What Is Gapping in Trading? How Prop Traders Handle Gaps in Forex

Oct 20, 2025

Many traders ask, what is gapping in trading, and how does it affect forex markets?

In simple terms, gapping happens when a price jumps from one level to another without any trades in between. On a chart, it looks like a blank space or “gap.”

Even though forex trades 24 hours a day, five days a week, gapping in trading still occurs. It usually happens after weekends or long holidays when news or market events push price sharply up or down.

For prop traders, gaps are part of the job. They bring both risk and opportunity. The difference lies in how a trader reacts and manages exposure.

What Is Gapping in Forex?

Before diving into how prop traders deal with it, let’s answer the question: What Is Gapping in Forex?

A gap in forex is when a currency pair opens at a different price from its previous close — leaving a visible space on the chart. For instance, if EUR/USD closes at 1.0850 on Friday and opens at 1.0900 on Monday, that’s a gap up. If it opens at 1.0800, it’s a gap down.

So, what is gapping in forex trading really about? It’s the result of price reacting to new events while the market is closed. Central banks, hedge funds, or large investors may act on weekend news, causing sharp price changes when the market opens again.

While gapping is common in stocks, it still matters in forex - especially for swing traders or funded prop traders who hold trades over the weekend.

What Causes Gapping in Trading?

There are several reasons why gapping in trading occurs, especially in forex:

Weekend News and Events

Political news, economic data, or central bank decisions often break over the weekend. When markets reopen, traders adjust instantly to the new sentiment.

Global Shocks

Sudden events like conflicts, natural disasters, or global policy changes cause markets to reprice currencies fast.

Low Liquidity

When there are fewer open orders — such as during holidays or quiet sessions — prices can jump more easily between levels.

Institutional Positioning

Big investors often adjust or hedge their portfolios during market breaks. This can drive large price gaps when trading resumes.

That’s why what is gapping in trading is such a key concept to understand: it reveals how sensitive markets are to surprise information.

Types of Gaps in Forex Trading

Knowing the different kinds of gaps helps traders judge whether to follow or fade the move. Here are the four main types often seen when learning what is gapping in forex trading:

1. Common Gaps

These appear inside a trading range or during quiet sessions. They’re usually small and tend to fill quickly. Traders view them as short-term imbalances. To interpret these areas correctly, it helps to understand how to read forex charts like a pro.

2. Breakaway Gaps

Breakaway gaps occur when price jumps out of a strong support or resistance zone. They mark the start of a new trend and usually stay open longer.

3. Continuation (Runaway) Gaps

These gaps happen in the middle of a trend, showing strong momentum. Traders often ride them, expecting the current move to continue.

4. Exhaustion Gaps

Exhaustion gaps appear near the end of a trend. Price may jump in the direction of the trend but soon reverse. They often hint at a possible change in direction.

Understanding these helps traders see how gapping in trading connects to broader market psychology - optimism, panic, or exhaustion.

What Does It Mean When a Gap “Fills”?

In what is gapping in trading, one common term is the “gap fill.”

A gap fill happens when price moves back to the pre-gap level.

For example, if EUR/USD gaps up on Monday but drifts back down to Friday’s close, that’s a filled gap. Many traders believe gaps must fill, but not all do.

Fast fills usually mean the market overreacted to news.

Slow fills or no fills suggest strong continuation and conviction.

Prop traders pay close attention to gap fills because they often become key support or resistance zones later.

Why Gapping in Forex Matters

Even a small gap can shake a trader’s plan. Imagine holding a buy trade on Friday with a stop at 1.0800. The market opens on Monday at 1.0780 - skipping your stop level. The loss ends up larger than expected. That’s called slippage, a common risk in gapping in trading.

Slippage occurs when orders get executed at worse prices because the market jumps past them. This is why experienced prop traders plan carefully around weekend closes and major news. Learn how to control this risk by reading Margin vs Leverage.

Gaps also create emotional stress. Many traders panic when they see a price far from their entry or stop. Prop traders, on the other hand, expect it and manage it like any other market move.

How Prop Traders Handle Gaps in Forex

Prop traders who understand what is gapping in forex follow clear systems. They focus on preparation and risk management, not luck.

Here’s how they do it.

1. Reduce Exposure Before the Weekend

Most professional traders close or reduce positions before Friday’s close, especially when key data or central bank speeches are scheduled.

2. Keep Position Size Small

If they must hold over the weekend, they trade smaller. A smaller position limits damage if the market gaps sharply on Monday.

3. Avoid Thinly Traded Pairs

Illiquid pairs — such as exotic currencies — are prone to larger gaps. Prop traders focus on majors like EUR/USD, GBP/USD, or USD/JPY to stay safer. For more insight which currency pairs to trade on, check best pairs to trade in forex for Consistent Profits.

4. Wait for Market Confirmation

After a gap, they wait for price action to show direction. They don’t guess. If the market confirms continuation, they trade with it. If it fades, they take the opposite side.

