranges:

Buy near support

Sell near resistance

Take smaller targets

Range markets reward patience more than speed. Many gold forex trading strategies rely on range reactions when macro direction remains unclear. Price often rejects the same levels several times before a real breakout happens. Traders who enter in the middle of the range usually get stuck in choppy movement.

Gold Strategy Example trade (range market):

Gold trades between 2,300 resistance and 2,270 support for several days. The daily chart shows no clear trend, and candles keep rejecting both edges.

Price drops toward 2,272 and slows near support. On the 1H chart, selling pressure weakens and small bullish candles begin forming.

Entry: Buy near 2,274 after rejection confirmation.

Stop loss: Below range support at 2,262.

Target: Mid‑range at 2,285 or resistance near 2,300.

The goal is not catching a huge move. Range trading focuses on repeated reactions between levels. Many traders lose money by chasing breakouts that fail. Waiting for price to reach the edges usually provides cleaner and lower‑risk setups.

3. Breakout Conditions Within a Profitable Gold Trading Strategy

Gold often compresses before large moves. Volatility drops, candles tighten, and liquidity builds near key levels. This phase looks quiet, but it usually means the market is preparing for expansion. Buyers and sellers stack orders around the same price, creating pressure that eventually releases.

When price finally breaks:

Moves can be fast and aggressive

Late entries become risky

Retests often give safer entries

A true breakout usually comes with strong momentum and little hesitation. Price leaves the range quickly because liquidity above or below the level gets triggered at once.

Forex Gold Example trade (breakout setup):

Gold trades between 2,380 and 2,400 for several sessions. Candles become smaller and volatility drops. Traders begin watching the 2,400 resistance level closely.

After US inflation data comes weaker than expected, gold breaks above 2,400 with strong bullish candles. Instead of chasing the move, a trader waits for a pullback.

Price retests the breakout level near 2,402 and holds as support. Buyers step in again and momentum returns.

Entry: Buy near 2,404 after confirmation.

Stop loss: Below the retest low at 2,392.

Target: Expansion toward 2,440 based on range height projection.

The key idea is patience. Breakouts reward traders who wait for confirmation, not those who chase the first candle. A profitable gold trading strategy often focuses on confirmed expansion rather than early prediction. Breakouts usually follow major news or shifts in expectations.