5. Track and Review

Prop traders log every gap they trade - noting the time, size, and outcome. Over time, this data helps them recognize which gaps tend to fill and which extend.

How Prop Firms Manage Gap Risk

Prop trading firms like Pipstone Capital, have systems to protect both the company and its traders from gap risk. Managing gapping in trading is part of their core model.

1. Weekend Policy

Most firms limit or prohibit open trades over weekends. Some allow small positions but reduce risk allocations.

2. Daily Drawdown Rules

Even if a gap hits an account hard, the firm’s system prevents total loss by enforcing a daily or overall drawdown cap.

3. Real-Time Monitoring

Prop firms track all funded accounts in real time. If exposure becomes risky during an event, they can step in or alert traders.

4. Trader Education

Traders are taught what is gapping in forex trading and how to react. They learn to close positions before high-impact events and plan around risk.

This structure ensures traders stay disciplined and consistent - not emotional or impulsive when a gap strikes. To understand more about how prop firms structure trader development and capital allocation, read Traditional Trading vs. Prop Trading.

Gap Trading Strategies for Prop Traders

Prop traders use different methods to profit from gaps while controlling risk. Here are three reliable ones.

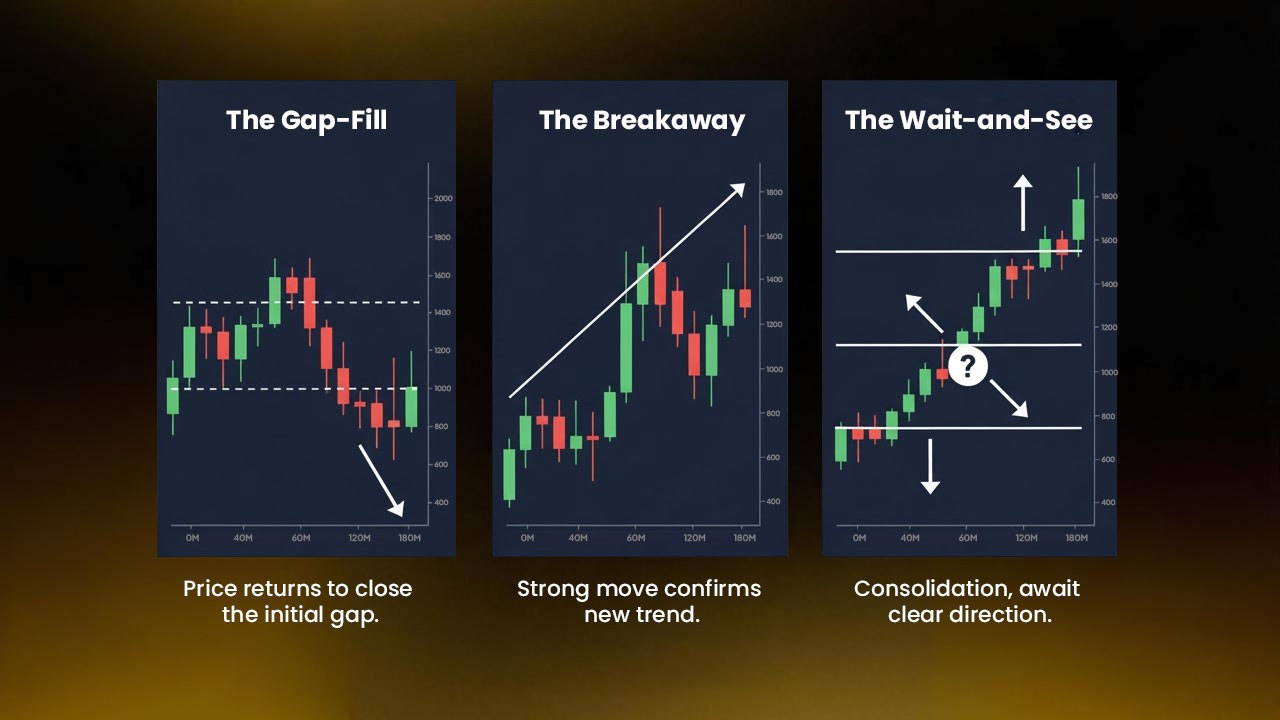

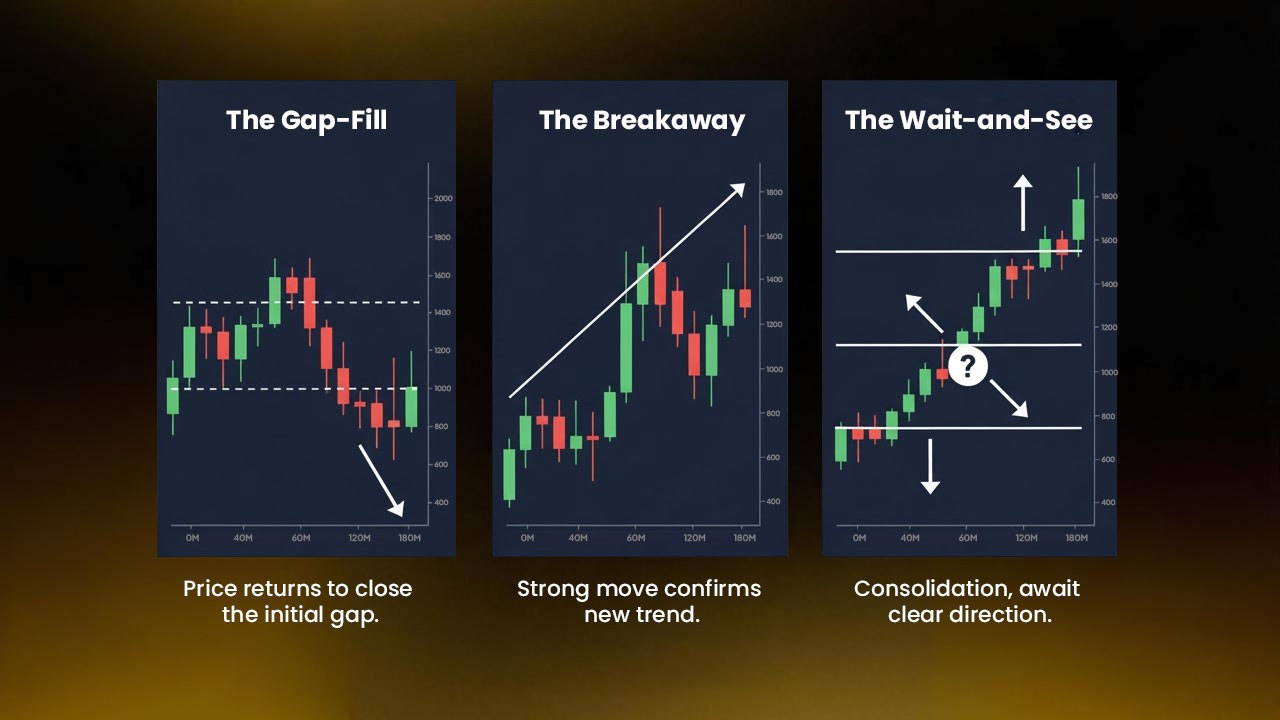

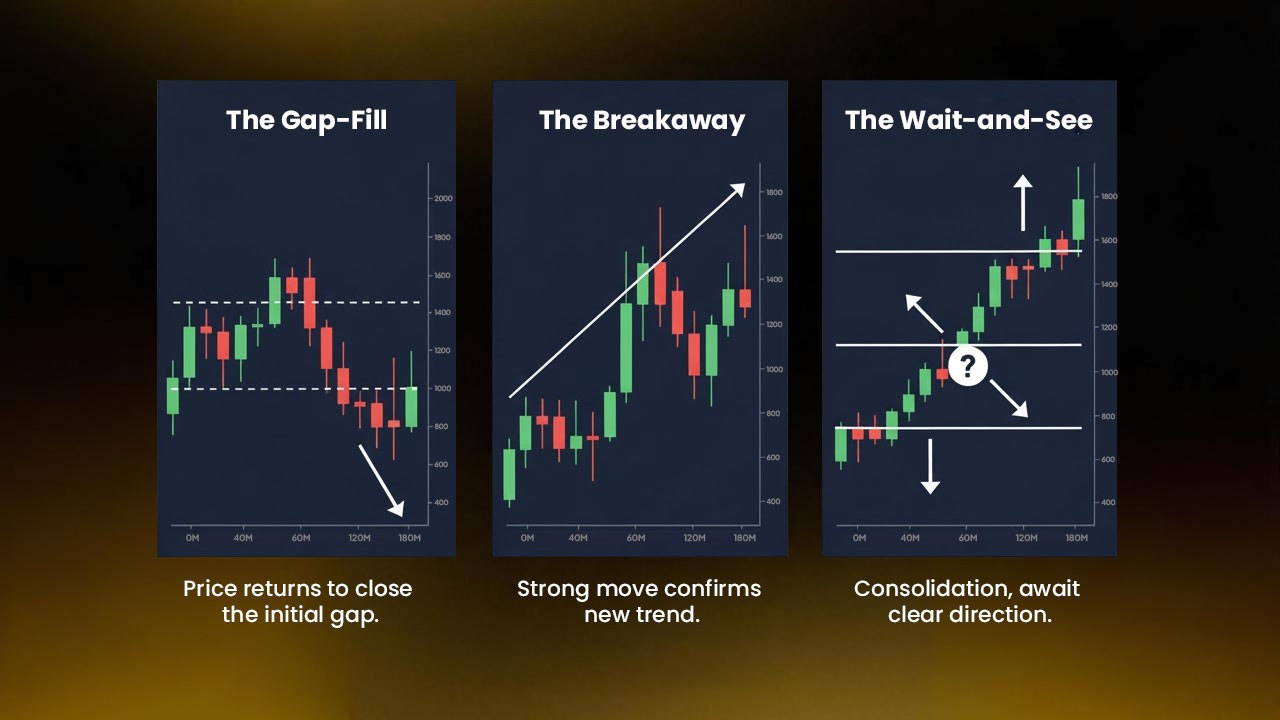

1. The Gap-Fill Setup

If a gap appears against a key support or resistance zone, traders expect it to fill. They enter once price rejects the gap edge.

This works best with common or exhaustion gaps. This works best with common or exhaustion gaps. For deeper learning, check How to Trade Using Supply and Demand in Forex.

2. The Breakaway Setup

When a major breakout occurs with strong momentum, traders follow the direction of the gap. They wait for a minor pullback to confirm the breakout, then enter in the same direction.

3. The Wait-and-See Setup

This approach is simple but smart. Traders wait one or two candles after the open. Once the market picks a side, they trade with it - not against it.

Each method balances risk and reward, proving that understanding what is gapping in trading helps in real decisions, not theory alone. To smoothly apply these gap strategies within a firm that matches your trading goals, explore How to Choose the Best Swing Trading Prop Firms.

How Prop Traders Stay Emotionally Stable During Gaps

Gaps can trigger panic or greed fast. Prop traders stay calm because they train for it and follow structure, not emotion. They practice reacting under pressure so that quick market jumps don't affect their decisions. They stick to tested systems and remember that a single gap isn’t the end of a plan but part of normal volatility.

Prop traders follow a few simple rules:

Never chase price after a gap.

Don’t move stops out of fear.

Wait for confirmation before re-entry.

Treat every gap as new information, not a disaster.

In prop trading, emotional control and routine discipline matter as much as technical skill. Staying composed lets traders follow their edge while firms like Pipstone Capital provide structure, risk tools, and funded accounts that keep them consistent.

Why Many Gaps in Forex Get Filled

If you’ve studied what is gapping in forex trading, you’ve heard the saying, “Gaps always fill.” That’s not always true, but many do. Here’s why:

Overreaction

Price may have over-adjusted to news and later corrects itself.

Liquidity Hunting

Market makers often move price back to collect pending orders near the gap.

Profit Taking

Early traders lock profits, which pushes price back into the gap area.

Still, breakaway gaps in strong trends may stay open for long periods. The trick is knowing which type you’re facing. To see how sentiment shifts drive these moves, read Bullish vs Bearish.

Pipstone Capital: Key Takeaways on Gapping in Trading and How Traders Benefit

When traders truly understand what is gapping in trading, they stop fearing it and start using it as a signal for opportunity.

At Pipstone Capital, traders can start with a $5,000 funded account challenge and trade real markets under fair rules, raw spreads, and fast payouts, all designed to help them grow safely while managing risks like weekend gaps.

You can also learn how to pass Pipstone Capital funded challenge to make the most of these opportunities.

FAQ: Gapping in Trading

What is gapping in trading?

It’s when the price of a market, like a forex pair, jumps from one level to another without trades between them — creating a blank space on the chart.

Is swing trading good for beginners?

Yes. It’s easier to learn than day trading since decisions happen slower. Beginners can focus on chart patterns, risk management, and patience without needing to watch screens all day.

Best time frame for forex swing trading?

Most traders use 4-hour or daily charts for clean, reliable signals. These time frames reduce market noise and show clearer trends for entry and exit decisions.

Can swing traders use prop firm accounts?

Yes. Many funded traders prefer swing trading because it allows holding positions overnight or across sessions. It also suits firms that value disciplined, lower-frequency trading styles.

Biggest risk in swing trading forex?

The main risk comes from unexpected news or weekend gaps that cause sharp moves against open trades. Without stop losses or position limits, these events can wipe out gains quickly.

What Is Gapping in Forex and why does it happen?

It usually happens after weekends or holidays when new events or news affect currency values before markets reopen.

Does every gap in forex get filled?

No. Common and exhaustion gaps often fill quickly, while breakaway and continuation gaps may stay open for longer.

How can traders avoid losses from gapping in trading?

Close or reduce positions before weekends, avoid holding through high-risk events, and always use manageable position sizes.

What do prop traders do when a gap appears?

They stay calm, assess direction, and trade only after confirmation. They don’t chase moves or fight the market.

Is gapping in forex trading good or bad?

Neither. It’s a normal part of market behavior. The key is preparation and risk control, not prediction.

Why is it important to learn what is gapping in trading?

Because understanding gaps helps traders anticipate risk, plan entries, and protect capital during volatile market openings.

What Is Gapping in Trading? How Prop Traders Handle Gaps in Forex

Oct 20, 2025

Many traders ask, what is gapping in trading, and how does it affect forex markets?

In simple terms, gapping happens when a price jumps from one level to another without any trades in between. On a chart, it looks like a blank space or “gap.”

Even though forex trades 24 hours a day, five days a week, gapping in trading still occurs. It usually happens after weekends or long holidays when news or market events push price sharply up or down.

For prop traders, gaps are part of the job. They bring both risk and opportunity. The difference lies in how a trader reacts and manages exposure.

What Is Gapping in Forex?

Before diving into how prop traders deal with it, let’s answer the question: What Is Gapping in Forex?