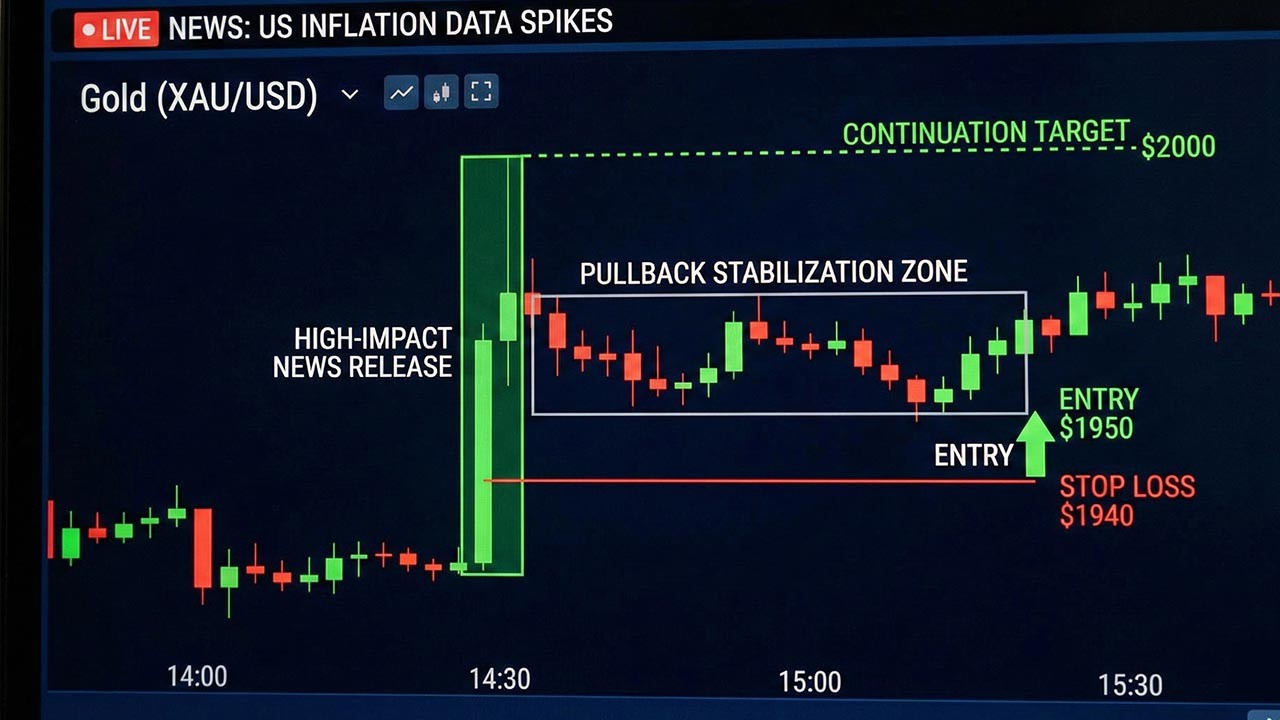

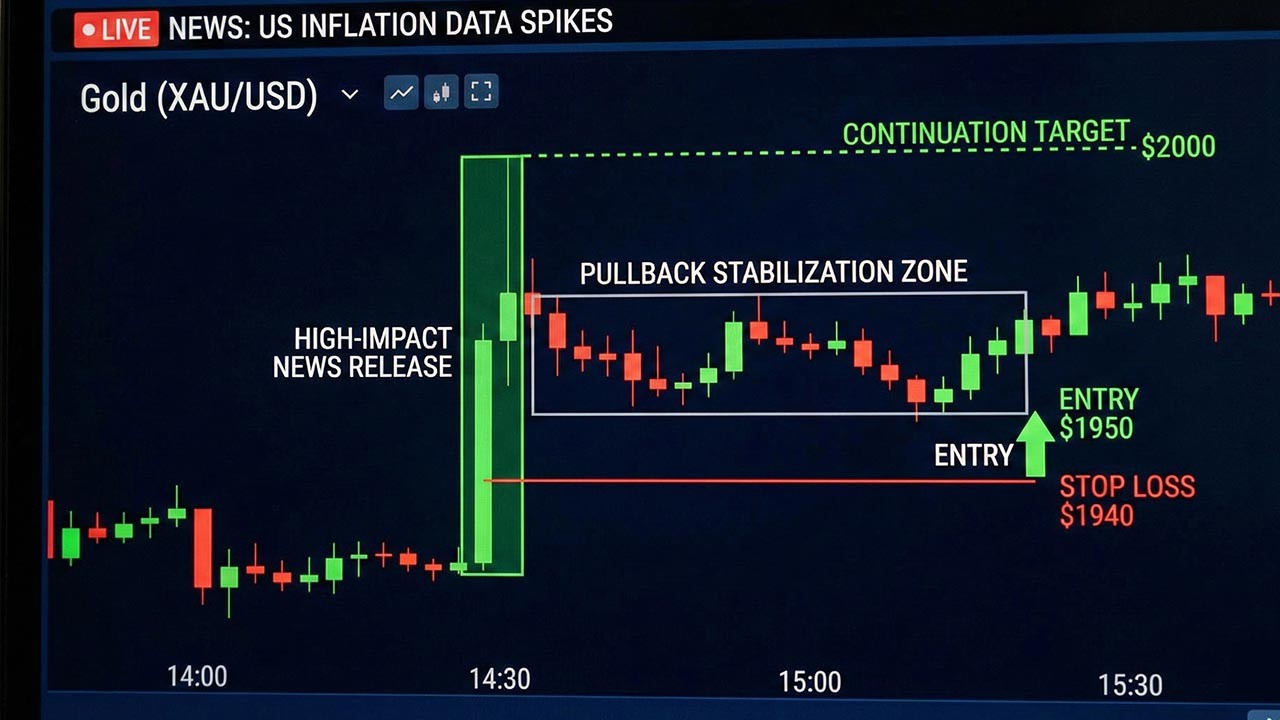

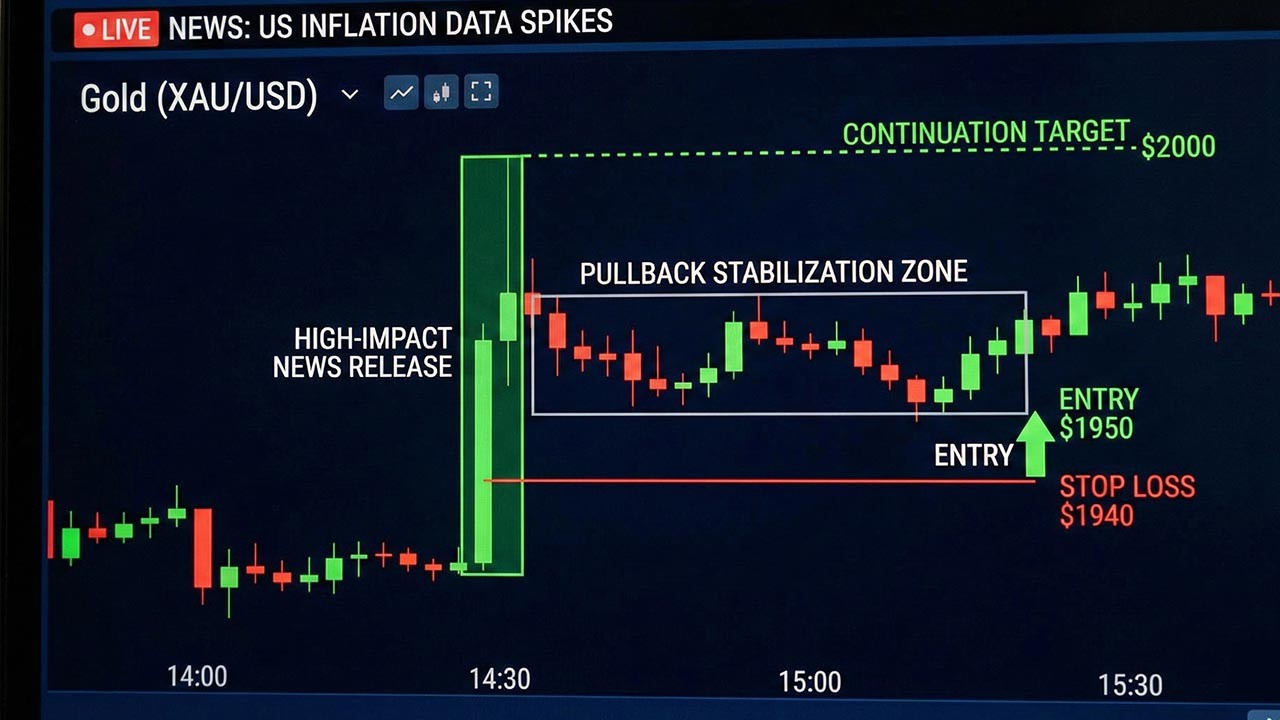

4. News-Driven Volatility

Economic releases create sharp spikes. During major announcements, liquidity increases suddenly and price can move without clear pullbacks. Spreads may widen and candles can travel large distances within seconds.

Key events include:

CPI inflation data

Non-Farm Payrolls

Federal Reserve statements

Unexpected geopolitical news

News trading is less about prediction and more about reaction. The first move is often emotional, while the second move shows real direction once liquidity settles.

Example trade (news volatility setup):

Gold trades calmly near 2,360 before a US CPI release. Inflation prints lower than expected and price spikes quickly to 2,390 within minutes. Many traders chase the move and enter late.

Instead of buying the spike, a trader waits. Price pulls back toward 2,375 as early buyers take profit. On the lower timeframe, selling slows and buyers defend the level.

Entry: Buy near 2,378 after price stabilizes.

Stop loss: Below pullback support at 2,365.

Target: Continuation toward 2,410 if momentum resumes.

Gold can move violently within minutes. Traders should reduce position size, avoid emotional entries, or stay flat until volatility settles after major releases.

Reading Liquidity and Market Structure for the Best Gold Trading Strategy

Gold respects liquidity zones. These are areas where many orders sit.

Price often sweeps a level before reversing. This traps impatient traders and fuels the next move.

A common pattern looks like this:

Price breaks above resistance briefly

Traders enter late

Market reverses sharply

New trend begins

Waiting for structure confirmation reduces false entries.

Look for higher highs and higher lows in bullish markets. Watch for lower highs in bearish conditions.

Simple structure reading often works better than complex indicators. Many experienced traders build their gold strategy trading approach around liquidity behavior instead of indicator signals.

XAU/USD Multi-Timeframe Analysis

Gold trading improves when traders zoom out first.

Start with the daily chart. Mark major highs, lows, and trend direction. This shows where institutions are active.

Move to the four-hour chart. Look for pullbacks or consolidation areas.

Use lower timeframes only for entry timing.

Many losses happen when traders focus only on small charts. A five-minute signal against a daily trend often fails.

The larger timeframe controls the story. This approach is common among traders who hold positions longer and focus on structure rather than noise, which is why many gold traders adopt principles similar to swing trading forex.

Best Trading Sessions for Gold

Gold trades all day, but not all hours are equal.

The strongest moves usually appear during:

London session

New York session

London–New York overlap

This period brings the highest liquidity. Institutional orders drive cleaner trends and clearer setups.

Asian session moves tend to be slower and less reliable for breakout trading.

Timing alone can improve trade quality.

Indicators: Keep Them Simple

Indicators can help, but they should confirm decisions, not create them.

Common tools used by gold traders include:

Moving averages for trend direction

RSI for momentum exhaustion

Fibonacci levels for pullbacks

Too many indicators create confusion. Price action should remain the main guide.

If indicators disagree with price structure, trust price.

Risk Management in a Volatile Market for a Profitable Gold Trading Strategy

Gold volatility increased into 2026. Risk control matters more than accuracy.

Key rules include:

Risk a small percentage per trade

Place stops beyond logical levels

Avoid revenge trading after losses

Accept missed trades calmly

Gold can spike quickly during news events. Tight stops placed randomly often get hit.

Plan risk before entering, not after. Traders who want a clearer framework for managing exits often rely on structured rules for stop placement and targets, which are explained in detail in this guide on stop loss and take profit trading.

Consistency comes from protecting capital. Without risk control, even the best gold trading strategy fails over time. These habits become even more important when traders operate under evaluation rules, where discipline and drawdown control decide whether a trader can successfully pass a forex prop firm challenge.

Psychology: The Hidden Strategy

Many traders know setups but fail due to emotion.

Gold creates strong reactions because moves feel urgent. Traders chase candles and enter late - that ends up ruining traders’ emotions, hence entering biased.

Common mistakes include:

Entering after large moves

Moving stop losses emotionally

Overtrading during volatile sessions

Ignoring trading plans

Patience often produces better results than activity.

A good strategy works only when followed consistently. Many of these mistakes come from skipping trading fundamentals early on, which is why revisiting core habits covered in these forex trading tips for beginners can help traders rebuild discipline.

Building a Flexible Gold Trading Plan Using Modern Gold Trading Strategy Principles

A strong 2026 strategy is not one setup. It is a decision process. Many traders eventually turn this process into a structured trading plan for a funded account, where rules help remove emotional decisions during volatile markets.

A practical workflow looks like this:

Check macro sentiment for the week

Identify market condition

Mark key liquidity zones

Wait for price reaction

Confirm structure shift

Enter with defined risk

This approach adapts to changing volatility instead of fighting it. Adaptability is what separates an average system from a best gold trading strategy used consistently by skilled traders.

Common Mistakes Traders Make With Gold

Many losses come from misunderstanding gold behavior.

Frequent errors include:

Treating gold like a currency pair

Trading without macro awareness

Overusing indicators

Ignoring session timing

Risking too much during news events

Gold rewards patience and planning more than speed.

Why Adaptation Is the Real Edge in 2026

Markets change faster today. Algorithms, institutional flow, and global news move price quickly.

Rigid strategies struggle because conditions shift often.

Successful traders focus on reading environment first. They adjust tactics instead of forcing trades.

Trend traders wait for momentum. Range traders stay selective. Breakout traders wait for confirmation.