A gap in forex is when a currency pair opens at a different price from its previous close — leaving a visible space on the chart. For instance, if EUR/USD closes at 1.0850 on Friday and opens at 1.0900 on Monday, that’s a gap up. If it opens at 1.0800, it’s a gap down.

So, what is gapping in forex trading really about? It’s the result of price reacting to new events while the market is closed. Central banks, hedge funds, or large investors may act on weekend news, causing sharp price changes when the market opens again.

While gapping is common in stocks, it still matters in forex - especially for swing traders or funded prop traders who hold trades over the weekend.

What Causes Gapping in Trading?

There are several reasons why gapping in trading occurs, especially in forex:

Weekend News and Events

Political news, economic data, or central bank decisions often break over the weekend. When markets reopen, traders adjust instantly to the new sentiment.

Global Shocks

Sudden events like conflicts, natural disasters, or global policy changes cause markets to reprice currencies fast.

Low Liquidity

When there are fewer open orders — such as during holidays or quiet sessions — prices can jump more easily between levels.

Institutional Positioning

Big investors often adjust or hedge their portfolios during market breaks. This can drive large price gaps when trading resumes.

That’s why what is gapping in trading is such a key concept to understand: it reveals how sensitive markets are to surprise information.

Types of Gaps in Forex Trading

Knowing the different kinds of gaps helps traders judge whether to follow or fade the move. Here are the four main types often seen when learning what is gapping in forex trading:

1. Common Gaps

These appear inside a trading range or during quiet sessions. They’re usually small and tend to fill quickly. Traders view them as short-term imbalances. To interpret these areas correctly, it helps to understand how to read forex charts like a pro.

2. Breakaway Gaps

Breakaway gaps occur when price jumps out of a strong support or resistance zone. They mark the start of a new trend and usually stay open longer.

3. Continuation (Runaway) Gaps

These gaps happen in the middle of a trend, showing strong momentum. Traders often ride them, expecting the current move to continue.

4. Exhaustion Gaps

Exhaustion gaps appear near the end of a trend. Price may jump in the direction of the trend but soon reverse. They often hint at a possible change in direction.

Understanding these helps traders see how gapping in trading connects to broader market psychology - optimism, panic, or exhaustion.

What Does It Mean When a Gap “Fills”?

In what is gapping in trading, one common term is the “gap fill.”

A gap fill happens when price moves back to the pre-gap level.

For example, if EUR/USD gaps up on Monday but drifts back down to Friday’s close, that’s a filled gap. Many traders believe gaps must fill, but not all do.

Fast fills usually mean the market overreacted to news.

Slow fills or no fills suggest strong continuation and conviction.

Prop traders pay close attention to gap fills because they often become key support or resistance zones later.

Why Gapping in Forex Matters

Even a small gap can shake a trader’s plan. Imagine holding a buy trade on Friday with a stop at 1.0800. The market opens on Monday at 1.0780 - skipping your stop level. The loss ends up larger than expected. That’s called slippage, a common risk in gapping in trading.

Slippage occurs when orders get executed at worse prices because the market jumps past them. This is why experienced prop traders plan carefully around weekend closes and major news. Learn how to control this risk by reading Margin vs Leverage.

Gaps also create emotional stress. Many traders panic when they see a price far from their entry or stop. Prop traders, on the other hand, expect it and manage it like any other market move.

How Prop Traders Handle Gaps in Forex

Prop traders who understand what is gapping in forex follow clear systems. They focus on preparation and risk management, not luck.

Here’s how they do it.

1. Reduce Exposure Before the Weekend

Most professional traders close or reduce positions before Friday’s close, especially when key data or central bank speeches are scheduled.

2. Keep Position Size Small

If they must hold over the weekend, they trade smaller. A smaller position limits damage if the market gaps sharply on Monday.

3. Avoid Thinly Traded Pairs

Illiquid pairs — such as exotic currencies — are prone to larger gaps. Prop traders focus on majors like EUR/USD, GBP/USD, or USD/JPY to stay safer. For more insight which currency pairs to trade on, check best pairs to trade in forex for Consistent Profits.

4. Wait for Market Confirmation

After a gap, they wait for price action to show direction. They don’t guess. If the market confirms continuation, they trade with it. If it fades, they take the opposite side.

5. Track and Review

Prop traders log every gap they trade - noting the time, size, and outcome. Over time, this data helps them recognize which gaps tend to fill and which extend.

How Prop Firms Manage Gap Risk

Prop trading firms like Pipstone Capital, have systems to protect both the company and its traders from gap risk. Managing gapping in trading is part of their core model.

1. Weekend Policy

Most firms limit or prohibit open trades over weekends. Some allow small positions but reduce risk allocations.

2. Daily Drawdown Rules

Even if a gap hits an account hard, the firm’s system prevents total loss by enforcing a daily or overall drawdown cap.

3. Real-Time Monitoring

Prop firms track all funded accounts in real time. If exposure becomes risky during an event, they can step in or alert traders.