Flexibility keeps traders aligned with market behavior.

Final Thoughts on Developing a Gold Trading Strategy in 2026

Gold trading in 2026 is about awareness and control. Volatility creates opportunity, but also risk.

The strongest traders follow a simple structure:

Understand macro sentiment.

Identify market condition.

Wait for price confirmation.

Manage risk carefully.

There is no perfect indicator or fixed system. Adaptation remains the most reliable strategy. Traders who refine their gold trading strategy over time often achieve more stable results than those searching for a single perfect setup.

Many traders develop and test these habits while trading with firms like Pipstone Capital, where structured rules encourage discipline and consistent execution.

Gold will continue to react to uncertainty and global change. Traders who stay patient and flexible can use that volatility to their advantage.

FAQ: Gold Trading Strategies

What is the best gold trading strategy in 2026?

There isn’t one fixed method that works all the time. The traders who do well adjust to the market first, then trade trends, ranges, or breakouts only when price clearly supports the idea.

Is gold good for forex trading strategies?

Yes. Gold moves often and reacts strongly to news, which gives traders regular opportunities. Many traders like it because levels tend to respect liquidity and momentum shows clearly.

Can beginners use a gold trading strategy successfully?

Yes, but simplicity matters. Focus on clear support and resistance, keep risk small, and avoid jumping into fast moves. Trading less often usually leads to better decisions.

What makes a profitable gold trading strategy?

A profitable gold trading strategy combines market context, patience, and strict risk management. Consistency matters more than finding perfect entries.

When is the best time to trade gold?

The London and New York session overlap usually provides the strongest moves. Liquidity increases and trends become clearer during this period.

Do indicators work in gold strategy trading?

Indicators can help confirm direction, but price structure should lead decisions. Most experienced traders keep indicators simple and focus on market behavior.

Gold Trading Strategy in 2026: Adapting to Market Volatility

Feb 18, 2026

Gold has always held a special place in trading. In 2026, that role feels even stronger. Traders are no longer treating gold like a simple commodity. It now behaves more like a reaction to fear, policy changes, and global money flow.

Price moves faster than before. Trends form quickly and can reverse without warning. This forces traders to adjust how they approach XAUUSD. Old fixed strategies no longer work on their own. Adaptation is now the real edge.

This guide explains how gold behaves in 2026 and how traders can adjust their strategy to match market volatility. It presents a practical gold trading strategy that reflects how professionals approach modern markets. Throughout this article, you will see how a best gold trading strategy is built from context, timing, and discipline rather than indicators alone.

Why Gold Moves Differently in 2026

Gold reacts to confidence. When markets feel uncertain, money moves into gold. When risk appetite rises, gold often slows or pulls back.

Several forces drive price action today:

Interest rate expectations

Inflation fears

Central bank decisions

Geopolitical tension

Strength or weakness of the US dollar

Gold often moves before news becomes official. Traders react to expectations, not just outcomes. A hint of policy change can move price hundreds of pips.

This means traders must watch the bigger picture first. Charts alone are not enough.

The Core Rule: Macro First, Technicals Second in a Gold Trading Strategy

Many beginners start with indicators. Professional traders begin with context. Every profitable gold trading strategy starts with understanding why price moves before deciding how to trade it.

Before entering any trade, ask one question:

Is the market seeking safety or risk?

If fear dominates, gold usually trends higher. If markets chase growth, gold may struggle or move sideways.

Once bias is clear, technical analysis helps find timing. Support and resistance levels become entry zones, not prediction tools.

This simple order matters:

Understand market mood

Choose direction bias

Wait for price confirmation

Enter with controlled risk

Skipping the first step leads to poor trades.

Understanding Market Conditions in 2026

Gold no longer stays in one behavior for long. Traders must identify the current market type.

There are four main environments.

1. Trending Markets in Gold Strategy Trading

Strong trends appear when macro pressure builds. Rate cuts, inflation shocks, or crisis events can push gold steadily higher. When large funds move into gold, price rarely moves in a straight line. Instead, it trends in waves made of impulses and pullbacks.

In trending markets:

Buy pullbacks during bullish phases

Sell rallies during bearish phases

Avoid trading against momentum

A pullback is not a reversal. It is often just profit taking before the next move. Many traders lose money by selling strong uptrends too early. The safer approach is waiting for price to return to support inside the trend.

Gold Example trade (bullish trend):

Gold breaks above a major resistance at 2,350 after weak inflation data. The daily chart shows higher highs forming. Instead of buying the breakout candle, a trader waits.

Price pulls back to 2,330, which was previous resistance and now acts as support. On the 4H chart, candles slow down and buyers step back in. A bullish structure forms with a higher low.

Entry: Buy near 2,332 after confirmation.

Stop loss: Below the pullback low at 2,318.

Target: Previous high near 2,380 or trend continuation.

The idea is simple. Trade with institutional flow, not against it. Trends often continue longer than expected, which is why patience during pullbacks produces cleaner entries.

Gold trends often last weeks once institutions align. Many traders consider trend continuation setups part of the best strategy to trade gold because momentum supports cleaner entries.

2. Range Markets and Gold Forex Trading Strategies

Sometimes uncertainty freezes direction. Price moves between clear highs and lows without commitment. Buyers and sellers stay balanced, which keeps gold trapped inside a visible box on the chart.

During ranges:

Buy near support

Sell near resistance

Take smaller targets

Range markets reward patience more than speed. Many gold forex trading strategies rely on range reactions when macro direction remains unclear. Price often rejects the same levels several times before a real breakout happens. Traders who enter in the middle of the range usually get stuck in choppy movement.

Gold Strategy Example trade (range market):

Gold trades between 2,300 resistance and 2,270 support for several days. The daily chart shows no clear trend, and candles keep rejecting both edges.

Price drops toward 2,272 and slows near support. On the 1H chart, selling pressure weakens and small bullish candles begin forming.

Entry: Buy near 2,274 after rejection confirmation.

Stop loss: Below range support at 2,262.

Target: Mid‑range at 2,285 or resistance near 2,300.

The goal is not catching a huge move. Range trading focuses on repeated reactions between levels. Many traders lose money by chasing breakouts that fail. Waiting for price to reach the edges usually provides cleaner and lower‑risk setups.

3. Breakout Conditions Within a Profitable Gold Trading Strategy

Gold often compresses before large moves. Volatility drops, candles tighten, and liquidity builds near key levels. This phase looks quiet, but it usually means the market is preparing for expansion. Buyers and sellers stack orders around the same price, creating pressure that eventually releases.

When price finally breaks:

Moves can be fast and aggressive

Late entries become risky

Retests often give safer entries

A true breakout usually comes with strong momentum and little hesitation. Price leaves the range quickly because liquidity above or below the level gets triggered at once.

Forex Gold Example trade (breakout setup):

Gold trades between 2,380 and 2,400 for several sessions. Candles become smaller and volatility drops. Traders begin watching the 2,400 resistance level closely.

After US inflation data comes weaker than expected, gold breaks above 2,400 with strong bullish candles. Instead of chasing the move, a trader waits for a pullback.

Price retests the breakout level near 2,402 and holds as support. Buyers step in again and momentum returns.

Entry: Buy near 2,404 after confirmation.

Stop loss: Below the retest low at 2,392.

Target: Expansion toward 2,440 based on range height projection.

The key idea is patience. Breakouts reward traders who wait for confirmation, not those who chase the first candle. A profitable gold trading strategy often focuses on confirmed expansion rather than early prediction. Breakouts usually follow major news or shifts in expectations.

4. News-Driven Volatility

Economic releases create sharp spikes. During major announcements, liquidity increases suddenly and price can move without clear pullbacks. Spreads may widen and candles can travel large distances within seconds.

Key events include:

CPI inflation data

Non-Farm Payrolls

Federal Reserve statements

Unexpected geopolitical news

News trading is less about prediction and more about reaction. The first move is often emotional, while the second move shows real direction once liquidity settles.

Example trade (news volatility setup):

Gold trades calmly near 2,360 before a US CPI release. Inflation prints lower than expected and price spikes quickly to 2,390 within minutes. Many traders chase the move and enter late.

Instead of buying the spike, a trader waits. Price pulls back toward 2,375 as early buyers take profit. On the lower timeframe, selling slows and buyers defend the level.

Entry: Buy near 2,378 after price stabilizes.

Stop loss: Below pullback support at 2,365.

Target: Continuation toward 2,410 if momentum resumes.

Gold can move violently within minutes. Traders should reduce position size, avoid emotional entries, or stay flat until volatility settles after major releases.

Reading Liquidity and Market Structure for the Best Gold Trading Strategy

Gold respects liquidity zones. These are areas where many orders sit.

Price often sweeps a level before reversing. This traps impatient traders and fuels the next move.

A common pattern looks like this:

Price breaks above resistance briefly

Traders enter late

Market reverses sharply

New trend begins

Waiting for structure confirmation reduces false entries.

Look for higher highs and higher lows in bullish markets. Watch for lower highs in bearish conditions.

Simple structure reading often works better than complex indicators. Many experienced traders build their gold strategy trading approach around liquidity behavior instead of indicator signals.

XAU/USD Multi-Timeframe Analysis

Gold trading improves when traders zoom out first.

Start with the daily chart. Mark major highs, lows, and trend direction. This shows where institutions are active.

Move to the four-hour chart. Look for pullbacks or consolidation areas.

Use lower timeframes only for entry timing.

Many losses happen when traders focus only on small charts. A five-minute signal against a daily trend often fails.

The larger timeframe controls the story. This approach is common among traders who hold positions longer and focus on structure rather than noise, which is why many gold traders adopt principles similar to swing trading forex.

Best Trading Sessions for Gold

Gold trades all day, but not all hours are equal.

The strongest moves usually appear during:

London session

New York session

London–New York overlap

This period brings the highest liquidity. Institutional orders drive cleaner trends and clearer setups.

Asian session moves tend to be slower and less reliable for breakout trading.

Timing alone can improve trade quality.

Indicators: Keep Them Simple

Indicators can help, but they should confirm decisions, not create them.

Common tools used by gold traders include:

Moving averages for trend direction

RSI for momentum exhaustion

Fibonacci levels for pullbacks

Too many indicators create confusion. Price action should remain the main guide.

If indicators disagree with price structure, trust price.

Risk Management in a Volatile Market for a Profitable Gold Trading Strategy

Gold volatility increased into 2026. Risk control matters more than accuracy.

Key rules include:

Risk a small percentage per trade

Place stops beyond logical levels

Avoid revenge trading after losses

Accept missed trades calmly

Gold can spike quickly during news events. Tight stops placed randomly often get hit.

Plan risk before entering, not after. Traders who want a clearer framework for managing exits often rely on structured rules for stop placement and targets, which are explained in detail in this guide on stop loss and take profit trading.