4. Trader Education

Traders are taught what is gapping in forex trading and how to react. They learn to close positions before high-impact events and plan around risk.

This structure ensures traders stay disciplined and consistent - not emotional or impulsive when a gap strikes. To understand more about how prop firms structure trader development and capital allocation, read Traditional Trading vs. Prop Trading.

Gap Trading Strategies for Prop Traders

Prop traders use different methods to profit from gaps while controlling risk. Here are three reliable ones.

1. The Gap-Fill Setup

If a gap appears against a key support or resistance zone, traders expect it to fill. They enter once price rejects the gap edge.

This works best with common or exhaustion gaps. This works best with common or exhaustion gaps. For deeper learning, check How to Trade Using Supply and Demand in Forex.

2. The Breakaway Setup

When a major breakout occurs with strong momentum, traders follow the direction of the gap. They wait for a minor pullback to confirm the breakout, then enter in the same direction.

3. The Wait-and-See Setup

This approach is simple but smart. Traders wait one or two candles after the open. Once the market picks a side, they trade with it - not against it.

Each method balances risk and reward, proving that understanding what is gapping in trading helps in real decisions, not theory alone. To smoothly apply these gap strategies within a firm that matches your trading goals, explore How to Choose the Best Swing Trading Prop Firms.

How Prop Traders Stay Emotionally Stable During Gaps

Gaps can trigger panic or greed fast. Prop traders stay calm because they train for it and follow structure, not emotion. They practice reacting under pressure so that quick market jumps don't affect their decisions. They stick to tested systems and remember that a single gap isn’t the end of a plan but part of normal volatility.

Prop traders follow a few simple rules:

Never chase price after a gap.

Don’t move stops out of fear.

Wait for confirmation before re-entry.

Treat every gap as new information, not a disaster.

In prop trading, emotional control and routine discipline matter as much as technical skill. Staying composed lets traders follow their edge while firms like Pipstone Capital provide structure, risk tools, and funded accounts that keep them consistent.

Why Many Gaps in Forex Get Filled

If you’ve studied what is gapping in forex trading, you’ve heard the saying, “Gaps always fill.” That’s not always true, but many do. Here’s why:

Overreaction

Price may have over-adjusted to news and later corrects itself.

Liquidity Hunting

Market makers often move price back to collect pending orders near the gap.

Profit Taking

Early traders lock profits, which pushes price back into the gap area.

Still, breakaway gaps in strong trends may stay open for long periods. The trick is knowing which type you’re facing. To see how sentiment shifts drive these moves, read Bullish vs Bearish.

Pipstone Capital: Key Takeaways on Gapping in Trading and How Traders Benefit

When traders truly understand what is gapping in trading, they stop fearing it and start using it as a signal for opportunity.

At Pipstone Capital, traders can start with a $5,000 funded account challenge and trade real markets under fair rules, raw spreads, and fast payouts, all designed to help them grow safely while managing risks like weekend gaps.

You can also learn how to pass Pipstone Capital funded challenge to make the most of these opportunities.

FAQ: Gapping in Trading

What is gapping in trading?

It’s when the price of a market, like a forex pair, jumps from one level to another without trades between them — creating a blank space on the chart.

Is swing trading good for beginners?

Yes. It’s easier to learn than day trading since decisions happen slower. Beginners can focus on chart patterns, risk management, and patience without needing to watch screens all day.

Best time frame for forex swing trading?

Most traders use 4-hour or daily charts for clean, reliable signals. These time frames reduce market noise and show clearer trends for entry and exit decisions.

Can swing traders use prop firm accounts?

Yes. Many funded traders prefer swing trading because it allows holding positions overnight or across sessions. It also suits firms that value disciplined, lower-frequency trading styles.

Biggest risk in swing trading forex?

The main risk comes from unexpected news or weekend gaps that cause sharp moves against open trades. Without stop losses or position limits, these events can wipe out gains quickly.

What Is Gapping in Forex and why does it happen?

It usually happens after weekends or holidays when new events or news affect currency values before markets reopen.

Does every gap in forex get filled?

No. Common and exhaustion gaps often fill quickly, while breakaway and continuation gaps may stay open for longer.

How can traders avoid losses from gapping in trading?

Close or reduce positions before weekends, avoid holding through high-risk events, and always use manageable position sizes.

What do prop traders do when a gap appears?

They stay calm, assess direction, and trade only after confirmation. They don’t chase moves or fight the market.

Is gapping in forex trading good or bad?

Neither. It’s a normal part of market behavior. The key is preparation and risk control, not prediction.

Why is it important to learn what is gapping in trading?

Because understanding gaps helps traders anticipate risk, plan entries, and protect capital during volatile market openings.

What Is Gapping in Trading? How Prop Traders Handle Gaps in Forex

Oct 20, 2025

Many traders ask, what is gapping in trading, and how does it affect forex markets?

In simple terms, gapping happens when a price jumps from one level to another without any trades in between. On a chart, it looks like a blank space or “gap.”