Consistency comes from protecting capital. Without risk control, even the best gold trading strategy fails over time. These habits become even more important when traders operate under evaluation rules, where discipline and drawdown control decide whether a trader can successfully pass a forex prop firm challenge.

Psychology: The Hidden Strategy

Many traders know setups but fail due to emotion.

Gold creates strong reactions because moves feel urgent. Traders chase candles and enter late - that ends up ruining traders’ emotions, hence entering biased.

Common mistakes include:

Entering after large moves

Moving stop losses emotionally

Overtrading during volatile sessions

Ignoring trading plans

Patience often produces better results than activity.

A good strategy works only when followed consistently. Many of these mistakes come from skipping trading fundamentals early on, which is why revisiting core habits covered in these forex trading tips for beginners can help traders rebuild discipline.

Building a Flexible Gold Trading Plan Using Modern Gold Trading Strategy Principles

A strong 2026 strategy is not one setup. It is a decision process. Many traders eventually turn this process into a structured trading plan for a funded account, where rules help remove emotional decisions during volatile markets.

A practical workflow looks like this:

Check macro sentiment for the week

Identify market condition

Mark key liquidity zones

Wait for price reaction

Confirm structure shift

Enter with defined risk

This approach adapts to changing volatility instead of fighting it. Adaptability is what separates an average system from a best gold trading strategy used consistently by skilled traders.

Common Mistakes Traders Make With Gold

Many losses come from misunderstanding gold behavior.

Frequent errors include:

Treating gold like a currency pair

Trading without macro awareness

Overusing indicators

Ignoring session timing

Risking too much during news events

Gold rewards patience and planning more than speed.

Why Adaptation Is the Real Edge in 2026

Markets change faster today. Algorithms, institutional flow, and global news move price quickly.

Rigid strategies struggle because conditions shift often.

Successful traders focus on reading environment first. They adjust tactics instead of forcing trades.

Trend traders wait for momentum. Range traders stay selective. Breakout traders wait for confirmation.

Flexibility keeps traders aligned with market behavior.

Final Thoughts on Developing a Gold Trading Strategy in 2026

Gold trading in 2026 is about awareness and control. Volatility creates opportunity, but also risk.

The strongest traders follow a simple structure:

Understand macro sentiment.

Identify market condition.

Wait for price confirmation.

Manage risk carefully.

There is no perfect indicator or fixed system. Adaptation remains the most reliable strategy. Traders who refine their gold trading strategy over time often achieve more stable results than those searching for a single perfect setup.

Many traders develop and test these habits while trading with firms like Pipstone Capital, where structured rules encourage discipline and consistent execution.

Gold will continue to react to uncertainty and global change. Traders who stay patient and flexible can use that volatility to their advantage.

FAQ: Gold Trading Strategies

What is the best gold trading strategy in 2026?

There isn’t one fixed method that works all the time. The traders who do well adjust to the market first, then trade trends, ranges, or breakouts only when price clearly supports the idea.

Is gold good for forex trading strategies?

Yes. Gold moves often and reacts strongly to news, which gives traders regular opportunities. Many traders like it because levels tend to respect liquidity and momentum shows clearly.

Can beginners use a gold trading strategy successfully?

Yes, but simplicity matters. Focus on clear support and resistance, keep risk small, and avoid jumping into fast moves. Trading less often usually leads to better decisions.

What makes a profitable gold trading strategy?

A profitable gold trading strategy combines market context, patience, and strict risk management. Consistency matters more than finding perfect entries.

When is the best time to trade gold?

The London and New York session overlap usually provides the strongest moves. Liquidity increases and trends become clearer during this period.

Do indicators work in gold strategy trading?

Indicators can help confirm direction, but price structure should lead decisions. Most experienced traders keep indicators simple and focus on market behavior.

Gold Trading Strategy in 2026: Adapting to Market Volatility

Feb 18, 2026

Gold has always held a special place in trading. In 2026, that role feels even stronger. Traders are no longer treating gold like a simple commodity. It now behaves more like a reaction to fear, policy changes, and global money flow.

Price moves faster than before. Trends form quickly and can reverse without warning. This forces traders to adjust how they approach XAUUSD. Old fixed strategies no longer work on their own. Adaptation is now the real edge.

This guide explains how gold behaves in 2026 and how traders can adjust their strategy to match market volatility. It presents a practical gold trading strategy that reflects how professionals approach modern markets. Throughout this article, you will see how a best gold trading strategy is built from context, timing, and discipline rather than indicators alone.

Why Gold Moves Differently in 2026

Gold reacts to confidence. When markets feel uncertain, money moves into gold. When risk appetite rises, gold often slows or pulls back.

Several forces drive price action today:

Interest rate expectations

Inflation fears

Central bank decisions

Geopolitical tension

Strength or weakness of the US dollar

Gold often moves before news becomes official. Traders react to expectations, not just outcomes. A hint of policy change can move price hundreds of pips.

This means traders must watch the bigger picture first. Charts alone are not enough.

The Core Rule: Macro First, Technicals Second in a Gold Trading Strategy

Many beginners start with indicators. Professional traders begin with context. Every profitable gold trading strategy starts with understanding why price moves before deciding how to trade it.

Before entering any trade, ask one question:

Is the market seeking safety or risk?

If fear dominates, gold usually trends higher. If markets chase growth, gold may struggle or move sideways.

Once bias is clear, technical analysis helps find timing. Support and resistance levels become entry zones, not prediction tools.

This simple order matters:

Understand market mood

Choose direction bias

Wait for price confirmation

Enter with controlled risk

Skipping the first step leads to poor trades.

Understanding Market Conditions in 2026

Gold no longer stays in one behavior for long. Traders must identify the current market type.

There are four main environments.

1. Trending Markets in Gold Strategy Trading

Strong trends appear when macro pressure builds. Rate cuts, inflation shocks, or crisis events can push gold steadily higher. When large funds move into gold, price rarely moves in a straight line. Instead, it trends in waves made of impulses and pullbacks.

In trending markets:

Buy pullbacks during bullish phases

Sell rallies during bearish phases

Avoid trading against momentum

A pullback is not a reversal. It is often just profit taking before the next move. Many traders lose money by selling strong uptrends too early. The safer approach is waiting for price to return to support inside the trend.

Gold Example trade (bullish trend):

Gold breaks above a major resistance at 2,350 after weak inflation data. The daily chart shows higher highs forming. Instead of buying the breakout candle, a trader waits.

Price pulls back to 2,330, which was previous resistance and now acts as support. On the 4H chart, candles slow down and buyers step back in. A bullish structure forms with a higher low.

Entry: Buy near 2,332 after confirmation.

Stop loss: Below the pullback low at 2,318.

Target: Previous high near 2,380 or trend continuation.

The idea is simple. Trade with institutional flow, not against it. Trends often continue longer than expected, which is why patience during pullbacks produces cleaner entries.

Gold trends often last weeks once institutions align. Many traders consider trend continuation setups part of the best strategy to trade gold because momentum supports cleaner entries.

2. Range Markets and Gold Forex Trading Strategies

Sometimes uncertainty freezes direction. Price moves between clear highs and lows without commitment. Buyers and sellers stay balanced, which keeps gold trapped inside a visible box on the chart.

During ranges:

Buy near support

Sell near resistance

Take smaller targets

Range markets reward patience more than speed. Many gold forex trading strategies rely on range reactions when macro direction remains unclear. Price often rejects the same levels several times before a real breakout happens. Traders who enter in the middle of the range usually get stuck in choppy movement.

Gold Strategy Example trade (range market):

Gold trades between 2,300 resistance and 2,270 support for several days. The daily chart shows no clear trend, and candles keep rejecting both edges.

Price drops toward 2,272 and slows near support. On the 1H chart, selling pressure weakens and small bullish candles begin forming.

Entry: Buy near 2,274 after rejection confirmation.

Stop loss: Below range support at 2,262.

Target: Mid‑range at 2,285 or resistance near 2,300.

The goal is not catching a huge move. Range trading focuses on repeated reactions between levels. Many traders lose money by chasing breakouts that fail. Waiting for price to reach the edges usually provides cleaner and lower‑risk setups.

3. Breakout Conditions Within a Profitable Gold Trading Strategy

Gold often compresses before large moves. Volatility drops, candles tighten, and liquidity builds near key levels. This phase looks quiet, but it usually means the market is preparing for expansion. Buyers and sellers stack orders around the same price, creating pressure that eventually releases.

When price finally breaks:

Moves can be fast and aggressive

Late entries become risky

Retests often give safer entries

A true breakout usually comes with strong momentum and little hesitation. Price leaves the range quickly because liquidity above or below the level gets triggered at once.

Forex Gold Example trade (breakout setup):

Gold trades between 2,380 and 2,400 for several sessions. Candles become smaller and volatility drops. Traders begin watching the 2,400 resistance level closely.

After US inflation data comes weaker than expected, gold breaks above 2,400 with strong bullish candles. Instead of chasing the move, a trader waits for a pullback.

Price retests the breakout level near 2,402 and holds as support. Buyers step in again and momentum returns.

Entry: Buy near 2,404 after confirmation.

Stop loss: Below the retest low at 2,392.

Target: Expansion toward 2,440 based on range height projection.

The key idea is patience. Breakouts reward traders who wait for confirmation, not those who chase the first candle. A profitable gold trading strategy often focuses on confirmed expansion rather than early prediction. Breakouts usually follow major news or shifts in expectations.

4. News-Driven Volatility

Economic releases create sharp spikes. During major announcements, liquidity increases suddenly and price can move without clear pullbacks. Spreads may widen and candles can travel large distances within seconds.

Key events include:

CPI inflation data

Non-Farm Payrolls

Federal Reserve statements

Unexpected geopolitical news

News trading is less about prediction and more about reaction. The first move is often emotional, while the second move shows real direction once liquidity settles.

Example trade (news volatility setup):

Gold trades calmly near 2,360 before a US CPI release. Inflation prints lower than expected and price spikes quickly to 2,390 within minutes. Many traders chase the move and enter late.

Instead of buying the spike, a trader waits. Price pulls back toward 2,375 as early buyers take profit. On the lower timeframe, selling slows and buyers defend the level.

Entry: Buy near 2,378 after price stabilizes.

Stop loss: Below pullback support at 2,365.

Target: Continuation toward 2,410 if momentum resumes.

Gold can move violently within minutes. Traders should reduce position size, avoid emotional entries, or stay flat until volatility settles after major releases.

Reading Liquidity and Market Structure for the Best Gold Trading Strategy

Gold respects liquidity zones. These are areas where many orders sit.

Price often sweeps a level before reversing. This traps impatient traders and fuels the next move.

A common pattern looks like this:

Price breaks above resistance briefly

Traders enter late

Market reverses sharply

New trend begins

Waiting for structure confirmation reduces false entries.

Look for higher highs and higher lows in bullish markets. Watch for lower highs in bearish conditions.

Simple structure reading often works better than complex indicators. Many experienced traders build their gold strategy trading approach around liquidity behavior instead of indicator signals.