Even though forex trades 24 hours a day, five days a week, gapping in trading still occurs. It usually happens after weekends or long holidays when news or market events push price sharply up or down.

For prop traders, gaps are part of the job. They bring both risk and opportunity. The difference lies in how a trader reacts and manages exposure.

What Is Gapping in Forex?

Before diving into how prop traders deal with it, let’s answer the question: What Is Gapping in Forex?

A gap in forex is when a currency pair opens at a different price from its previous close — leaving a visible space on the chart. For instance, if EUR/USD closes at 1.0850 on Friday and opens at 1.0900 on Monday, that’s a gap up. If it opens at 1.0800, it’s a gap down.

So, what is gapping in forex trading really about? It’s the result of price reacting to new events while the market is closed. Central banks, hedge funds, or large investors may act on weekend news, causing sharp price changes when the market opens again.

While gapping is common in stocks, it still matters in forex - especially for swing traders or funded prop traders who hold trades over the weekend.

What Causes Gapping in Trading?

There are several reasons why gapping in trading occurs, especially in forex:

Weekend News and Events

Political news, economic data, or central bank decisions often break over the weekend. When markets reopen, traders adjust instantly to the new sentiment.

Global Shocks

Sudden events like conflicts, natural disasters, or global policy changes cause markets to reprice currencies fast.

Low Liquidity

When there are fewer open orders — such as during holidays or quiet sessions — prices can jump more easily between levels.

Institutional Positioning

Big investors often adjust or hedge their portfolios during market breaks. This can drive large price gaps when trading resumes.

That’s why what is gapping in trading is such a key concept to understand: it reveals how sensitive markets are to surprise information.

Types of Gaps in Forex Trading

Knowing the different kinds of gaps helps traders judge whether to follow or fade the move. Here are the four main types often seen when learning what is gapping in forex trading:

1. Common Gaps

These appear inside a trading range or during quiet sessions. They’re usually small and tend to fill quickly. Traders view them as short-term imbalances. To interpret these areas correctly, it helps to understand how to read forex charts like a pro.

2. Breakaway Gaps

Breakaway gaps occur when price jumps out of a strong support or resistance zone. They mark the start of a new trend and usually stay open longer.

3. Continuation (Runaway) Gaps

These gaps happen in the middle of a trend, showing strong momentum. Traders often ride them, expecting the current move to continue.

4. Exhaustion Gaps

Exhaustion gaps appear near the end of a trend. Price may jump in the direction of the trend but soon reverse. They often hint at a possible change in direction.

Understanding these helps traders see how gapping in trading connects to broader market psychology - optimism, panic, or exhaustion.

What Does It Mean When a Gap “Fills”?

In what is gapping in trading, one common term is the “gap fill.”

A gap fill happens when price moves back to the pre-gap level.

For example, if EUR/USD gaps up on Monday but drifts back down to Friday’s close, that’s a filled gap. Many traders believe gaps must fill, but not all do.

Fast fills usually mean the market overreacted to news.

Slow fills or no fills suggest strong continuation and conviction.

Prop traders pay close attention to gap fills because they often become key support or resistance zones later.

Why Gapping in Forex Matters

Even a small gap can shake a trader’s plan. Imagine holding a buy trade on Friday with a stop at 1.0800. The market opens on Monday at 1.0780 - skipping your stop level. The loss ends up larger than expected. That’s called slippage, a common risk in gapping in trading.

Slippage occurs when orders get executed at worse prices because the market jumps past them. This is why experienced prop traders plan carefully around weekend closes and major news. Learn how to control this risk by reading Margin vs Leverage.

Gaps also create emotional stress. Many traders panic when they see a price far from their entry or stop. Prop traders, on the other hand, expect it and manage it like any other market move.

How Prop Traders Handle Gaps in Forex

Prop traders who understand what is gapping in forex follow clear systems. They focus on preparation and risk management, not luck.

Here’s how they do it.

1. Reduce Exposure Before the Weekend

Most professional traders close or reduce positions before Friday’s close, especially when key data or central bank speeches are scheduled.

2. Keep Position Size Small

If they must hold over the weekend, they trade smaller. A smaller position limits damage if the market gaps sharply on Monday.

3. Avoid Thinly Traded Pairs

Illiquid pairs — such as exotic currencies — are prone to larger gaps. Prop traders focus on majors like EUR/USD, GBP/USD, or USD/JPY to stay safer. For more insight which currency pairs to trade on, check best pairs to trade in forex for Consistent Profits.

4. Wait for Market Confirmation

After a gap, they wait for price action to show direction. They don’t guess. If the market confirms continuation, they trade with it. If it fades, they take the opposite side.

5. Track and Review

Prop traders log every gap they trade - noting the time, size, and outcome. Over time, this data helps them recognize which gaps tend to fill and which extend.

How Prop Firms Manage Gap Risk

Prop trading firms like Pipstone Capital, have systems to protect both the company and its traders from gap risk. Managing gapping in trading is part of their core model.

1. Weekend Policy

Most firms limit or prohibit open trades over weekends. Some allow small positions but reduce risk allocations.