XAU/USD Multi-Timeframe Analysis

Gold trading improves when traders zoom out first.

Start with the daily chart. Mark major highs, lows, and trend direction. This shows where institutions are active.

Move to the four-hour chart. Look for pullbacks or consolidation areas.

Use lower timeframes only for entry timing.

Many losses happen when traders focus only on small charts. A five-minute signal against a daily trend often fails.

The larger timeframe controls the story. This approach is common among traders who hold positions longer and focus on structure rather than noise, which is why many gold traders adopt principles similar to swing trading forex.

Best Trading Sessions for Gold

Gold trades all day, but not all hours are equal.

The strongest moves usually appear during:

London session

New York session

London–New York overlap

This period brings the highest liquidity. Institutional orders drive cleaner trends and clearer setups.

Asian session moves tend to be slower and less reliable for breakout trading.

Timing alone can improve trade quality.

Indicators: Keep Them Simple

Indicators can help, but they should confirm decisions, not create them.

Common tools used by gold traders include:

Moving averages for trend direction

RSI for momentum exhaustion

Fibonacci levels for pullbacks

Too many indicators create confusion. Price action should remain the main guide.

If indicators disagree with price structure, trust price.

Risk Management in a Volatile Market for a Profitable Gold Trading Strategy

Gold volatility increased into 2026. Risk control matters more than accuracy.

Key rules include:

Risk a small percentage per trade

Place stops beyond logical levels

Avoid revenge trading after losses

Accept missed trades calmly

Gold can spike quickly during news events. Tight stops placed randomly often get hit.

Plan risk before entering, not after. Traders who want a clearer framework for managing exits often rely on structured rules for stop placement and targets, which are explained in detail in this guide on stop loss and take profit trading.

Consistency comes from protecting capital. Without risk control, even the best gold trading strategy fails over time. These habits become even more important when traders operate under evaluation rules, where discipline and drawdown control decide whether a trader can successfully pass a forex prop firm challenge.

Psychology: The Hidden Strategy

Many traders know setups but fail due to emotion.

Gold creates strong reactions because moves feel urgent. Traders chase candles and enter late - that ends up ruining traders’ emotions, hence entering biased.

Common mistakes include:

Entering after large moves

Moving stop losses emotionally

Overtrading during volatile sessions

Ignoring trading plans

Patience often produces better results than activity.

A good strategy works only when followed consistently. Many of these mistakes come from skipping trading fundamentals early on, which is why revisiting core habits covered in these forex trading tips for beginners can help traders rebuild discipline.

Building a Flexible Gold Trading Plan Using Modern Gold Trading Strategy Principles

A strong 2026 strategy is not one setup. It is a decision process. Many traders eventually turn this process into a structured trading plan for a funded account, where rules help remove emotional decisions during volatile markets.

A practical workflow looks like this:

Check macro sentiment for the week

Identify market condition

Mark key liquidity zones

Wait for price reaction

Confirm structure shift

Enter with defined risk

This approach adapts to changing volatility instead of fighting it. Adaptability is what separates an average system from a best gold trading strategy used consistently by skilled traders.

Common Mistakes Traders Make With Gold

Many losses come from misunderstanding gold behavior.

Frequent errors include:

Treating gold like a currency pair

Trading without macro awareness

Overusing indicators

Ignoring session timing

Risking too much during news events

Gold rewards patience and planning more than speed.

Why Adaptation Is the Real Edge in 2026

Markets change faster today. Algorithms, institutional flow, and global news move price quickly.

Rigid strategies struggle because conditions shift often.

Successful traders focus on reading environment first. They adjust tactics instead of forcing trades.

Trend traders wait for momentum. Range traders stay selective. Breakout traders wait for confirmation.

Flexibility keeps traders aligned with market behavior.

Final Thoughts on Developing a Gold Trading Strategy in 2026

Gold trading in 2026 is about awareness and control. Volatility creates opportunity, but also risk.

The strongest traders follow a simple structure:

Understand macro sentiment.

Identify market condition.

Wait for price confirmation.

Manage risk carefully.

There is no perfect indicator or fixed system. Adaptation remains the most reliable strategy. Traders who refine their gold trading strategy over time often achieve more stable results than those searching for a single perfect setup.

Many traders develop and test these habits while trading with firms like Pipstone Capital, where structured rules encourage discipline and consistent execution.

Gold will continue to react to uncertainty and global change. Traders who stay patient and flexible can use that volatility to their advantage.

FAQ: Gold Trading Strategies

What is the best gold trading strategy in 2026?

There isn’t one fixed method that works all the time. The traders who do well adjust to the market first, then trade trends, ranges, or breakouts only when price clearly supports the idea.

Is gold good for forex trading strategies?

Yes. Gold moves often and reacts strongly to news, which gives traders regular opportunities. Many traders like it because levels tend to respect liquidity and momentum shows clearly.

Can beginners use a gold trading strategy successfully?

Yes, but simplicity matters. Focus on clear support and resistance, keep risk small, and avoid jumping into fast moves. Trading less often usually leads to better decisions.

What makes a profitable gold trading strategy?

A profitable gold trading strategy combines market context, patience, and strict risk management. Consistency matters more than finding perfect entries.

When is the best time to trade gold?

The London and New York session overlap usually provides the strongest moves. Liquidity increases and trends become clearer during this period.

Do indicators work in gold strategy trading?

Indicators can help confirm direction, but price structure should lead decisions. Most experienced traders keep indicators simple and focus on market behavior.