2. Daily Drawdown Rules

Even if a gap hits an account hard, the firm’s system prevents total loss by enforcing a daily or overall drawdown cap.

3. Real-Time Monitoring

Prop firms track all funded accounts in real time. If exposure becomes risky during an event, they can step in or alert traders.

4. Trader Education

Traders are taught what is gapping in forex trading and how to react. They learn to close positions before high-impact events and plan around risk.

This structure ensures traders stay disciplined and consistent - not emotional or impulsive when a gap strikes. To understand more about how prop firms structure trader development and capital allocation, read Traditional Trading vs. Prop Trading.

Gap Trading Strategies for Prop Traders

Prop traders use different methods to profit from gaps while controlling risk. Here are three reliable ones.

1. The Gap-Fill Setup

If a gap appears against a key support or resistance zone, traders expect it to fill. They enter once price rejects the gap edge.

This works best with common or exhaustion gaps. This works best with common or exhaustion gaps. For deeper learning, check How to Trade Using Supply and Demand in Forex.

2. The Breakaway Setup

When a major breakout occurs with strong momentum, traders follow the direction of the gap. They wait for a minor pullback to confirm the breakout, then enter in the same direction.

3. The Wait-and-See Setup

This approach is simple but smart. Traders wait one or two candles after the open. Once the market picks a side, they trade with it - not against it.

Each method balances risk and reward, proving that understanding what is gapping in trading helps in real decisions, not theory alone. To smoothly apply these gap strategies within a firm that matches your trading goals, explore How to Choose the Best Swing Trading Prop Firms.

How Prop Traders Stay Emotionally Stable During Gaps

Gaps can trigger panic or greed fast. Prop traders stay calm because they train for it and follow structure, not emotion. They practice reacting under pressure so that quick market jumps don't affect their decisions. They stick to tested systems and remember that a single gap isn’t the end of a plan but part of normal volatility.

Prop traders follow a few simple rules:

Never chase price after a gap.

Don’t move stops out of fear.

Wait for confirmation before re-entry.

Treat every gap as new information, not a disaster.

In prop trading, emotional control and routine discipline matter as much as technical skill. Staying composed lets traders follow their edge while firms like Pipstone Capital provide structure, risk tools, and funded accounts that keep them consistent.

Why Many Gaps in Forex Get Filled

If you’ve studied what is gapping in forex trading, you’ve heard the saying, “Gaps always fill.” That’s not always true, but many do. Here’s why:

Overreaction

Price may have over-adjusted to news and later corrects itself.

Liquidity Hunting

Market makers often move price back to collect pending orders near the gap.

Profit Taking

Early traders lock profits, which pushes price back into the gap area.

Still, breakaway gaps in strong trends may stay open for long periods. The trick is knowing which type you’re facing. To see how sentiment shifts drive these moves, read Bullish vs Bearish.

Pipstone Capital: Key Takeaways on Gapping in Trading and How Traders Benefit

When traders truly understand what is gapping in trading, they stop fearing it and start using it as a signal for opportunity.

At Pipstone Capital, traders can start with a $5,000 funded account challenge and trade real markets under fair rules, raw spreads, and fast payouts, all designed to help them grow safely while managing risks like weekend gaps.

You can also learn how to pass Pipstone Capital funded challenge to make the most of these opportunities.

FAQ: Gapping in Trading

What is gapping in trading?

It’s when the price of a market, like a forex pair, jumps from one level to another without trades between them — creating a blank space on the chart.

Is swing trading good for beginners?

Yes. It’s easier to learn than day trading since decisions happen slower. Beginners can focus on chart patterns, risk management, and patience without needing to watch screens all day.

Best time frame for forex swing trading?

Most traders use 4-hour or daily charts for clean, reliable signals. These time frames reduce market noise and show clearer trends for entry and exit decisions.

Can swing traders use prop firm accounts?

Yes. Many funded traders prefer swing trading because it allows holding positions overnight or across sessions. It also suits firms that value disciplined, lower-frequency trading styles.

Biggest risk in swing trading forex?

The main risk comes from unexpected news or weekend gaps that cause sharp moves against open trades. Without stop losses or position limits, these events can wipe out gains quickly.

What Is Gapping in Forex and why does it happen?

It usually happens after weekends or holidays when new events or news affect currency values before markets reopen.

Does every gap in forex get filled?

No. Common and exhaustion gaps often fill quickly, while breakaway and continuation gaps may stay open for longer.

How can traders avoid losses from gapping in trading?

Close or reduce positions before weekends, avoid holding through high-risk events, and always use manageable position sizes.

What do prop traders do when a gap appears?

They stay calm, assess direction, and trade only after confirmation. They don’t chase moves or fight the market.

Is gapping in forex trading good or bad?

Neither. It’s a normal part of market behavior. The key is preparation and risk control, not prediction.

Why is it important to learn what is gapping in trading?

Because understanding gaps helps traders anticipate risk, plan entries, and protect capital during volatile market openings.